Groupon Stock: Finally, It’s Time to Go Long (Rating Upgrade) (NASDAQ:GRPN)

jbk_photography/iStock Editorial via Getty Images

With market volatility rising, the best way to overcome index fluctuations is to invest in contrarian stocks that have little correlation to the overall market. This means digging deep into unloved and forgotten names. It may not be the flashiest stock of the day, but it has solid fundamentals for a reasonable valuation.

Surprisingly, one name that fits this criteria well is Groupon.NASDAQ:GRPN), what was once a popular trading site has now become quite niche. Groupon’s stock price is down more than 20% year to date, but there are some surprising fundamental improvements the company has to highlight.

The Groupon cloud is lifting

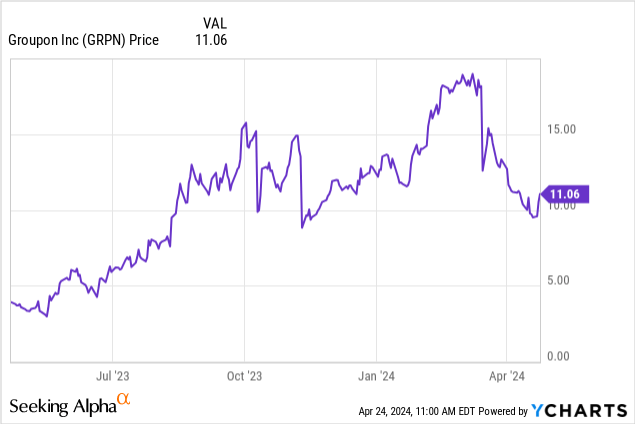

I last wrote a neutral opinion on Groupon back in October, when the stock was trading close to $12 per share. At the time I quoted: While the company’s continued improvement in profitability has led to green growth, I noted two key concerns: continued customer loss and limited liquidity.

Unfortunately, Groupon continues to post negative performance, but at least the revenue decline is easing (more on this in the next section). However, the company have As you can see in our fourth quarter earnings call below, we have made notable progress in improving our liquidity position.

Groupon Liquidity Action (Groupon 4th quarter performance data)

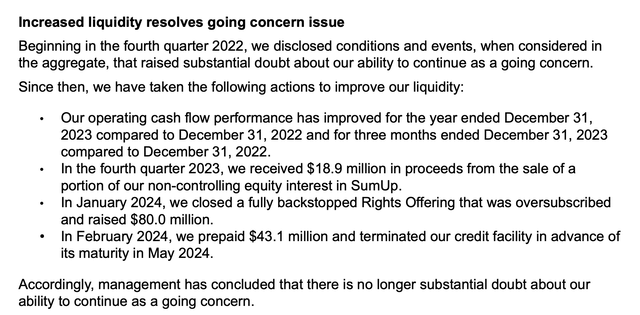

Continuing to improve operating cash flow is the most important part of improving Groupon’s liquidity. The company continues to take an aggressive stance on reducing operating costs. SG&A expenses have declined sequentially each quarter over the past two years as the company sheds middle management staff and also reduces its real estate footprint.

Groupon SG&A Cost Trends (Groupon 4th quarter performance data)

As you can see in the chart above, Groupon’s SG&A hit a multi-year low of $72 million in the most recent quarter, down -35% year-over-year. Along with the sale of stakes in minority subsidiaries, Groupon ended the fourth quarter with $216.4 million in cash and long-term investments (although it also carried $269.2 million in debt). Meanwhile, full-year FCF in FY23 was -$97 million. So even if Groupon doesn’t do anything more to stop its current burn rate (which is unlikely, as it continues to cut costs and could see its revenue decline easing), it would have more than one FCF. There are years of cash left on the books. Groupon is actually forecasting positive FCF this year, and hopes FY23 will be its final year of FCF burn.

Overall, many of my near-term concerns about Groupon have been addressed, and the sequential improvement in EBITDA the company is pursuing gives me confidence: optimistic About this stock: It’s worth investing a small amount in your portfolio. Groupon’s next major catalyst is its first-quarter earnings release, expected in mid-June. However, it is better to maintain a long position now that the stock price is falling.

Q4 Downloads

Now, let’s take a closer look at Groupon’s latest results.

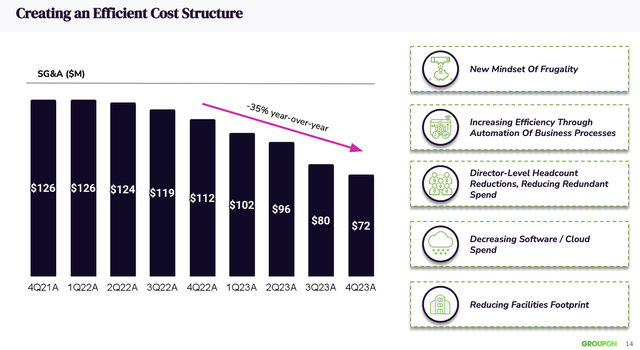

Groupon Key Trend Indicators (Groupon 4th quarter performance data)

The first thing to note is that while Groupon’s revenue continues to decline, as you can see in the chart above, comps are getting easier and its actual performance is improving. Fourth-quarter sales were down “only” -7% year-over-year, a five-point improvement over the -12% year-over-year decline in the third quarter.

The company noted improved performance during the holiday period as consumer engagement levels rose throughout the quarter. Comments from CEO Dusan Senkypl on the fourth quarter earnings call:

Overall, we are pleased with our day-to-day execution during the holiday season as we have coupled an enhanced variety of transactions with proactive management of how we drive performance marketing and distribute exposure. Our customers responded and we saw business pick up and trends improving throughout the quarter.

On the market demand side, we have seen an improvement in the number of unique visitors to our website due to the growth of paid channels and improved direct traffic attrition rates. Within the paid channel, we continued to grow in SEM and Display while achieving our desired ROI goals. Although it’s still early days, we’ve seen success with revamped affiliate channels, including early traction in the influencer market. Search and relevance continue to be important priorities as Google improves its algorithms and actively manages impression distribution. Lastly, we are continuing our efforts to reduce our reliance on promotional spending. As previously discussed, improving the mix of paid marketing and promotional spend is a key step to improving the health of your market.

On the supply side of the market, we continue to see strength in our Things To Do vertical and enterprise accounts. Here we see companies returning to our platform after long absences and existing companies increasing the amount of business they want to do through Groupon. . “Both are encouraging signs.”

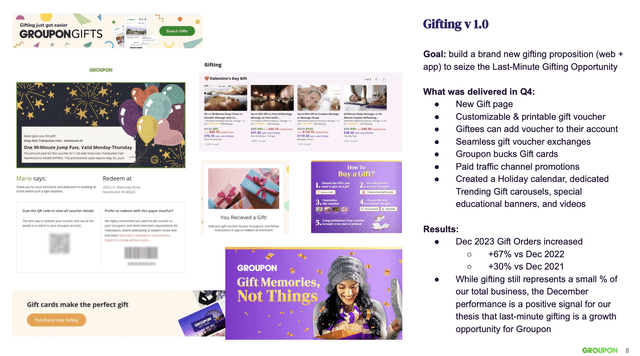

Product innovation is another lever the company leverages to drive performance. The company has launched a gifting feature that allows users to “gift” experiences to someone. As you can see in the chart below, futures orders for the quarter were up 67% year over year.

Give a Groupon as a gift (Groupon 4th quarter performance data)

From a profitability perspective, Groupon’s adjusted EBITDA was $26.9 million for the quarter, compared to a loss of -$5.3 million in the year-ago quarter. EBITDA improvement 48% In nominal terms, Adjusted EBITDA margin of 20% compared to the third quarter also improved by 8 points compared to the third quarter.

Valuation, Risks and Key Takeaways

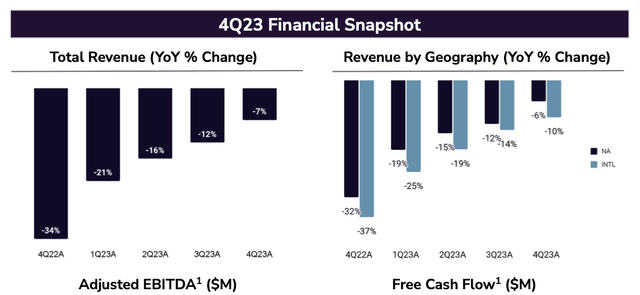

At a current stock price of just over $10, Groupon has a market capitalization of $372.6 million. And after accounting for $216.4 million in cash and long-term investments against $269.2 million in debt on the company’s latest balance sheet, here are the results: The enterprise value is $425.4 million.

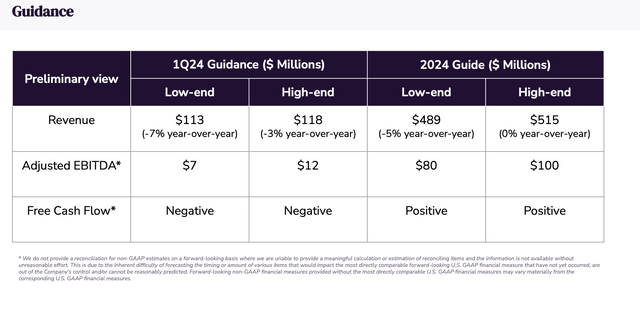

Meanwhile, the company is guiding for an adjusted EBITDA range of $80 million to $90 million for the year.

groupon view (Groupon 4th quarter performance data)

Considering that Groupon ended the fourth quarter with full-year adjusted EBITDA of over $100 million, and that the margin at the midpoint of guidance is ~18%, which is lower than the 20% in the fourth quarter, I’d say this is a more than reasonable outlook. Relative to this midpoint, Groupon trades at 4.7.x EV/FY24 outlook interim adjusted EBITDA.

In my opinion, Groupon’s outlook is skewed low. Considering all the cost actions the company is taking, we are optimistic that the company can achieve an adjusted EBITDA margin of over 20% in FY24. I think the company can seize the opportunity. At least Adjusted EBITDA is $100 million and could rise up to $100 million. 6x EV/FY24 high-end adjusted EBITDA of $100 millionThis forms my target price. $16 For the company (which has up to 40% upside from current levels, which is also where Groupon traded earlier this year before its fourth quarter results came out).

Of course, Groupon is cheap because it is fraught with risk. There are two key red flags on my radar. The first is an increase in supply. Groupon’s ability to continue to operate as a provider of niche experiences and deals will depend on its ability to offer these localized products on its platform in the first place. With its overall sales force and workforce shrinking, Groupon may find it more difficult to source attractive deals to put on its platform. The second is consumer contraction. Groupon’s outlook hinges on its ability to achieve roughly constant year-over-year revenue growth. Supply contraction and general apathy can be difficult to address.

That said, for Groupon, comps are moderating, it’s too cheap to ignore, and with its low valuation, we think the potential rewards outweigh the risks. Now is the time to be optimistic.