Hercules Capital Stock: Why It’s Trading at a Premium (Rating Upgrade) (NYSE:HTGC)

scalatore1959/iStock via Getty Images

outline

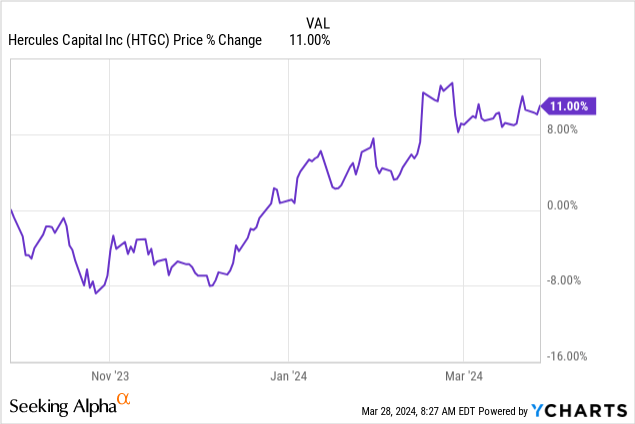

I previously worked at Hercules Capital (New York Stock Exchange:HTGC) dates back to August 2023. Since then, HTGC has achieved total returns in excess of 13% due to continued net investment income (NII) growth and high dividend distributions. price is Dividend yields have risen over the past six months and currently stand at around 8.7%. Although the price has risen sharply, we are upgrading our investment opinion to Buy at this level. The current price is trading at a large premium to NAV (Net Asset Value), but we plan to continue increasing our positions to snowball dividend yields.

We’ve covered a lot of business development companies (BDCs) this month, but it’s easy to say that HTGC stands out among them all. Their portfolio and strategy have proven effective, and management continues to drive results. that much There were clear signs of portfolio growth and increased levels of profitability, leading to several additional dividend payments.

The Federal Reserve is expected to begin cutting interest rates in the second half of 2024. I personally believe we will see very mild cuts, but I believe HTGC is very well positioned to grow despite any interest rate cuts. History has shown them to thrive in a near-zero interest rate environment, and I think their strong portfolio and investment strategy will continue to support and drive growth. Therefore, we upgrade our investment rating to Buy even though the price is close to an all-time high.

portfolio

HTGC’s portfolio consists mostly of bond investments and warrant portfolios. Most of you are familiar with debt investing, which is the loans or debt that Hercules provides to its portfolio companies. They collect interest on this debt equal to the total amount received by NII. Their debt investments consist of 125 portfolio companies with investment sizes between $5 million and $200 million and a total cost basis of $3.06 billion. The effective rate of return on the debt investment portfolio is 15.3%.

Warrants, on the other hand, are bonds that give the holder the right to purchase a precise quantity of a company’s stock at an agreed upon price. This portion of HTGC’s portfolio is much smaller, with a fair value of $186 million. But I think it’s worth mentioning because management seems to be trying to grow this area of the portfolio. It appears as if warrants were issued along with the bond investment portfolio to serve as an additional revenue source that could contribute to the overall investment return. The warrant portfolio includes holdings in 103 companies and 74 companies.

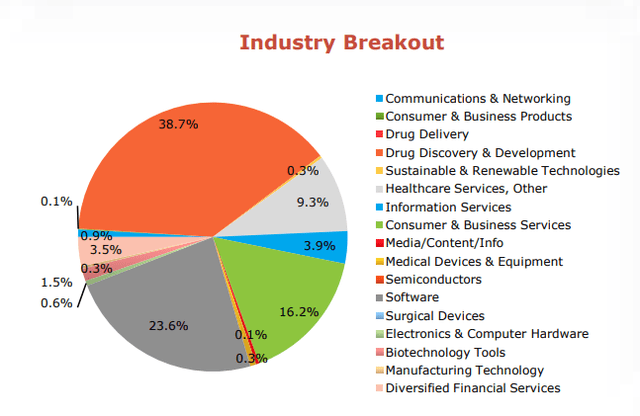

HTGC 4th quarter presentation

I also like that the portfolio is diverse across industries, with a focus on healthcare and pharmaceuticals, as well as IT services, software, and equipment. The portfolio is not only diverse by industry, but also by region. The majority of portfolio companies are based in the Western United States, accounting for 47% of exposure. They have 27% exposure to the Northeastern United States and 11% international exposure.

Approximately 84% of the portfolio is classified as senior secured first lien debt, and 8.4% of the portfolio is classified as senior secured second lien debt. Equity investments make up about 5% of the portfolio, while the aforementioned warrant positions only make up 1% of the overall portfolio composition.

Strategies and Interest Rates

Here, HTGC is managed internally, ensuring maximum return on your investment. This means that, unlike externally managed BDCs that have to pay commission costs to separate investment advisors, HTGCs only pay actual operating expenses and nothing else. Although this concept seems simple, it can have a serious impact on BDC performance. For example, let’s look at externally managed Prospect Capital (PSEC), a stock I’ve covered recently. This means that HTGC has no incentive to increase fees as the total amount of assets under management increases.

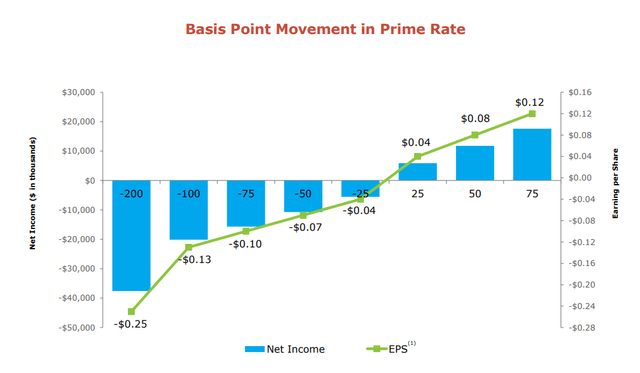

Hercules focuses on pre-IPO and mergers and acquisitions (M&A) venture capital-backed companies that have demonstrated high levels of growth. Approximately 96% of the debt investment portfolio consists of floating rate loans. More importantly, these floating rate loans have an interest rate floor. This means there is a limit to how low this interest rate can go. This provides significant downside protection against interest rate cut sensitivity.

HTGC 4th quarter presentation

You can visually see how interest rates can affect your bottom line and EPS. No one knows how much the Federal Reserve will cut interest rates, but it appears to be closely watching how the labor and employment markets develop. Now they are expected to have smaller interest rate cuts. So I think a modest rate cut of -50 basis points is a fair ballpark area to expect. A decline of -50 basis points is expected to reduce EPS/NII by -$0.07 per share.

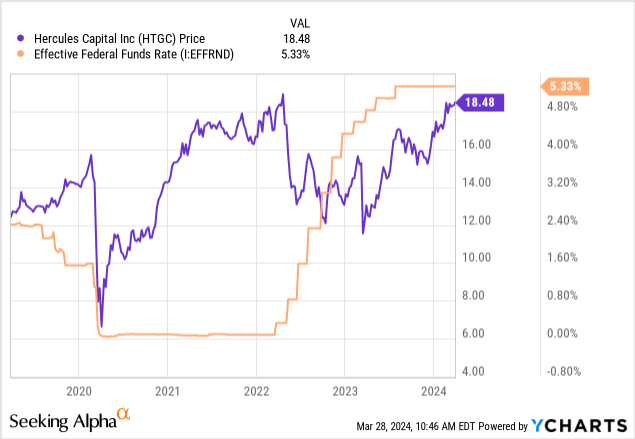

However, I would like to point out that HTGC still thrived during periods when interest rates were close to zero. We can see an inverse relationship between prices and the federal funds rate. As interest rates approached zero, HTGC prices surged. Even when interest rates started to rise, prices would fall slightly and then accelerate back up due to increased NII levels.

finance

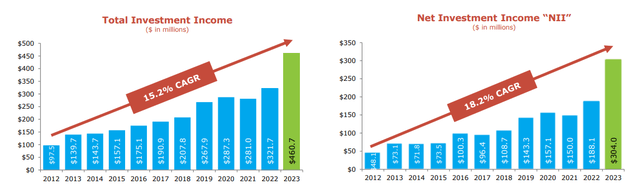

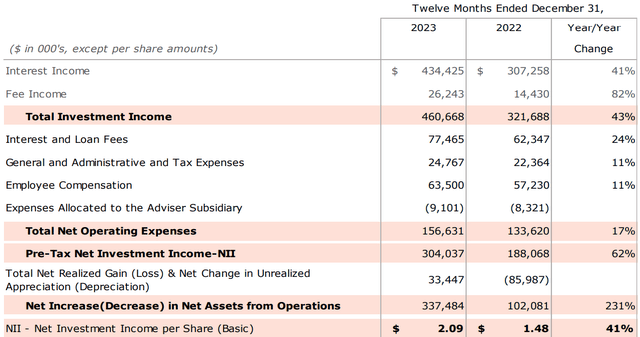

The most important metric here is the reported net investment income (NII). In its most recent fourth quarter earnings report, NII reported $0.56 per share. This resulted in the company ending fiscal 2023 with total net investment income of $304 million. This represents an impressive 61.7% year-on-year growth! HTGC has found a way to take advantage of the high interest rate environment to provide good rewards to shareholders.

HTGC 4th quarter presentation

If we look at total investment returns over the past 10 years, we see that total returns have grown at a compound annual growth rate (CAGR) of 15.2%. Additionally, overall NII grew at a CAGR of 18.2% over the same period. This growth helped management achieve a level of investable liquidity of $744 million.

We can also see that NII per share has increased by a total of 41% year over year. For comparison, here are some NII growth metrics from relevant peer BDCs:

- Trinity Capital (TRIN): NII increased 25.6% year-over-year.

- Ares Capital (ARCC): $707 million in total investment income and 10.5% year-over-year growth.

- Main Street Capital (MAIN): Total investment income growth of 13.5% YoY.

HTGC 4th quarter presentation

Commitments have steadily increased each year. As of the end of fiscal 2023, total loan commitments were approximately $17.3 billion, compared to $15.7 billion the previous year. It is worth emphasizing that since its inception in 2005, there has not been a single year in which appointments fell less than the previous year. To add context, the new commitments are great because it means a steady stream of income will be able to fund HTGC’s debt investment portfolio companies. This can also help drive growth within the portfolio and further increase the level of income produced within it.

risk profile

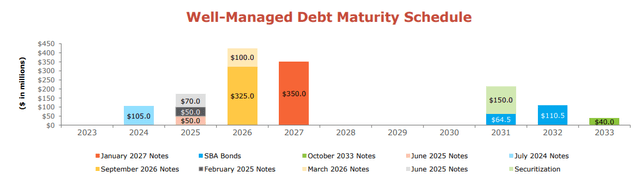

Their debt investments typically have short-term maturities between 36 and 48 months. Additionally, our debt maturity schedule has a significant amount of notes maturing in September 2026 and January 2027. However, this is still a long way off and management has plenty of time to expand the portfolio through additional loan commitments. As mentioned earlier, they have $744 million in liquidity as a cushion.

HTGC 4th quarter presentation

Additionally, HTGC currently has solid investment grade ratings from Fitch and Moody’s.

- Pitch: BBB-

- Moody’s: Baa3

The interest rate cut is expected to be mild, within the range of -50bp. When this happens, HTGC is well suited to continue delivering strong NII results in this environment. But I may be wrong, and the rate cuts may be more aggressive than I expected. In this case, NII may have a more negative impact and impact NII than expected. Accordingly, there is a possibility that additional dividends may slow down or stop altogether. However, so far there are no signs of NII growth slowing down and its cash reserves are sufficient to cover future liabilities.

Dividends and Valuation

The recently announced quarterly dividend is $0.40 per share and the current dividend yield is 8.7%. NII is reported at $0.56 per share, meaning dividend coverage here is approximately 140%. This is a huge margin of safety, and the additional cash flow is one of the reasons the fund has been able to issue several additional dividends. The most recent additional dividend of $0.08 per share was issued in early March. This follows a prior additional dividend declared in October 2023 and a prior increase of 2.6% in August 2023.

Dividend growth for already high-yielding assets has been spectacular. Over the past five years, dividends have grown at a CAGR of 5.10%. Zooming out over a longer period of 10 years, the dividend still grew at a CAGR of 3.36%. This is completely acceptable for a BDC with a four-year average dividend yield of 12.84%. Returns have decreased significantly due to rising stock prices, but recently it was possible to catch stocks with returns exceeding 15%.

Hercules is trading at a higher premium to NAV than usual. As a result, many people are choosing to stay on the sidelines for a better entry, and I don’t blame them! But I believe you have to pay for quality. The stock is currently trading at a premium of more than 60% to NAV. For reference, the three-year average insurance premium is 43.22%. We saw premium reach as high as 75% at the 2022 peak and discounts as low as -34% in the 2020 crash.

CEF data

Although I don’t think we’ll see HTGC stock trading at a discount again any time soon, I do think we could see some price declines as prices go lower. However, HTGC’s portfolio is well-suited to steering these interest rate changes, as mentioned earlier, so we’re not worried. Moreover, if we remain in an environment where average interest rates remain higher, that would be a good thing for BDCs like HTGC as a whole. Since the portfolio consists mostly of floating interest rates, the higher the interest rates, the higher the profitability indicator of debt investments.

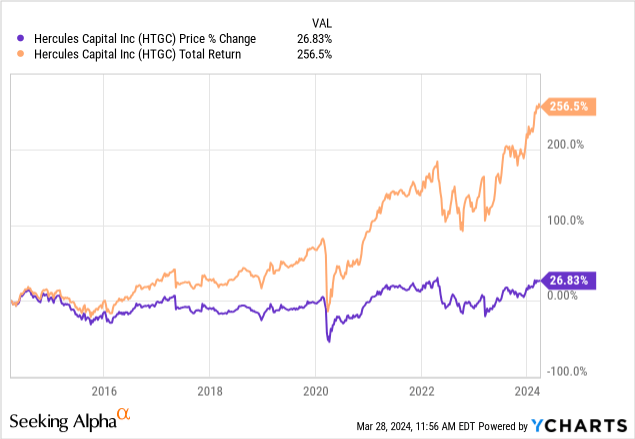

Price action is a little less important to me here, as HTGC can continue to provide high-yield dividend income on a consistent basis. Over the past 10 years, prices have risen 27% while total returns have exceeded 256%. This is due to consistently high distributions, and we believe that most investors who continue to hold HTGC also prioritize consistent profits over price increases. As a result, I have upgraded my investment rating to Buy and plan to continue building positions and receiving consistent dividends.

takeout

Hercules Capital remains a top BDC that offers high levels of dividend income while consistently growing net investment income over time. Prices have risen sharply recently, and the premium to NAV is currently over 60%. However, after taking another look at its growth, portfolio, and loan covenants, HTGC remains the best choice to weather future interest rate changes. Their portfolios are diversified across different geographies and industries, mitigating any kind of concentration risk.

Despite mediocre price increases, HTGC’s total returns were very high. However, investors typically do not add BDCs to their portfolios for the sake of price appreciation. Instead, we focus on the income HTGC can continue to provide. We upgrade our rating to Buy due to continued NII growth and the ability to mitigate interest rate sensitivity through well-structured debt portfolio investments. Additionally, new efforts to grow our portfolio are not slowing down and continue to increase year after year.