Fortinet Bears may be wrong to doubt the company’s turnaround (FTNT)

Yuichiro Chino/Moment via Getty Images

investment thesis

Fortinet (NASDAQ:FTNT) recently announced its full-year FY23 results yesterday, which showed an improvement over the crucial third quarter of FY23, which cast doubt on the cybersecurity company’s full-year performance. at 3rd quarter callInvestors were quick to drive the stock price down last year, but management has made active efforts to restore confidence with its investor base, including attending technology conferences over the past three months. Wells Fargo TMT Conference and Barclays Global Technology Conference.

Considering management’s commentary on the recent earnings call and the forward-looking outlook for full-year 2023 results released yesterday, we see upside for Fortinet and rate it a ‘Buy’.

Introduction to Fortinet and the Journey to SASE

Before reviewing the latest earnings call, we think it’s important to review Fortinet’s business. We briefly describe the model and explain why Secure Access Service Edge (SASE) is critical to the next step for cybersecurity companies. Fortinet was founded by the Xie brothers, Ken and Michael, and is headquartered in Sunnyvale, California, to sell on-premises cybersecurity hardware and virtual machine products, including firewalls, software-defined wide area networks (SD-WAN), and virtual machines. was established. Private network (VPN), etc. The company has demonstrated resilience through many business changes. One of them is to shift dependence from hardware product revenue to service revenue.

The company is currently undergoing another transformation to expand the scope of its cybersecurity products in the SASE space and compete with other large players such as Palo Alto (PANW) and Cisco (CSCO). In its third quarter FY23 earnings call, management expressed disappointment with its own performance as product sales declined slightly year-over-year, while also setting mid- to long-term expectations that the company would shift its focus to faster-growing, safer operations such as SASE. “The market will expand over the next few quarters.”

Therefore, as we review our overall FY23 performance, we believe it is important to also look at improvements in our numbers and commentary from management.

View Q4 and Full Year Results

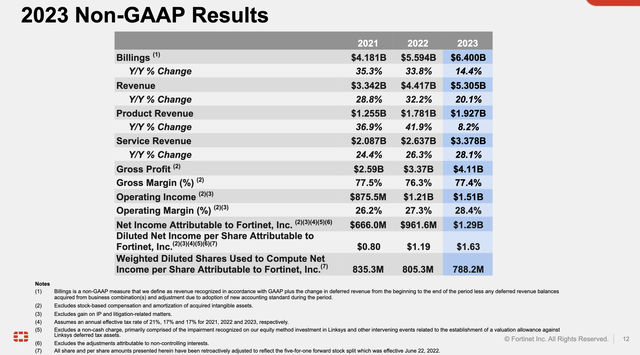

In the fourth quarter, Fortinet reported revenue of $1.42 billion, up 10.3% year over year and slightly beating consensus estimates by 0.7%. For the full FY23, Fortinet’s revenue rose 20% year over year to $5.3 billion, meeting market expectations. Most of the revenue increase was driven by the services revenue segment, which accounted for 63.7% of revenue, with the remainder coming from product revenue. Services revenue increased slightly by 20.1%, but as you can see below, it was product revenue that had the steepest decline in three years. I previously mentioned how management expressed disappointment with product revenues slowing more than expected. The slide below shows exactly the scale of the slowdown in product revenues.

FY23 Q4 Investor Presentation, Fortinet

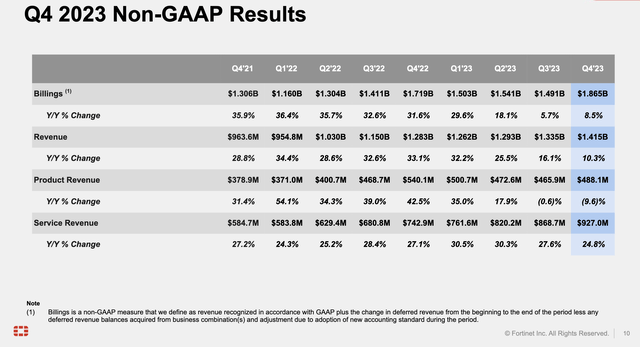

Billings for fiscal 2023 grew 14.4% year over year, slower than revenue growth. However, most of the expectations for a slowdown here were already laid out by management last quarter, along with the mitigation strategies they are working on through their SASE product offerings. Drilling down by aq/q, we see that some of the claims growth has already recovered in Q4 FY23 after six consecutive quarters of slowing quarterly y/y claims metrics, as seen in the chart below.

FY23 Q4 Investor Presentation, Fortinet

These are very early and encouraging signs of the initial success the company is already seeing in Billings. Fortinet’s transition will take several quarters as the company launches more SASE products and upskills its sales and marketing teams to become SASE certified. But during the fourth quarter earnings call, management provided more information about the trends seen in the billings, which show just how important Fortinet’s SASE expansion is. While secure networking accounted for the largest share of the bill at 60%, SASE’s bill was surprising at 21% of the total bill. In my opinion, this was a welcome improvement compared to the third quarter. I think the next few quarters may be a little challenging, but I am confident that management will be able to successfully complete the transition to SASE by the end of this year. This was also reflected by management at the Barclays Technology conference late last year and stated:

Yes, it hasn’t been announced yet for ’24. Obviously, it’s just a kind of indicator that tells us the direction of our thinking. Because people have always worried about what the future will look like. From a billing perspective, what we’ve said for 2024 is that we expect bill growth to return to double digits by the second half of next year.

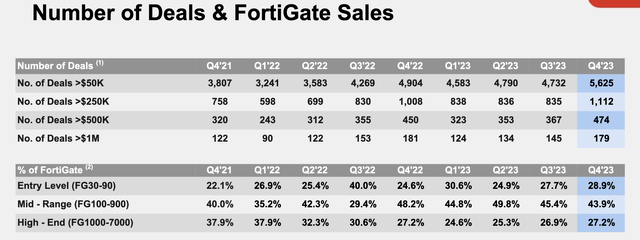

Another thing that caught my attention in the earnings report was the development of Fortinet’s customer base. In general, Fortinet has a wide range of customers from small and medium-sized businesses to enterprises, but has a stronger bias towards small and medium-sized businesses. However, I have noticed some sequential improvement in their transactions, especially the larger ones such as $500,000+ and $1 million+. We hope to see this number grow further in the future, allowing Fortinet to reduce its dependence on the SMB customer base. In my opinion, shifting Fortinet’s dependence to larger customers will allow it to expand margins and keep costs consistent.

FY23 Q4 Investor Presentation, Fortinet

Moving on to profit. Fortinet achieved a gross margin of 76.7%, which is in line with its long-term range of 76% to 78%. Non-GAAP operating margin increased 1.1% to 28.4%. Although management hasn’t mentioned this directly, my guess is that a slew of deals were launched to demonstrate how effective Fortinet’s sales and marketing spending is for the company. When asked specifically about this, Fortinet’s CFO noted that such large deals weren’t actually forecast last year, which could mean they probably helped margins higher than expected.

FY23 Q4 Investor Presentation, Fortinet

Valuation model suggests strong upside potential

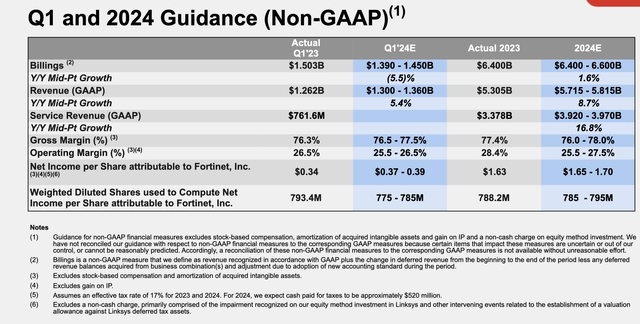

Management released guidance for FY24, which was a bit lukewarm in my opinion. But I also think management is being conservative and trying to temper expectations. I’ve attached guidance below that shows that Billings is still growing, but at a very slow pace.

FY23 Q4 Investor Presentation, Fortinet

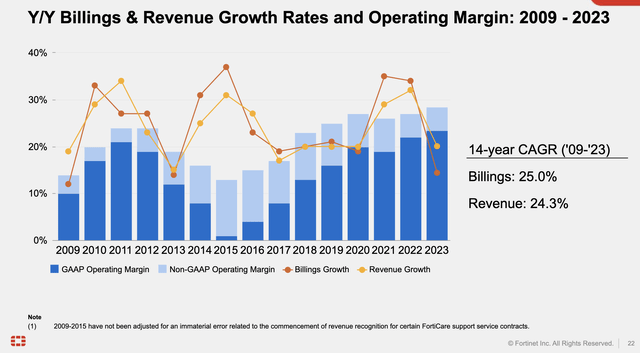

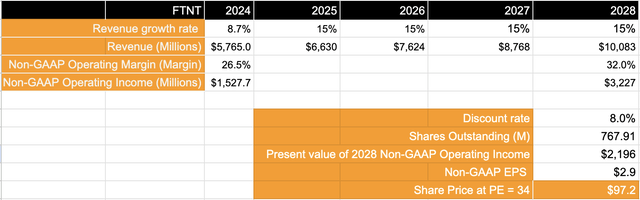

Given how management has already begun executing to gain market share in the SASE market, we are optimistic that Billings can continue to deliver healthy double-digit growth starting in FY25. Now, as we observe the company’s operational efficiency this year, I would continue to expect operating margins to continue to expand to our target of 32% in FY28, growing at ~20% CAGR. For this growth rate, I value Fortinet at ~30%.

author

Risks and other factors to consider

Because Fortinet is in a transition period, there is always a risk that the transition may fail or take longer than usual to complete. However, given the progress Fortinet has already made in transitioning to SASE and its history of completing transitions previously, I am optimistic about Fortinet’s transition. However, I will be paying close attention to management commentary throughout the year to provide advice on trends seen in Billings. We mentioned earlier in our FY23 report how SASE contributed ~21% of billings. Based on its current FY24 guidance, Fortinet is expected to build expectations throughout the year as it moves through its product cycle and participates in more technology conferences. Additional color on how the SASE market share is evolving is expected to be shared here. Additional headwinds from competition could further impact Fortinet’s ambitions to expand into SASE.

Fortinet is still in the business of selling hardware products, and because it isn’t selling enough of its hardware products, the company may have more inventory on its balance sheet than expected. This will deteriorate working capital and put pressure on free cash.

conclusion

In summary, I am optimistic about management’s transition to the SASE market. At the same time, management has demonstrated efficiency in controlling costs, increasing profits, and focusing on innovation. With these positive developments, I rate Fortinet a ‘Buy’.