Genuine Parts: Wait for Your Next Buying Opportunity on This Dividend King (NYSE:GPC)

Exterior of a NAPA auto parts store. freely

In recent years, I have added long-term growth to my investment strategy. This can be seen while purchasing items from the likes of Amazon (AMZN). alphabet(google) over the past few years.

However, I remain essentially a dividend growth investor focused on buying quality businesses at favorable valuations. That’s why my portfolio includes dozens of Dividend Kings and/or Dividend Aristocrats.

Over time, Dividend Aristocrats and Dividend Kings fall from grace. However, I believe that a well-diversified portfolio and occasional monitoring of such businesses (e.g. selling as fundamentals deteriorate) can lead to better performance over the long term.

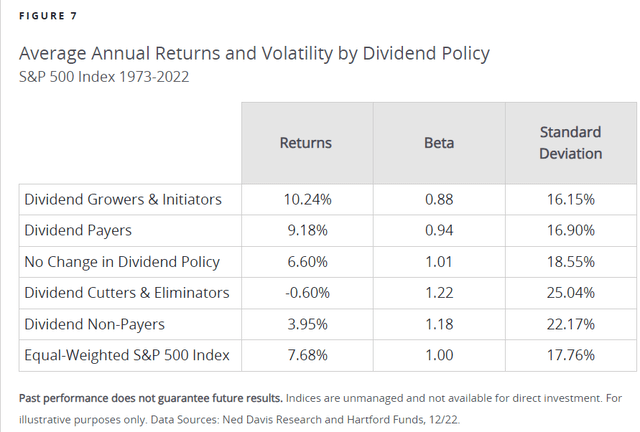

The Hartford Fund – The Power of Dividends

From 1973 to 2022, dividend growers and initiators, as a class, achieved total annual returns of 10.2%. that That’s significantly better than the equal-weighted S&P 500’s annual total return of 7.7% (SP500) The index has been created. Put another way, your investment in dividend growers and initiators would have been worth 3.5 times more than the same investment in the S&P 500 at the end of that period.

Genuine parts company (New York Stock Exchange: GPC) is a dividend king with 67 consecutive years of dividend growth. The last time I covered Dividend Kings was in June 2021. At that time, I rated it as a hold. At that time, I liked the basics of Genuine Parts Company. But I didn’t like the review. As my discussion of fundamentals will support, I still believe this is a fundamentally sound business. However, the valuation is still too high to justify an upgrade to a Buy rating.

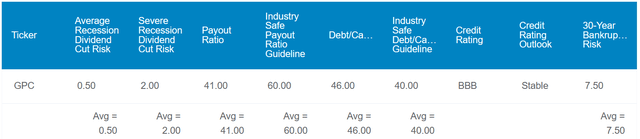

dividend king jen research terminal

Genuine Parts’ 2.7% dividend yield is reasonably attractive compared to the S&P 500’s 1.4% yield. This is especially true when you consider that there should be ample room to extend dividend growth for the foreseeable future.

One reason is that the 41% EPS payout ratio is much lower than the 60% EPS payout ratio that rating agencies want for the Genuine Parts industry. The debt-to-capital ratio is 46%, slightly exceeding the 40% desired by credit rating agencies. Therefore, Genuine Parts’ liabilities received a BBB rating from S&P with a stable outlook.

The 0.5% risk of the company’s dividend being cut in the next average economic downturn is the lowest acceptable at Dividend King Zen Research Terminal. Even in a severe recession, this risk only rises to 2%, above the 1% minimum, but not really that high. To get some insight into how these dividend cut risk estimates are calculated, they are based on a variety of metrics. This includes the company’s payout ratio and debt-to-equity ratio versus the industry safety ratio set by credit rating agencies.

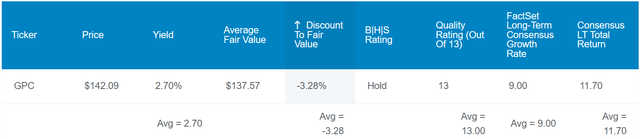

dividend king jen research terminal

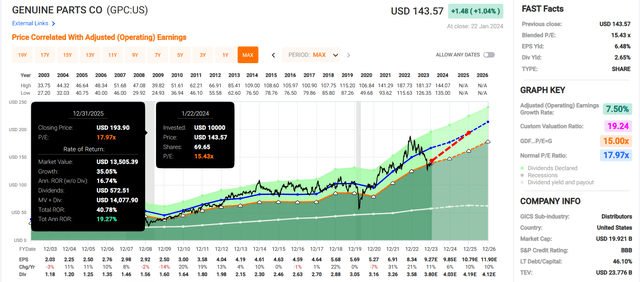

The biggest downside to genuine parts may be their valuation. Using historical dividend yields and P/E ratios as proxies (i.e. 10-year and 25-year average valuation metrics), the stock could each be worth $138. For Genuine Parts, looking at the FAST graph, I think these metrics are fair because the fundamentals (e.g. growth) are pretty much the same over the period. Compared to the current stock price of $142 (as of January 23, 2024), this indicates that Genuine Parts is overvalued by 3%.

If the company grows as expected and returns to fair value, here’s the total return it could deliver over the next 10 years:

- Yield 2.7% + 9% FactSet Research annual growth consensus (which we believe is reasonable considering low-to-mid single-digit net sales growth in genuine parts, margin expansion and share buybacks) – 0.3% annual valuation multiple contraction = 11.4% annualized total return potential, or 194% 10-year cumulative total return vs. S&P’s 9.8% annualized total return, or 155% 10-year cumulative total return.

Mixed quarter, but strong results nonetheless

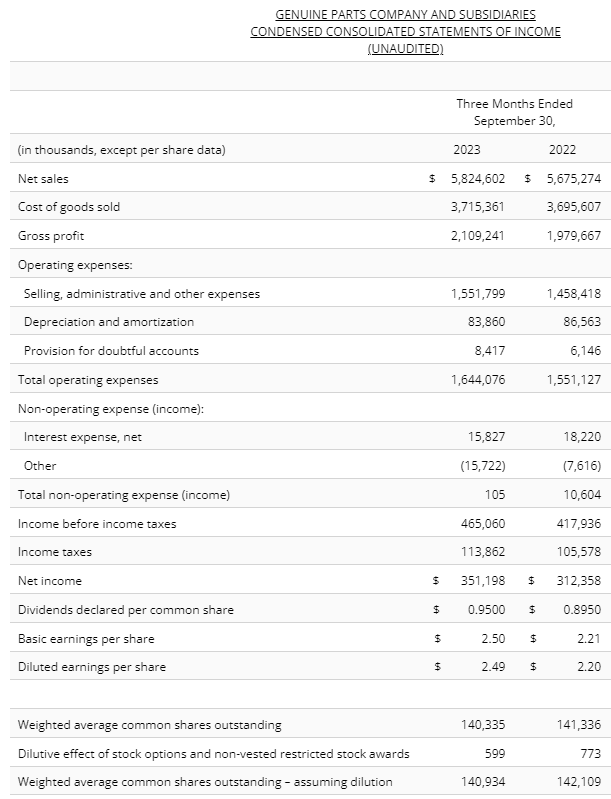

Press release on genuine parts performance for the third quarter of 2023

Genuine Parts Company, which fell $90 million short of analyst consensus on net sales, failed to double its performance in the third quarter. Despite this, the company’s net sales grew 2.6% year over year to $5.8 billion.

Genuine Parts Company’s sales growth was driven by several parts: First, comparable sales increased 0.5% during the third quarter (0.6% for Automotive and 0.3% for Industrial). Next, additional acquisitions made within each segment contributed 1.7% of net sales growth for the quarter (2.4% in Automotive and 0.6% in Industrial). Third, the favorable foreign currency translation in the automotive sector (1.1%) offset the unfavorable foreign currency translation in the industrial sector (-0.3%). This represents a net sales increase of just 0.5% for the quarter. Finally, a negative impact of 0.2% from other factors in the Automotive segment partially offset net sales growth of 0.1% during the quarter.

Genuine Parts Company’s adjusted diluted EPS hit $2.49 in the third quarter, up 11.7% year-over-year. This is $0.07 above analyst consensus. Thanks to improved operating efficiencies, the company’s non-GAAP net profit margin increased 40 basis points to 6% in the quarter. Combined with a larger net sales base and lower share count, Genuine Parts Company’s adjusted diluted EPS growth outpaced its net sales growth during the quarter (details in the previous three paragraphs taken from Genuine Parts’ Q3 2023 earnings press release ).

Analysts expect net sales to reach $5.66 billion in the fourth quarter (earnings due on February 16). This represents a 2.5% growth compared to Q4 2022 net sales of $5.52 billion. In my view, I tend to agree with the analysts’ consensus. Genuine Parts Company’s moderate revenue growth and additional acquisitions will help the company meet these forecasts.

Additionally, analysts’ consensus is that Genuine Parts will increase adjusted diluted EPS by $2.20. This corresponds to a growth rate of 7.3% compared to the same period last year. Again, I think this makes sense. This is because we believe that net sales growth, margin expansion, and share repurchases can drive this level of growth.

Momentum is clearly on the company’s side, with 8 out of 10 EPS revisions rising over the past 90 days. Finally, the projected adjusted diluted EPS of $9.89 in 2024 would be a healthy 6.7% growth rate compared to the consensus of $9.27 in 2023 (paragraph information according to Seeking Alpha).

Moving to the balance sheet, the company’s debt to adjusted EBITDA was 1.6x as of September 30. This is well below CFO Bert Nappier’s target leverage ratio of 2-2.5x per opening statement during the third quarter 2023 earnings call. Additionally, the company had $2.2 billion of available liquidity on its balance sheet at the end of the quarter.

Ample free cash flow can support dividend growth

Over the past five years, Genuine Parts Company’s quarterly dividends per share have increased a cumulative 31.9%, currently at $0.95, for a compound annual growth rate of 5.7%. I expect dividend growth to remain brisk at least for the next few years.

That’s because through the first three quarters of 2023, Genuine Parts Company had free cash flow of $732.6 million. Compared to $393.4 million in dividends paid, this is a free cash flow payout ratio of 53.7% (information from page 8 of 31 of Genuine Parts’ Q3 2023 10-Q filing). This leaves the company with enough capital to pay increasing dividends, repurchase stock, and service its debt obligations.

Risks to Consider

Genuine Parts Company is a good company, but it still faces risks that could harm its investment thesis.

The automotive and industrial parts industry is competitive. For a company to maintain and build market share, it must continue to provide value to its customers. Otherwise, the company’s market share and growth prospects may decline over time.

Another risk with genuine parts is the possibility of a cybersecurity breach. Even if you invest in updating your IT systems, there is no guarantee that a breach will not occur. If such an event occurs on a large enough scale, sensitive customer, employee, and supplier data can be compromised. This could result in a loss of trust in the company’s brand and lead to lawsuits that could damage its growth story.

Finally, Genuine Parts Company’s automotive store brands are primarily independent stores (6,679 out of 9,801 as of end-2022). If these franchises come into conflict with the company, Genuine Parts Company’s sales could be strained as it sells inventory from company-owned distribution centers to those franchisees (page 5 of 93 in Genuine Parts’ 10-K filing).

Summary: Waiting for a better long-term risk/reward proposition.

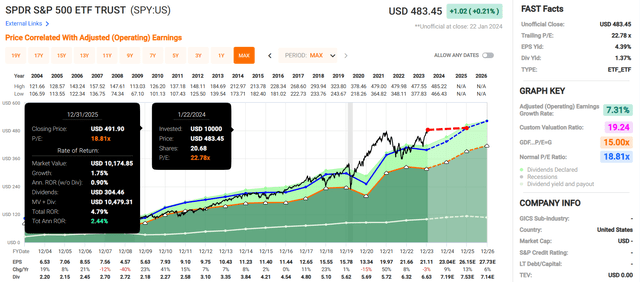

FAST Graph, FactSet FAST Graph, FactSet

Based solely on the 15.4 blended P/E ratio, Genuine Parts could have some upside in the coming years. This is lower than the normal P/E ratio of 18. If it returns to this valuation multiple and grows as expected, it could generate a cumulative total return of 41% by 2025. This is significantly better than the 5% cumulative total return predicted for the SPDR S&P. 500 ETF Trust (SPY) over that period.

But I still buy a lot of companies over the next decade and beyond. At this time, I am not interested in adding to my position. This is because you want to build in a margin of safety to dramatically increase your chances of earning a 10% annual total return. If Genuine Parts raises its dividend as expected next month and falls into the low $130s, I would consider upgrading the rating to Buy. First of all, your starting rate of return will be closer to 3%. Additionally, these valuations would, in my view, provide a cushion against some deviation from analyst growth consensus. In my opinion, this will make purchasing genuine parts more persuasive.