Fortinet: Don’t Wait for This Cybersecurity Leader to Recover to All-Time Highs (NASDAQ:FTNT)

JHVEPhotography

Fortinet, Inc. upgraded the paper. (NASDAQ:FTNT) In late November 2023, the market took a huge hit after reporting disappointing third quarter results. I argued that FTNT had fallen to long-term support levels, which attracted the attention of deep buyers. I saw an important opportunity through surrender.

That thesis has come to fruition as FTNT has significantly outperformed the S&P 500, delivering a total return of nearly 30% since the previous update. From its November lows, FTNT has rallied more than 50% to last week’s highs, surprising bearish investors who had little faith in the wide-moat cybersecurity market leader.

It’s important to consider that Fortinet is a highly profitable SaaS leader, with a best-in-class “A+” profitability rating. While a slowdown in its core networking business will likely lead to significant selling, the market has also been quick to reflect weak growth momentum. Additionally, management provided Here are some insights from our early December meeting: Fortinet “looks forward to a return to a normal environment” As a result, while the high-growth phase triggered by the pandemic is likely gone, Fortinet remains well-positioned to strengthen its capabilities in the fragmented cybersecurity market.

Therefore, the company has an integrated, end-to-end SASE stack based on a “one-size-fits-all” approach. As a result, customers can “deploy SASE on-premises or in the cloud, depending on their preference.” Combined with its core networking advantages, the company is confident it can continue to gain market share. Still, Fortinet warned that despite its market leadership, there are inherent transition costs. “For Fortinet to be successful in this regard,” executives emphasized, “our customers must be willing to replace existing products.”

As a result, network effects and scale advantages benefit Fortinet and help it secure a competitive moat, while providing powerful defensive capabilities to important players such as Palo Alto Networks (PANW) and cloud-based leaders such as CrowdStrike (CRWD). provide. Given the built-in switching costs, it is not surprising that cybersecurity leaders often trade at a significant premium to the market.

Fortinet is scheduled to release its fourth quarter and FY23 earnings call on February 6. Investors are likely viewing 2024 as a reset year after several years of rapid growth. Therefore, investors may need to look a little further ahead and assess whether FTNT can continue to regain its earnings growth momentum.

Accordingly, analysts’ estimates suggest that revenue and adjusted EPS growth are expected to accelerate again in FY25. Fortinet is expected to record revenue growth of 15.1% in 2024, after expected to slow to 12.1% in FY24. Adjusted EPS growth is also expected to slow significantly to 7.2% before accelerating again to 16.2%. Therefore, I urge investors to look a little further forward when assessing whether FTNT is still priced appropriately given its thesis.

FTNT is valued at a FY25 adjusted EPS multiple of 34.2x, well below its 10-year average of 47x. As a result, it appears that the market has not yet fully reflected the recovery, suggesting that further re-evaluation remains possible.

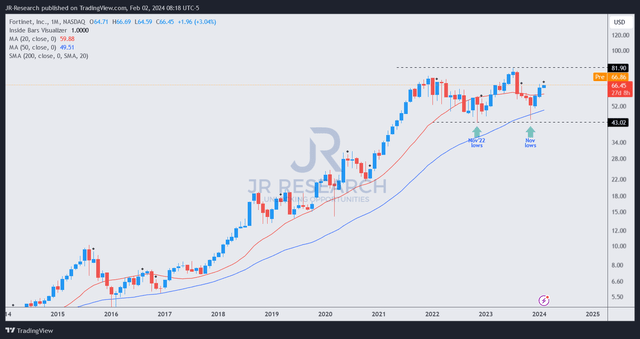

FTNT price chart (monthly, long term) (Trading View)

Additionally, FTNT’s long-term uptrend bias has kept it undefeated despite a sharp selloff in 2023. In fact, the lower $40 level is well supported as deep buyers have come back aggressively to defend, seeing a very attractive risk/reward profile as FTNT weak holders. surrendered.

While the most attractive buying levels are likely over, FTNT’s long-term price action suggests an uptrend continuation bias is at play.

With this in mind, we find it appropriate to maintain a bullish bias on FTNT, although it no longer makes sense to maintain a Strong Buy rating.

Rating: Downgraded to Buy.

IMPORTANT NOTE: Investors should exercise due diligence and be careful not to rely on information provided as financial advice. Always be an independent thinker, and please note that unless otherwise stated, the ratings are not intended to establish specific entry/exit times at the time of writing.

I’d like to hear from you

Do you have any constructive comments to improve our paper? Have you noticed a critical gap in our perspective? Did you see something important that we didn’t see? Do you agree or disagree? Please leave your comments below to help everyone in our community learn better!