Forex Aggressiveness Monitor – Trading Strategy – April 7, 2024

Want to monitor aggression between buyers and sellers by the minute? Now you can! welcome to Aggression Monitor FX!

that much Aggression Monitor FX Indicators are developed for markets that do not provide real data volumes, such as the Forex market.

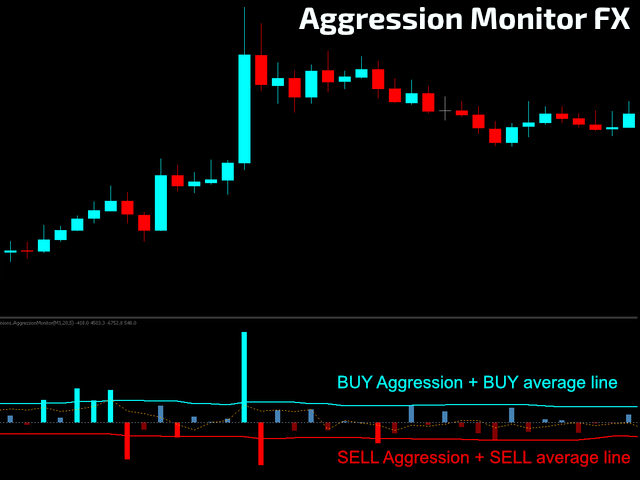

We have developed a method of using 1-minute tick volume data generated by forex (and other) brokers and manipulating this into “attack” information in a highly visual histogram with additional lines of analysis. And it worked! (But you don’t have to trust us. You can try our completely free demo version on the charts yourself. Instructions are provided below.)

This indicator also has the option to switch to real volume where available, so it’s not just for Forex!

But is tick volume as good as actual volume?

According to veteran forex trader Caspar Marney, you can check out his profile on Linkedin. FX Trader Magazine, April – June 2011The title is “Are price updates a good proxy? What is the actual trading volume of FX?“, and he found that the correlation between the two was in the range of over 90%!

How to “read” this indicator

- Using the classic technical analysis you already know, you can identify several patterns and confluences. Aggression Monitor FX.

- Wyckoff fans will enjoy this additional volume information.

- Scalpers can use this indicator to find exhaustion and persistence points (over the M5 period).

- This is a non-lag indicator that can be used to support and confirm all your strategic decisions (well, it’s a bit of a pace, since it’s at one-minute intervals).

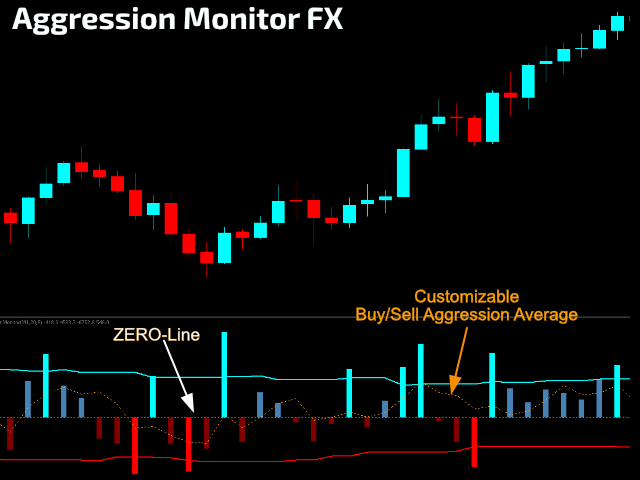

- There are two separate average lines. One is for buying pressure and the other is for selling pressure. The histogram lights up when attack volume exceeds the average.

- There is also a third average line representing the buy/sell pressure delta, which can be used as a thermometer of volume direction. It can be used as a reference for power when the indicator is above/below the Zero-Line. You can shorten or extend the analysis period to collect data about your ENTRY/EXIT strategy.

- This can also be very useful in creating a Stop Loss strategy.

setting

- Type of volume to use – actual volume or graduated volume

- Time period to be used for scanning volume data – select the desired time period accordingly. It is always less than the period currently in use. The smaller the period, the greater the granularity of the volume data.

- Average period for each strike (buy and sell) – a moving average is applied to the buy and sell sides of the volume histogram.

- Buy/Sell Delta Volume Average Period – Select the delta analysis period.

- Do you want to hide indicator names in subwindows?

- Display success/failure feedback messages in log window (Expert tab)