Gold Market Commentary: Gold Hits New High in 2023

Petrovich9

Review in 2023

- Gold demand from emerging markets (EM) has not only provided stability to sluggish developed market (DM) activity, but has also helped push gold prices to record highs.

- Central bank demand, mainly from emerging market institutions, contributed significantly. This added up to 15% to gold’s annual performance.

- Bond yields were a bit of a drag as they made a round trip to end the year similar to where it started, despite hitting a 15-year high in October.

It is expected

- Geopolitical risks in the Middle East continue to bubble, increasing short-term inflation risks.

- January tends to be a strong seasonal month. The jury is out on whether recent price history is discouraging or encouraging investment. So far so good.

- The recent shift in speculative focus to two-year Treasury yields suggests the market may have gotten ahead of itself. After the December Federal Reserve meeting.

Elimination of DM outflow with EM inflow

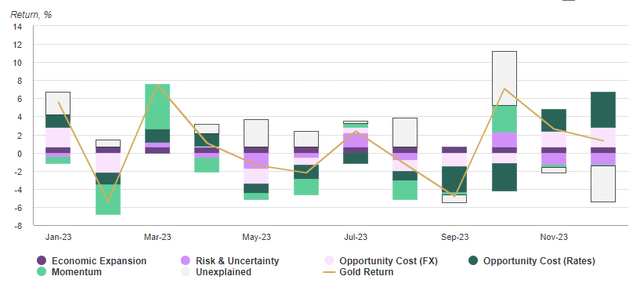

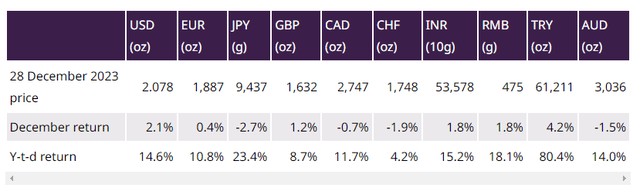

Gold prices rose 15% in 2023, reaching US$2,078 per ounce, an all-time high by annual close.One. Closing prices were also daily records and reflected in all but one currency (Table 1). Gold also ended the year as one of the best performing assets. According to (GRAM), the influential drivers of gold returns in 2023 were central banks, geopolitics, interest rates and gold’s prior (lagged) monthly returns (Chart 1).

We estimate that central banks contribute around 10-15%. Because not all central bank purchases can be observed at a simultaneous monthly frequency, we rely on two factors within the model to infer central bank impacts: the constant (economic expansion) and the unexplained part. Before 2022, the constant was c.4%. We believe net central bank purchases have been a strong contender since then, pushing it up nearly 8%. Additionally, the unexplained portion of returns totaled 12% in 2023. If we change the constant and attribute all residuals to the central bank, we arrive at 17%. A variation of GRAM replacing Brent with the Geopolitical Risk Index (GPR) gives 13%, so we settled on a figure between 10 and 15%. In part, this is because surprisingly resilient retail demand cannot be ruled out. Additional contributors.

Chart 1: Central banks and geopolitics help push gold to new highs*

Sources: Bloomberg, World Gold Council; disclaimer

*Data as of December 31, 2023. Our Gold Return Attribution Model (GRAM) is a multiple regression model for monthly gold price returns that categorizes the four main thematic drivers of gold performance: economic expansion, risk and uncertainty, opportunity cost, and momentum. These topics are the drivers of gold demand. Most importantly, investment demand is considered to be the marginal driver of gold price returns in the short term. ‘Unexplained’ refers to the percentage change in the gold price that is not explained by the factors currently included in the model. The results shown here is the result of an analysis covering the estimated period from February 2007 to December 2023.

Table 1: All currencies except the single currency (CHF) hit record highs in 2023

*Data up to December 31, 2023. Based on LBMA gold price PM in USD quoted in local currency. Sources: Bloomberg, ICE Benchmarks Bureau, World Gold Council

Increasing geopolitical risk has been a key driver in 2023 and the inclusion of GPR in the model captures this. This contributed about 5% to revenue and mitigated the impact of falling inflation and other risks (contribution -3%).

Interest rates appear to have had a lower impact on prices than expected at the start of the year. The round-tripping of 10-year yields (both nominal and real), central bank buying and generally higher uncertainty have helped gold. Prices are more or less unaffected by volatile opportunity costs. Nominal rate of return contribution c. Gold’s performance of -2% suggests that, excluding the impact of breakeven inflation, the impact of real interest rates is around -3%.

Combining the monthly impact, gold’s previous monthly returns have resulted in a significant cumulative lag in 2023 (-4%). However, this can be seen as a positive feature that alleviates volatility in the gold market. As we saw between 2013 and 2015, this also works in reverse.

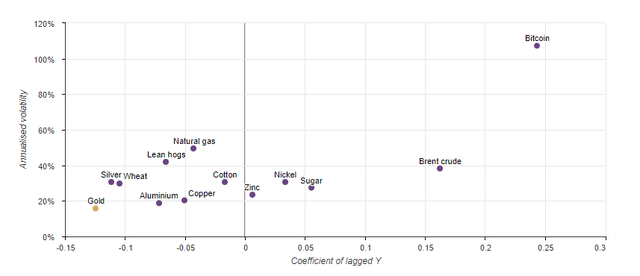

Chart 2: Self-adjusting gold prices contribute to lower relative volatility*

Sources: Bloomberg, World Gold Council; disclaimer

*Monthly data from December 2010 to December 2023. The . The y-axis shows the annual volatility for the entire window.

The lag caused by lagged returns supports the notion that the gold market is populated by price-sensitive buyers and investors who buy at higher prices. This is a hallmark of gold’s dual nature. We see this happening across both the Jewelry, Bars and Coins sectors at both annual and quarterly frequencies. Central banks can also exhibit price sensitivity, especially if they make regular purchases over long periods of time, something we have seen over the past two years.

Price sensitivity explains the negative coefficient on return lag. And this is a factor that is likely to reduce gold’s volatility. When comparing gold to other commodities, there appears to be a relationship between the lag coefficient of the dependent variable and its annual volatility (Chart 2). We added Bitcoin to our analysis to highlight that these highly speculative assets are likely to have higher volatility, some of which is driven by increased speculative momentum.

It is expected

The 2024 Gold Outlook analyzes three economic scenarios and their impact on gold in 2024. One of these scenarios focused on the consensus view that a soft landing would occur in the United States and Europe. China’s growth will slow. Inflation risks will decline, but long-maturity interest rates will remain high and high prices will suppress consumer demand. In this context, gold’s performance may be underperforming and its upside may depend on continued central bank demand.

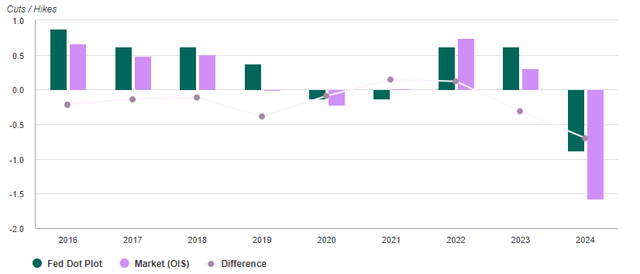

Chart 3: The market may have gotten ahead of itself*

Sources: Bloomberg, World Gold Council; disclaimer

*Fed dot plot (Economic Outlook Summary) vs. Market (OIS) projected policy rate one year ahead as of December of the previous year. Data from December 2016 to December 2023.

Financial conditions have eased noticeably due to the bond market rebound, but market expectations for a policy interest rate cut seem excessive (Chart 3). This is something that some Fed officials expressed concerns about after the December meeting.2 -The tensions over the Suez Canal have highlighted how ongoing geopolitical factors can have a rapid inflationary (rising cost) impact.

While we still view a real resurgence in inflation as unlikely, this scenario is likely positive for gold as it weakens monetary policy and risks a harder landing in the future.

Chart 4: Gold performs a biennial dance when policy uncertainty is high*

Sources: Bloomberg, World Gold Council; disclaimer

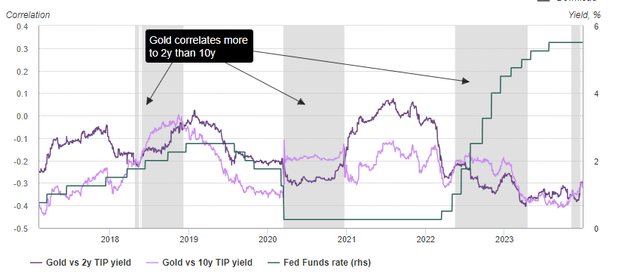

*Daily data from March 2016 to December 2023. Correlation calculated over a 200-day rolling period between the log return of the price of gold (US$/oz) and the change in bond yields.

In 2023, gold influenced 2-year Treasury yields (real and nominal) more than the historically more important 10-year yield, which tends to happen during periods of heightened policy uncertainty (Chart 4). These anomalies diminished over the summer as peak interest rates became more certain and supply issues focused attention on the lower half of the yield curve. But over the past few weeks, we appear to have shifted back to monetary policy, perhaps highlighting the dangerously narrow path to an economic soft landing.

Intermediate start in 2024

Gold has been the surprise star in 2023, surging amid rapidly rising interest rates and a recovering economy. Central banks should be greatly appreciated for their outstanding performance, but rising geopolitical risks are likely to make investors hesitant to abandon gold as a key driver of central bank demand. Meanwhile, interest rate-driven weakness in developed markets, which drive European ETF flows, was not enough to dampen gold’s performance.

In the short term, there is likely to be a tug-of-war between historically positive January seasonality and a backlash against the dovish sentiment that pushed prices to record highs in December. Likewise, there may be a battle between intermittent inflationary fears (transportation costs) and recession impulses (JOLTS employment), highlighting just how perilous the path to an economic soft landing can be.

OneWe use LBMA gold price PM.

2Top Fed officials are trying to dampen expectations of an imminent rate cut (ft.com)

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.