FLEX LNG Stock: Betting on Resilient Demand for LNG Carriers (NYSE:FLNG)

shanshe

memo: I previously worked on FLEX LNG (New York Stock Exchange:FLNG) february. I discussed extensively the LNG market and LNG carrier propulsion systems (steamships vs. MEGA/MEGI and X-DF). I reviewed the FLNG vehicle specifications (age and propulsion), discussed the company’s financial position, and estimated the company’s value. FLNG is top-notch It has a fleet of vessels equipped with the latest generation engines while maintaining liquidity to handle debt and operations. FLNG distributes dividends with an attractive yield of over 10%. My conclusion was a ‘buy’ rating. In today’s note, we discuss the FLNG 2023 report, assessment and ratings.

fleet

FLNG has one of the best fleets in the LNG sector. The company’s ships are equipped with the latest generation engines ME-GA/ME-GI and X-DF. The average age of the fleet is less than five years.

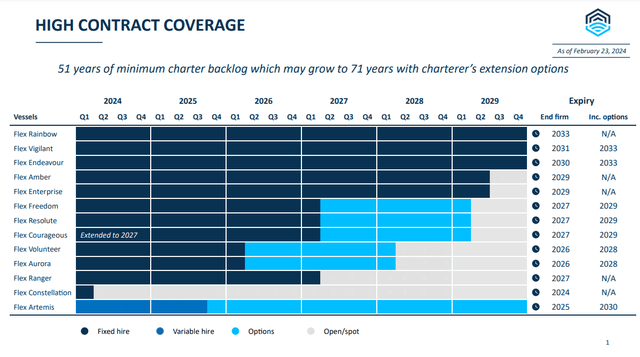

The LNG shipping industry is mainly operated through long-term TC (Time Charter) contracts, and FLNG is no exception. The company reports that it has a history of 51 years. The minimum charter balance is expected to increase to 71 years with charterer extension options. The table below is from last time FLNG Presentation Indicates the company’s hiring schedule.

FLNG presentation

Nine of the vessels are contracted until 2027, and five are contracted until 2029. In 2024, the company reported 94% coverage. Flex Constellations will return after a three-year TC in March/April 2024. On her last earnings call, her company’s management revealed that FLNG was planning a 20-day dry docking for her. In the first quarter of 2024, FLNG expects to contract for Flex Artemis at a price of $75,000 to $80,000 per day. She is the only vessel hired on flexible rates (variable hire).

FLNG achieved a TC of $79,461/day in 2023 and a TC of $72,806/day in 2022. Daily OPEX remained relatively stable at $14,500/day. For FY24, the company projects daily OPEX per vessel of $14,900/day. FLNG maintains low OPEX compared to peers Dynagas (DLNG) and Cool Company (CLCO). DLNG had daily OPEX of $15,172 in 4Q23, while CLCO had daily OPEX of $16,600.

2023 Report Discussion

In 2023, FLNG achieved revenue of $371 million, up $24 million from 2022. Operating expenses increased by $3.9 million, reaching $68.3 million in 2023. Two factors had a negative impact on the company’s bottom line. Increased interest expense ($108 million in FY23 vs. $76.5 million in FY22) and lower derivatives gains ($18.2 million in FY23 vs. $79.6 million in FY22). In 2023, FLNG realized net income of $120 million, 37% lower than in 2022. The cash flow statement is consistent with a decline in the company’s net income. FLNG provided operating cash flow of $175 million in 2023, compared to $219 million in 2022.

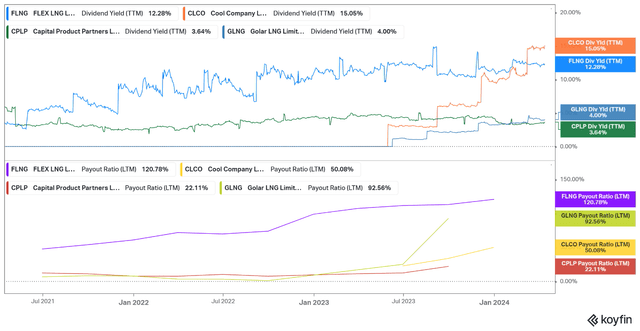

FLNG pays dividends with an attractive yield. In 2023, the company will pay $3.125 per share, resulting in a TTM yield of 11.8%. FLNG pays quarterly regular and special dividends of $0.75 per share. Payout ratios are higher than CLCO and CPLP.

coy pin

CLCO offers a higher yield of 15% and a lower payout ratio of 50%. A payout ratio well below 100% increases confidence in the company’s ability to distribute dividends over the long term. Golar LNG (GLNG) does not fit perfectly into the group. The company operates floating LNG (FLNG) and is not involved in LNG transportation. However, GLNG is still part of the LNG sector. So having it on the list adds more detail to the picture.

balance sheet

As of December 31, 2023, FLNG reported cash of $410 million, long-term debt of $788 million, and total debt of $1.812 billion, including $920 million under lease agreements. FLNG’s new vessels are priced as evidenced by the company’s leveraged capital structure, total debt to equity of 213% and total debt to total assets of 68%.

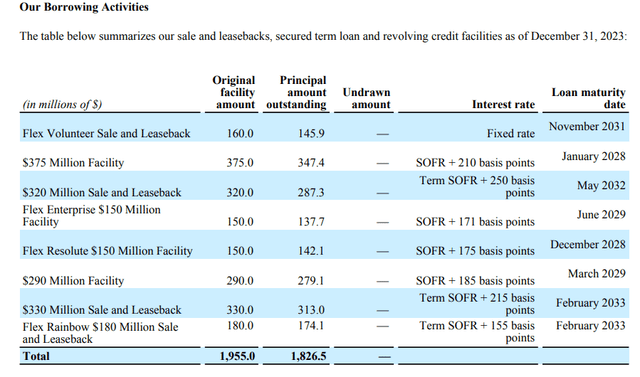

The table below from the FLNG 2023 Annual Report shows the company’s debt mix.

FLNG 2023 Report

In 2023, FLNG will enter into three tranches of credit facilities, including a $290 million credit facility, a $330 million sale and lease agreement to finance Flex Amber and Flex Artemis, and a $180 million sale and lease agreement for Flex Rainbow. We have signed two new contracts. As a result, interest expenses increased compared to the previous year, as previously pointed out.

The first debt maturity is in 2028, with a revolving credit facility of $375 million and a term loan facility of $150 million. FLNG therefore has sufficient headroom to service its debt in 2028. The company also has ample liquidity. In 20223, we achieved operating profit of $217 million while having to cover $85.6 million in net interest expense.

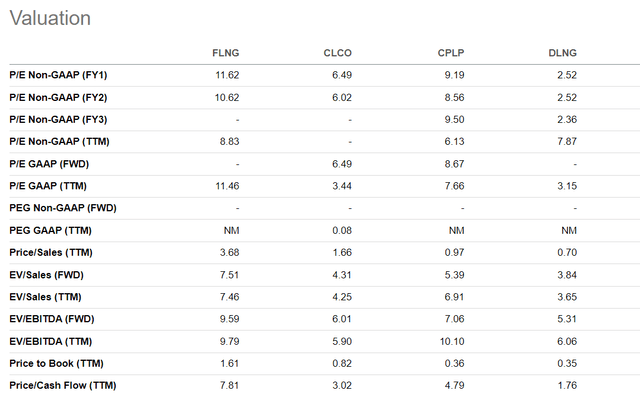

evaluation

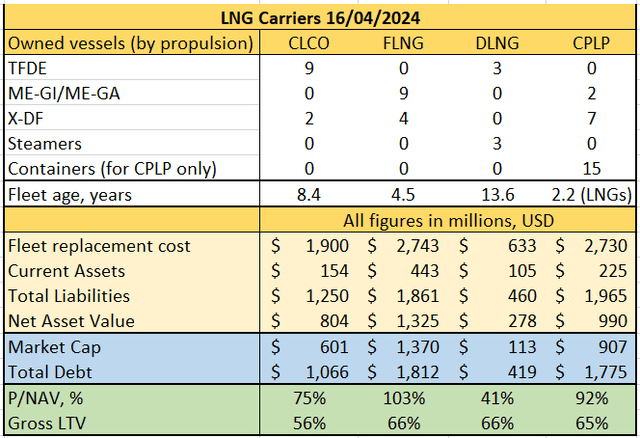

The table below presents three factors for shipping investors: fleet quality (configuration, propulsion, age), value (price relative to NAV), and leverage (total LTV). We chose a company dedicated to LNG. Capital Product Partners (CPLP) also owns container ships. However, the company’s ambition is to become a significant player in the LNG transportation sector. So it deserves a place in the group.

Author data

FLNG trades at 103% PNAV. For comparison, February had a PNAV of 106%. The slight increase is due to a decline in market capitalization and an increase in vehicle replacement value. In February, it priced a new LNG carrier with the latest generation propulsion unit at $262 million. Today’s estimates used the last data from Fearnley’s Weekly, which put the figure at $264 million. As mentioned earlier, the FLNG fleet comes at a price. FLNG’s LTV is 66%.

Now let’s look at the EV multiple. FLNG recorded 7.53 TTM EV/Sales and 9.87 TTM EV/EBITDA in February. FLNG’s multiples have remained fairly similar since the price has fallen 4.62% since I reported.

pursue alpha

FLNG remains the most expensive of its peers, trading above its five-year average. Taking all variables into account, CLCO strikes the perfect balance of vehicle quality, leverage, value, and dividend yield. Nonetheless, FLNG still offers upside potential considering its fleet, dividend yield, and balance sheet.

Investor Takeaways

FLNG is a great proposition for income-oriented investors. However, this idea comes with some risks. The most noticeable thing is the decline in LNG demand and the oversupply of LNG ships.

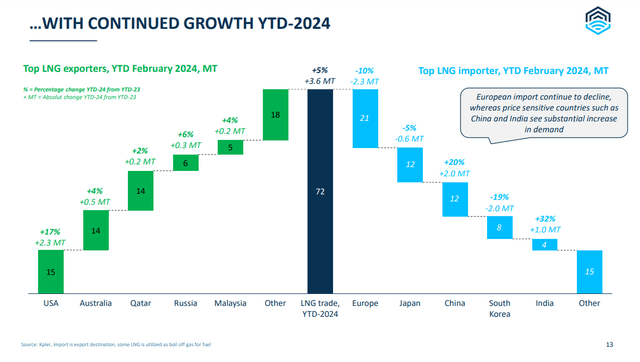

Despite the high order volume, we like the LNG shipping theme. LNG and nuclear power are urgently needed to make progress toward clean energy production. I am optimistic about LNG demand in the short and long term. The table below shows LNG demand growth in February 2024 YTD.

FLNG Presentation

The left section shows the change in exports and the right side the change in imports over the same period. LNG levels increased in all major exporting countries. On the other hand, India and China achieved significant demand growth, offsetting the decline in demand in the EU. Japan also saw a decline in imports due to the restart of nuclear power plants.

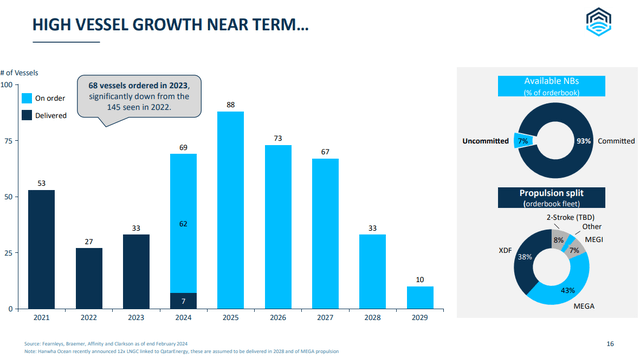

Let’s look at another potential risk: high order volumes and oversupply.

FLNG Presentation

By February 24, seven vessels had been delivered. A further 62 vessels are expected to be delivered by the end of 2024. By 2025, the fleet will increase by 88 more ships. This is a large number considering the total LNG fleet size of 709 ships (reported at the end of 2023).

But the devil is hidden in the details. The top right chart shows that 93% (percentage of order book) of NB (new builds) are already reserved. This means that only 7% of new ships are currently on the market.

Propulsion specifications are another determining factor. Steamships (LNG carriers powered by steam turbines) are much less efficient than new ships with MEGA/MEGI and XDF engines. This means they do not comply with environmental regulations.

In the 1990s and early this century, almost all steamships were hired out under 20 or more long-term contracts. Most contracts expire in the next few years. According to FLNG’s last presentation, 24 steamships are scheduled to be redelivered under contract in 2024. 25 ships are scheduled to be redelivered in 2025. I doubt they will be hired on attractive terms. Spot rates for steamers could go as low as $25,000 per day, more than 65% of the average TCE realized by FLNG in 2023.

Old steamships will slowly be retired and ships with newer generation engines will take their place. In conclusion, I expect strong LNG demand and a resilient market for new LNG vessels over the next few years.

FLNG leveraged its balance sheet to increase its financial risk. However, looking at the company’s cash position and operating cash flow/operating profit, we are confident in its ability to repay debt. FLNG also has no debt maturities for the next four years. The average lifespan of the FLNG fleet is less than five years, mitigating operational risks from unexpected repairs and extensive maintenance.

What I like about FLNG is the availability of ships. This means the company is not in queue with other shipowners for new vessels. Ships generate cash flow now, not then. The final revenue history quote below illustrates FLNG’s strategy to keep its fleet size unchanged.

We’ve had this question for a while. We watch the markets, but we are stewards of shareholder capital. If you sign a contract for a boat today, you might get it in ’27 if you’re lucky. However, slot availability is now entering ’28’. So that means we’re spending $262 million today to buy ships in 2028. So we won’t see that money for four years.

It’s not the price, it’s not the $262 million. You may need to take out a loan because you need supervision, or you may need to get a building loan from the bank that requires an interest rate. The interest rate is 4%. They might want a 2% margin, so that’s 6%. So taking that into account, the cost of that ship would probably be around $285 million, not $262 million. In other words, is there a better use for your cash than paying dividends?

FLNG’s proactive approach to fleet building is worth mentioning. The company ordered the ships for less than $190 million per ship. As previously noted, taking into account the 4% interest rate and 2% premium, the new build could cost as much as $285 million.

FLNG is part of my portfolio as an income generator. The company has a top-tier fleet, a healthy balance sheet, and distributes generous dividends. My verdict remains unchanged. We give FLNG a Buy rating.