Find and Use Fake Pumps for 💰️ – Analysis and Forecast – April 7, 2024

At some point in trading, everyone will experience unpredictable price fluctuations. We expected the XAUUSD price to fall, but there are cases where it rises. Also, after good news for the USD, gold prices surged by the month, as happened last Friday, April 4th after the NFP news.

Some experts call it manipulation. I like to call this a game where every participant can influence the outcome to some degree. There is no “correct” price.

But there is an equilibrium price!

Now you might be asking, “What on earth is the equilibrium price?”

Let’s look at something similar. very old Money games from other domains:

Imagine that’s you. 😁 And there is no way to not sell newspapers. Your children and wife depend on you and the money and food you provide by selling newspapers. So this is serious.

newspaper pump strategy

Find 10 friends and borrow money from the bank for 2 hours.

Then lend this money to your friends.

The pump will now start. It’s 7:30 in the morning.. You and your friends are waiting for a flood of people rushing to work. Just like they do every day.

When the streets are crowded, friends are shouting and screaming and everyone is trying to buy a newspaper. They even give you real money and everyone pays a few cents more just to buy the newspaper. Because you shouted, “Guys, don’t be too fast. There aren’t too many papers left. Everyone take one sheet!” 😍

Now everyone runs to the newsstand and buys a newspaper. You sell them all. And you sell it at a higher price.

What now? yes. All my actor friends came back and gave me back the newspaper. return borrowed money to the bank. You share the profits with your friends. 💵

complete! Your kids and wife love you! 🏝️

What are the prices of newspapers? Yeah – I went back down.

Is there a similar situation in the market? This is it!

How can you recognize a market pump?

nice question. Let’s think a little bit about the simplified newspaper example. What does it look like? There are two very important characteristics:

-

Newspaper prices are average Rising only from ONE stand. Other newspaper sellers are not affected. However, this is difficult to find in the global market. Because as retail traders, we use data streams integrated by many liquidity providers before they are “public.” So if anyone can see it, these are market makers who provide expensive live data connections to multiple exchanges.

-

This is just a type of newspaper, pumped. Other newspapers are sold at regular price. Of course, it’s possible that all the other newspaper editors missed the hot news, but that’s highly unlikely.

So, if the price of gold moves without USD to move, and neither does silver, there must be something fishy!

Explore Market Pumps

Let’s briefly compare the rate of change of gold price and USD index price.

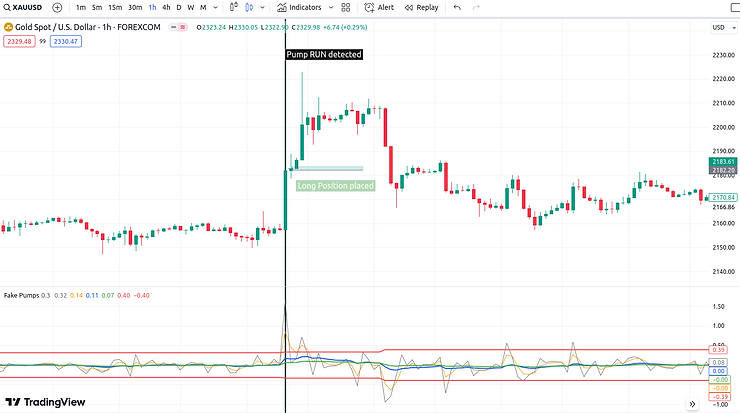

I created a nice TradingView indicator. Here’s what it looks like:

The chart shows XAUUSD with a 5M period along with a “fake pump indicator” at the bottom. A surge above the red line means gold prices have risen “too quickly” and are expected to come back.

Therefore, we set SHORT with a target of $1 (assuming the gold price is $2297).

Using the same indicator on higher time frames would actually indicate the beginning of an uptrend!

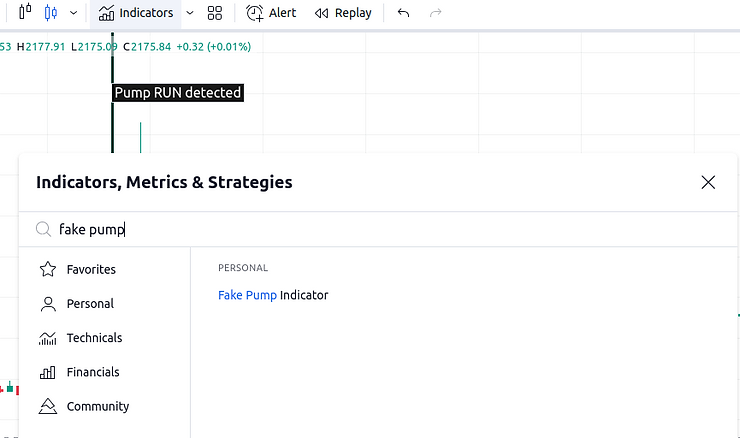

Install Fake Pump Indicator on TradingView

Just click on “indicators” and search for “fake pump indicator.” The indicator above will jump right to you. 😍

If it doesn’t work for any reason, please let me know. I will help you.

Taken at the pump

Imagine being able to click a button whenever you see a potential return pump and forget about the rest. Sometimes the price doesn’t come back right away. However, your magic button takes interest in this and makes your trades profitable. Even if your situation sucks.

That button is called THE EXECUTOR BUTTON. this is BFG9000.

Executor-Trigger works very well in most cases. and i found it Works best when combined with a fake pump indicator.. Will you love this combo as much as I do? 🙂