Good news: This bull market is expanding! | Exchange places with Tom Bowley

We’ve looked at just about everything you need to check to see the development of this powerful long-term bull market beyond the start of 2023. There’s really only one thing missing, and no more. I’ll explain more about that in a moment.

But let’s take a look at the most aggressive sectors of the stock market and evaluate the growth-versus-value trades that have characterized and driven the massive rise in U.S. stocks.

Technology (XLK):

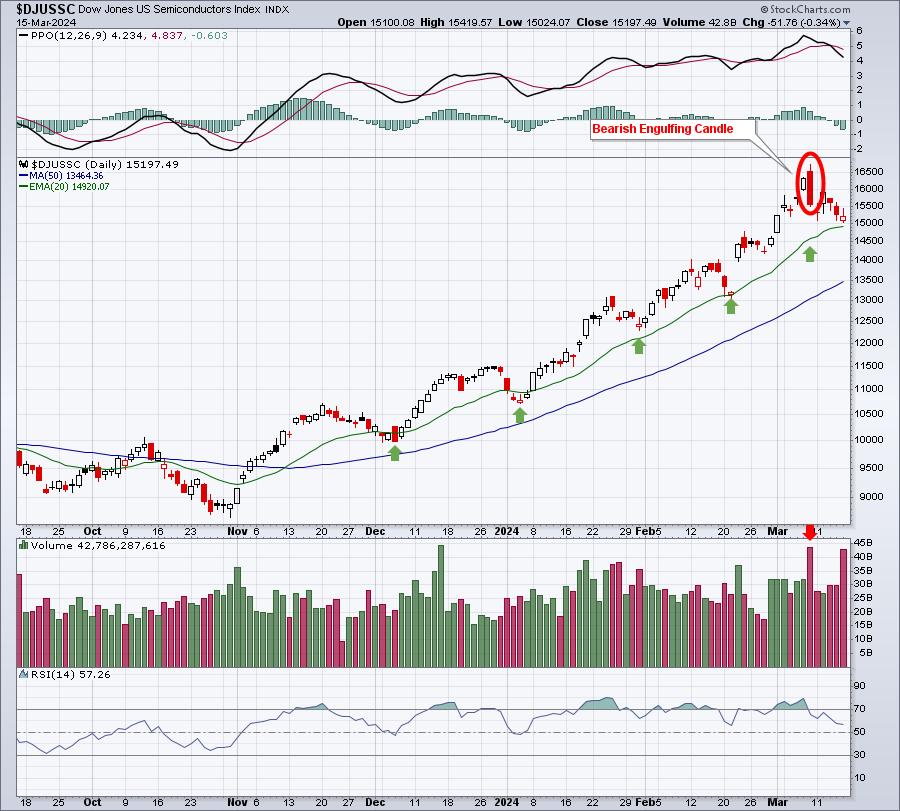

Semiconductors ($DJUSSC) have been the lifeblood of technology leadership, and technology now accounts for nearly 30% of the S&P 500. This is thanks in large part to the tremendous progress in technology stocks. After making an incredible 200% advance in semiconductors over 15 months, we’ve seen DJUSSC cool off a bit. This started with the downward trend I pointed out a week ago.

DJUSSC fell approximately 10% from its high on Friday, March 8 to its low on Friday, March 15. This had a bigger impact on technology stocks overall compared to most sectors last week.

A very ugly bearish engulfing candle with huge volume cannot be ignored. That could represent the main top of this group for a while, and that’s not a bad thing. You shouldn’t expect DJUSSC to triple every 15 months. This is not sustainable. However, any short-term disruption would likely have a significant impact as there are many constituent stocks in both the S&P 500 ($SPX) and NASDAQ 100 ($NDX). This group is much more represented in $NDX. Semiconductors account for nearly 22.86% and 9.76% of $NDX and $SPX, respectively. While the S&P 500 has a lot of growth stocks, the NASDAQ 100 is much more influenced by growth stocks. This is why I like to follow the $NDX:$SPX ratio. This is the “growth to value” ratio that puts into perspective the risk environment we find ourselves in. When the ratio goes up, you can generally conclude that market conditions are “risky,” which usually leads to higher stock prices. price. However, if the ratio falls, you should be more careful, as it can signal “risk aversion.” Here’s where we currently stand:

In the summer of 2023, the $NDX:$SPX ratio declined and this “risk-off” signal led to a 10% correction as the benchmark S&P 500 followed the decline. But take a look at the last three “risk-off” readings on the $NDX:$SPX ratio. The S&P 500 has been on the rise for most of the year, especially over the past two months. What has changed?

Thank you for your question. Because this is the missing ingredient in the 2024 secular bull market. Let me show you what has changed. This is called BULLISH ROTATION.

XLI:$SPX

XLF:$SPX

XLE:$SPX

XLB: $SPX

During the summer months, when we “hipped the risk,” the profits generated by selling aggressive segments simply left the market and spun into other segments of the market, causing no bullishness. You can check this by following all of the red directional lines for each of the four sectors shown above. This time it’s different. The related sector chart above helps visualize the differences.

I believe technology will be fine with time. But periods of underperformance may not be a bad thing at all. In fact, this cycle is creating tremendous opportunities in other areas of the market as well. You need to recognize these changes now, because it’s increasingly likely that the current bull market is just getting started.

In this Monday morning’s article in our free EB Digest newsletter, we’ll feature companies (outside the technology sector) that recently went bankrupt and whose prices are likely to rise even higher in the future as money pours into the sector. You can sign up for this free newsletter with your name and email address by clicking here. No credit card required, and you can cancel your subscription at any time.

Take advantage of this rotation!

Happy trading!

tom

Tom Bowley is Chief Market Strategist at EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom compiles a comprehensive Daily Market Report (DMR) to provide guidance to EB.com members each day the stock market is open. Tom has been providing technical expertise here at StockCharts.com since 2006 and also has a fundamental background in public accounting, giving him a unique blend of skills to approach the U.S. stock markets. Learn more