Freshworks Q4 Results: Growth Uncertainty After 2024

SOPA Images/LightRocket via Getty Images

investment thesis

Freshworks Co., Ltd. (NASDAQ:FRSH) delivered guidance for 2024 that was in line with expectations. This is unavoidable bad news. The good news is that Freshworks’ growth is accelerating. that fundamental profitability This means the stock is trading at an attractive price.

Essentially, the problem with stocks is that the intrinsic value of these businesses needs time to grow enough to match the stock’s expectations. However, I believe we will look back at $20 per share as a low over the next 12 months.

Here’s why I maintain lukewarm optimism about FRSH.

A quick summary

Last October, I concluded the following optimistic analysis:

Freshworks offers a compelling opportunity. Although we are no longer in a hyper-growth phase, It is valued at a stable 20% CAGR and a net sales multiple of approximately 9x to 10x, highlighting a reset in investor expectations.

This means Freshworks can now prioritize improving profitability. This guidance could end 2023 with EPS of around $0.22, which would be a significant leap forward from past performance.

It may not be a high-octane growth stock, but Freshworks shows promise for consistent, long-term returns with improved valuation prospects.

As a result, FRSH achieved EPS of $0.26 for 2023, significantly higher than previous expectations of $0.22.

And this leads to the following argument.

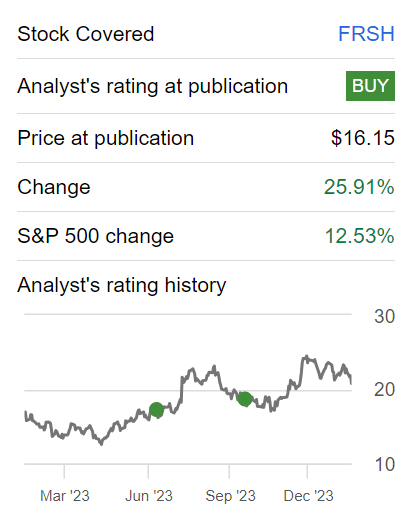

Author’s work on FRSH

Since I became bullish on FRSH, FRSH has performed strongly and is up significantly more than the S&P 500 (SP500). Although I know this investment thesis is not flawless, I nonetheless maintain lukewarm optimism about this stock.

Why Freshworks? Why now?

Freshworks creates business solutions with a particular focus on customer service tools. It aims to help companies optimize their work processes and increase productivity. They compete with ServiceNow (NOW), Salesforce (CRM), and HubSpot (HUBS).

Going forward, Freshworks appears to have promising near-term prospects. Fourth quarter 2023 results demonstrated strong financial performance, exceeding revenue expectations of $160.1 million.

Additionally, the launch of the Freshworks customer service suite and notable client acquisitions, including partnerships with Big Lots, S&P Global, Fila and others, represent expanded market reach and awareness of key brands.

The Neo platform, the foundation of its product portfolio, represents the company’s commitment to serving enterprise customers. It also reflects improved operating efficiencies as Freshworks transitions from a cash-burning company in 2022 to generating $78 million in free cash flow in 2023 (making it more profitable going forward).

But Freshworks also faces challenges. The competitive environment in the software industry is fierce and continuous differentiation is required for continued growth.

The introduction of AI capabilities, including Freddy Copilot and Insights, brings opportunities but also challenges to ensure effective integration and customer adoption. Additionally, because the company targets large enterprises, scalability issues may arise if it wants to meet the different needs of its broader customer base.

Additionally, the departure of key executives such as Chief Revenue Officer (CRO) Pradeep Rathinam is raising questions about Freshworks’ ability to retain executive talent.

Given this mixed context, let’s now discuss Freshworks Inc.’s finances.

Outlook for 2024 points to a CAGR of 20%

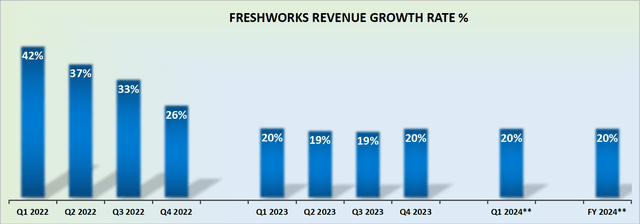

FRSH Revenue Growth Rate

Freshworks’ 20% CAGR guide. Right off the bat, this is the main drawback of the bull case. I expected Freshwork to dazzle investors with solid guidance. Especially considering that comparisons to previous years are much easier.

As a result, the main question I have is what will happen in 2025? Can Freshworks find a way to increase revenue growth again? Or will growth slow down from 2024?

So when investors are asked to pay a large premium for growth stocks, they demand certainty and strong premium growth. And I’m not sure if Freshworks can do either of these.

Against this background, let’s take a look at the valuation of this stock.

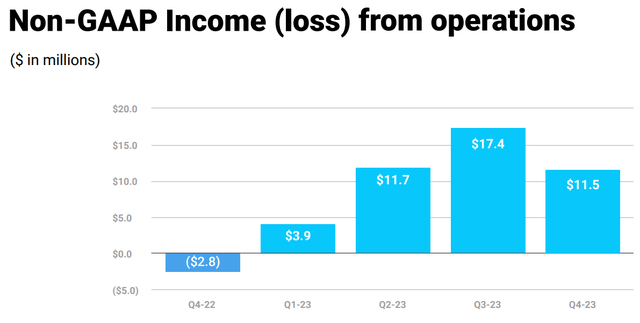

FRSH stock valuation – 100x non-GAAP operating income

FRSH achieved a non-GAAP operating margin of 7.2% in the fourth quarter of 2023. Meanwhile, guidance for the first quarter of 2024 is already close to a non-GAAP operating margin of 9%. In fact, this is an expansion of about 180 basis points year-over-year.

As a result, with management guiding to deliver a non-GAAP operating margin of approximately 9% in 2024, I believe it is possible for FRSH to deliver a non-GAAP operating margin of 10% once the year is done and the dust settles.

This represents a 55% year-over-year increase in non-GAAP operating income.

4th quarter 2023

Ostensibly, investors are asked to pay 100 times non-GAAP operating income. That sounds compelling, but you have to consider that the business is still growing at a 20% CAGR and has only just begun its path to profitability in 2023.

with Other 12-month sales growth, along with some operating leverage, Freshworks could see non-GAAP operating margins of about 13%, or close to $110 million. This values the stock at 64 times non-GAAP operating earnings.

conclusion

Freshworks’ outlook looks promising with 2024 guidance in line with expectations and showing improved underlying profitability.

While my optimistic stance remains, uncertainty remains regarding continued growth beyond 2024.

On the financial front, Freshworks has impressively transitioned from a cash burner in 2022 to one generating $78 million in free cash flow in 2023, reflecting improved operating efficiencies.

However, the 20% CAGR guidance for 2024 raises questions about the company’s ability to maintain its growth rate, which is critical to justifying its current valuation of 100x non-GAAP operating earnings. Despite the positive progress in profitability and growing business, careful consideration of Freshworks Inc. is warranted given the uncertainty surrounding the company’s ability to meet investor expectations and navigate evolving market dynamics.

Overall, I’m lukewarmly bullish on this stock.