General: Speculative Buy (OTCMKTS:ARZGF)

Mrkit99/iStock Editorial via Getty Images

General insurance (OTCPK:ARZGF) has solid fundamentals and an overcapitalized position, which could lead to improved shareholder compensation policies in the near term.

As covered in the previous article, on the other hand Generali has an interesting dividend yield, and since Generali’s growth prospects are unimpressive, a premium valuation is not warranted and I recommend it. SA/NV Age (OTCPK: AGESY) as a better income alternative.

As you can see in the following graph, this recommendation performs well, considering that ageas SA/NV showed a 13.5% increase for Generali, while it performed less than 4% for Generali.

Price/Performance (Bloomberg)

In this article, we review Generali’s most recent earnings and update its investment case to see whether it is currently one of the more interesting earnings options within the European insurance sector.

Revenue Analysis

Generali reported. a few weeks ago financial results The first nine months of 2023 (September 2023) exceeded expectations, especially in terms of bottom line.

In September 2023, Generali’s gross premiums increased by 4.7% year-on-year to €60.5 billion, driven by positive momentum in the non-life insurance (P&C) segment. In fact, non-life insurance premiums increased by more than 11% compared to the same period in 2022, while the life insurance sector reported more moderate performance.

Given that Generali’s business is more geared towards the life insurance segment, rising interest rates are making other investment alternatives such as term deposits in the banking sector more attractive to customers, putting some pressure on the bottom line. This can be considered good operational performance. It flows into life insurance products.

Consolidated operating profit in September 2023 increased by 16% year-on-year to €5.1 billion, driven by strong profits in the P&C segment driven by lower climate costs compared to 2022. The segment’s operating results increased 50% year-on-year to €2.15. Meanwhile, the Life Insurance segment recorded an operating profit of approximately EUR 2.8 billion (-1.1% YoY), while the Asset Management segment recorded an operating profit of EUR 728 million (+3.8% YoY).

The strong results in the P&C segment are justified by better pricing, as the company has recently increased prices across several insurance lines over the past few quarters to reflect inflationary pressures and higher claims costs. In fact, Generali has been increasing prices for auto and other personal insurance, with average premiums rising 6.9% in September 2023 compared to the previous year. Another positive factor in our operating results was the inclusion of claims costs, leading to a combined ratio of 94.3% in September 2023. , compared to more than 97% the previous year.

When it comes to investment income, rising bond yields have helped boost returns, and we’ve also seen some gains from equity exposure, which has benefited from the strength in stocks this year.

This positive operating momentum increased adjusted net profit to €2.9 billion for the first nine months of 2023, up nearly 30% year-on-year. The solvency ratio was 224% as of the end of September, maintaining a very strong level of capitalization within the European insurance sector.

These positive results do not include the company’s recent agreement to acquire Liberty Mutual’s insurance businesses in Portugal, Spain, Ireland and Northern Ireland, as well as its pending acquisition of Conning Holdings in its wealth management division. These two deals were announced a few months ago and are expected to close sometime in 2024. This will increase Generali’s exposure to its non-life and wealth management segments as part of its strategy to diversify its business and reduce its dependence on life insurance.

Nonetheless, life insurance is expected to remain the company’s most important segment over the next few years, unless Generali makes relatively large acquisitions in other business segments. Although we don’t expect this to happen, Generali’s strong capital position allows it to make acquisitions, and it may decide to grow its business in a significant way in the P&C or asset management sectors through potential acquisitions if the opportunity arises.

Nonetheless, Generali will hold an investor day at the end of January next year to update investors on its strategy for the next few years and possibly provide new financial targets for 2024-26. I do not expect the company’s strategy to change significantly from its current strategy, which focuses primarily on organic growth and will use excess capital positions to return capital to shareholders.

This is clearly a positive for dividends, which are likely to become the preferred method of distributing profits and excess capital to shareholders in the coming years, and a share repurchase program may also be announced. These expectations are supported by Generali’s capital ratios, which are well above the peer average, with a solvency ratio of approximately 200%, and the company’s superior capital generation capabilities.

This means that Generali may be more aggressive with its capital return policy in the coming years as it won’t have to retain as much profit going forward.

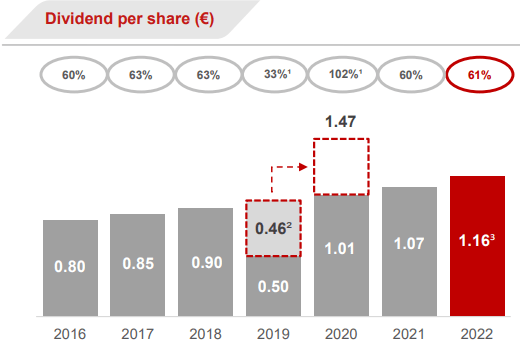

However, given that dividends are expected to grow from €1.16 per share based on 2022 earnings to almost €1.40 per share by 2026 (based on 2025 earnings), this doesn’t seem to be expected from the current street.

dividends (Normally)

This implies an annual growth rate of just 6.2% over the next three years, which is close to Generali’s historical growth rate over the past three years, but seems quite conservative. Nonetheless, the last annual dividend of €1.16 per share represented an increase of 8.4% per year, compared to the previous year when dividends increased by 5.2% and 5.9% per year respectively.

Current dividend estimates suggest that Generali will increase its dividend to €1.25 per share in relation to its 2023 earnings, with the dividend expected to grow by 7.8% YoY, so cutting the annual growth rate from next year would not make much sense. age. So it certainly appears that Generali has room to beat current sell-side expectations for its dividend over the next few years, which would be a positive catalyst for the stock’s upside in the near term.

The dividend policy will likely be updated at the upcoming Investor Day, an important event for Generali’s investors to keep an eye on. If a company decides to be more aggressive with its shareholder compensation policy, it could potentially be well received by the market.

conclusion

Generali has solid fundamentals, but this was reflected in its valuation a few months ago, so I recommend buying age with SA/NV instead of Generali. I still prefer the Belgian company in the long term, but I think it makes sense to take a speculative stance on Generali. That’s because the company will have a major event next month that could move its stock price.

Given that Generali has a solid capital position, it may decide to be more aggressive with its capital returns, making it an interesting speculative play in the near term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.