Fifth Third Bancorp First Quarter Earnings Preview: Higher Interest Rate Boost Guidance (NASDAQ:FITB)

RiverNorthPhotography

Stock of Fifth Third Bancorp (NASDAQ:FITB) has recovered meaningfully from last year’s levels in the wake of Silicon Valley’s failure, but has essentially remained at around $34 for all of 2024. Because January grade sharing has been put on hold, FITB basically treaded water, while the S&P rebounded modestly. 1st quarter results scheduled to be announced Friday, April 19Day, now is a great opportunity to preview the launch and decide how to trade the stock. I am becoming more and more optimistic.

pursue alpha

Fifth Third Bancorp’s fourth quarter results were strong.

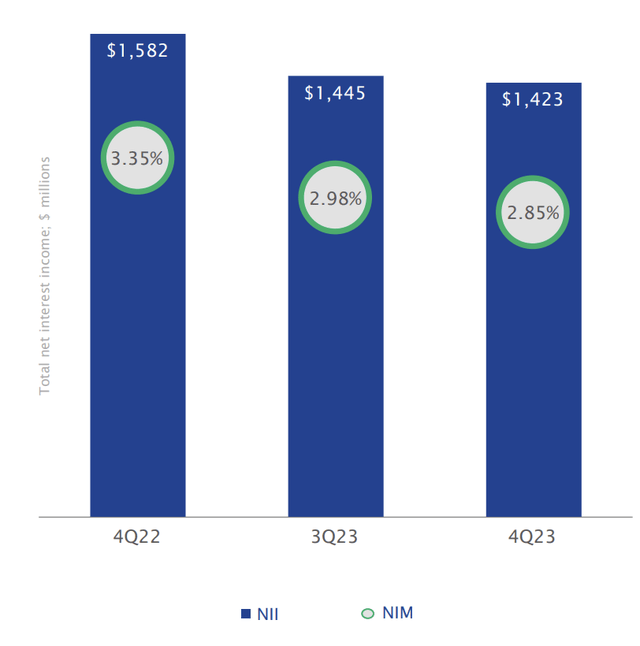

Before we look at what to expect, it’s worth recalling what Fifth Third most recently reported. The company earned $0.99 in adjusted EPS, beating estimates by $0.09. The bank’s net interest margin (NIM) continues to decline, but is only 13bp, suggesting that the rate of decline is gradually improving and may be approaching the bottom.

Fifth Third Bancorp

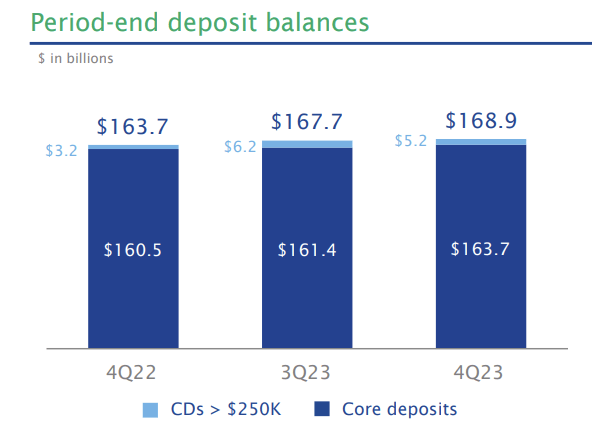

Importantly, FITB was the best performer on deposits, with deposits up 3% over last year despite industry deposit declines. Given how important deposits are to a bank’s funding profile, I considered stable deposits a prerequisite for investing in the sector. This is one test that FITB passes well, aided by its faster-growing Sunbelt exposure. Of course, the cost of these deposits is much higher, rising 24 basis points sequentially to 3%.

Fifth Third Bancorp

Finally, credit quality was strong, with charge-offs lowering from 41 basis points to 32 basis points. However, non-performing loans reached up to $649 million. However, FITB was fully prepared for losses with $2.5 billion in provisions. At almost 4x coverage, FITB is in a good spot compared to the ~250% coverage ratio, which I consider sufficient.

Overall, these were encouraging results. The worst pressure on NIM is felt, deposits are stable and credit costs are moderate. In addition, considering strong performance, share repurchase in the second half of the year was guided to $300 million to $400 million. These results were impressive, and while the buybacks came sooner than expected, we felt the stock price reflected this, so we rate FITB a “Hold,” which has proven to be a fair rating over the past three months.

What to note from FITB’s first quarter earnings results

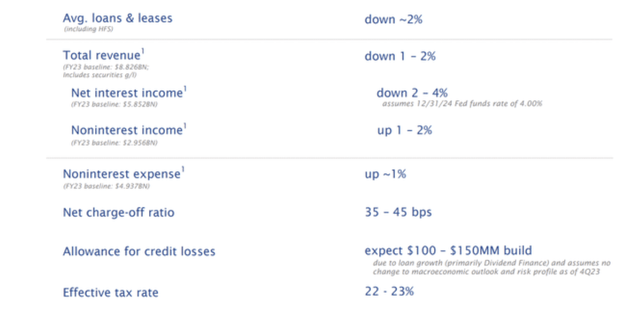

Currently, analysts expect FITB to earn $0.72 in adjusted EPS in the first quarter. In January, I estimated FITB’s earnings power to be $3.20, and the current consensus is $3.21. You can see the company’s initial guidance for the year below. I think investors will focus most on three things: net interest income, deposit levels/costs, and loan losses. Given how much the macro environment has changed, there are likely to be concerns about losses and hopes for interest gains.

Fifth Third Bancorp

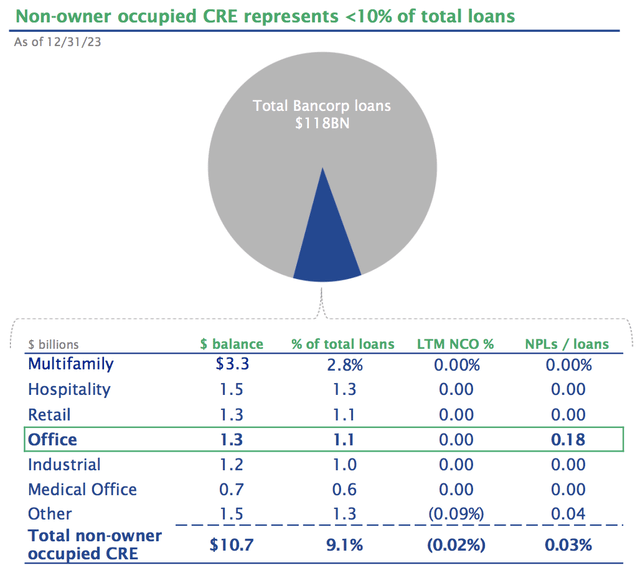

Let’s start with the part that concerns me the least. It’s credit quality. Troubles at New York Community Bancorp (NYCB) have heightened long-standing concerns about commercial real estate (CRE). Offices in particular are worth less than they were before COVID-19, and high interest rates are driving valuations further down. Although the banking industry is expected to suffer losses as a result, FITB is believed to be in a relatively advantageous position.

Fifth Third Bancorp

FITB holds only $11 billion (about 9%) of non-owner-occupied CRE and only 14% of its loans are to commercial real estate overall. Of these, 30% are multifamily properties, primarily located in the Southeast, which is a comfortable asset class given favorable population dynamics. The NYC rent-controlled multifamily market is suffering due to new legislation, but this is a local issue and not related to FITB’s portfolio. If the office loan is 1%, a meaningful delinquency rate may be manageable here. With reserves already increasing, we expect another solid quarter in terms of credit quality.

I see NIM and deposits as inherently linked because deposits are the main source of funding. Deposits in the first quarter tend to decline as they tend to increase in December due to year-end closings and related activities, before normalizing in the first quarter. I view the deposit growth as very impressive, and I believe there will be around $1 billion in deposit outflows, consistent with seasonal trends. A bigger leak would be disappointing.

The key question is the cost of deposits. At the beginning of the year, it looked like the Fed could cut interest rates 4 to 6 times, but now 0 to 2 cuts appear to be the most likely outcome. This could mean deposit costs remain higher for longer. With the Fed still keeping interest rates in check, the pace of growth in deposit costs will likely slow substantially. After a 24 basis point rise in the fourth quarter, we believe an 8 to 12 basis point increase will be the key benchmark.

Looking at this, NIM should compress to less than 5 basis points from Q4 levels and is likely a quarter away from the bottom.

This will help you know whether you need to change your guidance for a 2-4% decline in net interest income this year. In my opinion, FITB will see a net benefit from higher rates. It has a $57 billion portfolio of fixed-rate securities and $11 billion in fixed-rate swaps, but most of its loans are at floating rates. Assuming a beta of one-third of deposit rates, FITB has a net exposure to floating rates of approximately $40 billion to $50 billion. If Fed interest rates were to average 40 basis points higher this year, that should add about $125 million to $150 million to net income, or about $0.20 per share.

Therefore, we believe FITB is risk-biased toward raising its net interest income guidance along with the results. The biggest reason this won’t happen is that they will have to raise deposit rates significantly faster than I expect to offset the higher interest income on their loan book. That’s why we take deposits so seriously and expect FITB to strengthen its guidance.

Capital will be concentrated

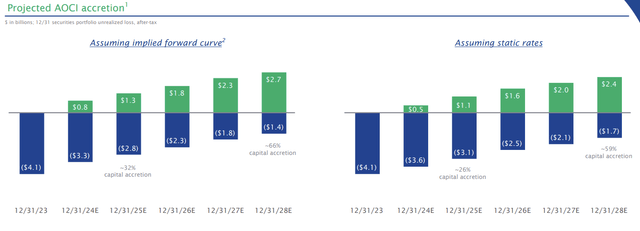

While higher interest rates help the company’s earnings power, I think they’re likely to be a headwind for capital. Therefore, we will listen carefully to any changes to the stock repurchase guidance. FITB’s CET1 ratio increased from 9.8% in the third quarter to 10.3% in the fourth quarter. The target was 10.5% by mid-year, so buybacks were possible. However, these calculations exclude accumulated other comprehensive income (AOCI). FITBs, banks with more than $100 billion in assets, will be required to phase this into their calculations starting at the end of 2025.

As mentioned above, FITB holds a securities portfolio worth $57.4 billion. Because these bonds were purchased at lower yields, they incurred a loss of $4.1 billion. If this were included in capital calculations today, CET1 would be significantly lower at 7.7%.

As you can see below, taking into account the equal pull of maturing and near-maturity bonds, on the December 31, 2023 forward curve, this loss would be reduced to $2.8 billion by the end of next year, with a capitalization of 8.5%. . If interest rates remain the same, losses would be reduced by $300 million, or 8.2-8.3% on equity. Of course, you can also keep your earnings to build capital on top of this.

Fifth Third Bancorp

In fact, bond yields have shown an upward trend this year. This means that AOCI losses are likely to remain larger for longer. However, I would like to note that yields have been rising since 3/31. As you can see, 7-10 year Treasury notes (IEFs) have lost almost 5% of their value YTD, but only 2% in the first quarter.

pursue alpha

That means the 3/31 AOCI loss reported by FITB is likely to be smaller than the current loss. We highlight this because FITB is building additional capital (up to 10.5%) to prepare for the phase-in of AOCI. If AOCI is greater than previously assumed, FITB will need to hold on to more of its former AOCI capital for a longer period of time, which could delay the buyback by one to two quarters.

Fifth Third’s advance guidance for “second half” repurchases of $300 million to $400 million is quite broad, so we don’t expect the company to change it materially, especially now that interest rates could fall again. Additionally, higher net interest income will help offset some of these losses. Still, FITB warns there is a risk that share buybacks could slow if interest rates continue to rise. However, we expect it to continue to guide buybacks in 2024, even if the language softens somewhat. Nonetheless, I think a 4% dividend is safe.

conclusion

I expect FITB to raise net interest guidance, but potentially cautious on capital returns. If this guidance change is accurate, FITB could be in a position to earn $3.30-$3.40 this year, up from $3.20 previously. This could leave the stock with returns of more than 10x, which we believe is relatively cheap given its strong deposit base and the benefits from higher interest rates. I think earnings could be a catalyst to push the stock higher after it consolidates to $34-$36. With most community banks trading 10-12x earnings, FITB can be seen near the upper end of this range, or $39, offering a 12.5% upside and a total return of 16-17% including dividends. Therefore, I am upgrading the stock to Buy ahead of earnings.