Goldman Sachs BDC: Headwinds to Sail (NYSE:GSBD)

Chris Hondros

This article focuses on: Goldman Sachs BDC (New York Stock Exchange:GSBD), a Goldman Sachs Group (GS) entity that handles direct lending. Global credit markets are heating up as volatile interest rates and credit spreads combine to create a speculative environment. like Therefore, we decided to bring you our latest findings on Goldman Sachs BDC.

Without further delay, let’s discuss our findings.

Goldman Sachs BDC Principles and Outlook

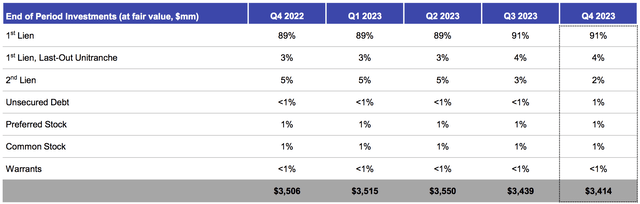

Goldman Sachs BDC is a direct lender primarily targeting U.S. middle market first-lien loans. Although the company’s portfolio includes other debt segments, it is very clear from the diagram below that the main focus is first lien loans. Goldman BDC also works with companies to improve their capital structures and uses its network to access advantageous capital.

Goldman Sachs BDC

I just wanted to touch on the second component of Goldman. This is BDC’s business. Frankly, we have very little input into this component of the business. Instead, we decided to focus on the hard facts conveyed by Goldman Sachs BDC’s portfolio data.

Let’s do this analysis from the bottom up.

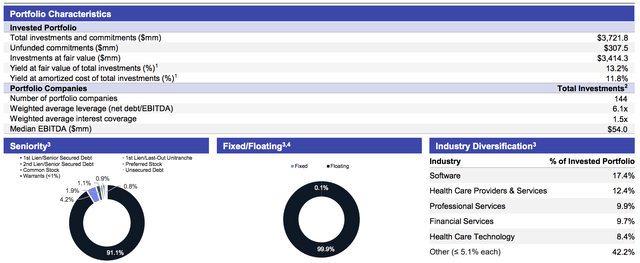

Looking at the fund’s portfolio, we see that its 144 components have a weighted average interest coverage of 1.5x and a weighted average net debt/EBITDA of 6.1x. We believe these figures are very poor, especially considering the uncertainty inherent in the economic environment.

Nonetheless, we do not believe floating rates add fundamental risk for the time being, as we have a strong belief that interest rates will be lower in the future. Additionally, Goldman Sachs BDC holds major holdings across cyclical (financial services) and non-cyclical (health care providers and services) industries, diversifying the sector while phasing out some of the vulnerable multiplier risks.

Goldman Sachs BDC

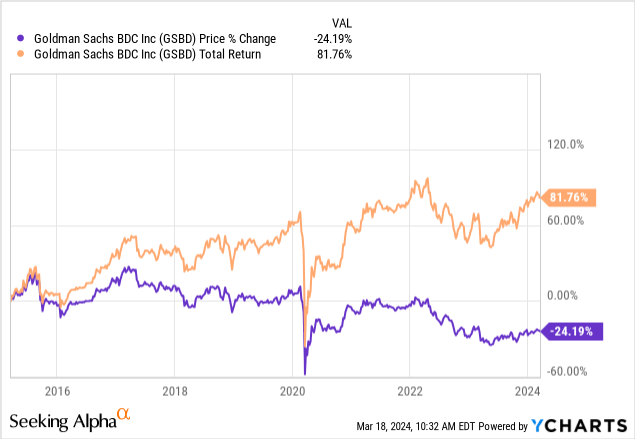

The following diagram shows the time series of asset values and returns for Goldman Sachs BDC. Below the figure we discuss the outlook for the components.

Goldman Sachs BDC

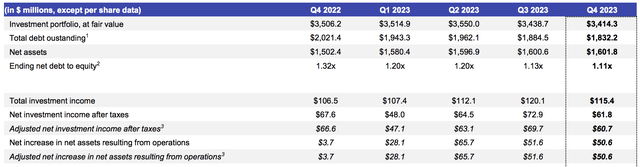

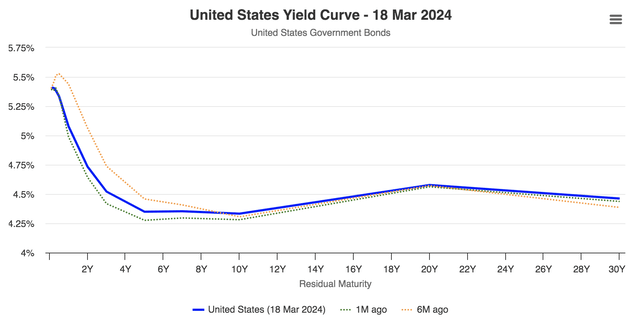

Goldman’s results raise some interesting points. The US yield curve and credit spreads have maintained their usual inverse relationship over the past year, as reflected in Goldman Sachs GSBD results.

The fund’s investment income increased 8.35% year over year, reaching $115.4 million. Additionally, Goldman Sachs BDC’s net asset value was $1.62 billion, up 6.6% from the previous year. A positive correlation between bond asset values and income may seem unusual, but 90.9% of Goldman Sachs BDC’s portfolio is floating rate instruments. This means that negative or zero interest rate duration products are likely to be prominent in the company’s portfolio.

worldgovernmentbonds.com

It is no coincidence that Goldman Sachs BDCs’ net asset value expansion and simultaneous credit spread softening have occurred despite their asset base showing no negative sensitivity to interest rates. We believe that the fund’s primary collateral exposure means it holds a large amount of credit spread duration (i.e., there is an inverse relationship between asset values and spreads). However, because lower credit spreads generally lead to lower direct lending income, increasing income at the same time loses much of the validity of our argument.

st louis fed

Our analysis led us to the conclusion that the income-based outlook for this vehicle is based on interest rates. However, credit spreads can have a greater impact on net asset value. By assuming such a relationship, we think Goldman Sachs BDC’s outlook could soften in the coming quarters. Our rationale is that interest rates will eventually be lower as year-on-year inflation eases. As interest rates fall, credit spreads are likely to increase due to the natural inverse relationship between the yield curve and the credit curve.

Unless the fund significantly improves its financing costs (which is likely), we expect to see a decline in net asset value and net income later this year and into 2025.

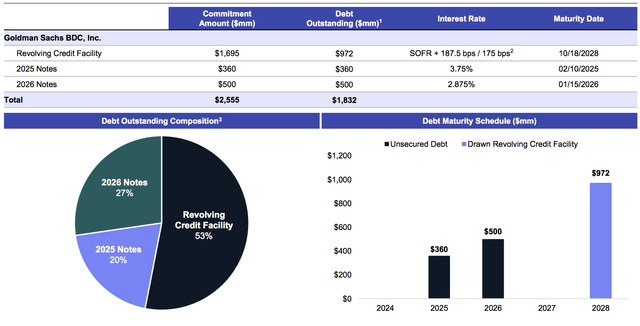

Fund’s Capital Structure (Goldman Sachs BDC)

Valuation and dividends

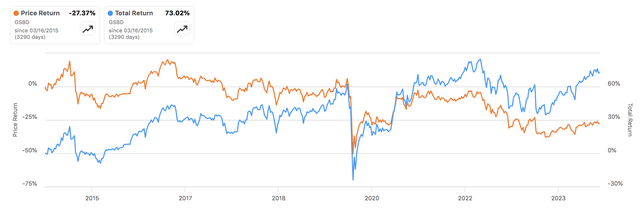

Most of Goldman Sachs BDC’s past returns have come from income. In fact, investors have experienced negative price returns from the beginning. Therefore, we believe that a fund’s valuation analysis functions first and foremost as a risk assessment.

pursue alpha

The March 18 intraday market price divided by Goldman Sachs BDC’s most recently measured book value per share translates to a P/NAVPS of 1.04x. We don’t see much relative under/overvaluation in this, and we consider the assets to be fairly highly valued on a trailing basis.

| metric system | value |

| NAVPS | $14.62 |

| market price | $15.15 |

| P/NAVPS | 1.04x (rounded) |

Source: Seeking Alpha

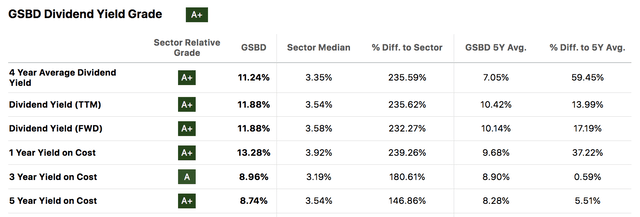

Goldman Sachs BDC’s dividend profile sparks another conversation. Key indicators suggest that the security has best-in-class dividend characteristics. For example, Goldman Sachs BDC’s cost-indicative yield suggests that investors can enter a position at any time and still receive good dividends. However, it is worth considering that dividends are cyclical in nature.

pursue alpha

final verdict

Our view is that Goldman Sachs BDC could experience poor performance for the remainder of 2024. We believe that the changing interest rate and credit spread environment will affect the portfolio’s net asset value and interest income. Moreover, we are concerned about the fund’s interest coverage and debt/EBITDA ratio given the uncertainty inherent in the economy.

Despite the worrying outlook, we do not believe the asset is a hard sell. Therefore, we give Goldman Sachs BDC a Hold rating.