FSMD: Works on SMMD (NYSEARCA:FSMD).

PM Images/DigitalVision via Getty Images

I don’t like the term “smart beta” as it’s more of a marketing term than an actual description. That said, I totally prefer and am a fan of factor tilted portfolios. It’s a different mix of holdings than what’s accessible in passive headline benchmarks. for teeth, Fidelity Small-Mid Cap Multifactor ETF (NYSEARCA:FSMD) looks interesting in that it is a variation on the basic market capitalization weighted index approach.

By default, FSMD uses a multi-step rule-based approach to portfolio construction. This is not simply replicating the composition of the broad market index. Instead, we actively focus on small and mid-cap U.S. companies that have attractive valuations, high-quality characteristics, positive momentum, and lower volatility than the overall market. These are all fascinating. This is especially true given how much turmoil there has been in the small-cap sector. yesteryear.

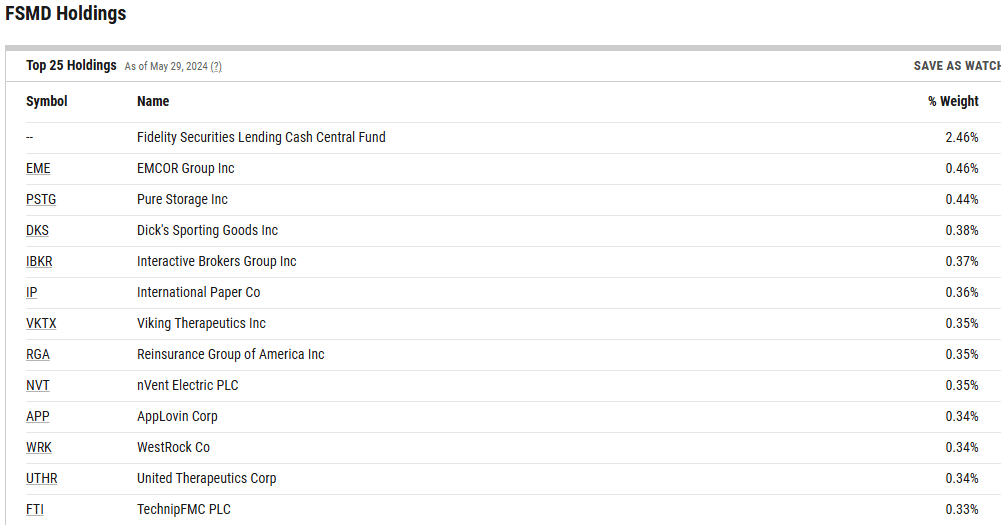

Explore Holdings

The fund holds nearly 600 assets and is very diversified. No position will account for more than 0.5% of the portfolio. This is important because it suggests that the fund has not only eliminated idiosyncratic risks, but is also pure in the factors it seeks to address.

ycharts.com

Interestingly, this mix of positions makes the valuation quite good. The price-to-earnings ratio is 15.22 and the price-to-sales ratio is 1.274 (all according to YCharts), making it a relatively cheap fund from a fundamental analysis perspective.

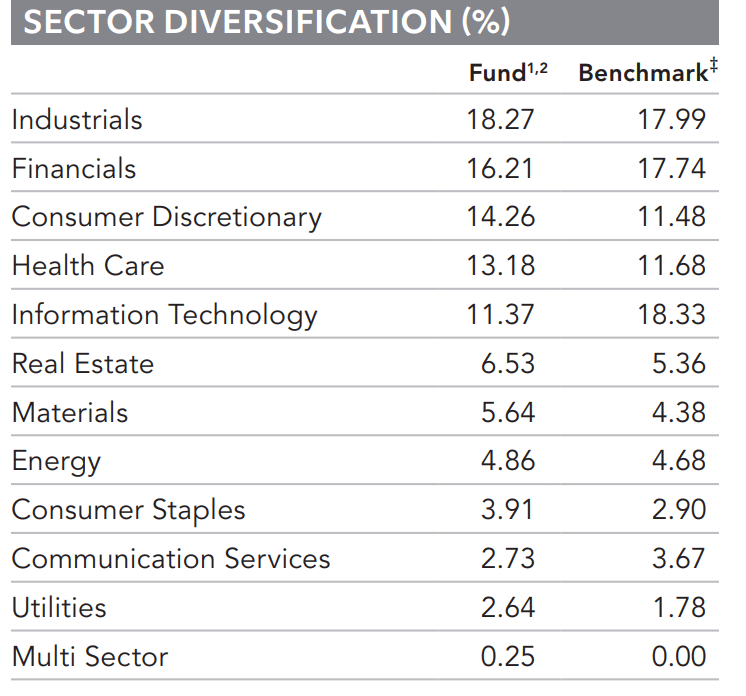

Sector composition and weighting

Since this is in the small and mid-cap segment of the market, industrials account for the largest share at 18.27%, which is not surprising given the widespread nature of the industry. Financials and Consumer Discretionary round out the secondary and tertiary distributions. I like that there are no overpowering sectors, which makes it look more diverse overall than other funds I often see.

fidelity.com

FSMD’s exposure to the financial sector, particularly regional banks, deserves special attention. Quality and valuation screening will help funds avoid the pitfalls of this sector. However, investors should be mindful of factors that could create headwinds for the stock, such as a prolonged period of high interest rates, the impact of which could lead to a decline in the local bank’s net interest margin. Specific.

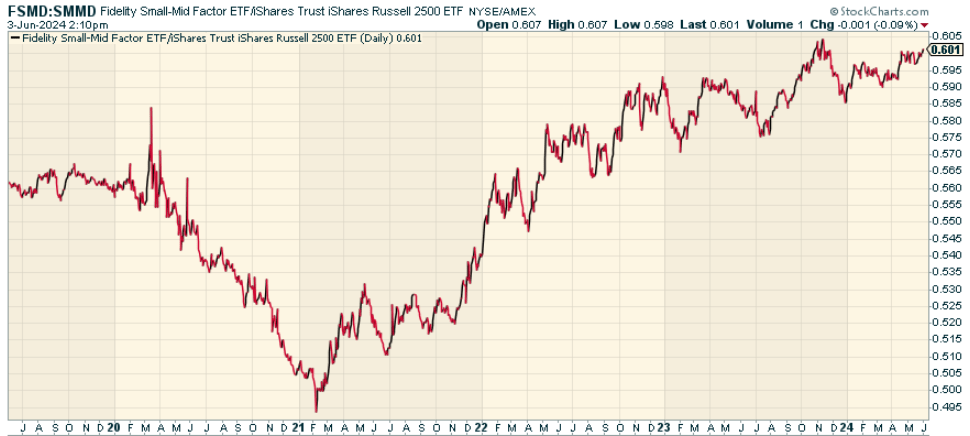

Peer Comparison: FSMD vs SMMD

It may be worth comparing this fund to the iShares Russell 2500 ETF (SMMD), a market-cap-weighted ETF that tracks the Russell 2500 Index. This also works in small to mid cap space. If we look at the price ratio of FSMD to the more exponential SMMD, we can see that SMMD has performed meaningfully. The high quality screens here helped a lot.

stockcharts.com

Evaluate pros and cons

The good news is that FSMD’s strategic beta positioning combines the low-cost efficiency of passive management with the potential for outperformance relative to market-cap-weighted indices. -Quality and momentum signals as well as low volatility. Additionally, FSMD’s emphasis on the small- and mid-cap universe provides access to the potential for faster growth and higher returns compared to large-cap stocks. We are positioned to take advantage of new trends and market opportunities.

Something negative? FSMD’s highly diversified approach, which includes nearly 600 holdings, may further steer the fund toward index-like behavior. Moreover, FSMD’s exposure to local banks creates additional sector-specific risks (although not as concerning as it was a year ago).

conclusion

I think the Fidelity Small-Mid Multifactor ETF works really well. It performs well compared to more passive proxies operating in the market-cap universe, and its quality and momentum screens lower the risk of “zombie companies” infecting portfolios (which has been a major drag on the Russell 2000 small-cap index). especially). I think it’s worth considering allocation.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of living as a passive investor and ready to take control of your financial future? Introducing the Lead-Lag Report, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk drivers, discovering high-reward ideas, and gaining valuable macro observations. Stay ahead of the competition with critical insights into leaders, laggards, and everything in between.

Switch from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to get access and try the Lead-Lag report free for 14 days.