Graham Holdings (GHC) Stock: Lack Of Growth And Poor Capital Allocation Dilute Confidence

Editor’s note: Seeking Alpha is proud to welcome John-Paul Lake as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Untangling all of the business units reveals lackluster growth engines. malerapaso/E+ via Getty Images

Investment Thesis

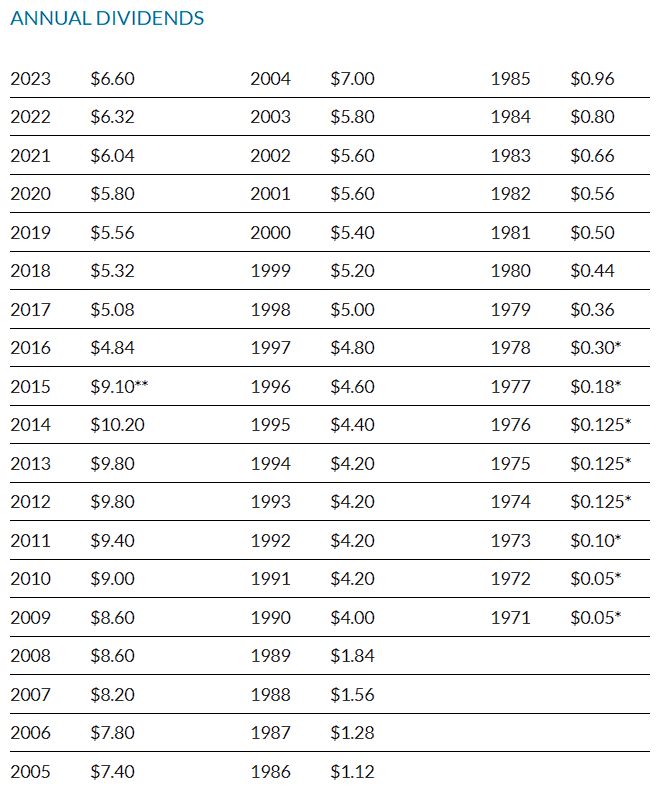

My goal is to identify the future Dividend Aristocrats or Champions, and this article examines whether Graham Holdings Company (NYSE:GHC) has a reasonable chance of someday achieving that distinction. The company’s dividend history is quite strong; from 1971 to 2014, dividends per share increased every year except for five stretches (’74 – ’76, ’91-’94, ’01-’02, ’08-’09, and ’12-’13) where they were held constant. Four of those pauses in dividend growth were during recessions so it’s nice to see that the company was financially in a position to maintain the dividend. However, the prior history of dividend growth was fueled by a different mix of businesses, while the current Graham is a very different company, lacking a growth engine and track record of accretive acquisitions that can compound operating income and cash flow to support annual dividend increases.

Company History

Graham Holdings has a storied and interesting history, dating back to 1877 when it began publishing The Washington Post. After the sale of The Washington Post to Jeff Bezos in October 2013, the company changed its name to Graham Holdings Company in November of the same year. Today Graham is a diversified conglomerate holding company. Since the sale of The Washington Post, the company has completed at least 15 acquisitions and now prides itself on having five business units; Education, Broadcasting, Manufacturing, Automotive, and Healthcare.

Graham seems to fancy itself after Berkshire Hathaway, and the company even has a sizable (relatively speaking) portfolio of marketable securities ($697MM as of the most recent quarter ended 12/31/2023). Berkshire Hathaway and Markel Group constitute the largest holdings in the marketable securities portfolio representing $401MM and $78.7MM respectively. Warren served on the Graham Board of Directors for 37 years, retiring in 2011.

In 2014 the company spun off its Cable One business and the dividend was reset lower at $4.84 per share. Since that time, Graham has resumed its annual dividend increases at a 4.5% CAGR and 2024 will be the 8th consecutive year of increases. My goal is to find the next Dividend Aristocrats, starting with companies approaching the 10th year of consecutive dividend increases; so Graham is nearing my evaluation window.

Graham investor relations website

To evaluate the likelihood that Graham can continue increasing dividends for at least 17 more years and attain Dividend Aristocrat status, let’s look at its business units first. Then, I will examine the financial statements and valuation.

Education (36% of Revenues)

The largest division is headlined by the Kaplan company – familiar to many of us who needed some SAT prep classes or tutoring assistance. Today, Kaplan has expanded its service offerings to include English language programs, operations support for universities, professional certification testing, corporate training, and even operates a sixth-form college in the United Kingdom. The company now operates in 27 countries serving 1.2 million students. Graham’s leadership team argues that the global market for educational services is forecast to continue rising as emerging economies want to upskill their labor pool and the global middle class continues to expand.

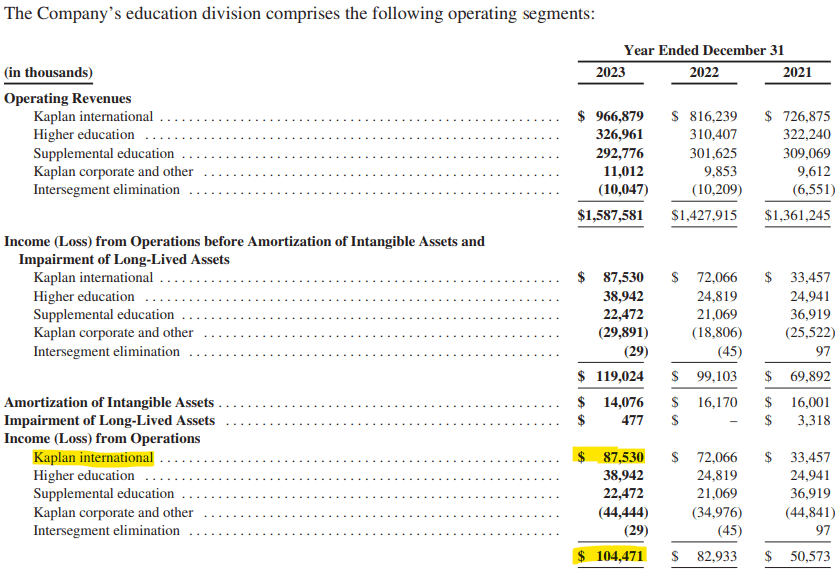

Kaplan revenues increased 11% in 2023 compared to 2022. Looking back further, we see stagnate revenue growth after considering inflation. In 2018 Kaplan generated $1.45B in revenue and in 2023 that figure was $1.59B, or just under 10% cumulative growth. The COVID pandemic explains part of the trend as the company reports that enrollment metrics just recovered during 2023. Nevertheless, I would expect to see more substantial revenue growth if the educational market is as big and lucrative as the company claims. In addition, during the most recent 4th quarter, two of Kaplan’s segments (Higher Education and Supplemental) delivered flat or declining revenue. The growth and profit engine within Kaplan appears to be the International segment. In fact, Kaplan International accounted for all of the operating income of Kaplan in the 4th quarter of 2023 and 84% of operating income for the full year 2023. That means that the entire United States segment is essentially operating at breakeven.

Company 10-K 2023

While the education industry has been growing along with global population and incomes, I see artificial intelligence as a major threat going forward. Just since the AI “boom” kicked off, there are already numerous companies offering personalized tutor services (Synthesis and Khanmigo are just two of many). Kaplan’s model relies in part on human tutors, instructors, and test proctors. Sure, there will always be a need for a human element, and Kaplan could attempt to acquire these AI edtech companies, but will the culture of Kaplan mesh with a software centric business? I think competitors like Paper and Powerschool are more likely suitors for emerging/startup AI edtech companies.

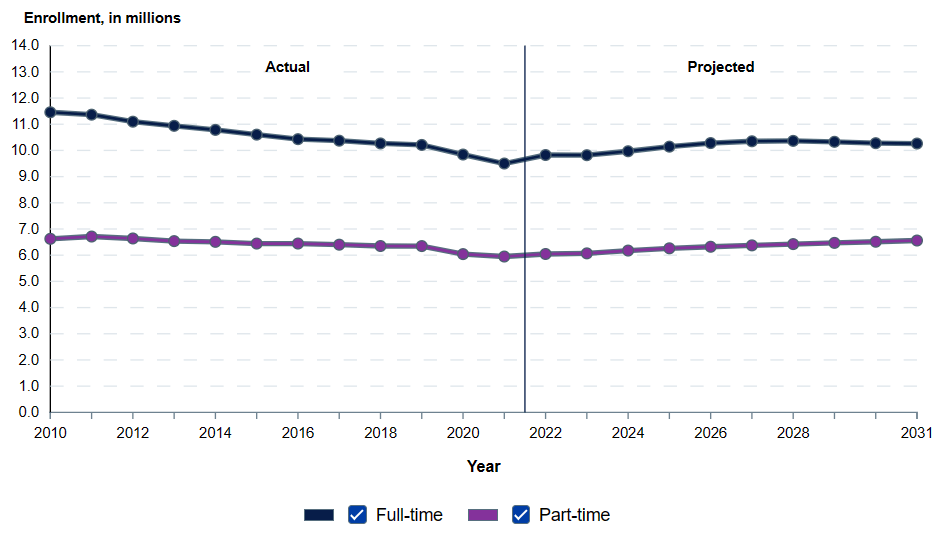

The second headwind that I see for Kaplan is declining college enrollment in the United States.

National Center for Education Statistics

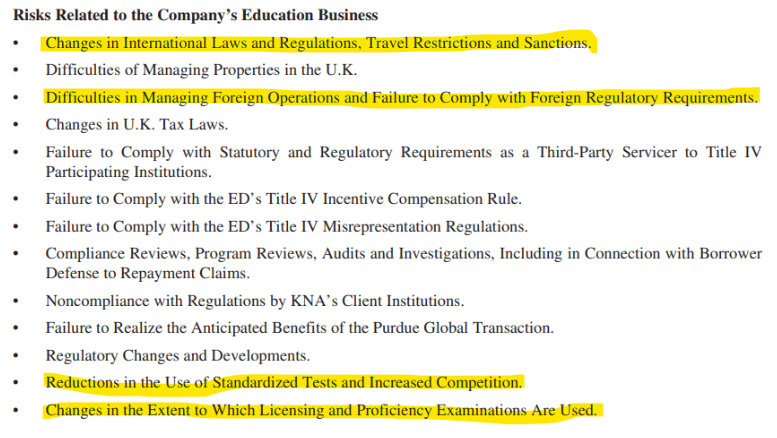

The postgraduate enrollment is somewhat better, but projected to only grow from 3.2 million to 3.4 million in 2031. Thus, the imperative and greatest opportunity for Kaplan is outside the borders of the United States. The challenge with international education would seem to be that every country has different policies and regulatory environments. Graham notes this in the risks disclosure of the latest 10K.

Company 10-K 2023

Furthermore, the last bullet points in the risk disclosure point to the third challenge that I foresee with Kaplan; declining use of standardized tests and proficiency exams. Hiring practices certainly seem to be changing in the United States. With a shrinking workforce, employers are placing more emphasis on experience and showing a willingness to train employees on the job. Public attitudes about postsecondary education have been dropping with only 36% of the population having “a great deal” or “quite a lot” of confidence in higher education, down from 48% in 2018 and 57% in 2015.

Many universities in the United States have also adopted a “test optional” admissions policy. Personally, I wonder how long these policies will stay in place given that standardized tests have predictive value and it would seem that academic institutions would want a high completion rate as that equates to multiple years of tuition income. All in all, the education business unit has some growth potential internationally, but also significant headwinds that are likely underappreciated.

Broadcasting (11% of Revenues)

Media, unlike some other Graham divisions, seems to make sense given the company’s history in that space. The current media business consists of 7 local television stations in 4 states (TX, FL, MI, VA). While the populations of Texas, Florida and Virginia are growing, the entire local broadcasting industry is in decline. Graham’s media group President acknowledges that the industry faces stiff headwinds and they have several initiatives underway aimed at stemming or even reversing the drops in viewership.

What we believe: The historic model of the past is declining. Disintermediation of the bundle and cord cutting reduces profits and makes distribution more challenging. What this means: Earnings tied to net retransmission and traditional linear broadcast will shrink from the levels of today. Graham Investor Day December 12, 2023 presentation.

Their primary strategy is to double down on “uniquely local” coverage, while the national broadcasters and consolidators are focused on driving cost synergies and reducing local market overhead by heavy use of syndicated content.

I think the strategy here has merit even though it may not be enough long-term to resuscitate revenue growth, and I like one of their initiatives in particular. Graham launched a streaming offering for high school sports. We know that professional sports both nationally and internationally are a huge, growing market and media companies are paying enormous sums for the broadcast rights. While high school sports will never compete with Monday Night Football, it can be a low-cost addition to a local broadcast lineup and likely attract advertisers who want to reach the youth age bracket and their parents at the same time. In Texas, famed for “Friday night lights”, this could be a real differentiator. Graham claims to have developed the technology and operations to stream these games efficiently and reliably. Note that I don’t live in one of these regions so I can’t personally vouch for the claim.

While it’s early days, we’re excited about the economic model that we’re building. We stream and run advertising on the games, local partners sponsor a “player of the game,” and we provide access to games with high production value that family, friends, and alumni would otherwise miss out on. This model does not rely on network content, drives both linear and streaming viewership, and is uniquely local, further enhancing and differentiating our brand in market. – Graham Investor Day December 12, 2023 presentation.

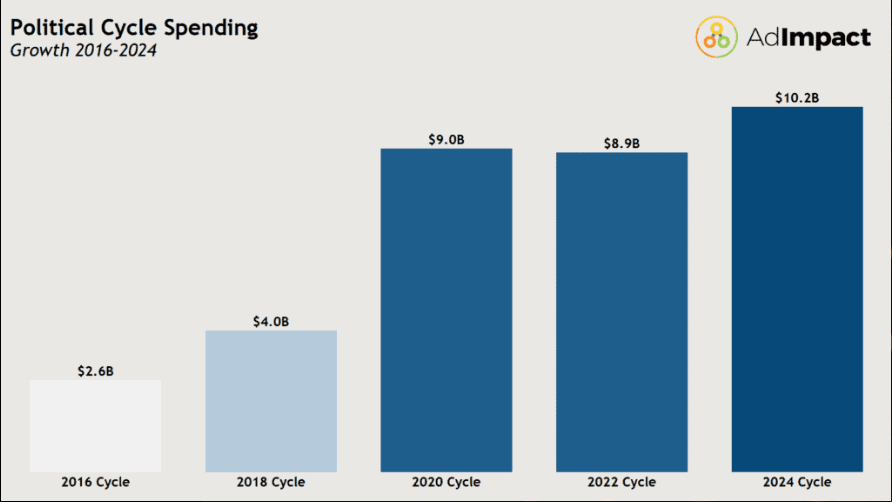

Perhaps the most talked about driver of Graham’s revenue in years like 2024 is political advertising. The Presidential election cycle reliably delivers a bonanza of political advertisements, much to the chagrin of many of us who tire of seeing politicians badmouth each other every evening for months on end leading into November. This year will be no different. In fact, projections are for election advertising to increase 13% from the 2020 total.

AdImpact

Interestingly, Graham did not capture the same percentage increase in advertising from 2018 to 2020 as the national spend, which grew 125% from $4B to $9B; Graham’s political advertising revenue only increased 42%. Advertising spending is highly variable by congressional district depending on which seats are considered safe for incumbents and which are heavily contested “battlegrounds”. Spending in the 2022 mid-terms nearly matched the “on-cycle” Presidential year spending in 2020.

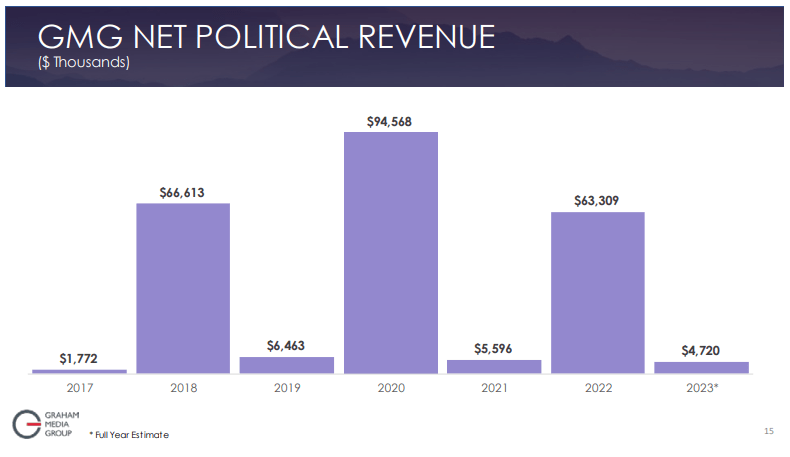

Company Investor Day Presentation 2023

If Graham’s net political ad revenues rebound to the same level as 2020, that would be an increase of $30 million, or about $6.44 in earnings per share. Such an assumption is fair given that Michigan is one of the key battlegrounds states this cycle and Graham’s station in Detroit should therefore benefit. Texas and Florida were not really in contention during 2020 as Trump carried Texas by 5.6 points, Florida by 3.3 points and Biden walked away with Virginia by over 10 points. Michigan was also heavily fought over in 2016 (Trump won the state) and 2020 (Biden won) so I think political ad revenue for Graham should be very similar to 2020.

Is the upcoming political advertising revenue a reason for the runup in Graham shares since November 2023? It’s hard to say, given that Graham is a holding company and that Broadcasting only accounts for 11% to 13% of total revenue. You can see that Graham does not trade in lockstep with other broadcast companies. In particular, the high share price for competitors like SBGI, GTN and SSP was on January 25th, 2024. That was two days after the New Hampshire primary when it started to look like Trump would easily win the GOP nomination and therefore advertising spend for the remainder of the primaries would be less than expected as GOP challengers started dropping out. Ultimately, if GHC shares have priced in EPS assumptions higher than ~$6.50, I think they are too optimistic, and any one-time boost is not enough to offset the larger material issues with the other business units and the declining overall outlook for local broadcasting.

GHC up 30% since November while other broadcasters have declined after NH primary election (Seeking Alpha)

Automotive (24% of Revenue)

Graham owns eight automotive dealerships in the Washington, D.C. metropolitan area and

Richmond, VA. Given that our goal is to find companies with a higher likelihood of becoming a Dividend Aristocrat, I struggle with three issues when assessing this business unit’s ability to contribute to long-term dividend growth.

- Service/maintenance and repairs are a large source of profit for most automotive dealers. Electric vehicles require less maintenance than internal combustion engines because they have fewer moving wear parts. As EV’s become a greater share of the market, this will likely decrease service revenues and profit at dealerships.

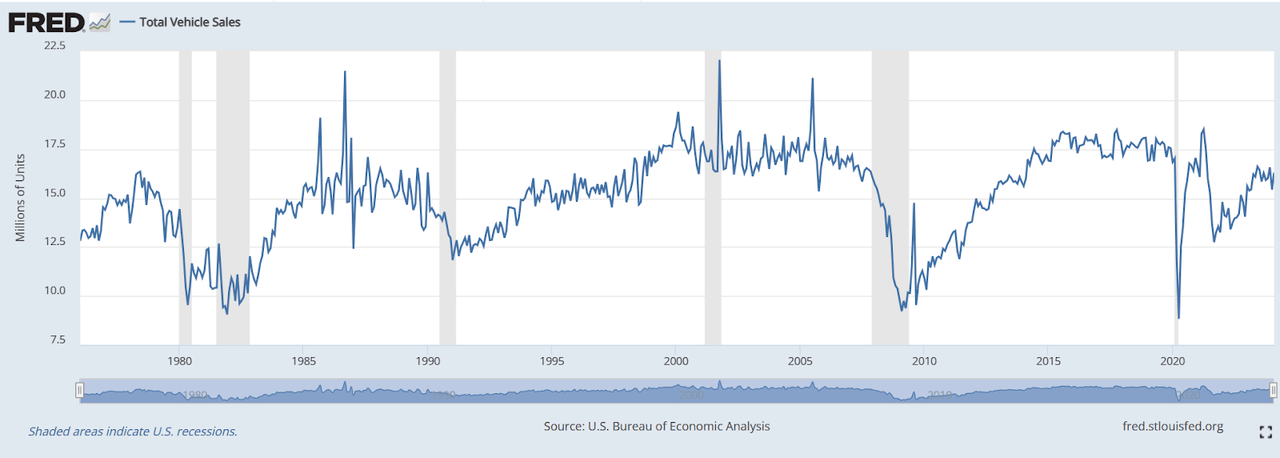

- Automobile sales are not a growing market long-term as shown by the data going back to 1965. This is not likely to change given trends with millennials and Gen Z who seem less interested in owning a car.

U.S. Bureau of Economic Analysis

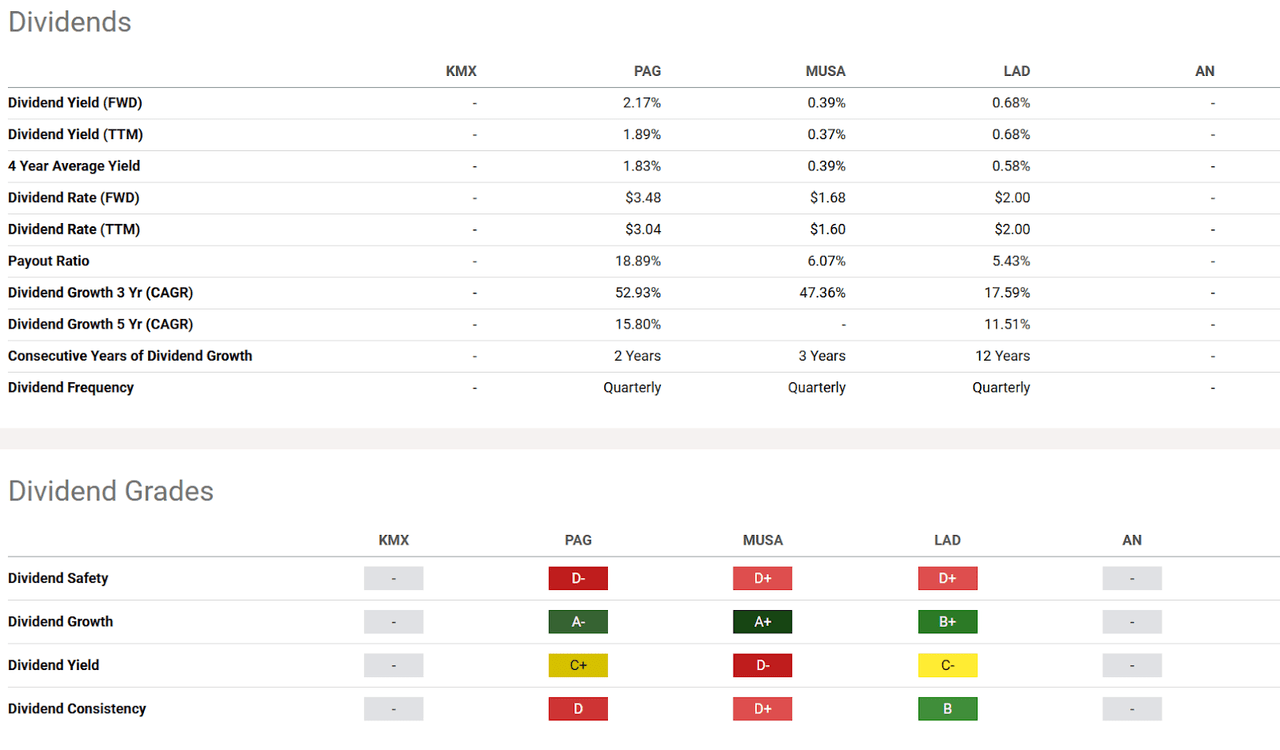

- Auto dealers have not shown that they can consistently pay and increase dividends over time. Here is a snapshot from Seeking Alpha of five publicly traded auto dealers. Only three currently pay a dividend, and only one has increased the dividend for more than 3 years. All three have D ratings for Dividend Safety.

Seeking Alpha Dividend Profile of Auto Dealers

Other Business Units

The remaining businesses represent just under 30% of total revenue. I will offer some high-level questions and concerns on each one before addressing the financial statements, capital allocation and valuation.

Manufacturing (10% of Revenue)

As described in the company’s 10-K, this business unit consists of

…Hoover, a supplier of pressure impregnated kiln-dried lumber and plywood products for fire retardant and preservative application; Dekko, a manufacturer of architectural lighting and electrical components; Joyce/Dayton Corp., a manufacturer of screw jacks and other linear motion systems; and Forney, a global supplier of products and systems that control and monitor combustion processes in electric utility and industrial applications.

-

What are the scale advantages and competitive differentiators here?

-

The construction (Hoover) industry is holding on at the moment but it’s certainly prime for a drop if and when the next recession finally arrives.

-

Commercial office space is in a bear market due to the prevalence of “work from home” that arose as a result of the pandemic. Plenty of forecasters think the bottom is still to drop out in this market as vacancy rates have declined but cap rates and prices have not declined at the same pace. There is a lot of commercial mortgage debt that will need to be refinanced too.

-

The Forney business provides products used in gas fired or cogeneration power plants and thermal heat plants like a coal power plant. Neither of these end markets seems poised to grow significantly over the long term given the focus on reducing greenhouse gas emissions.

Healthcare (10% of Revenue)

According to the 10-K, this business unit consists of the Graham Healthcare Group and it provides

…home health, hospice and palliative services. GHG also provides other healthcare services, including nursing care and prescription services for patients receiving in-home infusion treatments, ABA therapy clinics, physician services for allergy, asthma and immunology patients, in-home aesthetics and healthcare software-as-a-service technology.

-

Healthcare is notoriously regulated and while excessive regulation can often result in entrenched companies and oligopoly market dynamics, it typically also reduces innovation and increases inefficiencies.

-

The company’s risk disclosure in the latest 10K probably sums up my concerns best about this business unit.

Company 10-K 2023

Other (8% of Revenue)

Looking in the 10-K we find a description of the last business unit, or rather a collection of “other” businesses that includes:

an online art gallery and in-person art fair business; an online commerce platform featuring original art and designs on an array of consumer products; an owner and operator of websites; restaurants; a custom framing company; a marketing solutions provider; a customer data and analytics software company; Slate and Foreign Policy magazines; and a daily local news podcast and newsletter company.

-

The company philosophy and strategy is not well articulated as to the role of these companies in the corporate portfolio, and visibility on operating performance is low.

-

Are these companies a distraction to senior management? While each business has its own management team, they do consume some amount of time and overhead resources and without a clearly articulated role in value creation for shareholders I struggle to see the rationale for owning these businesses.

Capital Allocation

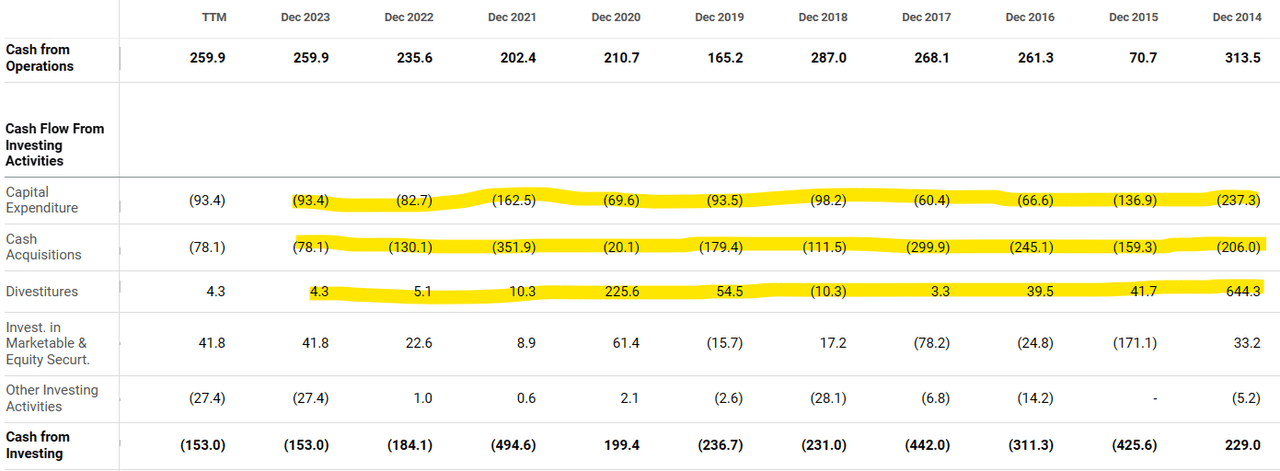

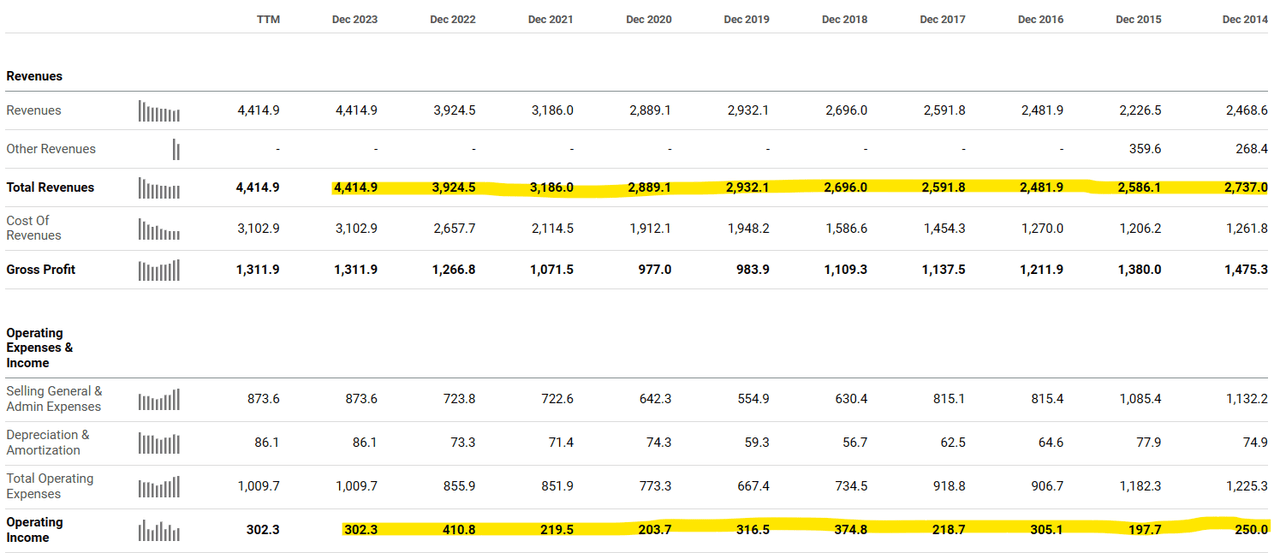

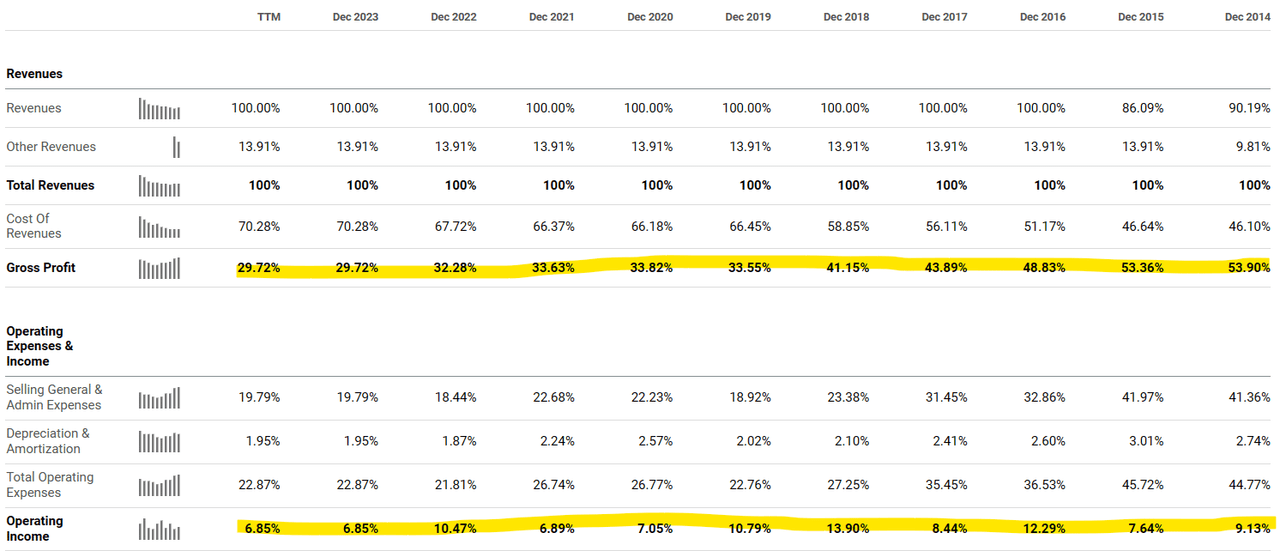

For a company that seems to aspire to be a mini Berkshire Hathaway the track record is not compelling thus far. Over the 10 years beginning in 2014 thru 2023, Graham has invested $1.1 billion in capital expenditures and $1.78 billion in acquisitions. Against this total investment of $2.88 billion the company also realized $1.02 billion in proceeds from divestitures, for a net investment of $1.86 billion.

Seeking Alpha Financials for Graham Holdings Company

Over the same time period, revenue has grown from $2.7 billion to $4.4 billion and operating income has increased from $250 million to $302 million. Gross profit margins have declined from 54% to 30%, and operating profit margin has decreased from 9.13% to 6.85%. Cash Flow from Operations has also been flat from 2016 to 2023 ($261MM to $260MM).

While this is a simplistic and very high level way of looking at the business, you have to ask the question if the investment and diversification has built a more profitable and valuable company. Meanwhile, the old Cable One subsidiary has continued to grow and increase its operating income margins from just over 20% in 2014 to over 32% in 2023, perhaps demonstrating the value of focus.

Seeking Alpha Financials for Graham Holdings Company Seeking Alpha Financials for GHC

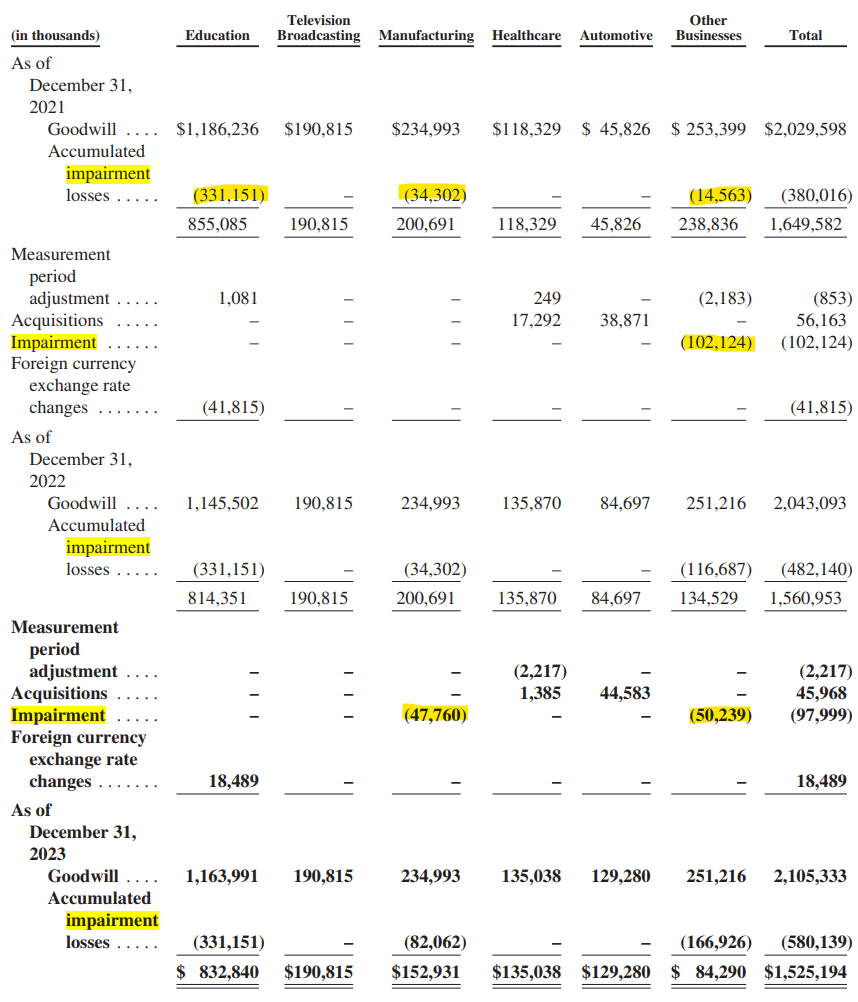

Additionally, we can look at the price paid for these acquisitions and here the results are concerning. For the years ended December 31, 2023, 2022 and 2021, the Company recorded goodwill and other long-lived asset impairment charges of $99.1 million, $129.0 million and $32.9 million, respectively. Cumulatively, Graham has written off $580 million of goodwill against original carrying value of $2.1 billion; that’s nearly 28%. This shows that the company is overpaying for acquisitions and destroying shareholder value. The impairments have come in the Education, Manufacturing and Other business units, and on a percentage basis Manufacturing has taken a 35% impairment and Other a 66% hit.

Company 10-K 2023

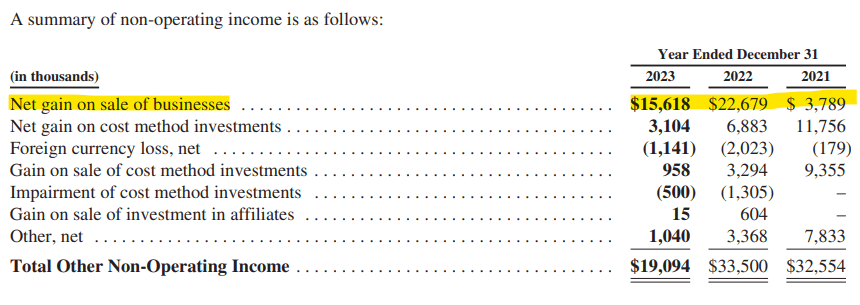

Have there been any profitable investments? Yes, apparently a few, as $42 million in net gains have been recorded on sale of businesses in the most recent three years. That’s not enough to offset the nearly $600 million of goodwill impairment.

Company 10-K 2023

Valuation

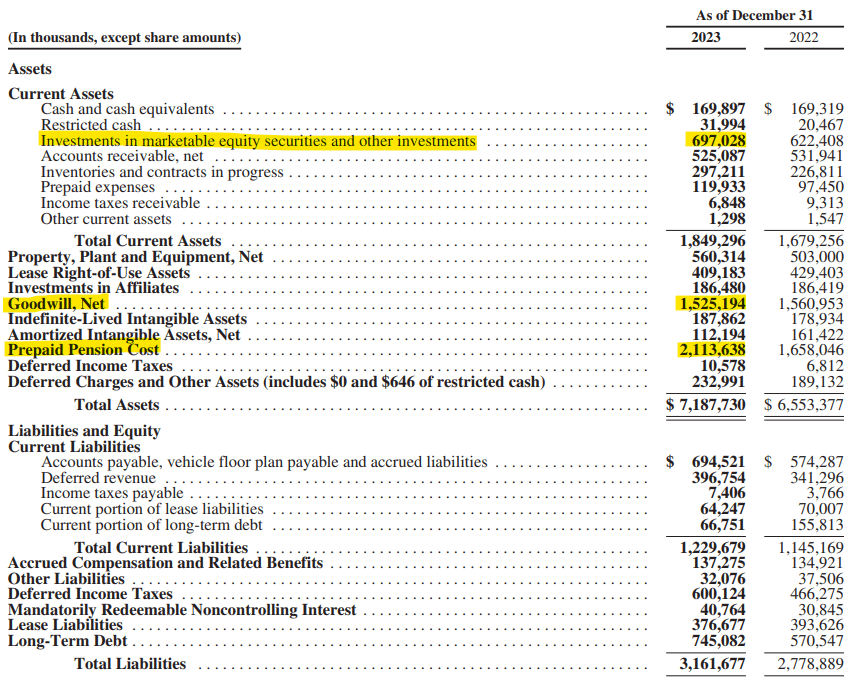

Proponents for the stock on a valuation basis may point to the price to book ratio, which is sitting at about 0.85 as of this writing. I am hesitant to put a lot of weight on the book value because it includes significant non-operating assets in the form of investments in marketable securities (mentioned above), questionable Goodwill that is possibly still at risk of future impairment, and prepaid pension costs (asset). The marketable securities and pension fund are subject to market volatility. Shareholders can get the same exposure through other investment vehicles and unless or until management shows that they can allocate capital more effectively, I think Tangible Book Value per share is the better metric to focus on and it is only $480.15. On a price to tangible book value basis the stock is trading at about 1.57 times, arguably fairly valued at best.

Company 10-K 2023

Conclusion

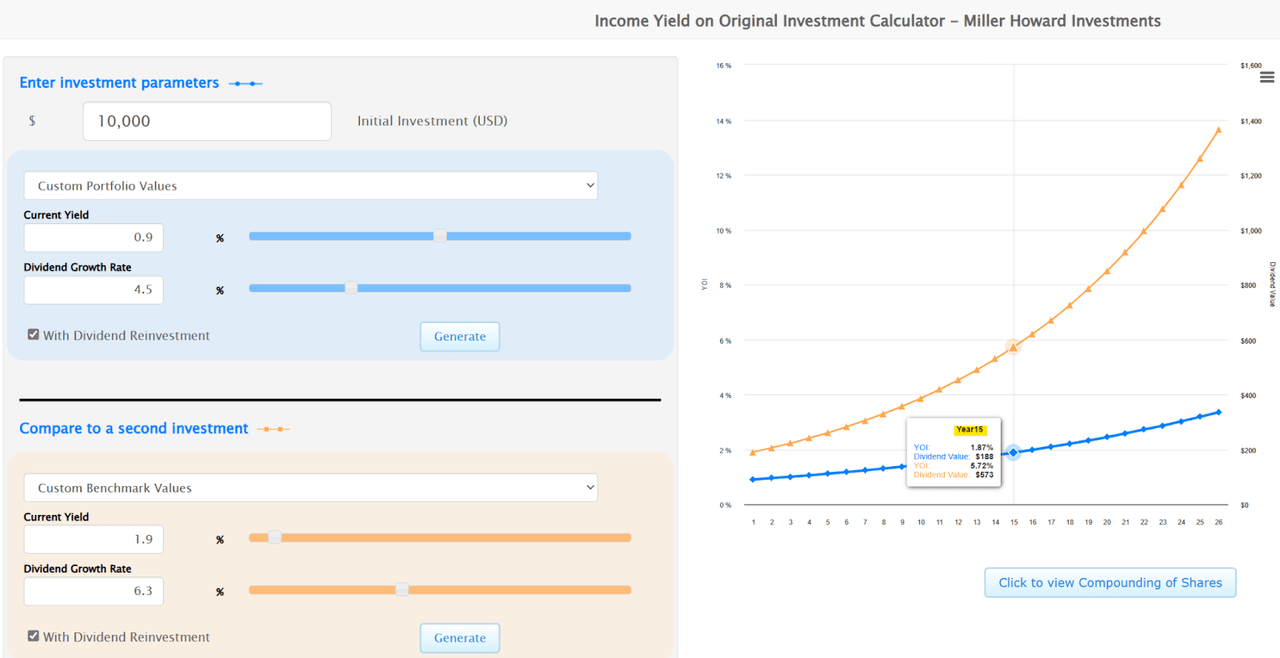

Currently, I don’t see a path to Graham becoming a Dividend Aristocrat someday because of the poor capital allocation and lack of a long-term growth engine. Too, there are much better dividend growth compounders available, as Graham only offers a 0.9% dividend yield compounding at 4.5% annually.

For comparison, you can buy the Vanguard Russell 1000 Value Index (VONV), with a 1.96% yield and 6.3% dividend growth CAGR over the past 10 years. Over the next 15 years, just this difference in starting dividend yield and growth rate can mean a big difference when looking at the yield on original investment cost. I love this free tool from Miller Howard Investments called the Income Yield on Original Investment Calculator. Just enter the dividend yield and dividend growth rate on two investments that you want to compare and the calculator shows you the future value of dividends.

Entering a $10,000 investment in GHC compared to VONV and we see that in 15 years, GHC would be paying $188 in annual dividends vs. $573 for VONV. The calculator generates a nice graph showing the dividend value over time.

Miller Howard Investments Website

I rate the shares a Sell and would move to Hold at $650, which is based on backing out my estimated $6.44 in earnings per share multiplied by the current PE (GAAP basis) of 17 (total of $109.48) from the current share price of about $760. Anyone considering a short position on the stock should watch for upside risk based on better-than-expected results at Kaplan or Graham Media (broadcasting).