Hash Scout

This article was published in Bitcoin Magazine. Sponsored by “The Primary Issue”. HIVE DIGITAL TECHNOLOGY LTD Part of Bitcoin Magazine’s “Buy The Numbers” content series. click here To get an annual Bitcoin Magazine subscription.

Click here to download a PDF of this article.

There are less than 30,000 blocks left until the halving, and the stakes couldn’t be higher. For many Bitcoin mining operators, this will determine the success or failure of bets made in this Bitcoin era. Did I grow up too fast? Can you handle a catastrophic drop in hash prices? Will my current energy contract cancel my operation? Bitcoin itself remains indifferent. When Bitcoin was created, encrypted by Satoshi and enforced by nodes around the world, halving was inevitable. The block will continue to flow and bleed. The biggest question many people are asking is how we will navigate this coming battle. Perhaps a better question is where should they be positioned on the board when combat occurs? While knowing how to build and operate an efficient Bitcoin miner is important, a critical success factor remains energy costs. It is determined by your location on the map. To find higher ground you need to do a Hash Recon.

This halved event will challenge even the most battle-hardened veterans. They must optimize their operations at all costs. For inexperienced operators, energy costs may seem like a variable that can be overlooked. They tend to only focus on building up as much hashrate as possible and completely forget about efficiency, i.e. the energy consumed per hash generated. In the long run, energy costs are the most important variable. Of course, dollars per terahash matter, Bitcoin price matters, and network hash rate matters. It’s all important. But energy costs are the kingmaker. After all, the legendary 7-year-old Antminer S9 is still profitable today with energy cheap enough.

At the center of miners’ considerations are two fundamental factors: mining revenue and energy costs. These two variables are used to quickly calculate mining profitability figures. It is important to note that this does not take into account additional operating costs such as labor costs and other associated costs of running the mine. This remains a useful formula for keeping the lights on.

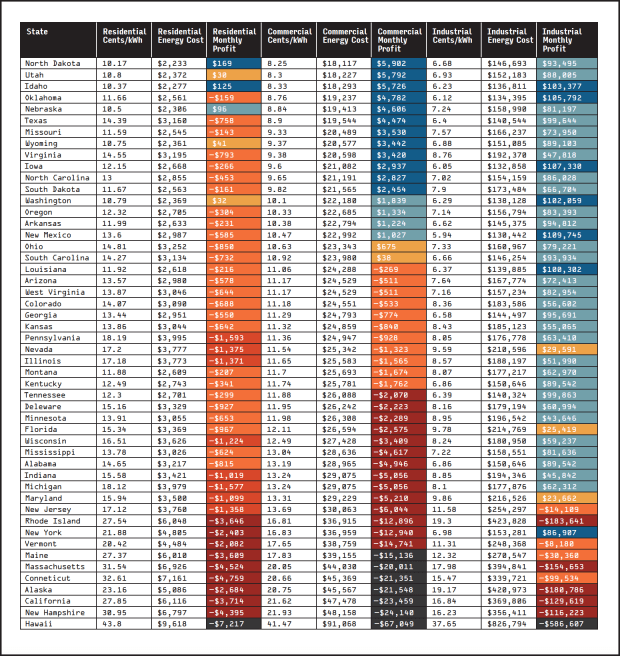

Mining operators vary in size, and the easiest way to tell them apart is by how much power they use. The U.S. Energy Information Administration (EIA) is responsible for monitoring energy trends and classifying consumption and power costs into residential, commercial, and industrial customer power rates. We will focus on how mining operators can benefit from the rates applicable to each of these three categories.

- Residential: <30kW — Includes residential miners with 1 to 10 Bitcoin mining machines. A typical home cannot handle much more energy than this and must install additional electrical infrastructure. Residential sizes have the highest energy bills within the same state.

- Commercial: 30kW-1MW — Targeted at small businesses and Bitcoin mining operators with 10 to 300 miners. The commercial scale range is characterized by energy consumption greater than residential scale but less than industrial scale. This range is typically up to 1 MW in size. Commercial-scale miners receive better rates than residential customers within the same state, but they are not large enough to negotiate successfully with power companies.

- Industry: >1 MW — Operations with over 300 mining machines. Industrial-scale operators are large enough power consumers to negotiate energy costs through power purchase agreements and obtain energy at the lowest cost within the same state.

Despite these changes in scale, all three categories of mining operators are united by a common need for cost-effective power. While some miners may be limited by geographic constraints, enterprising miners are actively exploring areas with cheaper energy rates. Let’s call this jurisdictional arbitrage. Negotiate a lower price.

war games

Now that we have a better understanding of what the various resizing operations look like, let’s crunch the numbers. Since we don’t have the benefit of a crystal ball, we simulate a war game using the following data points:

- BTC price is $30,000.

- The network hash rate is 400EH/s.

- Bitmain Antminer S19j Pro 100TH/s, 3kW per unit.

- Housing size: 10 Bitcoin miners.

- Commercial scale: 100 Bitcoin miners.

- Industry size: 1000 Bitcoin miners.

- Energy tariffs (EIA) as of 2023 YTD.

Let’s apply a simple mining profitability formula (mining revenue – power cost) to see how mining operators handle this scenario across the United States.

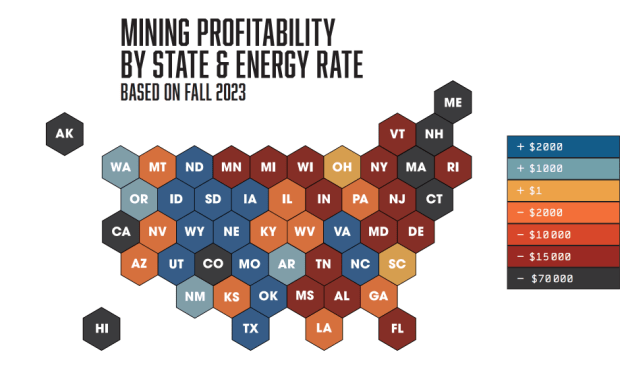

It’s pretty sobering to run the numbers, as you can immediately see how unprofitable mining would be based on the scenario we’ve outlined. Only 40 states can make money at industrial rates, 18 can make money at commercial rates, and 6 states can make money at residential rates. If we were to run the same simulation and implement halving to cut the daily mining profits in half, we would suddenly have an apocalyptic scenario where mining operations would become unprofitable. Of course, Bitcoin does not exist in a vacuum, and this does not account for changes in the network hash rate and Bitcoin price.

The war game looks bleak for residential-scale operators. Due to the conditions stated, profitability on residential energy bills appears difficult and mining operations are likely to incur losses across the country. Some may pursue this route to accumulate SATs without KYC, but for many this does not justify operating at a loss.

Commercial rates offer a more promising outlook for operators as lower energy costs expand profitability in more states. Nonetheless, only a few states offer a profitable environment for small business miners, especially in the potentially difficult year of 2024.

The landscape changes further at the industrial scale, where miners have more influence and their rightful place at the table. Energy producers pay attention when operator demand approaches or exceeds 1 MW. This reflects a shift from rounding errors to meaningful consumers. Profitability is possible in 40 states for industrial-scale miners, but some states still struggle.

The question is whether the mine operators will survive the next day’s fighting. Withstanding the onslaught of increased competition, halving, and unpredictable Bitcoin prices will not be easy. Operators need to find efficiencies wherever possible. This basic principle is true. Profitability can be achieved with sufficiently low hardware and energy costs. The biggest headline of this entire article is that the geographic location where your operations are performed is probably the most important success factor in running a mining operation. In most countries, this means you should not connect your Bitcoin miner. But if you’re ambitious enough to get into the trenches and conduct hash reconnaissance, you still have a chance. This is where you earn your stripes and claim the ground.

This article was published in Bitcoin Magazine. Sponsored by “The Primary Issue”. HIVE DIGITAL TECHNOLOGY LTD Part of Bitcoin Magazine’s “Buy The Numbers” content series. click here To get an annual Bitcoin Magazine subscription.

Click here to download a PDF of this article.