Franklin BSP Real Estate Stock: Dividend Yield of 10.8%, but Coverage is Slipping

peeterv/iStock (Courtesy of Getty Images)

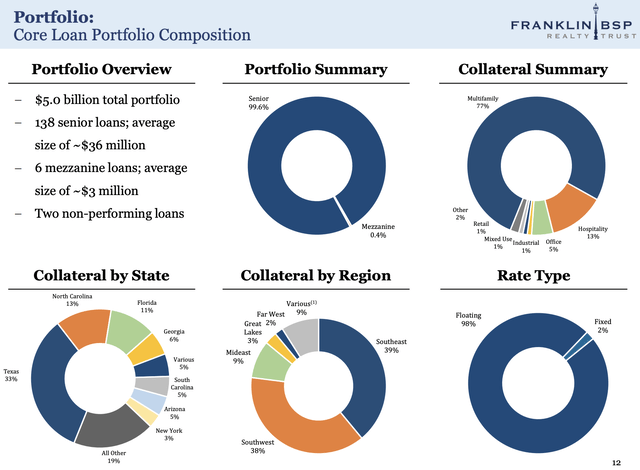

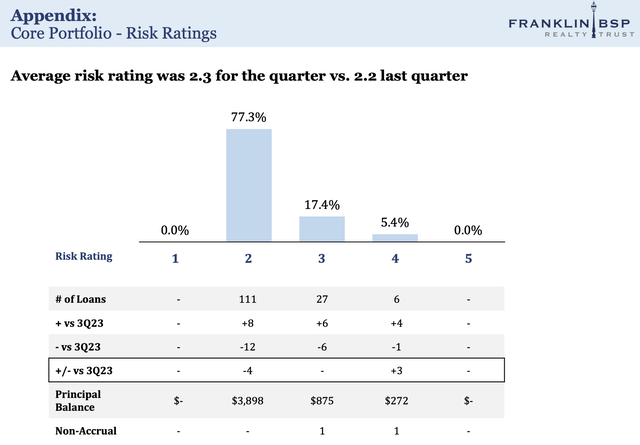

Franklin BSP Real Estate (New York Stock Exchange: FBRT) Like other mortgage REITs, it has been fighting the Fed over the past two years by spreading its $5 billion commercial real estate loan portfolio across 144 loans. This is the most recently reported fourth quarter of fiscal year 2023. The portfolio is heavy in multifamily loans, with a 77% allocation, but is also diversified across office, hotel, and industrial properties, among other real estate collateral. CRE anxiety illustrates deep market fears about three headwinds currently facing U.S. commercial real estate. The Federal Reserve raised its benchmark interest rate to 5.25% to 5.50%, the highest in more than 20 years, due to inflation, increased office vacancies due to people working from home, and a seesaw economic situation. me Last covered The outlook for summer 2022 is broadly neutral.

Franklin BSP Real Estate Accounting Supplementary Materials, Fourth Quarter 2023

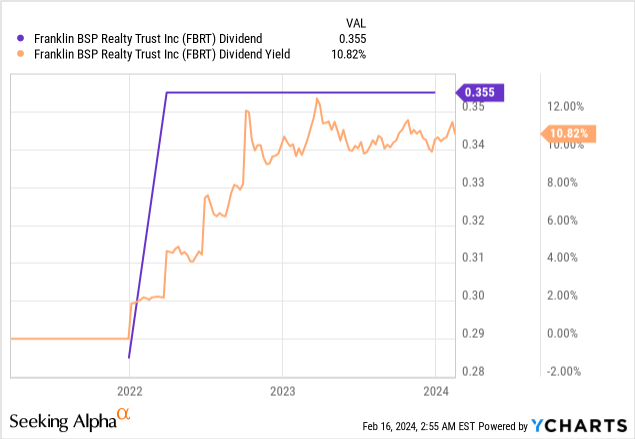

FBRT last paid a quarterly cash dividend of $0.355 per share, unchanged sequentially, and paid an annualized dividend of $1.42, giving it a forward dividend yield of 10.8%. The safety of this distribution against widespread CRE instability is uncertain in 2024. The FBRT loan portfolio is 98% floating rate loans with only 5% exposure to office assets and has extensive U.S. geographic exposure, but with a material allocation to solar. belt. The mREIT began trading in 2021 following the merger of Benefit Street Partners Realty Trust and Capstead Mortgage Corporation. What Capstead prefers (New York Stock Exchange:FBRT.PR.E) The name was changed at that time and has remained the same.

Origins and Dividend Safety

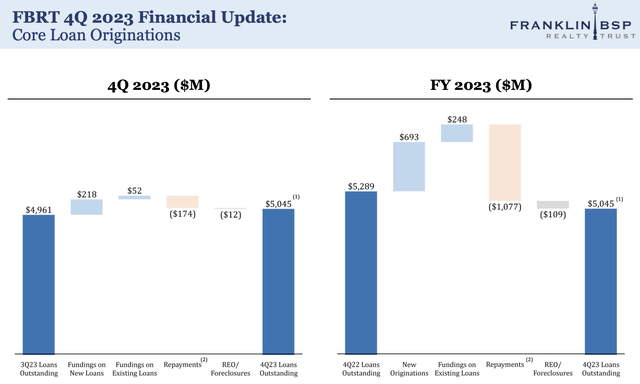

FBRT generated total revenue of $263.95 million in full-year 2023, up 27.6% from the previous year but missing consensus estimates by $4.09 million. Growth was driven by a year-on-year rise in base interest rates and new loans of $693 million through 2023. FBRT originated $218 million in new loans during the fourth quarter. This was ahead of repayments of $174 million, but annual repayments of $1.08 billion were $384 million ahead of 2023 repayments. This has resulted in a decline in outstanding loans but also increased liquidity for FBRT providing security against a turbulent macro backdrop.

Franklin BSP Real Estate Fiscal Year 2023 Fourth Quarter Supplement

FBRT had $338 million in unrestricted cash at the end of the fourth quarter, up 88% from $180 million a year ago and accounting for 5.7% of FBRT’s total assets. The mREIT’s total liquidity stands at $1.5 billion, including available financing, which management plans to deploy more aggressively in 2024. FBRT’s monetization call. They also indicated $78 million in additional funding due in February, in preparation for a still robust pipeline for the first quarter of fiscal 2024.

Franklin BSP Real Estate Fiscal Year 2023 Fourth Quarter Supplement

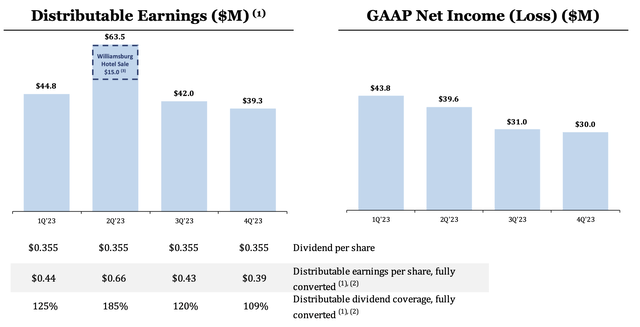

This would put the first quarter ahead of the fourth in terms of new creation as the mREIT attempts to strike a balance between defending against the specter of a recession and maintaining GAAP net income growth. Net interest income for the fourth quarter was $54 million, compared to GAAP net income of $30 million. This was a decrease of $1 million sequentially, but up from $27.2 million a year earlier due to higher base rates. The key risk here is reduced dividend coverage. Fourth quarter distributable earnings were $39.3 million, or approximately $0.39 per share, down 4 cents from the prior quarter. This means that the quarterly dividend of $0.355 per share went from 121% coverage in the third quarter to 110% coverage during the fourth quarter.

Book value and credit rating

Franklin BSP Real Estate Fiscal Year 2023 Fourth Quarter Supplement

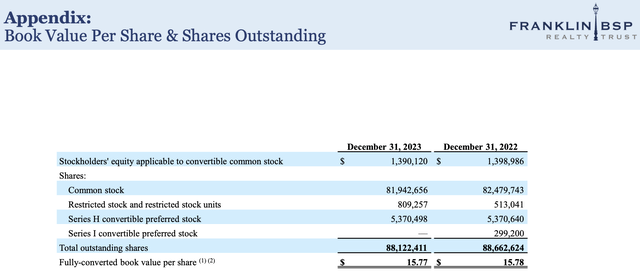

FBRT’s book value per share was $15.77, down from $15.82 in the third quarter and down slightly by 1 cent year-over-year. This means that Commons is currently trading at an 18% discount to book value. This set of large discounts opens up near-term upside for current shareholders.

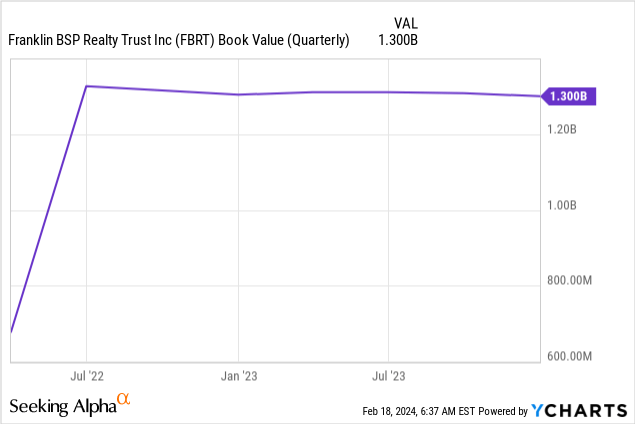

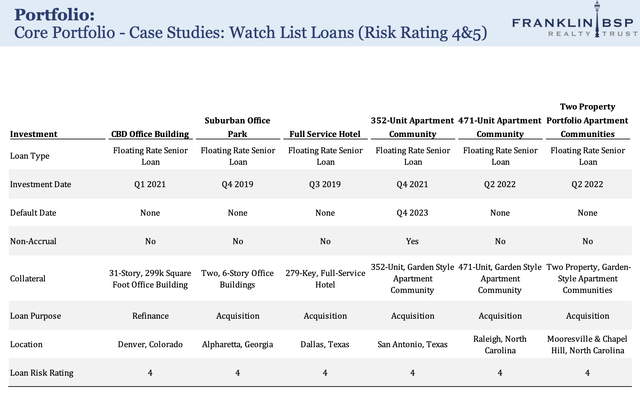

Critically, despite the headwinds faced by office real estate and multifamily developers due to high base interest rates, book values have remained broadly stable since the merger. FBRT had six assets on its watchlist at the end of the fourth quarter. There are another three foreclosed REO positions representing approximately 2% of total assets.

Franklin BSP Real Estate Fiscal Year 2023 Fourth Quarter Supplement

Of these watch list loans, only one, a 352-unit apartment complex in San Antonio, was outstanding as of the end of the fourth quarter. Additionally, while FBRT incurred no CECL expenses during the fourth quarter, it increased its general CECL reserves by $5.4 million, which now totals 96 basis points for the mREIT’s overall portfolio.

Franklin BSP Real Estate Fiscal Year 2023 Fourth Quarter Supplement

Overall, FBRT’s risk rating remains blinking green amid a sequential increase in loan originations in the first quarter, expected to improve underlying net income and drive coverage declines, reducing overall volatility with a focus on multifamily. FBRT is a buy at current levels, with its double-digit dividend yield and large discount to book value forming the rationale for the rating.