Hammond Manufacturing Company: Margin growth is a highlight (HMFAF)

Petra Richli/iStock via Getty Images

We’re less than a quarter of the way until 2024, but some stocks are already ahead of the curve. A representative example is Hammond Manufacturing Company (Hammond Manufacturing Company), a Canadian electrical and electronic components manufacturer.TSX:Hmm.A:CA) (OTCPK:HMAFAF), which represents a 42% increase year-on-year (YTD).

As a result, the stock’s trailing twelve-month (TTM) price-to-earnings (P/E) ratio is now 7.2x. This is among the highest levels in the past five years (see chart below). This again raises a question. Can current price levels be sustained?

Here we evaluate the company’s next steps in the context of its recently announced full-year 2023 results.

P/E, GAAP, TTM, 5 years (Source: Seeking Alpha)

About Us

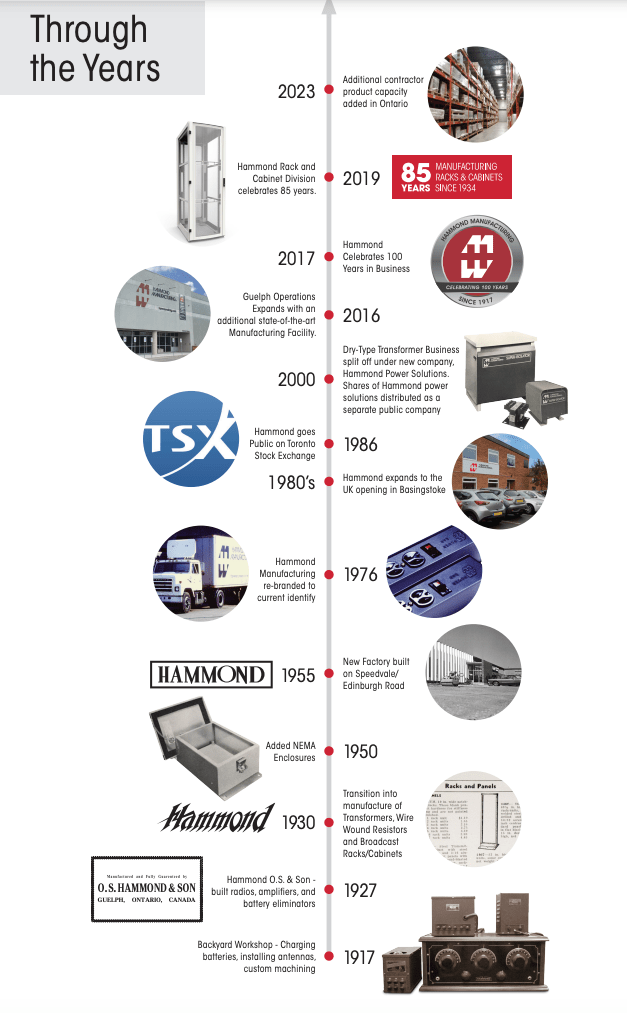

The company started as a radio and amplifier manufacturer in 1927 under the name Hammond OS & Son. We have come a long way in the last century. Currently, the company focuses on power-related products such as electronic and electrical enclosures, outlet strips and racks, and expands its transformer business into Hammond Power Solutions (OTCPK:HMDPF) 2016. I have something to tell you about the company’s history, growth, and profits, which I will talk about next time.

Source: Hammond Manufacturing Company

Sales growth slows due to weak market

The company’s sales grew 5.5% in 2023, which is lower than the compound annual growth rate (CAGR) of 8.5% over the past decade. The weak macroeconomic environment has led to relatively low growth, especially after two years of strong growth of 18.8% and 28.3% in 2022 and 2021, respectively.

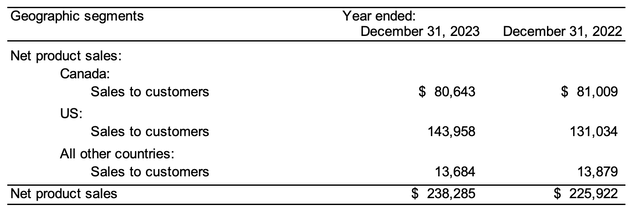

Growth in the United States, its largest market, accounting for more than 60% of sales, was a highlight for the company at 9.9%. This added 2.6% to growth, driven by the strength of the US dollar. But the same is true in other markets. Home country Canada, the second largest market and accounting for ~34% of revenues, actually saw a slight decline of 0.5%. Companies were already bracing for a recession in 2023, which didn’t happen, but Canada’s growth actually slowed from 3.8% to 1.1% in 2022. Contraction was also seen in European and UK markets. This can be seen in the 1.4% decline in sales to all other countries.

Sales by region (Source: Hammond Manufacturing Company)

Highest margins in 10 years

But what the company lacked in revenue growth this year, it made up for with its best margins in a decade. As cost of sales decreased by 1.3%, gross profit ratio recorded 36.2% (10-year average of 31.2%). Although the company does not mention inflation as a factor in this, it is noteworthy that inflation in Canada has fallen by half to 2.9% (YoY) compared to the same period last year as of January 2023. However, the company notes that price increases will remain at the same level from 2022 onwards, helping margins by negating the impact of rising costs.

Operating expenses increased, but showed a low growth rate of 11.5% compared to 17.6% in 2022. As a result, the gross profit margin increased to 11.7%, significantly higher than the 2022 average of 6.2%. Last 10 years. Likewise, net profit margins have increased from 3.9% to 7.9% over the past 10 years.

The balance sheet is healthy and interest expenses are in check.

In particular, considering that Hammond’s interest expenses increased by 63.2%, the increase in net profit margin is positive. This is the result of a 17% increase in gross debt (net debt unchanged) and higher interest rates. However, for context, the interest expense figure is still small at CAD 3.1 million, as total debt to assets ratio is still very controlled at 30% and operating income was up 42% for the year. Although the interest coverage ratio has decreased slightly, it is still strong at 9 times (2022: 10.3 times).

If we go back to the balance sheet along with the debt levels, the rest also looks good. The only aspect of concern is the desired fast ratio of 0.63x. However, this appears to be more of a deliberate decision on Hammond’s part than anything else. “The company holds high levels of inventory to provide good service to its customers. This policy has not only helped the market surge in 2021, but has also benefited the company and its customers.” And 2022.”. Even in 2019, the last year before the pandemic, the rate was only 0.5 times, so I wouldn’t worry about that number.

View

Regarding the outlook, the company does not provide numerical forecasts for 2024, but points out the following:

- US market growth expected to slow to ‘low single digits’

- In the rest of the world, it says “UK and European markets remain weak”, indicating that the trend of declining sales could continue this year.

- However, it focuses on margins and this is evident in two statements. First, it says, “The company will continue to maintain its goals of increasing revenue growth and market share, but will evaluate this against achieving acceptable margins.” Second, “our primary focus continues to be improving productivity and margins.”

Based on this, we made predictions about sales and profits. For revenue, we assumed US growth would slow to 2.5%, which may be a bit pessimistic from a current perspective, but is consistent with the midpoint of the guidance provided. For the rest of the world, we assumed that the contraction would continue at the same rate as in 2023, and for Canada as well. This will slow sales growth to 1.3% in 2024.

Net profit will increase at the same rate if you maintain your target margin, but not more. This resulted in a revenue forecast of ~CAD 19 million (USD 14.1 million). However, this leaves the 2024 forward P/E largely unchanged at 7.1x.

What’s next?

I believe the stock’s high P/E compared to historical levels puts the current stock price at risk for a downside. But at the same time, if recent margin growth is inevitable, the stock may soon look less expensive. For example, if net profit margin rises to 10% in 2024 (which is a lower growth rate than last year and is potentially possible given easing inflation and expected interest rate cuts that could lower costs), the P/E would immediately drop to 5.6x. .

That means it’s better to wait and see how Hammond’s margins develop this year. If it improves, there may be a buying case for the stock in the future. But for now, we’re going to put a hold rating on it to see if that happens.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.