H&E is well-positioned for construction spending growth in 2024 (NASDAQ:HEES)

xenon

Stock in H&E Equipment Services (Nasdaq: Song) has significantly underperformed and has been trading virtually flat over the past year. Since I recommended the stock in October, the stock has performed better, up about 11%, about 2% ahead of the S&P 500’s return. they have United Rentals (URI), this is likely due to concerns about large-scale spending and increased profits from used equipment sales. I believe these concerns are overblown and continue to expect the stock to rise to $55, which is why I am repeating my Buy recommendation.

pursue alpha

In the company’s third quarter, H&E reported a 24% increase in revenue to $401 million and adjusted EBITDA of 36% to $189 million. EPS rose nearly 30% to $1.35. Fleet size increased by 28% and utilization fell from 3.3% to 70%. This is why revenue growth lags vehicle growth. However, the utilization rate increased by 70 basis points from 69.3%.

This strong level of growth was a double-edged sword for H&E. Clearly, top and bottom line growth has been strong and positive as H&E has been able to drive more equipment rentals into strong markets. However, this growth was financed by H&E borrowing in excess of its cash flow to increase its fleet. At the same time, the operation rate is lower than a year ago, raising concerns that H&E is outperforming the market. Consistent with the previous quarter, management doubled down on this strategy by raising its 2023 growth capital spending guidance from $600 million to $650 million to $650 million to $700 million to account for increased customer demand and improved equipment availability. It was implied that there was.

HEES’ operating cash flow for the nine months was $277 million. Excluding working capital, it generated $398 million. This resulted in a free cash outflow of $176 million this year, as it invested $472 million in vehicles, up nearly 50% from $323 million last year. There are several reasons why I view this investment as appropriate and not threatening shareholder value. First, H&E’s EBITDA is growing faster than its debt ratio. Leverage remains modest at 2.1x Debt/EBITDA, slightly lower than a year, two or three years ago when leverage was as high as 2.5x. Despite the free cash outflow, H&E is a larger company today with less financial leverage. By building scale, we’ve actually reduced the risk of our financial profile compared to a few years ago.

One of the risks for companies with free cash flow is their reliance on debt financing. Now that interest rates are down from their all-time highs, this is less of a concern than it was a few months ago. Nonetheless, I’d like to note that of the $1.4 billion in debt, $1.25 billion is unsecured bonds that don’t mature until 2028, so there’s no real refinancing or interest rate risk. From a capital allocation and financial health perspective, H&E’s growth plans pose no problems.

Now, just because a company has the financial flexibility to invest huge sums doesn’t mean it should. There may be concern that if equipment demand declines, such fleet expansion will prove to be essentially the same unwise purchase as buying at the top of the market. I don’t think that’s likely here either.

Although we’ve focused on low utilization, it’s important to note that utilization can be too high. A business with 100% utilization is likely to have more demand than supply, which means money is tight. Investors would like to see capacity increase and overall utilization drop somewhat.

That’s where I think H&E sits. Last year, operating rates were very high given the surge in construction activity and disrupted supply chains, and are now returning to normal levels. Now, if utilization continues to decline, that would be a concern for me and a risk for investors to monitor. Fortunately, the third quarter is expected to see a sequential increase in utilization rates, stabilizing the situation to a healthier, more normal level.

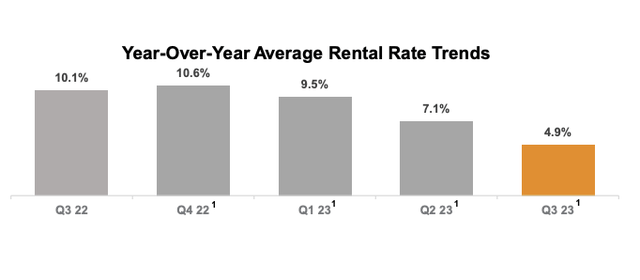

In addition to utilization, rental prices are a good indicator of demand. Rent continued to slow, rising 4.9% compared to last year, but quarterly rent stabilized from 1.1% in the second quarter to 1.2%. Inflation above 10% is unsustainable, but the fact that prices are still moving 5% per year is a sign of strong ongoing demand. Importantly, management expects rental rates to gradually improve in the fourth quarter.

H&E equipment

All of this supports continued demand, allowing H&E to expand its fleet. I think it is also important to emphasize that H&E is not simply adding vehicles to an existing market, increasing the risk of saturation. We’re expanding into new locations and filling those spots with our fleet. By September, H&E had opened 12 branches and is on track to meet its 12-15 branch directive. Next year, 15 additional regions are scheduled to be built. In line with this strategy, H&E additionally acquired Precision Rentals in December, helping deepen its network in the high-growth Phoenix and Denver markets.

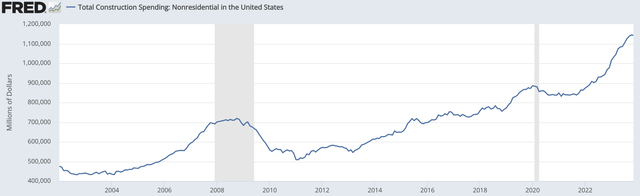

Of course, equipment rental demand can be related to economic activity. Approximately 69% of sales come from non-residential construction. As you can see below, activity here has exploded. This will be driven largely by government policy, with spending on the bipartisan infrastructure bill, the inflation reduction bill, and the CHIP Act increasing in both direct government spending and private sector incentives.

St. Louis Federal Reserve Bank

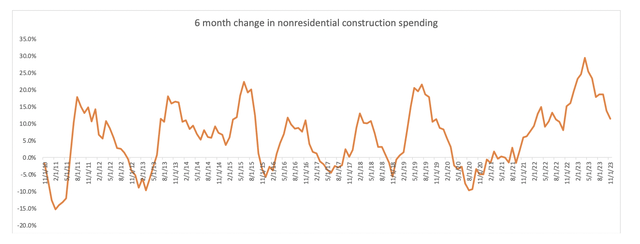

A few months ago, as these government programs began to expand, non-residential construction grew at a 30% annual rate. Of course, in an economy as developed as ours, such a pace of growth cannot be sustained and has slowed to 11%. These government programs will continue for several years, but this continuation simply supports spending levels and does not support further growth at these levels.

St. Louis Federal Reserve, my own calculations

My view is that, given the multi-year nature of these government programs, non-residential spending is likely to be less cyclical than it has historically been and should be maintained at current levels as growth continues to slow. Given H&E’s small size and expansion into new geographies, I believe the backdrop is sufficiently strong to support recent fleet expansion and continued double-digit growth. It would be worrisome if construction spending began to decline, but given government support and the greater likelihood of a soft landing, this does not appear to be the central case.

Another headwind for the stock would be concerns about earnings quality. Third quarter gross margin increased 20 basis points to 47%, driven by favorable mix and continued strength in the resale market. Gross profit from used equipment was $31 million, up from $11 million last year. That extra $20 million is about 0.40 cents of EPS. Margins are now 480 basis points higher, helping to fuel some of that increase. However, most of the gains were due to a 2.5-fold increase in pre-owned sales. As operating rates normalized, H&E returned to normal equipment sales. Therefore, we believe that this level of profit is not sustainable.

As supply chains improve, we now see equipment manufacturers delivering more product than ordered. This is unlikely in 2021-2022 when deliveries are low and backlogs are rising. Because new equipment is difficult to obtain, used prices have been strong. Once the supply chain normalizes, used prices may fall, reducing this source of profitability.

St. Louis Federal Reserve Bank

While this is a risk to EPS, it will actually benefit HEES’s cash flow. H&E invests four times its revenue from used equipment sales into new equipment. As equipment prices fall, your growth efforts will likely be less expensive and your return on invested capital will likely be higher. As the company expands its fleet, lower equipment prices are likely to be a net positive because any headwinds from lower used prices will be offset by improved margins on new purchases over time.

Finally, it is important to reiterate that the cash outflow resulting from these growth expenditures is voluntary. H&E can quickly reduce capital expenditures, age your fleet and generate cash flow. The holding period is only 41 months compared to the industry average of 49 months. Units sold last quarter were on average 75 months old, indicating the potential capacity to age those vehicles. However, with its growth plans, management expects it will take two to three years to achieve consistently positive free cash flow.

I recently downgraded United Rentals’ rating from ‘Buy’ to ‘Hold’, given that its free cash flow yield has declined to 6.5%. We see this as a perfect valuation given that the non-residential construction sector will remain strong but growth will slow further. When I last wrote about HEES, I claimed it had an operating cash flow capacity of about $400 million to $450 million at its existing fleet size, even assuming a modest decline in leasing rates. Fleet size has been kept constant.

Given management’s comments that rents will improve in the fourth quarter and into 2024, the $150 million estimate is likely lower by $15 million to $25 million.

This gives a constant free cash flow yield of 9-10%, which we believe is pricing in the risk of H&E overinvesting. In 2024, these fears will dissipate as we see non-residential spending holding steady and H&E delivering solid utilization results. This could move the stock price between $55 and $58, or a free cash flow yield of about 8%. Against this backdrop of increased construction spending, we believe H&E is attractive compared to larger competitors such as URI in that its smaller size offers a cheaper valuation and better expansion opportunities. With leverage weakened, this growth spending is not overly ambitious and I would maintain the stake for the long term.