Gold Garden – Analysis and Forecast – March 21, 2024

Rapid advancements in deep learning neural networks are transforming the gold trading ecosystem. Intelligent Trading Assistant will become a powerful partner for traders, leading the industry into a more intelligent, efficient and inclusive future. “Gold Garden” EA utilizes cutting-edge deep learning technology to analyze and train on 20 years of historical data, greatly improving the accuracy and stability of trading strategies. It acts like a clever and capable gardener, helping traders carefully manage their trading garden and making the trading process easier, smarter and more efficient. “Gold Garden” With the help of EA, gold trading is no longer a cold and complex numbers game, but a vibrant, wise and fruitful garden. Every transaction is like growing a golden flower, every decision is like harvesting sweet fruit. Let’s join hands with “Gold Garden” EA and turn trading into a happy garden as we enter the era of intelligent gold trading!

Instructions for use:

EA is a swing trading system based on daily and weekly time frames rather than high frequency trading EA. To increase accuracy, multiple transaction conditions must be met, resulting in an average of one transaction every five trading days.

The default configuration of EA is optimized, and traditional optimization methods cannot be applied due to the use of deep learning and other technologies. Users are advised not to optimize the settings themselves.

EA may have to deal with significant market volatility. Initially, users can familiarize themselves with the logic and operation of the EA by using a risk value of 0.01 or trading on a demo account. Due to the uncertainty of future news trends, users should still be mindful of trading risks and use high risk values cautiously. Currently the maximum risk value is limited to 0.05.

The current risk calculation formula is: Assuming your account’s available margin is $1,000, a risk value of 0.01 corresponds to an order size of 0.01 lots. If the calculated lot size is smaller than the minimum lot size, the system uses the minimum lot size (for example, 0.01 lot). (The formula is Lot = ACCOUNT_MARGIN_FREE / 1000 × Risk. Risk = Lot / (ACCOUNT_MARGIN_FREE / 1000))

Order Lot Size Mode Description:

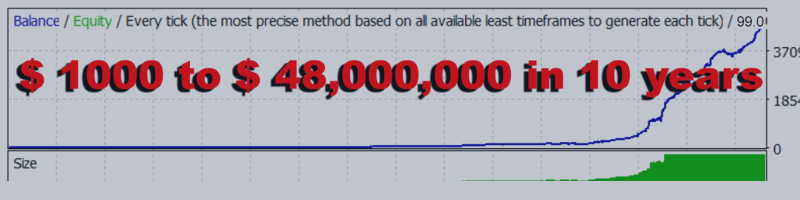

Risk Mode: This mode allows for compound growth of your funds by calculating the order lot size before each trade based on your account balance and risk value.

Initial Capital Mode: This mode calculates the order lot size only once, when the EA starts, based on your account balance and risk value. Subsequent changes to your account balance will not affect the lot size, so your funds will not increase compoundably.

Minimum Lot Size Mode: This mode uses a minimum lot size of 0.01 for orders.

Custom Mode: This mode uses custom lot size values for your order.

Low risk mode: Use the first risk mode corresponding to a risk value of 0.01.

Medium risk mode: Use the first risk mode corresponding to a risk value of 0.03.

High risk mode: Use the first risk mode corresponding to a risk value of 0.05.

Risk values only apply when using modes 1 and 2. Custom lot sizes only apply when using mode 4.