Guardant: Expecting double-digit sales comes at a cost (NASDAQ:GH)

Pgiam/iStock via Getty Images

Investment Summary

attache my last publication Guardant Health, Inc. (NASDAQ:GH) The stock price has moved sideways and ‘Hold’ seems appropriate.

In that report, I mentioned several factors that I believe will keep GH stock compressed. In particular, the price implied Expectations were that the market had a high required rate of return embedded in the GH stock price. This meant that the company had to produce results that would surprise investors. Sales growth has been extremely strong and revenue growth has been linear since 2021. This was positive.

Since then there have been several updates to the investment debate, which we will take a closer look at today. We will also share modeling modifications for companies that incorporate these new developments.

Investors clearly recognized and priced in GH’s revenue growth potential. As I write, the company’s sales have increased more than fivefold. This assessment reflects exceptional growth forecasts of 22-24% over the next few years.

Net-net, I continue to view GH favorably as a company and am inspired by its recent success in colorectal cancer testing. Unfortunately, this does not mean that it is a successful investment at this point according to the core investment principles I use. In that sense, I rate GH a hold in terms of fundamentals and valuation.

recent developments

1. Vote to approve shield blood test

In late May, a majority FDA panel voted that GH’s collateral cancer (“CC”) screening test, the Shield blood test, is safe and effective for patients. According to the World Health Organization (“WHO”), CC is “the third most common cancer worldwide, accounting for approximately 10% of all cancers.” It is also the second leading cause of tumor-related deaths in the world.

WHO also notes that CC is often diagnosed at an advanced stage, providing treatment options for a select few. As a result, there is a great need for therapeutic and medical innovation in this area, which we believe can be achieved through diagnostics. Obtaining an early diagnosis is so important that screening tests targeting points “upstream” of CC diagnosis are a no-brainer.

In that context, this could lead to short-term sentiment to boost the company’s stock price. This is already evidenced by the post-announcement drift, with investors adding $2 to $3 more per share to the market capitalization after the vote.

However, demand reached the stock well before the announcement as the stock price began to rise from its lows of ~$15-$16/share. The company’s first quarter numbers (more on that below) were the main catalyst leading up to the Shield announcement. In that call, ‘Shield’ was mentioned 29 times. And most importantly, in my opinion, is management’s updated guidance for 2024 (discussed below).Does not include revenue contribution from testing, which is subject to timing of Shield FDA approval and medical reimbursement coverage.“

The move is interesting after FDA staff earlier this month spoke about the potential risk that the Shield test could miss detecting advanced adenomas (“AA”) in patients. For reference, AA is the main precursor of CC.

However, the FDA supported the idea that the Shield test could improve screening rates and lead to earlier detection of CC in adults aged 45 years and older.

As a result, Shield approval is a short-term catalyst that will keep me interested in this company and its stock. As I wrote, with the stock rising from $16 to $31, it would be unwise to remain ready to wander on the sidelines for 1) improving fundamentals (e.g. operating profits) and 2) cooling valuation.

Figure 1.

TradingView, via Seeking Alpha

Q1 2024 Revenue Insights

As far as growth is concerned, the first quarter of 2024 has been a good one for the company. GH did $168 million in business, a 31% increase over sales in the first quarter of last year. Growth was even more pronounced as reported clinical tests increased 20% to ~c.47,000, and biopharmaceutical tests surged 37% to ~8,500. This increased gross profit to $103 million, a margin of 61%, down 300 basis points year-on-year. This was driven by better price mix across both operating segments.

Management revised its fiscal 2024 guidance after the quarter. It now expects growth of 20% to 21% at the top end and calls for revenue of $685 million at the upper end of the range, compared to $670 million previously. Gross margin for this appears to be 61% to 63%, an increase of 100 basis points over the previous range. This is expected to result in free cash outflow of approximately $285 million, an improvement over the previous forecast of $330 million.

As previously mentioned, these projections do not include screening revenue that has not yet been baked in following the May Shield test approval vote. As there is no clarity on this, I don’t want to speculate on this yet and would recommend waiting until Q2 earnings to get more visibility.

About the divisional composition of the top line in the first quarter –

-

Precision Oncology Revenue for the quarter was $156 million, up from $113 million last year. This was highlighted by a 40% increase in biopharmaceutical testing volume. Management said this follows a strong pipeline this year and expects further volume growth in biopharmaceutical testing over the remainder of the year.

-

development services Meeting management’s expectations, it attracted approximately $12.2 million in business. There were no apparent takeaways from this segment during the quarter.

Management also noted that the company has continued to increase the average selling price (“ASP”) of its Guardant360 liquid biopsy test for approximately 12 months now. The current price is in the $2900-$2950 range, which is higher than the forecast range of $2050-$2900 outlined in the previous call. This is a potential tailwind for future earnings, and we think the fact that it’s meeting demand at this price is good evidence that the market is taking advantage of the product.

Despite expectations from 1) approval of the company’s FDA Shield test, 2) continued revenue growth, and 3) revised FY 2024 guidance, this is not yet enough to change the company’s fundamental economics. It’s not my core investing principle. You need more body to have a good bone structure.

Underlying Economics Supporting a Hold Rating

In my last GH publication, I explained the difference between revenue growth and operating growth over the past two years. For the company, this is not necessarily a negative thing. Considering the company’s efforts to establish its market presence and introduce CC and liquid biopsy tests to the market, revenue growth is clearly the goal of the game for this name. Higher revenue signals more tests/screens being released out there.

The factual pattern of how executives begin down this path is very interesting. What I like to see in a company that is focused on growing revenue quickly is that total asset value remains in check. That is, assets should not grow faster than revenues.

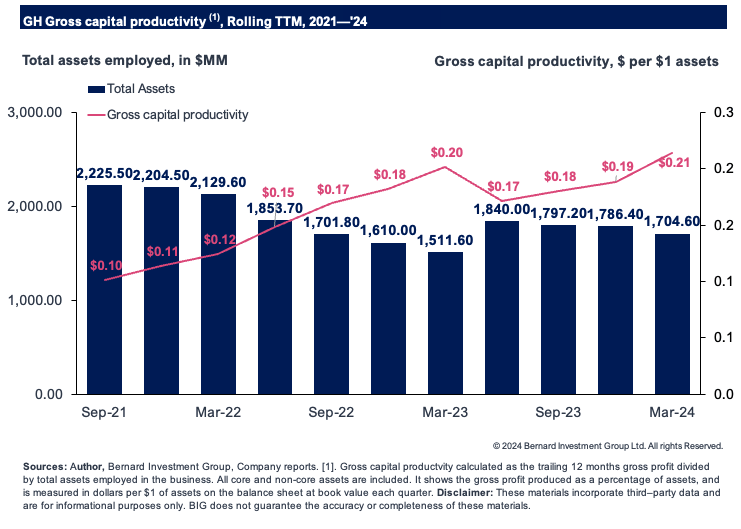

Second, find the amount of gross profit rotated from the assets used in the balance sheet. We did this for GH in Figure 2. As observed, the company is revolving around $0.21 in total profitability for every dollar of assets employed by the company. This includes all operating and non-operating assets. Positively, the company is operating with fewer total assets now than it did in 2021.

Figure 2.

Company documents, author

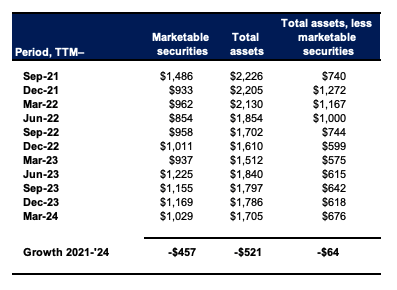

This is important because the company has very high cash and marketable securities relative to its total asset value. Removing capital tied up in securities makes the company much “leaner” from an asset strength perspective.

For example, in the March 2024 quarter, it had $1.7 billion in total assets on its balance sheet, representing approximately $1 billion in marketable securities. Taking the former out of the equation, we have total liabilities of $1.6 billion and assets of $676 million (Figure 3). Considering that the company has negative cash flow, it is completely reasonable to suspect that it is keeping this cash ratio too high as a liquidity buffer.

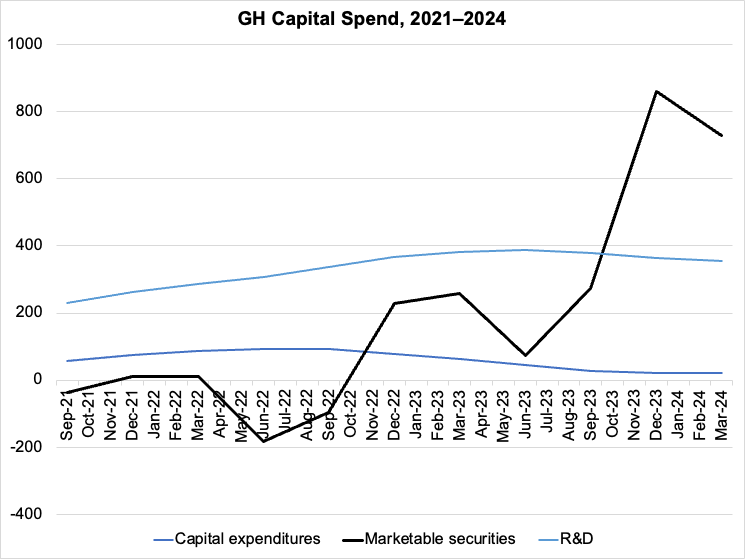

Despite this, I have never seen management take advantage or actually leverage it in areas other than 1) R&D and 2) securities. This is shown in Figure 4. As we enter a new interest rate cycle starting in 2022, management has begun gradually converting cash into marketable securities. At the same time, R&D investment and capital expenditures declined.

Figure 3. Most asset value is tied up in cash and securities.

company documents

Figure 4. Pay attention to the differences in cash to R&D and CapEx.

company documents

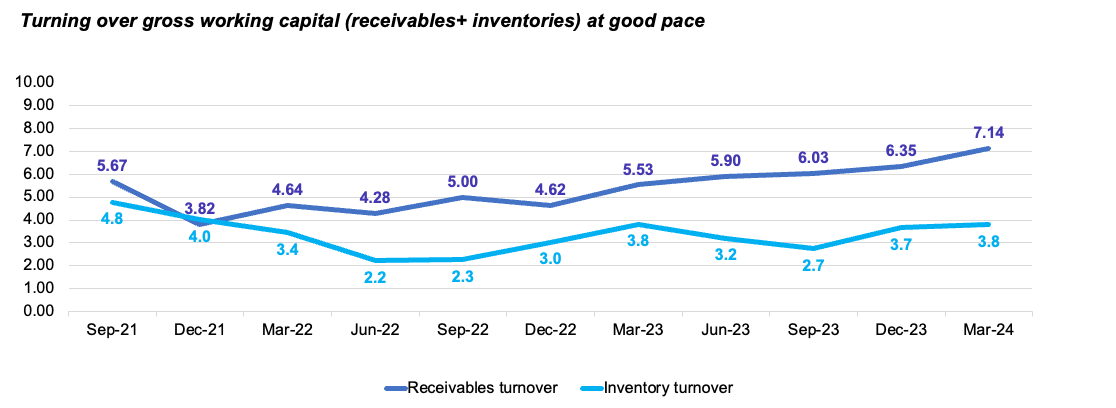

For what it’s worth, the company’s cash-strapped inventory and receivables are turning over relatively quickly. Figure 5 shows inventory and accounts receivable turnover on a rolling 12-month basis starting in 2021. As you can see, the company rotates its inventory approximately 3 to 4 times every 12 months. Accounts receivable turnover has grown rapidly, from about four times in 2022 to more than seven times in the past 12 months.

Figure 5.

Company documents, author

Update to communicate estimates

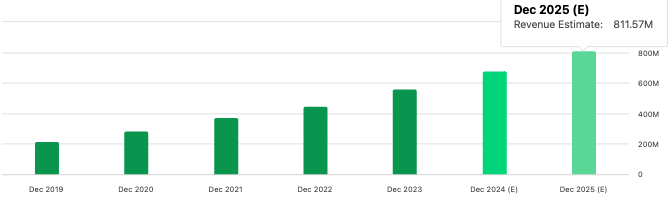

According to the consensus, the company expects strong earnings growth over the next three years, averaging about 20% per year, compared to comparable revenue growth rates. This will boost the company’s revenue to $680 million this year and $811 million in 2025. If the consensus turns out to be correct, this is a steep increase in sales, as you can see below.

Figure 6.

pursue alpha

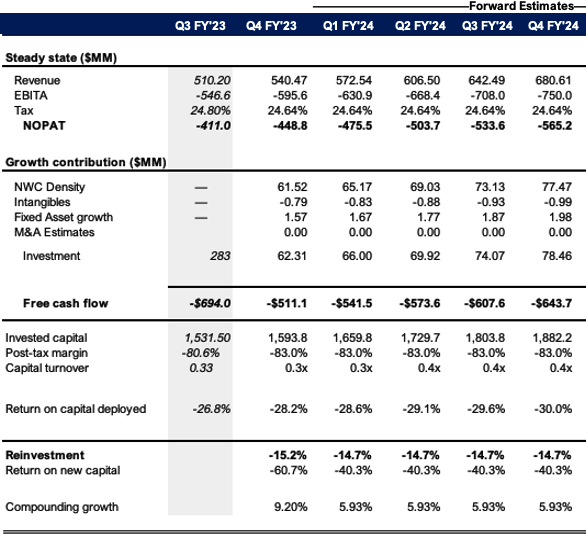

I made the following revisions to my modeling after the company’s first quarter numbers (Figure 7): I agree with the consensus estimate of $680 million in sales by the end of this year. I think it could take an investment of $80 million. Capital turnover is 0.4x, or $160 million.

The problem is that if the consensus numbers (and my numbers) are a reflection of GH’s current market value, there is little room to expect that investors have mispriced the company. That said, my numbers don’t deviate from Wall Street, so I can’t say I’m taking a different position than what’s already reflected in the price. I have a neutral opinion.

Figure 7.

Author’s estimate

evaluation

The stock is still priced for outstanding growth and currently has lofty expectations at 5x trailing sales of $564 million. If the company achieves the same 5x multiple of projected sales growth (~21%) outlined in this report (high in my opinion), the company would be worth about $3.4 billion to us today. Transaction (5×680 = $3,400).

Moreover, a multiple contract at the sector average of 3.7x would only value us at $2.5 billion based on these assumptions, even if the company achieved the strong growth numbers expected. (3.7×680 = $2,516).

This shows that valuations are tilted to the downside. Despite massive growth rates, a contraction in multiples would result in a roughly 25% decline in market value from a 26% reduction in multiples. In my opinion, each of these factors supports a Neutral rating.

conclusion

After examining the company’s recent developments and updated financials, my rating for GH remains Neutral due to its current high valuation. At 5x sales, this makes it highly vulnerable to multiple contractions, which could potentially compress the company’s market value by 25% if it falls to the sector multiple of 3.7x.

So, despite the impressive growth in unit volume and dollar value, and the expected high growth rate going forward, we believe this is well captured in the current market valuation, leaving little room for further upside to the expectations implicit in the price. Repeat hold.