Grand City Properties: Don’t Worry About Dividend Suspension (GRNNF)

miscellaneous photos

introduction

Grand City Properties (OTCPK:GRNNF), or GCP for short, recently suspended its 2023 dividend. According to the press release:

“teaThis decision was made as market uncertainty remains high and visibility into the overall impact on leverage, trading markets and valuations is increasing. Financing costs also remain limited. GCP management believes that in the current market environment, it is prudent for the company to be conservative in terms of preserving capital and liquidity while continuing to focus on deleveraging. “

While this may be disappointing for income investors, we think this is the right decision for the company in the long run. GCP remains attractively valued and has sufficient liquidity to cover maturities through 2026. As a result, we think income investors may want to view the dividend suspension as an opportunity to buy stocks for the long term. Besides, I think the stock offer There is a high possibility that prices will rise when interest rates are cut in the next 1-2 years.

Company Overview

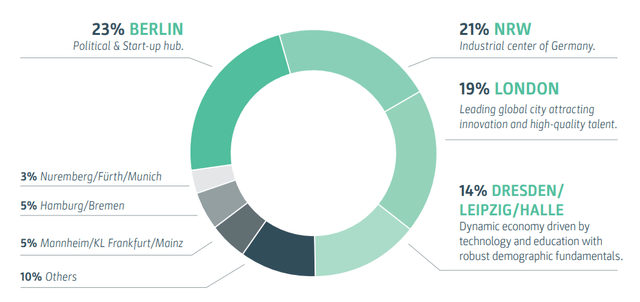

You can access all GCP investor resources here. The company owns 63,000 apartments (excluding those for sale), mainly in Germany (81% of the portfolio) and London (19%).

Portfolio Overview (Grand City Properties 2023 Annual Report)

Operation Overview

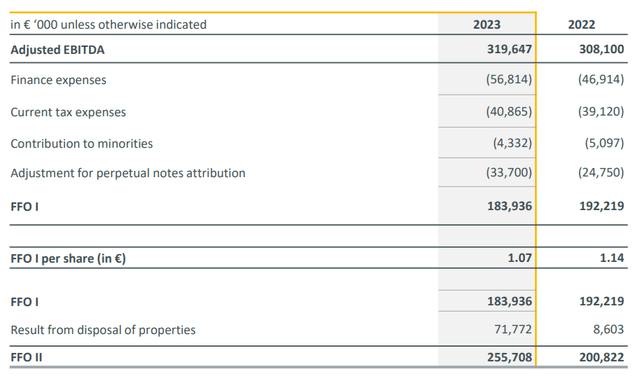

GCP’s key performance indicator is Funds From Operations I (FFO I), defined as:

FFO I = Adjusted EBITDA – Finance Expenses – Current Tax Expenses – Fractions – Interest on Perpetual Bonds:

FFO I & FFO II Bridges (Grand City Properties Q4 2023 Results Announced)

The Company also reports FFO II, which takes into account the results of dispositions. GCP aims to pay out 75% of FFO I over the long term.

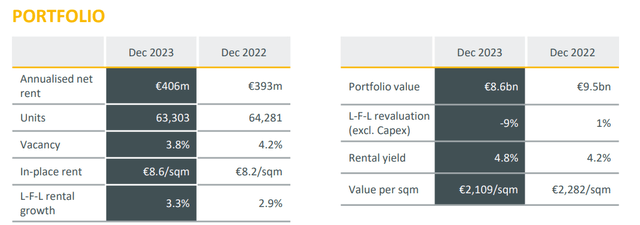

In 2023, GCP will FFO I per share €1.07/share, down 6% Y/Y due to higher interest expense, only partially offset by higher EBITDA. that much Similar rent growth In 2023 it was 3.3% (2022: 2.9%); Share Improved to 96.2% at year-end (2022: 95.8%):

Key Portfolio Characteristics (Grand City Properties Q4 2023 Results Announcement)

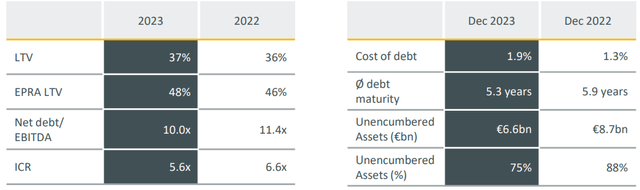

debt position

The company ended 2023 with net debt of €3.2 billion, a significant amount compared to its market capitalization of €1.7 billion. As of the end of the year, the average cost of debt is 1.9% (2022: 1.3%), and the average maturity is 5.3 years (2022: 5.9 years).

Leverage Indicators (Grand City Properties Q4 2023 Results Announced)

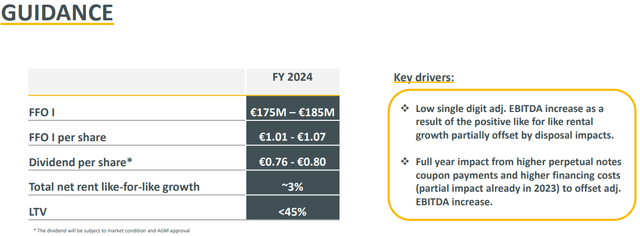

Outlook to 2024

Going forward, GCP expects FFO I per share to be 3% lower in 2024, at approximately €1.04/share. This is partially compensated by comparable rent growth of 3% due to higher interest expenses.

Outlook to 2024 (Grand City Properties 4th quarter 2023 results announced)

GCP could restore a dividend of approximately €0.78 per share in 2024, depending on market conditions.

real estate valuation

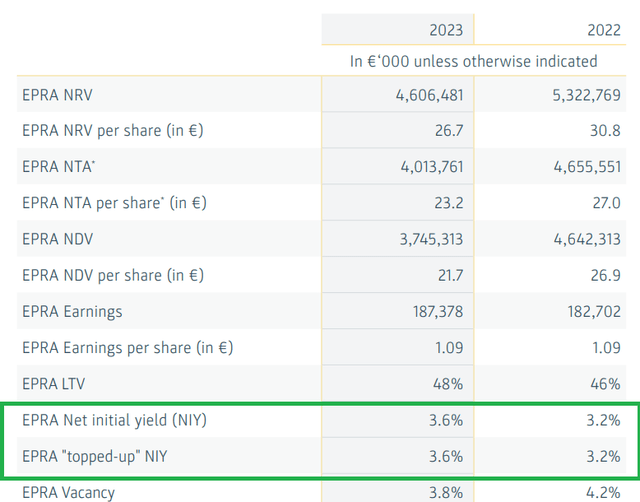

At the end of 2023, GCP’s portfolio was valued at an EPRA net initial return of 3.6%, up from 3.2% at the end of 2022.

EPRA Performance Measures (Grand City Properties 2023 Annual Report)

This resulted in EPRA net tangible assets. Little Ephra, € 23.2/week. a more conservative EPRA net disposal value, or Efra NDVThe amount accounting for deferred taxes (about €560 million for GCP) was €21.7 per share. The small difference between the two measures is partly due to the fact that rising interest rates in recent years have resulted in a gain of €268 million for EPRA NDV (resulting in GCP’s debt trading below par, which means EPRA NDV would have to pay less in a liquidation scenario). depreciated). Assume to some extent).

It is important to note that the tax of €560 million will only be payable if the portfolio’s real estate gains are realized. This is one of the reasons why GCP chose to skip its 2023 dividend. More retained earnings means less disposals, and less disposals means less disposals. The resulting realized profits and taxes are accrued.

The EPRA NDV can be adjusted for the effect of below-par debt. This results in an adjusted EPRA NDV of EUR 20.15 per share.

Market Implied Limit Rate

Using the three net asset value metrics described above and the EPRA 48% collateral-to-value measure (which is more conservative because it accounts for assets and liabilities on a pro rata basis, unlike the IFRS approach for full consolidation), we obtain the following for GCP: Find the market implied limit rate of .

| Little Ephra | Efra NDV | Adjusted EPRA NDV | |

| quest | 23.2 | 21.7 | 20.15 |

| Market implied cap ratio | 5.17% | 5.06% | 4.94% |

Source: Author calculations

We find that the market implied cap rate is around 4.9-5.2% depending on the exact NAV measure used.

Comparison with Bonobia

Now let’s compare GCP to Vonovia (OTCPK:VONOY), which we recently covered here. The biggest difference from a portfolio perspective is that GCP has exposure to expensive London real estate, while Vonovia’s Austria/Sweden exposure is generally in the lower tier segment of the market, in line with its German portfolio.

| Metrics\Company | GCP | I smell it |

| Share | 96.2% | 98% |

| Similar Rent Growth 2023 | 3.3% | 3.8% |

| Comparable rental growth in 2024 (forecast) | three% | 3.5% |

| EPRA Net Initial Return 2023 | 3.6% | 3.1% |

| Market Net Initial Return (EPRA NTA) | 5.17% | 4.01% |

| Market Net Initial Return (EPRA NDV) | 5.06% | 3.49% |

| Market Net Initial Return (Adjusted EPRA NDV) | 4.94% | 3.28% |

Source: Author calculations

We see GCP’s portfolio exhibiting lower same-rent growth rates in both 2023 and 2024 and higher vacancy rates, which clearly impacts its market-rate position. GCP’s portfolio, on the other hand, is more conservatively valued (at a higher EPRA net price) and does not suffer from Vonovia’s deferred tax issues to the same extent.

Overall, despite the risks associated with expensive London real estate, GCP looks like a slightly better choice compared to Vonovia. That’s mainly due to cheap valuations, which more than compensate for weak rental growth.

danger

Rising debt levels remain a key risk for Grand City Properties, which has an LTV ratio of 37-48% depending on the exact metric used. Using the company’s market capitalization, leverage reaches a whopping 65%. That means the company has enough cash (€1.2 billion) to allow GCP to meet all debt maturities through 2026, with sales signed but not yet closed. At that time, we expect the ECB deposit rates to be: It is currently well below 4%, providing a more favorable refinancing environment.

conclusion

Grand City Properties suspended its 2023 dividend to preserve liquidity. Nevertheless, we believe it has a relatively attractive value compared to its peer Vonovia, and has the potential for higher value appreciation in the long term due to its low deferred tax burden. As a result, I think this stock is a buy for both turnaround income investors as well as investors looking for long-term share price appreciation.

Thanks for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.