Ford: I Was Wrong (Downgrade) (NYSE:F)

Balkan cat

Ford Motor (New York Stock Exchange:F) is scheduled to report fourth quarter earnings on February 6, 2024, which in my opinion could be very disappointing on several fronts.

The automaker recently announced a costly deal with one of America’s largest companies. The UAW, the auto union, will likely take a big chunk of Ford Motor Company’s profits in the long run.

Moreover, Ford Motor Company said it is scaling back production of the electric version of its top-selling truck, the F-150, acknowledging that demand for electric vehicles is not as strong as expected. This view is confirmed by reports that electric vehicles are piling up on dealer lots, which could portend more serious demand problems in 2024.

Although Ford Motor reinstated its guidance for 2023 adjusted EBIT in November, we don’t think that will be the case in its February 6, 2024 earnings report. This is great for sentiment, which could potentially take a further hit related to Ford Motors’ 2024 guidance. So, I downgraded Ford Motor and admitted that my previously bullish stance was wrong.

My Rating History

Declining inflation prompted the company to issue a favorable near-term stock outlook for Ford Motor Company in October. We also thought that demand for electric vehicles would be much better than it actually was.

Ford Motor Company announced that it would reduce production of its flagship EV truck, the F-150 Lightning, due to weaker-than-expected demand.

In my opinion, slowing demand for electric vehicles, declining production, and a costly agreement with the UAW tilt the odds heavily in favor of poor guidance for 2024.

What do markets expect in the fourth quarter of 2023?

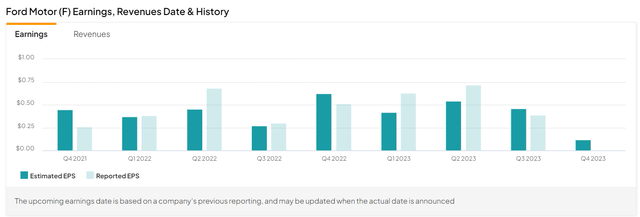

The market estimates Ford Motor Company’s fourth-quarter profit to be $0.12 per share, a 76% decrease from the previous year’s fourth quarter.

Given Ford’s recent developments, profit estimates have been lowered, largely due to growing concerns about the stability of demand for electric vehicles and the cost impact of labor contracts.

ford motor profits (Yahoo Finance)

A major issue in electric vehicle demand, the decline in EV popularity is now a major issue

Despite a record-breaking 1 million vehicles sold in the U.S. electric vehicle market by 2023, there are clear signs that demand for electric vehicles may be slowing, or at least not as resilient as expected.

One piece of evidence is that it takes dealers longer to sell electric cars. This means dealers spend more time on their lots, and consumers appear to prefer gasoline-powered cars.

Another piece of evidence is that rental car company Hertz isn’t seeing as much demand for its fleet of Tesla EVs as expected.

One factor that may be driving the shift away from electric vehicles is the recent significant decline in gasoline prices. The average price of gasoline in 2024 is expected to be $3.38 per gallon, making gasoline-powered cars much more attractive.

Ford Motors is carefully responding to slowing demand for electric vehicles, and announced earlier this month that it would reduce production of the F-150 Lightning to rebalance manufacturing to meet demand. These developments will likely be reflected in Ford Motor Company’s 2024 guidance. The F-150 Lightning is Ford Motor Company’s top-selling model, achieving record sales growth of 55% in 2023.

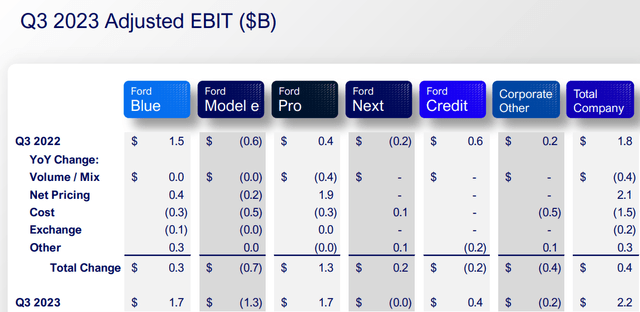

As demand for EVs slows, the loss of Ford Motor’s Model e division (consolidated electric vehicle business) is likely to remain very unprofitable.

The segment lost $1.3 billion in terms of adjusted EBIT, and investors should be prepared to see lower expectations for the segment in February.

Adjusted EBIT for the third quarter of 2023 (Ford Motor)

Downward pressure on Ford Motor Company’s guidance for 2024

Ford Motor Company reinstated its 2023 adjusted EBIT guidance in November after making large wage concessions to the UAW. This gives the automaker confidence that it will deliver adjusted earnings before interest and taxes of $10 billion to $10.5 billion and adjusted free cash flow of $5 billion to $5.5 billion in 2023.

But the 2024 guidelines will be another matter.

The labor contract will cost Ford Motor Company $8.8 billion over its lifespan (i.e. through 2028), but the automaker’s 2024 guidance is set to reflect higher labor costs this year as demand for EVs dwindles.

Revenue estimates expected to be downgraded following 2024 guidance

Ford Motor Co. is expected to see earnings per share decline 6% in 2024, according to consensus earnings estimates. The market is modeling 2024 earnings at $1.75 per share, but the market will only get good information about Ford. The state of the automobile business when the 2024 guidance comes out.

Ford Motor’s leading earnings multiple of 6.1x may not seem expensive, but considering the company’s earnings and free cash flow risks associated with the risks discussed in this article, pre-earnings stocks are extremely risky and probably best avoided. There is also a risk of estimates being revised down following Ford Motor’s guidance announcement.

revenue estimates (Yahoo Finance)

Backlash to the Investment Thesis

Ford Motor could see a rebound in demand for electric vehicles in the future and avoid the larger impact of the UAW settlement on its earnings if it can simply raise prices for its vehicles. This will help soften the blow and protect Ford Motor’s profit baseline.

Moreover, Ford Motor Company may deliver strong forecasts for adjusted EBIT and cash flow in 2024, contrary to my current expectations, in which case I would be prepared to revisit my investment thesis.

my conclusion

The setup ahead of Ford Motor’s 4Q-23 earnings report in February doesn’t look very promising.

The problem of slowing demand for electric vehicles is appearing everywhere. This issue has now come to a head with Ford Motor officially announcing that it is scaling back production of the F-150 EV truck.

The labor agreement with the UAW is also very costly, with a total price tag of $8.8 billion over the next five years. These factors will all put downward pressure on Ford Motor Company’s 2024 guidance.

As a result, as Ford Motor Co. prepares to report earnings on February 6, 2024, we think investors should brace for a shock as the stock could plummet following weak earnings and free cash flow guidance.

In my opinion, the factors discussed in this article also justify revising the stock’s classification to Hold.