Google: Consider buying before you go into FOMO mode

Unpublished by Kenneth Cheung/iStock via Getty Images

Google (NASDAQ:GOOGL) (NASDAQ:GOOG) has underperformed the S&P 500 (SPX) (SPY) since its previous update in October 2023, with the upgrade to Strong Buy. like As a result, the market doesn’t seem convinced that Google’s AI efforts can deliver significant near-term revenue growth compared to its peers. furthermore “Redesign your cost base“did not have the same effect as Amazon (AMZN) The stock has been outperforming recently since its October 2023 low. As a result, it’s interesting that despite its AI leadership, the market is still looking for more clarity from Google.

Shares of Telecom Sector ( What are we missing as a result? GOOGL is left. It’s the only Magnificent 7 that has broken away from recent market optimism and is still trading at a significant discount to its peers.

| name | Price/Fair Value |

|---|---|

| Alphabet Inc Class A | 0.83 |

| Amazon (AMZN) | 0.93 |

| Tesla Inc. (TSLA) | 0.94 |

| Microsoft (MSFT) | 0.96 |

| Apple (AAPL) | 1.16 |

| meta platform | 1.19 |

| Nvidia (NVDA) | 1.31 |

Mag 7 Fair assessment. Data source: Morningstar

An updated Morningstar valuation shows that GOOGL is valued at a 17% discount to fair value. Based on GOOGL’s future EBITDA multiple of 12.1x, it is lower than META’s revaluation multiple of 13x. In other words, we assessed that the market was likely to reallocate exposure based on META’s returns, so we assessed the social media leader as relatively undervalued.

However, while Meta is making great progress in AI investment and gaining momentum, Google is evaluated to have a more diversified business model. Google Search accounted for 55.6% of revenue in the fourth quarter. Adding in other advertising properties, advertising revenue represents approximately 76% of our revenue base in the fourth quarter. By contrast, Meta’s advertising segment accounted for nearly 98% of its fourth-quarter revenue, suggesting the market may have been too optimistic about the current advertising cycle.

Does this make sense? Google’s fourth-quarter earnings release suggests its recent advertising upswing may have peaked in the current cycle. With U.S. economic growth expected to slow in 2024, it is important to assess higher execution risk for the advertising cycle. Observant investors might have noticed that Google Network revenue was up 13.5% year-over-year, down 2%, significantly below the company average. Given Google’s broad advertising exposure, I believe this could provide investors with an early warning to prepare for a slowdown in advertising revenue that is likely to become more pronounced this year.

Google Bears may point to a disappointing earnings scorecard as the main reason for this week’s decline. While justified, it is also important to note that GOOGL headed into ER with relative optimism as it retested its all-time highs last week. Therefore, post-performance fluctuations as investors reallocate their exposure should not be viewed too pessimistically.

I don’t think investors have fully appreciated Google’s attempts and momentum to diversify away from its advertising-focused growth pillars. Management said in its earnings call that subscription growth has been solid. Google Cloud also benefited from expanded scale and monetization efforts, achieving full-year operating profitability. Microsoft is likely ahead of Google in monetizing its AI investments early, but Google is still huge when it comes to AI. CFO Ruth Porat emphasized that Google will continue to invest in AI to maintain its market leadership while redirecting its efforts to further optimize its cost base.

So it’s puzzling that the market sees META’s decision to pay a cash dividend as a big help in revaluing its stock above GOOGL’s multiple. Due to Meta’s less diversified business model, the company is assessed to be at higher risk of an advertising cycle downturn, as experienced in 2022. Google’s more diversified revenue base therefore suggests that the implied undervaluation has not been fully recognized by the market. Indicates a dip buying opportunity.

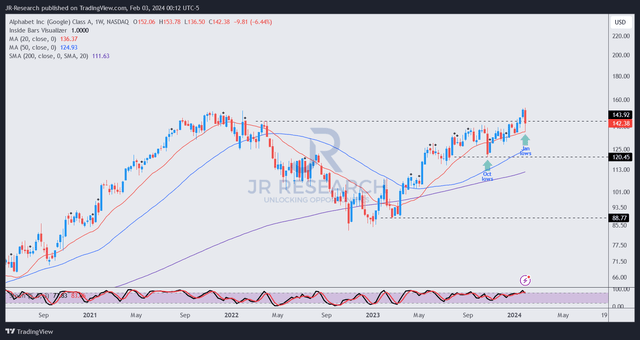

GOOGL price chart (weekly, mid-term) (TradingView)

As you can see above, the recent retest of all-time highs has not assessed the bull trap, suggesting that the downside should be well supported. Additionally, GOOGL closed well above its weekly low, indicating a return to dip-buying sentiment.

The October 2023 GOOGL bear trap (incorrect bearish analysis) supported the recent uptrend, as my previous paper did. As a result, since the FOMO surge has not yet reached GOOGL investors, I frame the recent sell-off as another opportunity for dip buyers to buy the undervalued Mag 7 leader.

Investment opinion: Maintain strong buy.

IMPORTANT NOTE: Investors should exercise due diligence and be careful not to rely on information provided as financial advice. Always be an independent thinker, and please note that unless otherwise stated, the ratings are not intended to establish specific entry/exit times at the time of writing.

I’d like to hear from you

Do you have any constructive comments to improve our paper? Have you noticed a critical gap in our perspective? Did you see something important that we didn’t see? Do you agree or disagree? Please leave your comments below to help everyone in our community learn better!