Greenhaven Road Capital Main Fund Q4 2023 Investor Letter

sankai

Dear Fellow Investors,

The Fund 1 returned approximately 15% in the fourth quarter, bringing the full year returns to approximately 51%. Returns will vary by fund and investment class, so please check your statements for your actual returns.

Our Q2 letter was themed around being “one day closer.” I wrote, “I believe that with each passing day we are ‘one day closer.’ These improvements will not always be reflected in share prices, and many times progress will not be linear, but time is the friend of a strong management team, and time is the friend of the competitively advantaged businesses. Time is our friend.”

I would like to say that all of our Q4 returns were generated because of our patience and our waiting for the one day to pass, but I do not think that is the full explanation. We benefitted from multiple expansion during the quarter as investors were willing to pay a higher P/E or P/S for the same underlying company. Building a business takes decades, but changes in pricing multiples can happen in an instant. The multiples for the stocks we own expanded in the fourth quarter as interest rate cuts became a credible possibility for most market participants in 2024. Fortunately, in addition to multiple expansion, several of our companies also took some very large steps forward as I will discuss throughout this letter. Multiple expansion and contraction amplify price movements, but there has been progress in the business building, which is what will matter most over the long term.

PAY ATTENTION!! TO WHAT??

Recently, podcaster Tim Ferriss interviewed Apollo Robbins, “the world’s most famous pickpocket.” The episode is wide- ranging, but – spoiler alert – not really about pickpocketing. Rather, they focus on how attention can be misappropriated. For Munger fans, he even cites Robert Cialdini (the author of Influence: The Power of Persuasion a book Munger liked so much he gifted Cialdini a share of Berkshire Hathaway). For me, listening to the podcast led to reading an article from “The New Yorker” and viewing a related video, which led to watching Robbins’ TED Talk on the “Art of Misdirection”, which resulted in a YouTube feed full of pickpocket demonstrations.

Unlike magicians, people like Apollo Robbins who pick-pocket as a form of entertainment are willing to discuss their strategies and techniques. Their craft involves predicting human behavior and controlling/misdirecting attention. As a viewer of this genre, we know there will be one or more steals, but, even when looking for and expecting the grab, it is still hard to see when it happens. The combination of multiple viewings, the ability to rewind, and step-by-step explanation of various techniques for framing attention reveals how the mark is distracted. The videos are bite-sized reminders of how susceptible we are to paying attention to the wrong details.

In Apollo Robbins’ case, every mark knows they are part of a pick-pocketing demonstration. Many have seen his videos before, their attention levels are at 110%, and all warning systems are activated, yet they are still unaware when personal items get removed. The act of paying attention is not enough to save them, and, in some cases, the mark’s heightened attention is used against them. Where we pay attention and how we pay attention can have a profound effect on the outcome. As Charlie Munger said, “The whole trick in life is to get so that your own brain doesn’t mislead you.”

While it is tempting to explore what pickpockets can teach us about the fraudulent side of investing – such as Enron’s fake accounting or Nikola’s management team pretending that a truck rolling down a hill was powered by their engine that actually did not work – for our style of investing, I see three set-ups involving investor attention where we can potentially profit over the long term.

The following are names I am personally ascribing to these “set-ups;” these names do not appear in investing textbooks, but I think they are apt descriptions. The first is “Macro Takes Over,” the second is “Short Termism,” and the third is “Don’t Know/Don’t Care.” I will briefly describe each of these, how some of the tenets of Greenhaven Road apply to counteracting them, and how we might profit from them over time.

Personally, I believe the hardest periods as a fundamental investor come when all the attention is shifted away from the companies themselves to the macro economy and/or the geopolitical landscape. When the entire market is swinging based on the expected words of the Federal Reserve chairman or the troop movements in a country such as Ukraine, large price movements are disconnected from what is actually happening at the companies we own. When Russia invaded Ukraine, markets swooned. Several of our companies had zero revenue in Ukraine and the surrounding area, yet their share prices moved materially. The macro periods are so difficult because they are accompanied by rapid re-pricing of the multiples that investors are willing to pay for future earnings. Bad things happen, investors are skittish, multiples go from 20x to 18x, and – boom – the stocks we own are down 10%.

In macro-focused periods, the multiple can expand or collapse overnight while the business’ earnings can be unchanged. Though the multiple will drive performance over the shorter term, fortunately, it is the business progress that determines true long-term returns. If a company can compound earnings at 15% for 20 years, they will have grown earnings by 16x. The business growth should have a far greater impact on the returns than the beginning or ending multiple. It is during these periods when the entire focus is on the “macro” that I repeat the mantra, “Fundamentals Matter.” Earnings matter, and the quality of those earnings matter. Cash flow matters; growth matters. How the growth is achieved matters. Fundamentals may not matter when the world goes “risk off” and everything is sold, but, over time, paying attention to fundamentals is essential in discerning quality and which companies have the chance to grow earnings at elevated levels for years through all of the macro challenges such as wars, interest rate changes, and pandemic(s).

The second area where a lot of investor attention can be misallocated is the very short term. This “short-termism” has several manifestations including in quarterly earnings estimates. Having sat in the COO, CFO, and board seats of operating businesses, I am always skeptical of how meaningful it really is to beat or miss earnings in any given quarter. There is an investment bank that includes the last 12 quarters of data on how much the company has beat or missed consensus earnings and what the stock price movement on earnings day was. This earnings day price movement analysis is a prominent part of every research report they distribute to their customers. On earnings calls, a disproportionate amount of the question-and- answer session is spent on questions that are effectively trying to dial in individual variables of a financial model such as gross margin to adjust the next quarter’s estimate by a penny or two.

As I listen to the calls, I am reminded of the Jeff Bezos quote, “When somebody … congratulates Amazon on a good quarter… I say thank you. But what I’m thinking to myself is … those quarterly results were actually pretty much fully baked about three years ago.”

Who am I to question one of the richest men in the world and a Hall of Fame operator? In my experience at smaller companies, the baking happens more like 1-1.5 years in advance of the quarterly announcement – not three. Nevertheless, the larger point still holds: current earnings are an output of actions taken months and years ago. Products are not built overnight, the sales process for a new customer is measured in months and years, acquisitions take quarters to execute, and integrating those acquisitions take years. To avoid “short-termism,” I am intentional about my information diet, the investors I spend time with (see Partners Fund managers), the types of questions that I ask management teams, and, most importantly, who we invest with.

In our Q4 2020 letter I wrote about the concept of Fight Club, a term I believe was applied to investment purposes by Dan McMurtrie of Tyro Partners. At the time I wrote that

Instead of thinking of a company as a group of assets managed by people, I think we are actually investing in a group of people managing assets. Those people are engaged in a series of fights with competitors while trying to scare off potential new entrants. Handicapping the fight is highly dependent on management, but also on existing assets, product positioning, balance sheets, and industry structure. These fights can be lopsided or can drag on, leaving both parties bloodied to a pulp. We want to own the strongest fighters in the easiest fights or the most underrated fighter with the best chance of surprising the lumbering, overconfident incumbents.

We are investing in people. We are trying to invest with management teams that have significant ownership aligning our interests. We are not going to have full transparency into the activities today that are driving the results in 2025/2026, but the management teams do. We don’t want to go into Fight Club with a manager with a history of misdirection. We cannot afford to be using our limited attention to protect our wallets at all times. As trite as it sounds, people really matter, and instead of myopically focusing on this quarter’s earnings estimate, I would rather assess the members of the management team, their internal investments of time, people, and capital, and their likelihood of bearing fruit in the future.

I believe that the third area of investing that provides opportunity for us is “Don’t Know/Don’t Care.” While our partnership’s investment mandate is broad, in the last several years, we have not owned a single company in the S&P 500, instead skewing towards much smaller companies – ones that I would argue most people “Don’t Know and Don’t Care” about. Many of our investments don’t “screen well” as the full opportunity is not laid out in the historical financial statements. A significant portion of the market is passive dollars such as indices – they do not even pretend to look or care. Then there are sell-side analysts who are paid to look, but they are covering 30+ companies in a time-compressed way that very much focuses on quarterly earnings, and often their work is riddled with errors one might expect of somebody stretched too thin. For example, on the day I am writing this letter, an analyst published a report on a company we own that is selling one of its divisions. The analyst properly removed the earnings from that division in their analysis but forgot to adjust the debt/cash levels for the proceeds, impacting their price target by more than 50%.

Over the past several years, just buying the largest companies has been rewarded, but I believe that over time, understanding the accounting of Cellebrite (CLBT) matters and will be rewarded. I believe that understanding that PAR could sign very large customers nine months before one was announced matters. I believe that the work we have done to understand Burford (BUR) and their portfolio of cases besides YPF matters. In a land of “don’t know/don’t care,” I care. I care like a person investing my life savings into these companies. It can be very lonely in periods of “risk off” where macro dominates or when others “don’t know/don’t care,” but, ultimately, I believe we will be rewarded for spending our attention in some of the boring corners of capitalism where we can have an informational advantage just by doing the work.

Top 5 Holdings

Because I have written about all our Top 5 holdings extensively in the previous letters, this letter’s discussion of them will have a greater focus on the seeds that management is planting today that I believe may drive results in one to two years. This is a speculative exercise but may be more instructive than highlighting the most recent accomplishments.

PAR Technology (PAR)– In October, our largest holding, PAR, announced their biggest customer win, Burger King. The path to Burger King was long and winding. One could argue that the first seeds were planted in 2014 when the company bought a cloud-based Point of Sale system called Brink. However, it also would not have happened if CEO Savneet Singh had not been hired in 2018. It also would not have happened if the company had not decided to pursue their Unified Commerce strategy in 2021. This overnight success was almost 10 years in the making and the result of a series of product, hiring, and acquisition decisions.

I see two sources of optimism for us as shareholders. The first is that, even though the Burger King announcement was the largest in company history and represents 8,000 Burger King locations in North America, there are also many reasons to believe that two other large chains (Tim Horton’s and Popeye’s) with the same owners as Burger King could be secured if the Burger King implementation is successful, representing an additional 8,000 locations in North America, and then eventually international Burger Kings.

None of the Burger King/Tim Horton’s/Popeyes/international opportunity shows up in the quarterly earnings right now. Fortunately, there may be more large chains behind Burger King. As the CEO of PAR said, “(w)hat makes us even more positive is that we believe we’re just at the beginning of a tidal wave of large deals coming to market, which should provide for long-term sustainable growth.” To quantify this, PAR has more RFPs due in the first 4 months of 2024 than they had in all of 2023. There are six Tier 1 restaurants in play. Based on some triangulation, parsing of words, scuttlebutt, and logic – my best guess is that PAR has won a chain that starts with a W and ends with a Y for their Punchh loyalty product.

I can predict that on the next earnings call, the majority of questions will be about gross margins for the past quarter and expenses for the coming quarter. I believe the reality is that if the competitive landscape remains favorable vs. NCR and Oracle, if PAR can deliver on their Unified Commerce platform, and if there are opportunistic acquisitions, our patience should be rewarded. The combination of an enterprise scale POS (point of sale) + payments + MENU (on-line ordering) + Loyalty + Back Office is resonating with customers. Payments are better because of POS integration, POS and Loyalty are better because of payments integration. Almost all customers buying MENU take payments. The products are reinforcing.

As I have mentioned in several letters, I am paying particular attention to the jockey here. Savneet Singh has an excellent track record of product development and capital allocation, and I think many of the pieces will come together in 2024 with an acquisition that is accretive and provides scale, the sale of PAR’s government business, and increased operating leverage. With these changes, I believe the company can end 2024 as more of a “pure play” software company with very attractive financial metrics. Specifically, the combination of revenue growth (30%+ on ARR), profit growth, and multiple expansion should yield a higher share price.

KKR (KKR)– The alternative asset manager laid out some of the seeds of growth they have planted at the Goldman Sachs conference last December, stating that “…there’s a lot of different ways to grow the firm, Asia, climate, infrastructure, insurance, private credit, private wealth. These are all things we’ve been building over the last several years that are now starting to have a really big impact on the firm. And so that’s part of the reason you hear such optimism from us.”

On their last earnings call, management said, “we continue to be added to more private wealth platforms as these vehicles ramp. Two years ago, we were on approximately 10 platforms, and today, that number is closer to 40 across the suite of products that we manage, with more to come…. they are now raising approximately $500 million a month. It’s a really strong start for us, especially relative to our expectations, only reinforcing our confidence in the scale and impact of the long-term opportunity here.”

In December, KKR doubled down on insurance, purchasing the remainder of Global Atlantic, which has historically focused on managing assets for the insurance industry. They also have a 200-person sales force focused on selling into the private wealth channel. Private wealth is barely moving the needle today, but this is an asset-gathering business, and the machine is being built. Yes, there is a limit to how much more money endowments and other institutions can allocate to private equity, but the private wealth engine is just starting and should be able to drive meaningful growth for a decade-plus.

KKR has also been changing its share structure and governance to qualify for the S&P 500. This should occur in 2024 and provide a nice one-time tailwind as a wave of passive money is forced to buy KKR shares.

Cellebrite (CLBT)– The company sells software tools to law enforcement agencies to collect and review data from cell phones, benefitting from the increasing types and volumes of data including geo location, photos, texts, emails, and social media. Cellebrite has built a wonderful business and is the scaled provider with a limited competitive landscape. One of their competitors was bought out by Thoma Bravo and has proceeded to increase prices in certain geographies by 30%+. I think Cellebrite will pull the price lever over the next three years but do it in a more subtle way – through new products with greater functionality. This is an ongoing process; they are rolling out their new Insight product, which is designed to sell more seats. They should also continue to gain traction with their case management and Pathfinder analytics products. As an example, Pathfinder, which helps make sense of all the data, now has a 30% attach rate, but only a mid-single-digit penetration rate. I believe that cross-sells of Pathfinder will fuel growth.

Law enforcement agencies are struggling with case closure rates, backlogs, and hiring technologically sophisticated employees, all while facing an ever-growing wave of data, priming the market for new products, cross-sells, and price increases. Selling new products with increased functionality for higher prices should satisfy customers and fuel growth.

In the short term, I think it is quite possible that the market will begin to appreciate the quality of the Cellebrite business: their products are truly mission-critical, the competitive landscape is limited, the value proposition is high, and there is a pricing umbrella. The company’s net dollar retention has consistently been above 120%. CLBT trades at 4X EV/CY 24 ARR (annual recurring revenue), a significant discount to a peer group average of more than 7x. Like PAR, we have the opportunity for revenue growth, earnings growth, and multiple expansion in 2024.

APi Group (APG)– APi Group is one of the more difficult companies we own to analyze from the outside. Fortunately, the demand for their core fire inspection and repair business is very stable, as fire inspections are statutory and are required by law for a building to be used. APi uses their inspection business to drive their repair business, which is also largely non-discretionary. A landlord can tolerate a leaky roof for a while but has to repair a broken sprinkler system immediately. The improvements of APi’s business come through thousands of small actions, including winning of new customers, improving route density for their trucks, and managing purchases throughout their supply chain. The company is digesting a large European acquisition and will realize the benefits of price increases and relief from supply chain disruptions.

APi Group has a core competency in successfully acquiring and integrating companies as they have made hundreds of acquisitions. As their debt levels are reduced toward their target level of 2.5x, which they are anticipated to have achieved in the most recent quarter, the company can continue the playbook of value accretive M&A and other capital allocation opportunities. While APi is the #1 player in the fire protection systems market with ~5% market share, the competitive environment is highly fragmented and conducive to acquisitions/roll-ups.

Like PAR, APi is another overnight success that was 10+ years in the making. Originally focused on contract- centric business, the company made the strategic shift to a recurring revenue model focused more on servicing fire safety systems than initial installation. Between 2007 and 2022, the more attractive inspection, servicing, and monitoring business grew from 15% of total revenue to 50%+. But the company isn’t stopping there and is targeting a 60%+ mix looking ahead. A business with high recurring revenue, resiliency to the overall economy due to statutory inspection requirements, and expanding margins through operating leverage should be assigned a higher multiple by market participants. With APi Group, we don’t need multiple expansion to do well as organic revenue growth and incremental growth through M&A will accrue to earnings growth that alone should generate attractive investment returns – multiple expansion would be a cherry on top.

Burford (BUR)– The litigation finance company is by definition “playing the long game” as their average case takes almost three years from funding to resolution, but many take significantly longer. As a result, earnings in three years really are being driven by the investments being made today. The two senior managers of Burford each own more than $100M worth of stock. They are building an asset management business. Two of management’s priorities with long-term implications are to continue to build out both their data science infrastructure – Burford believes that they have the best proprietary data on legal settlements, which improves their case underwriting and thus long-term returns – and their customer base.

Historically, the “deal pipeline” of cases came from law firms looking to get their legal work paid for by Burford so that clients were more likely to pursue their cases. Increasingly, large companies are coming to Burford with cases as a case financed by Burford allows management to pursue a case without hurting current year earnings and their current year bonuses. Burford is currently working with 2 Fortune 50 companies. Working directly with corporates is going to be important for continuing to grow the litigation financing business.

Like the rest of Burford’s investor base, I am paying attention to their Argentina YPF case because – if and when they can collect their judgement – the potential proceeds exceed the market capitalization of the company. The developments with the new Argentinian president are incrementally positive for Burford. We are also tracking several other material cases, including Sysco, and any indications of continued progress on the corporate front. As discussed in our investor presentation (to investors only) that accompanied our last letter, Burford’s business is one where power laws can come into play. In general, they earn good returns on average for “meat and potatoes” type cases but have the potential to earn incredible returns on a smaller basket of cases which can have outsized impacts on business valuation.

ANNUAL MEETING

We have had a variety of types of annual meetings—most have been in person at the Harvard Club in New York City, but a few have consisted of video-based presentations, which can be helpful given the number of our limited partners and the geographic dispersion. We are going to try a new format this year. In February, I will send our investors a video update and then follow that up with short videos of fireside chat style interviews with a selection of the management teams we are invested in. I think it is helpful to hear from our Fight Club. The videos should provide insights into the seeds being planted that will drive future returns. Please be on the lookout for the videos. As always, if you have questions, just reach out.

SHORTS

We remain short the flying taxi company that has the trifecta of regulatory risk, technology risk, and business model risk – and you could arguably throw in a healthy dose of execution risk. Shares were up in 2023, but I do not think time is the friend of this business.

We are short an EV manufacturer that delivered 6,001 vehicles last year. This is a subscale manufacturer that loses money with each car sold. In an increasingly competitive market place with declining prices, it seems hard to justify an almost $10B valuation at the end of the year.

We are short two companies facing significant litigation with the potential for treble damages (i.e., 3x the actual amount) for their actions and potential liabilities far in excess of their market capitalizations. The litigation will take time to play out, but given the low margins, commodity nature of their product, and capital intensity, it is an unlikely candidate for a GameStop-type short squeeze and I believe has the potential to decline by 50% or more.

We are also short three major indices and bought some “insurance” in the form of out-of-the-money options in late December when option prices made the risk/reward more palatable. The puts will soften the blow of any major decline in equity prices and are both an insurance policy and allow us to remain invested in this turbulent time.

OUTLOOK

I have little doubt that in 2024 we will see the return of the dynamics discussed in this letter. There will be periods where macro dominates, there will continue to be short termism, and despite my best efforts to spread the word – much of what we own will be solidly in Don’t Know / Don’t Care land. This is an election year in the United States, which will naturally distract investors from the fundamentals as poll results and debate answers are extrapolated into potential policies far into the future. But as I wrote in the last letter, “We have had multiple 50%+ up years. The returns come in chunks. I don’t know when the chunks are coming, but the gap between business progress and share price for our portfolio feels very wide.” With each passing day, we are one day closer to our fight club building their businesses and landing their punches.

Onwards,

Scott

NEW INVESTMENT – INTERNATIONAL WORKPLACE GROUP (IWG)

During the fourth quarter, we made one material new investment in London-listed IWG, a company that manages shared workspaces. IWG operates 19 different brands, the most well-known of which is Regus, that represent over 3,400 locations spread across 120 different countries serving 8 million customers ranging from freelancers looking for a desk outside of the home all the way up to multi-national companies.

Most conversations about IWG begin with: how is IWG different from WeWork, which is in bankruptcy? Well, unlike WeWork, IWG did not engage in a growth-at-all-costs campaign. Unlike WeWork, almost all IWG leases can be terminated by the company with minimal breakage costs.

Unlike WeWork, IWG’s management has earned investors’ trust. To return to the Fight Club metaphor, IWG’s management is quite different from that of WeWork, which was initially run by a CEO who appeared to front-run his shareholders by personally buying buildings and then selling them to WeWork for a profit. The same “enterprising” CEO also personally licensed the name “We” and charged the company millions of dollars per year for its use. In sharp contrast, IWG is run by its founder Mark Dixon, who still owns 28% of the company and has a very reasonable compensation package.

IWG has more scale with more than six times the number of locations as WeWork. This is important because it allows for more efficient customer acquisition and retention, and better property level monetization. Unlike smaller peers who generate most of their revenue from short-term leases, around one-quarter of IWG’s location-level revenue comes from ancillary products and services.

IWG also has much more suburban exposure, which lines up well both for companies that are requiring employees to come to the central office a couple of days per week (since they can provide a workspace closer to the employees’ homes for the other days) and to tap the vast array of companies not located in major cities. A final difference is profitability. Unlike WeWork, IWG has survived the Great Recession and Covid and has a 30-plus-year track record of profitability. In summary, IWG has better lease structures, better management, better locations, and better earnings.

Just being different from WeWork would be a terrible investment thesis. Fortunately, we believe that the company’s improving business model gives IWG the opportunity to significantly grow earnings and see its multiple expand from today’s depressed level. It’s unlikely that we would have invested if they were just sticking with their historical business of signing long term leases with landlords, improving the spaces, and then renting the space to individuals or small businesses on a short-term basis. The original flexible workspace model is both cyclical and capital intensive.

To address the cyclicality, IWG has taken several important steps beyond ring-fencing locations, which makes it easier to walk away. Specifically, the company started tying landlord payments to location revenues. This change has been going on for quite some time. Today, approximately 40% of rent expense is variable in nature. However, these variable rent locations still require significant upfront capital outlay by the company.

More recently, the company has introduced a new asset-light “partnership” model, which eliminates both cyclicality AND capital intensity. In this model, IWG asks landlords to put up all capital investments and pick up all operating costs of a location. In return for managing these locations, IWG takes a management fee, approximating 15% of revenues.

IWG’s business model transition is possible, in part, because of the headwinds facing the corporate real estate market. With vacancies continuing to rise, landlords are being forced to be more flexible and find new ways to fill their buildings. While a landlord’s first choice may be signing a credit-worthy tenant to a 20-year lease with terms very favorable to said landlord, those deals are harder and harder to find these days. In the face of the waning demand for office space, IWG is presenting landlords with a solution that helps them fill and monetize space that would otherwise sit empty. For its 15% fee, IWG oversees the build-out, marketing, and client onboarding, and uses its technology systems and networks of vendors to manage the space on a daily basis. By partnering, a landlord gets a turnkey solution to a revenue-generating shared workspace in their building and IWG gets paid for their services, and upside if the property performs.

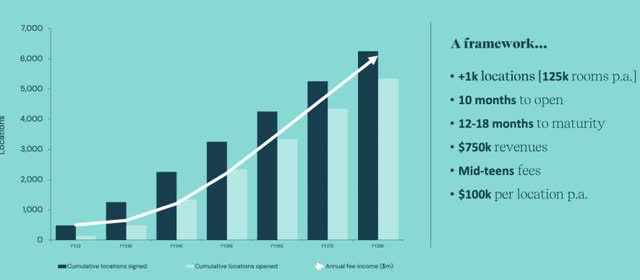

In simple terms, IWG puts out no cash and incurs no liabilities. The asset light and risk light partnerships model drastically changes the company’s economics of growth away from its historical constraints. In 2018, the company laid out over $400M in growth capex to add 299 locations. In 2024, growth capex is projected to be just $60M (15% of the former) to finance the opening of more sites. The primary constraint to growth now is signing up partners, not capital. Below is a chart from their investor day, looking at just their largest market, the United States. This is a different business going forward.

In 2022, IWG signed up approximately 462 locations for their partnership model; the number of new contracts likely exceeded 800 in 2023 and in 2024 should be in excess of 1,000 locations.

Partnering with IWG makes the process of turning vacant space into flexible workspace much easier for a landlord than doing it on their own. IWG has all of the vendors and systems in place to manage the transition to and operation of the property as flexible space, the landlord does not have to recreate the wheel. IWG has the marketing and sales teams in place, as well as the billing, staffing, and systems for things such as booking a conference room. In addition, IWG is also set up to monetize ancillary offerings such as printing, copying, internet, parking, and coffee from day one. IWG has scale that individual landlords do not have. Landlords who work with IWG see a path to higher revenues and lower costs with less “brain damage.” Similar to Hilton Hotels’ value proposition to property owners, a landlord working with IWG should make more money, even after paying IWG fees and revenue sharing, than if they managed the property on their own.

So, for both IWG and landlords, there are clear benefits. How about the customers? Yes, it is highly likely that the days of everybody working five days a week from an office are over, but most employers also don’t want a fully remote workforce. For employers, using shared workspace allows for up to 50% lower operating costs and zero capital expenditures; it keeps long-term leases off a company’s balance sheets, provides flexibility, and retains employees by allowing them to work closer to home.

IWG benefits from the following five attributes:

Network Effects – As the largest operator of flexible office space, they have the best geographic footprint. Signing a lease with IWG can provide access to spaces when you travel or allow the flexibility of access to a desk both when in your nearest city and when closer to home.

Scaled Economies Shared – A term coined by coined by Nick Sleep and Qais Zakaria of Nomad Partners, scaled economies shared is a strategy where a company that benefits from economies of scale shares those benefits with its customers, typically by offering lower prices, to gain long-term market share. As the scaled operator of flexible office space, IWG passes on most of the savings to their tenants and landlord partners. It is less expensive to partner with IWG than to be independent of them. Improved Competitive Landscape – IWG’s largest competitor is in bankruptcy. Gone are the days of WeWork growing at all costs, signing leases that did not make sense, and subsidizing their customers. A rational competitive environment favors the rational – in this case, IWG. Secular Tailwind – According to the HR Report, 90% of employees want flexibility in where they work, and 89% of employers report better retention because of flexible work options. It is highly likely that companies will continue to offer employees places to work outside of but near home. Flexible office space is approximately 2% of the corporate real estate market today and likely going far higher with IWG as the scaled leader. Proven Track Record of Success – landlords are not accustomed to these managed partnership deals. For many, it is their first time ever considering going this route with some of their space. IWG’s scale and duration of having a profitable track record makes them the safest route for landlords as they determine who to partner with.

The foundation of our investment in IWG is their partnership business. In round numbers, each partnership, when open and scaled, will generate $100K per year in contribution. So, the 1,000+ signups projected for this year should grow contribution by $100M per annum on a go-forward basis. Now, there is nothing magical about adding 1,000 locations per year. Given that they require no capital from IWG, it can open as many partnership locations as there is demand. It took IWG 34 years to get to 3,000+ locations under their old model. Capital was one of the biggest constraints to growth. With their partnership model, IWG is on track to add more than 1,000 locations in a single year with virtually no incremental capital.

As the partnerships are just ramping up, the business transition’s impact on the financial statements has been limited so far, but the wave is coming. Partnership locations take 10 months to open and 12-18 months to reach maturity. As shown in the chart below, all of the partnership signing activity to date has yet to really flow through the financial statements. But it will! With each day, we are one day closer. The wave is building.

In addition to the core business of managing shared workspaces, IWG has their Worka division, the largest flex workspace marketplace, which connects businesses and their employees to 40K+ flex spaces across 170 countries and 5,500 cities. Worka also has a real estate consulting business that assists corporates in their analysis of and transition to flexible workspaces. Worka (formerly Instant Group) is a business that has been built through acquisitions and is in the midst of integrating the acquired companies. As an example of how far they are from fully integrating, the Worka.com website, which will integrate all of the disparate pieces, is still being built out.

Worka could be an independent company, and there has been talk of spinning it off/selling it. There are benefits to having marketplace and consulting companies being independent, not owned by the largest supplier in the industry. For now, Worka is financially a fully owned subsidiary of IWG, but in practice is operated as a stand-alone company with its own management team and independent board. The division generated approximately $450M in revenue and $150M in EBITDA in 2023. Over the last decade, Worka’s revenue grew at a 20%+ CAGR on a combined basis. The company expects this growth rate to continue over time. Profitable marketplace businesses with 20%+ growth rates should be worth 10X EBITDA in my book. If the growth and profitability sustain, it is not hard to see Worka commanding a valuation in excess of $2B.

Before we ascribe a high multiple to the fast-growing-no-capital-required Worka, let’s look at the overall company. At the time of our purchases, in round numbers, IWG had a market capitalization of just under $2B USD and net debt of another

$750M. There are three divisions. The majority of revenues and profits currently come from the “company-owned” locations, which are expected to contribute $700M. Worka is the second largest contributor at $200M, and the quickly growing partnership business is yet to be material at $50M. Corporate activities partially offset the $950M in contributions outlined above. All of this yields a 2023 EBITDA of approximately $400M, projected to grow double digits in 2024 and reach $1B in the medium term. If you believe the guidance, we are paying less than 3X the medium-term EBITDA.

Could multiples compress on IWG? In a deep recession, they certainly could, but if they hold steady, EBITDA/earnings/cash flow should all grow significantly. It is also quite likely that, as more and more of the revenues and earnings come from the partnership business, a higher multiple is ascribed to the business. In 2027, more than half of the EBITDA should come from fees, which is a more stable asset-light business that investors often ascribe higher multiples to. I see a clear path to the share price tripling over time from the combination of revenue growth, earnings growth and multiple expansion.

Trying to explain share price and the movements in share price can be a fool’s errand, but in the case of IWG, there are at least three factors that may partially explain a mispricing of shares:

The Stench of “Office” – while a weak office market is driving the partnership business for IWG, many investors will not look at anything office-related. Large Shareholder Liquidating – two of the company’s largest outside shareholders were forced sellers in 2022: one is in the process of liquidating and the other was selling to meet redemptions. Partnerships Not Showing Up in the Financials – As previously discussed, between the time to renovate the space and the time to fill the space, it takes almost two years from signing for a partnership location to mature. The economic benefits of the scaling partnership business are not yet evident in the financial statements.

Investing in anything to do with the much-maligned office real estate market is an act of courage and took some handholding. Yaron Naymark of 1 Main Capital was helpful in laying out the business model transition, assets, and potential long-term economics of this investment, so thank you, Yaron.

|

Footnotes 1 Greenhaven Road Capital Fund 1, LP, Greenhaven Road Capital Fund 1 Offshore, Ltd., and Greenhaven Road Capital Fund 2, LP are referred to herein as the “Fund” or the “Partnership.” Disclaimer: This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The references to our largest positions and any positions listed in the Appendix are not based on performance. All of our positions will be available upon a reasonable request. All hyperlinks contained herein are not endorsements and we are not responsible for such links or the content therein. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.