Forget about high gas bills. Ethereum Still Bullish: Is It Time to Buy More?

Despite concerns about network congestion and high gas fees, Ethereum remains strong over the long term, according to Rollbit partner borovik.eth. Posted Key factors driving the positive outlook point to Ethereum’s developer ecosystem, its role in the broader blockchain ecosystem, and the launch of numerous layer 2 solutions (L2).

Will layer 2 activity push ETH to new highs?

Borovik.eth has maintained a deviant and bullish stance on ETH despite other layer 1 coins such as Solana (OSL) and Cardano (ADA) surging in 2023. In the analyst’s view, Ethereum’s scaling issues are manageable and developers “will permanently address these concerns in the long term.”

With this optimism, Rollbit partners believe that ETH will recover strongly in the coming sessions, especially considering the level of development of layer 2 scaling options for the pioneering smart contract platform. According to Borovik.eth, development of layer 2 off-chain options supported by large enterprises such as CCryptocurrency exchange oinbase and venture capitalists (VCs) are positioning Ethereum (ETH) favorably for a bull market.

As of December 26, ETH is maintaining an upward trend, but is cooling off after a solid rally in the fourth quarter of 2023. At spot rates, ETH underperforms most layer 1 platforms such as INJ (Injective Protocol) and SOL (Solana). New record in 2023. ETH price is still falling below the important resistance level of $2,400. If bulls overcome this line, ETH could fly above $3,500 in the coming months.

In particular, the surge in value of SOL in the second half of 2023 has led to comparisons with ETH. Nonetheless, most traders are optimistic. Arthur Hayes recently stated that users should begin rotating their funds from SOL, which underwrites the second most valuable coin by market capitalization, to ETH.

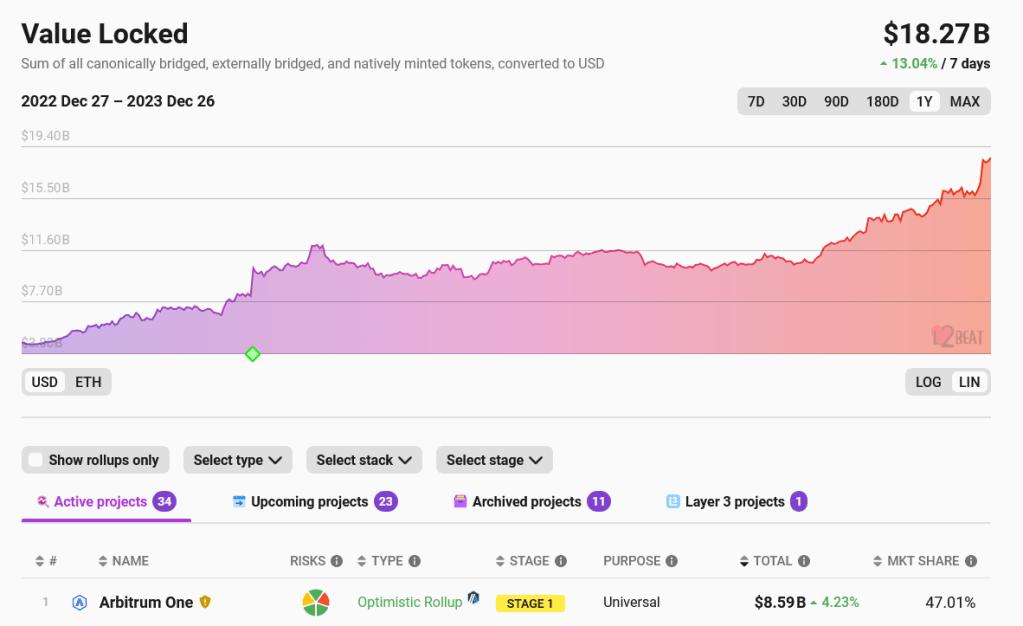

Ethereum Layer-2 manages over $18.8 billion.

Ethereum is facing issues with on-chain scaling, but developers have been working hard to resolve these issues. The launch of layer 2 off-chain options using rollups was central to this drive. Many of these solutions, including Arbitrum and Optimism, have been instrumental in reducing gas costs by relieving pressure on the mainnet. According to L2Beat, the Layer 2 protocol manages over $18 billion in Total Value Locked (TVL). There are also 34 active projects and 23 more in development.

Among the larger companies looking to adopt Layer 2 is Coinbase, which allows users to trade cheaply while relying on the Ethereum mainnet for security. According to Borovik.eth, over 60% of Base’s revenue comes from the roll-up fees charged, highlighting the importance of scaling solutions and Ethereum’s role in all of this.

Related Read: Shiba Inu Whale Moves $45 Million From SHIB Are you optimistic?

Dencun upgrades scheduled to be integrated next year will further reduce Layer 2 costs. The developers plan to release this update on the Goerli test network as early as mid-January 2024.

Featured image from Canva, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.