Forex Trading: Understanding Your Own Trading and Choosing the Best Option for You – Other – August 29, 2024

Forex Trading: Understanding Your Own Trading and Choosing the Best Option for You

What is equity trading?

Proprietary trading, commonly known as “prop trading,” involves trading activities that a company engages in for its own benefit, rather than on behalf of or for its clients. In proprietary trading, a company uses its own capital to trade various financial instruments, such as forex, stocks, bonds, and commodities, in an attempt to profit from price movements.

Companies engaged in prop trading, often called prop trading firms (prop firms), typically employ professional traders who are trained to execute specific trading strategies designed to maximize profits. Traders working at prop firms often receive commissions or profit shares based on the profits they generate, in addition to a fixed salary.

List of popular exclusive trading companies

-

FTMO

merit:- Attractive profit sharing structure (70-80% for traders)

- A clear and systematic evaluation program.

- Passing the assessment will give you access to large trading accounts.

disadvantage:

- A rigorous and time-consuming evaluation process.

- Registration fee for participation in the evaluation program.

-

TopstepFX

merit:- Education and support for beginning traders.

- A flexible trading environment with transparent risk rules.

disadvantage:

- This is a monthly fee for using the platform.

- It is a relatively long and time-consuming evaluation process.

-

The Five Us

merit:- There are no monthly fees after your initial payment.

- Access to significant capital with fair distribution of profits.

- There is no time limit to complete the assessment.

disadvantage:

- High profitability requirements.

- The profit distribution ratio is low compared to other prop companies.

Why Should You Choose Exclusive Trading Directly Through a Forex Broker?

Exclusive deals offered directly by forex brokers (e.g. Select axis A program offered by Australian real estate brokerage Axi has distinct advantages over traditional real estate companies.

Here’s why Axi Select stands out as a great and legitimate choice:

-

Direct integration with trusted brokers: Axi Select is provided by Axi, a reputable forex broker regulated by the Australian Securities and Investments Commission (ASIC). This ensures security and transparency in all transactions.

-

Access to significant capital and leverage: The program provides access to substantial trading capital of up to $1,000,000, allowing traders to take larger positions and maximize their profit potential. It also allows for higher leverage (1:100 leverage) since the capital is provided directly by the broker.

-

Flexibility of trading strategies: Axi Select traders have the freedom to use a variety of trading strategies without the strict restrictions commonly found in other prop firms. This allows traders to fully express their trading style.

-

No limits on profit targets and trading periods: Axi Select offers an achievable profit target of just 5%, allowing traders to focus on high-quality trading without time constraints.

-

Maximum loss limit: Axi Select sets a maximum loss limit of 10% at each level and implements an isolation system when a trader exceeds this limit. Once the isolation is lifted, the trader can resume Axi Select.

-

No evaluation fees or hidden costs: Unlike many prop companies that charge registration or assessment fees, Axi Select does not charge these fees. Traders can focus entirely on trading without worrying about additional costs.

-

Trader Development and Mentorship Program: Axi Select offers a development program that allows traders to hone their skills and learn directly from industry experts. The program is designed to help traders continuously improve their performance.

How to get started with Axi Select?

- You must have an account with Axi and complete at least 20 trades on Axi Select to be able to evaluate your trades based on risk and profitability (Edge Scoring).

- Qualified traders are determined by their edge score, and each level has a minimum score that must be met to receive funding.

- If you are eligible for the Axi Select program (Edge Score 50), enroll through the Client Portal.

- You will receive a “Welcome to Axi Select” email with live information for your MetaTrader 4 (Pro account).

- There is no registration fee to join Axi Select, but a minimum deposit of $500 – $4,000 is required.

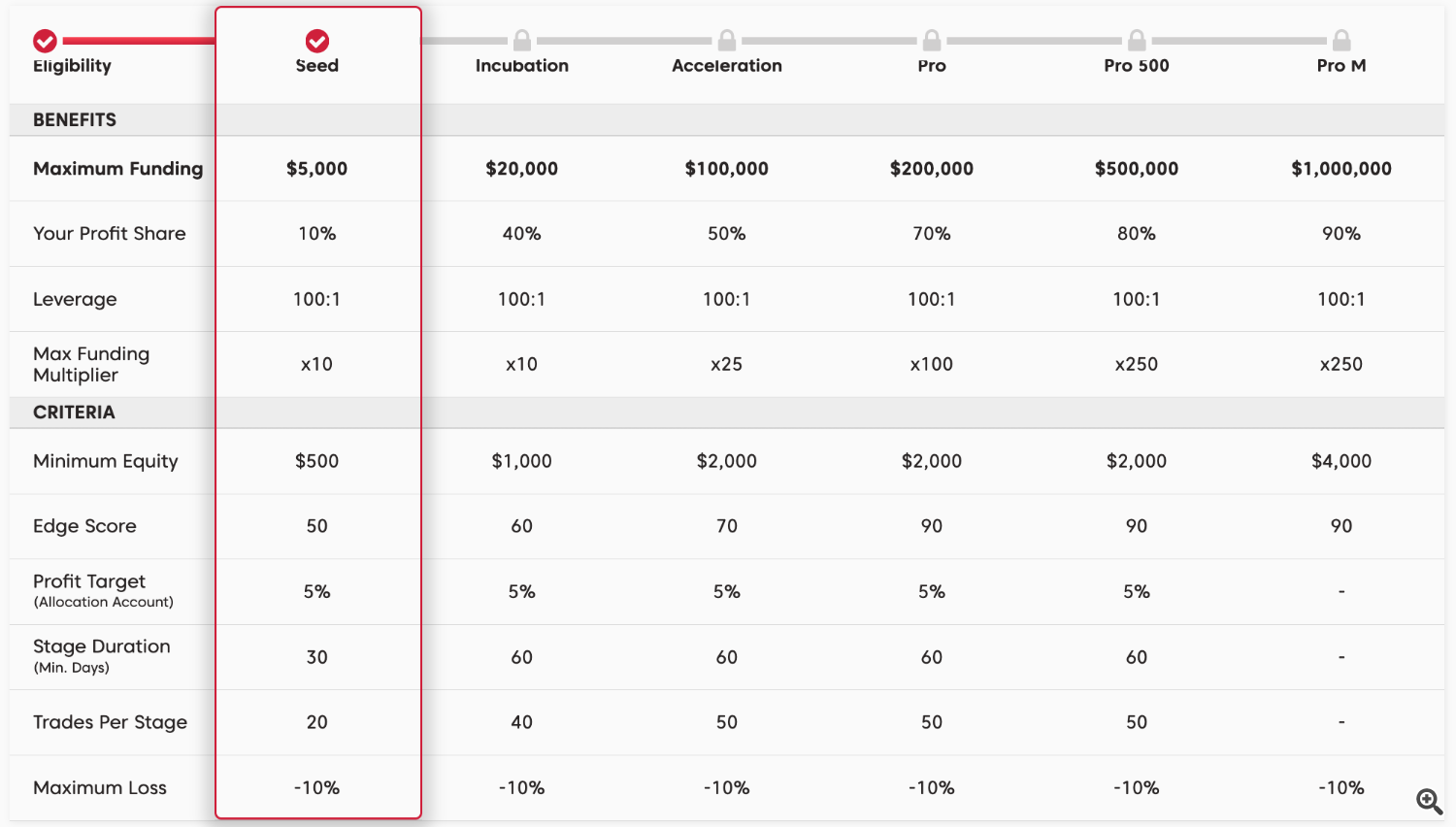

- Axi Select has 6 levels, starting from the SEED level (minimum balance $500, maximum funds $5,000) to the highest PRO M level (minimum balance $4,000, maximum funds $1,000,000).

- You will be notified by email when you meet the eligibility criteria, including minimum balance and edge score. The allocation account set by the broker reflects the trades executed on the Axi Select account.

- You will also have access to the Axi Select dashboard.

- All trades on your Axi Select account are recorded and mirrored (copy traded) by an allocated account funded by your broker.

- To increase your Edge Score, focus on trading and risk management.

- As your balance grows and meets the minimum balance required for the next level (including earned Edge points), you can upgrade to the next level and receive a new allocation account that provides more funds.

- Please see the Axi Select table below for more details.

Join Axi Select today!

If you are interested in advancing your trading career and joining an exclusive trading program with direct access to significant capital and professional development opportunities, join Axi Select today! Take advantage of the benefits offered by a leading forex broker and start trading with confidence.

Visit the Axi website to register for Axi Select today and start your journey to trading success!