GigaCloud Technology Stocks Soar: Will They Continue to Rise? (NASDAQ:GCT)

Johnny Powell

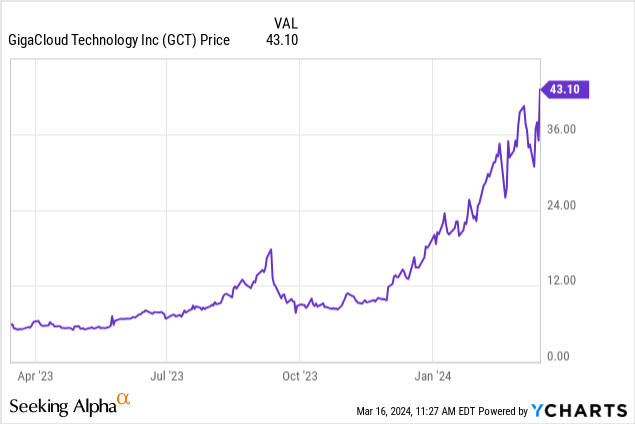

What we will look at today GigaCloud technology (NASDAQ:GCT). The stock has soared over the past few months, and investor optimism about this growth company is at an all-time high. These are the stocks we looked at. In the past, one of the things we mentioned was likely to double in 2024. Well, we have a stock that has tripled since mid-December. Take a look at this beautiful chart.

Now here’s something to consider. The stock debuted in 2022 and hit an intraday high of nearly $22 upon its debut. He quickly fell into the single digits and was mostly flat for the year. The stock enjoyed a speculative rally in late summer 2023, but then faltered. Then, the fire began to catch fire in mid-December 2023. The question is whether this operation can continue. Stock prices jumped hard due to the 2024 market rally. It’s easy to see a reversal, and you can easily see the stock reaching for a 30% or so correction within a week. It’s hard to say what might trigger it, but stocks that run like this often give back a significant portion. Investors must understand this reality. With that said, we see no catalyst to turn the sentiment around. Since growth has been impressive and management is doing well, I think the stock will move higher over the long term. So while we expect there to be some challenges in the short term, we think this practice will continue in the long term and healthy corrective actions will be taken in the meantime.

GigaCloud technology operations and evaluation

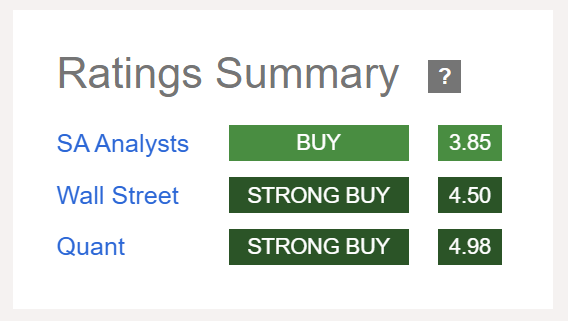

For followers unfamiliar with the company, GigaCloud Technology is an online B2B marketplace that facilitates international trade and transportation of bulky goods, including furniture, appliances, fitness equipment, and garden equipment. In addition to the marketplace, GigaCloud manufactures its own furniture and provides fulfillment services. We view the stock as a Buy. It also received positive reviews from its peers at Seeking Alpha, Street Analysts, and a solid rating from Quant.

Find your Alpha GCT rating

So what’s interesting about this work? This is a high-growth story, and despite the significant increase in share, it is still not significantly overvalued. Valuations are certainly higher than they were a week ago, but the growth in our opinion justifies this expansion of valuations. One of the catalysts for further growth has been a recent overhaul of its business model to simplify operations. New business models streamline the supply chain by bringing fulfillment in-house and managing the process directly from the factory to the customer. This reduces complexity, cost, errors, and delays, and potentially improves GigaCloud’s efficiency and profit margins. But the transition is underway and recent acquisitions aim to fill the gap. The long-term impact remains to be seen, so while it appears to be a successful proposition, its success needs to be monitored. That said, simplified operations suggest that financial improvement is likely to continue.

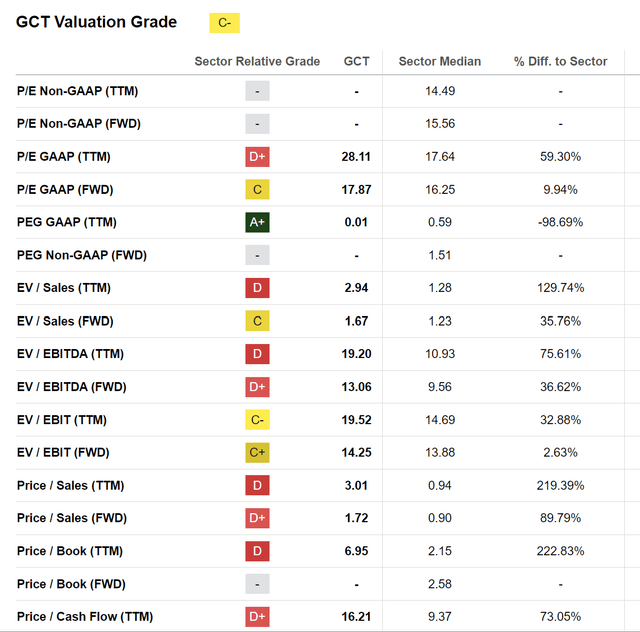

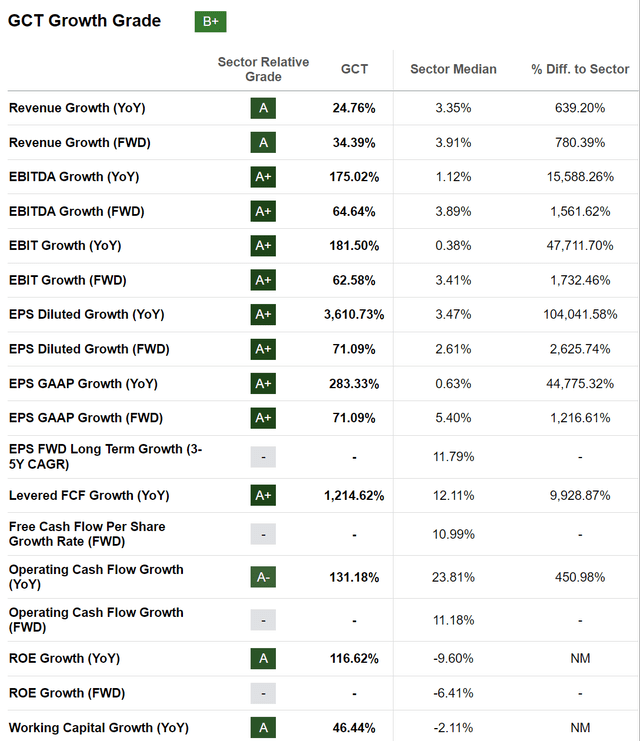

This was proven by the earnings just reported. We mentioned that this is a strong growth stock. Do you need proof? How about the fact that total revenue for the quarter increased 94.8% to $244.7 million from $125.6 million in Q4 2022? Not only did sales increase, but gross profit improved with significant margin improvement. Gross profit was $69.8 million, up 161.4% from $26.7 million in the fourth quarter of 2022. Gross margin increased to 28.5%, an improvement of 730 basis points from 21.2% in the fourth quarter of 2022. It’s a noticeable improvement. Adjusted EBITDA was $43.8 million, an increase of 188.2% from $15.2 million in the fourth quarter of 2022. And unlike many technology companies, this one is not unprofitable. Net income for the quarter was $35.6 million, up 184.8% from $12.5 million in the same quarter last year. This translates to $0.87 EPS. We expect this stock to continue to rise as this growth justifies the expansion of valuation metrics we’ve seen. And despite this massive share price rise, valuations remain reasonable. Check out the valuation quant.

Pursuing Alpha GCT Valuation

The overall rating has fallen, approaching ‘average’ levels. But folks, you have to balance this with extreme growth. Check out the growth quant.

Pursuing Alpha GCT Growth Quant

The numbers really speak for themselves.

But beyond business model changes, what is driving that growth? Well, the company has now successfully integrated Noble House and Wondersign, which has helped GigaCloud take a huge step forward in its global expansion. With this integration, the company now operates in multiple geographies, has a much broader product portfolio with premium products and has expanded its business network. This is in addition to organic growth in our core business. The company is spending working capital to boost research and development to strengthen its cloud infrastructure. The company is making real strides in transforming and strengthening its supply chain. Very impressive.

But we are not without risk. First, rapidly rising stocks usually give back a large chunk. It’s not a 100% guarantee, but history suggests there will be corrective action. This is more of a short-term risk that traders need to be aware of. Investors are expected to see continued growth. The second risk is that this is a Chinese company. Chinese stocks have had a tough time operating in a new and diverse region. However, GigaCloud’s customers are located outside of China. Any meaningful improvement in China and its markets could actually give stocks additional upside. The third risk to be aware of is exposure to shipping and transportation costs. Much of the margin expansion came from revisions/reductions in ocean freight rates. We have seen some interesting trading patterns in the Red Sea and Houthi attacks. However, in the longer term, significant increases in oil prices and transportation fuels are largely a continuing risk. Other disruptions to transportation routes are also risks to be aware of. Finally, as we move forward, it seems unreasonable to expect that we can continue to see tremendous growth on a percentage basis every year. This does not mean that stock prices will plummet, but investors need to keep in mind that explosive growth is likely to slow down.

Looking ahead to 2024, we expect another round of growth. Management set total revenue for the first quarter of 2024 to be between $230 million and $240 million. This also applies to warehouse fires in Japan. To be clear, this is expected to nearly double revenue year-over-year. Cash flow is increasing and the company continues to pursue expansion efforts. Lastly, there are share buybacks that further increase shareholder value. Based on current growth patterns, assuming revenue grows 33% in 2024 (which may be conservative), we could see EPS of $2.50 this year if margins remain in the low 20% range. That means just 17X FWD in stock. Guys, the price is still pretty cheap. We continue to see upward trends and buy stocks.