Goldman Sachs raises S&P 500 target to 5,200 amid heavy lifting from Big Tech

A previous version of this article incorrectly listed Netflix instead of Amazon as one of the Magnificent Seven stocks.

Just days ahead of Nvidia Corp.’s potentially pivotal results, Goldman Sachs raised its year-end S&P 500 target to 5,200, but much of that will depend on Big Tech’s ability to continue delivering strong returns.

“Our upgraded 2024 EPS forecast of $241 (8% growth) is higher than the top-down strategists’ mid-point forecast of $235 (6% growth) and reflects our expectations of stronger economic growth and higher revenues for the Information Technology and Communication Services sector. reflects expectations. It includes five of the ‘Magnificent 7’ stocks, the team led by top U.S. equity strategist David Kostin said in a note late Friday.

The new target puts Goldman in line with some of Wall Street’s most bullish forecasters: Oppenheimer’s John Stoltzfus and Fundstrat’s Tom Lee. They each recorded closes of 5,200 after what was accurately called the 2023 rally. Ed Yardeni of Yardeni Research took first place, targeting 5,400.

This is the second time that Goldman Sachs has raised its S&P 500 target from 4,700 to 5,100 in late December. Earlier this year, RBC Capital raised its S&P 500 forecast from 5,000 to 5,150, and UBS also raised its target from 4,850 to 5,150.

Behind this new outlook is a more optimistic economic outlook. Goldman Sachs economists recently raised their forecast for real U.S. GDP growth in the fourth quarter/quarter of 2024 to 2.4% due to increased consumer spending and housing investment. This is because they project the S&P 500 forward price/earnings multiple at 19.5x, slightly below the current 20x.

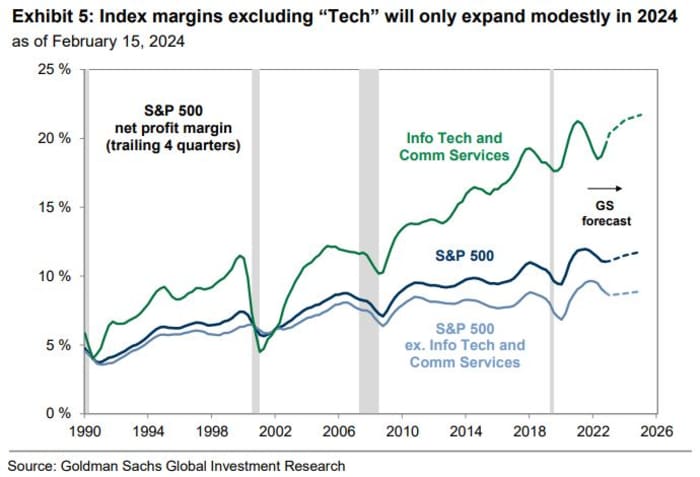

“The nearly completed fourth quarter earnings season highlighted the ability of companies to maintain profit margins despite slowing inflation,” Kostin and his team said.

But the bank’s rosy outlook hinges on Big Tech’s continued ability to perform. Kostin and his team announced in the fourth quarter that Magnificent Seven stocks: Meta Platforms META;

Microsoft MSFT,

Apple AAPL,

alphabet Google,

Tesla TSLA,

Amazon AMZN,

And NVIDIA NVDA,

Analysts have warned that Nvidia’s earnings, due Wednesday, could be a “make-or-break” moment for the stock, with earnings per share expected to hit $4.59, a surge of more than 700% from the same quarter last year.

read: Bullish bets on Nvidia and other ‘Magnificent Seven’ members near last year’s most crowded levels

Deutsche Bank strategist Jim Reid told clients on Monday: “It reflects the world we live in that the most important event of the week could be Nvidia’s earnings on Wednesday. The company is now the fourth largest company in the world and is the best performer in the S&P 500 so far this year (+46.6% YTD), so this will be very important for sentiment.”

As for Nvidia’s earnings, the Goldman strategist said that if the chipmaker reports in-line estimates, “Magnificent Seven would deliver 58% revenue growth, boosting revenue by 15% and boosting margins by 582 basis points annually.” .”

The bank expects information technology and communications services, which includes five of the Magnificent Seven (Meta, Microsoft, Apple, Alphabet and Nvidia), to post the strongest revenue growth among S&P 500 sectors this year. The remaining indices will see some improvement, but “the magnitude will be much smaller,” they said.

Goldman added that the strength of Big Tech has led to higher forecasts among peers, with the Magnificent Seven’s revenue estimates revised by 7% over the past three months and margin forecasts revised by 86 basis points. This contrasts with revenue and margin forecasts for the remaining 493 stocks being revised down by 3% and 30 basis points.

The bank said stronger-than-expected U.S. growth or a continued rally in large-cap stocks could both pose upside risks to their outlook.

“Similarly, disappointing macroeconomic or large-cap growth would pose downside risks to S&P 500 earnings forecasts. Additionally, accelerating input cost inflation will reduce the prospects for an initial profit margin rebound and thus reduce corporate profit growth overall,” Kostin and his team said.