Gold’s Future in 2024 – Analysis and Forecast – December 24, 2023

Weekly technical and fundamental analysis of gold:

Today is Sunday, December 24, 2023.. If we look at the daily chart of world gold ounces now, we can see that global gold has increased to a very important level of $1970 in the last business day. Gold showed a growth rate of 12.58% in 2023 and reached a historical high of $2,148.

Now, as we enter the new year of 2024, the world’s gold ounces face two major challenges. The first challenge is a change in the Fed’s monetary policy, and the second challenge is geopolitical issues and their impact on the global economy.

Looking at gold in 2023, it faces a severe banking crisis and inflation.

Financial markets were jubilant and optimistic when the Federal Reserve finally stepped away from tightening policies or raising interest rates in late 2022.

As the yield on 10-year Treasury bonds fell ahead of the new year in 2023, gold responded positively, rising by more than 6% in January 2023. However, when inflation began to rise again, gold entered a stagnation phase. Central banks have begun to review their policies.

Then, when the U.S. banking crisis and chaos began in March, gold also made a decision and surpassed the important level of $2,000. The region had the highest gold prices in the first quarter of 2023.

In just five days, three small and medium-sized banks in the United States, including Silicon Valley Bank, Silvergate Bank, and Signature Bank, went bankrupt, which was the fundamental factor causing capital to flow out to safe assets.

The Federal Reserve and key market regulators responded quickly by creating the Bank Liquidity Funding Program (BTFP) to ease tensions in financial markets, halting some of gold’s monthly upward trend and the precious metal showing modest growth in April.

Meanwhile, the market has realized that US inflation in the second quarter of 2023 will be more rigid than expected, and the market is also very competitive for job seekers.

In response to this problem, the Federal Reserve raised interest rates again.

Meanwhile, global gold ended May as fears and concerns about a banking crisis waned and spread to other banks and other parts of the financial markets, and 10-year Treasury yields rose. June is in the risk zone with a downward trend.

Then, after suspending tightening policy in June, the Federal Reserve raised interest rates by another 25 basis points in July to 5.25-5.5%.

Finally, gold also came under downward pressure over the summer, falling about 6% in the two months from August to September.

Geopolitical issues and the Fed’s dovish stance:

In the third quarter of 2023, as signs of a tight labor market in the United States (meaning a low employment rate but high labor force) and signs of decreasing inflationary pressures were observed, the Federal Reserve eased its austerity policy.

Although it is true that central bank policymakers have not mentioned any change or shift in monetary policy, global gold has come back to life.

At the same time, safe asset flows dominated after the Gaza Strip declared readiness for war and launched a counter-invasion operation in response to Hamas’ surprise attack on southern Israel on October 7, which resulted in civilian killings and hostage-taking. Financial markets and traders flocked to purchasing safe assets.

Global gold, considered a safe asset, also rose by more than 7% in the same month of October.

This not only pushed gold back above the important technical and psychological level of $2000, but also consolidated above this important level.

Meanwhile, news of Houthi rebels attacking three merchant ships in the Red Sea on Sunday and the US Navy’s response by shooting down three drones on December 10 sent gold prices higher again early in the week. .

This important factor sparked concerns about the Israel-Hamas conflict escalating into a broader crisis in the Middle East, with gold prices reaching a record high of $2,149 on December 11 during the Asian trading session.

It is true that after this brief war the price of gold fell back to a critical level of $2,000. However, it is true that the Federal Reserve’s adoption of a new dovish stance (meaning expansionary policies and interest rate cuts) has caused the US dollar to fall and fall globally. Reinforce your gold.

Global Gold Forecast to 2024:

The U.S. Federal Reserve has frozen interest rates in the 5.25-5.5% range since its last policy meeting in 2023, citing continued improvement in the inflation outlook.

Powell also announced a focus on ensuring major mistakes do not occur and rates do not remain high for long.

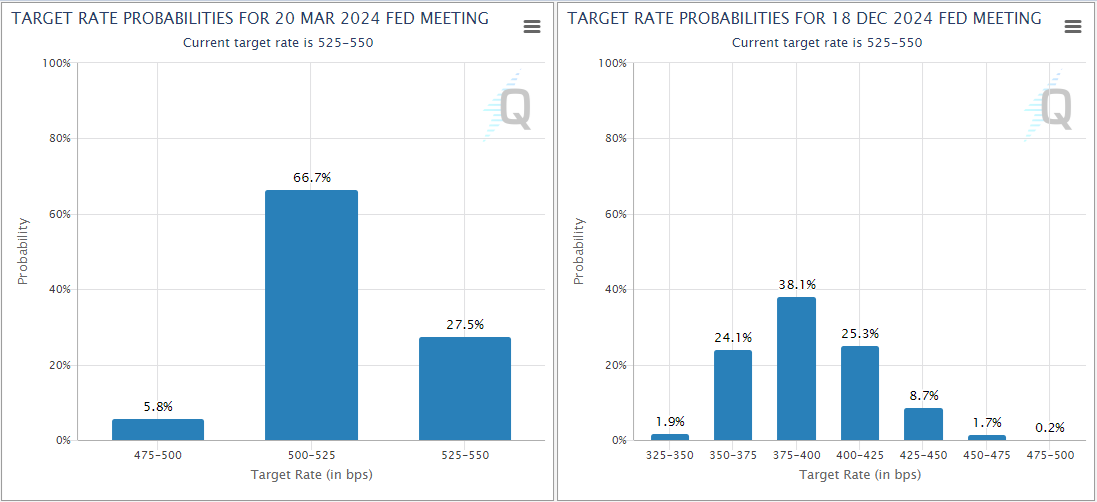

By December 2024, nearly 60% of markets see the Fed interest rate moving from 3.75% to 4% or lower.

Looking at the current market situation, interest rates reflected in the market next year are falling relatively significantly, and there is room for a dollar increase if macroeconomic indicators go against these expectations.

It is worth noting that the Federal Reserve is confident that there will be no recession in the United States. As you may recall, America’s gross domestic product (GDP) grew significantly in the third quarter (5.2% annualized).

Of course, don’t forget that it wouldn’t be at all surprising to see U.S. growth plummet in the first half of 2024, as inventory build-up was the main driver of GDP growth during that period.

Three possible scenarios for gold prices in the first half of 2024:

One. Inflation will fall steadily as the job market unbalances and economic activity remains relatively healthy. Additionally, GDP in the first and second quarters will be between 1.5% and 2%.

In this scenario, gold could still continue its upward trend, but the continuation of this upward movement would be limited before the long-term trend is completed.

A strong economy and strong job market will allow the Federal Reserve to adopt a cautious approach to monetary policy changes, limiting the decline in dollar and bond yields.

In this scenario, gold is also trending upward and there is also the possibility of bigger gains for this precious metal. However, a weakening U.S. economy could have a negative impact on other economies, including China, limiting demand for gold.

three. In the third scenario, gold would have a negative impact. The Fed’s priority is to return inflation to its 2% target, and policymakers are likely to refrain from cutting interest rates early even if the job market and economy are strong.

In this case, as US dollar bond yields rise, the US dollar strengthens and gold begins to fall.

Geopolitical instability and uncertainty

The Russia-Ukraine war in 2022 and the Israel-Hamas conflict in 2023 have shown that gold remains a safe and acceptable asset for investors in uncertain times.

If conflict in the Middle East region further escalates and expands, gold prices may rise further. Additionally, if the Russia-Ukraine war escalates again, it could have a similar impact on XAU/USD.

us presidential election

It is difficult to say for sure what impact the results of the presidential election or related trends will have on the financial market.

However, according to a RealClear Politics poll conducted on December 15, former US President Donald Trump had a nearly 50% chance of being re-elected.

If elected, President Trump seeks to impose a 10% tariff on most foreign products and gradually eliminate imports of essential goods from China over a four-year plan.

Deteriorating relations with China could have a negative impact on the outlook for gold demand, while higher tariffs could also make it more difficult for the Federal Reserve to reduce inflation to its 2% target.

As you know, China is the world’s largest consumer of gold. Thanks to the post-COVID-19 restart, the Chinese economy continued its upward trend again in 2023.

Gross domestic product (GDP) grew 4.9% in the third quarter, following 6.3% growth in the previous quarter.

Chinese government advisers told Reuters in exclusive interviews that their 2024 growth target was between 4.5% and 5.5%.

Meanwhile, Moody’s warned that China’s credit rating could be downgraded due to medium-term structural decline, increased risks related to economic growth, and continued decline in the real estate sector.

Weekly technical analysis of gold:

The weekly chart of global gold confirms the continuation of gold’s upward trend as we head into 2024.

If you look at the daily gold chart, you can see that last week the lower price limit was $2016 and the upper price limit was $2070.

Global gold ounces rose about 1.67% last week, pleasing market strength.

If you look at the gold chart, you can see that the price of gold closed at $2053.

that much RSI The indicator on the daily time frame is rising and shows 60. This indicates that gold has maintained its upward momentum and no further gains are expected.

Critical levels of support for Gold:

If gold starts to fall, the first important support level will be at $2040. If the market declines below this area, the next important level would be $2030. Finally, if gold falls below this area, the next important level will be the very important area of $2020.

Important resistance levels for gold:

If gold moves higher, the first important resistance level will be $2060. If the market gains above this area, the next important level would be $2070. Lastly, if gold crosses this area as well, the next important level would be $2080.

We hope you find this review and analysis useful and effective with your strategy and expertise.