Artificial intelligence can quickly scan the massive Bitcoin blockchain for signs of illicit activity, a capability that could dramatically enhance the work of law enforcement agencies fighting money laundering, a new report explains.

Blockchain analytics company Elliptic, together with MIT-IBM Watson AI Lab, uses a deep learning AI model to analyze Bitcoin transactions to detect money laundering patterns and identify wallets used in crime. published the research results.

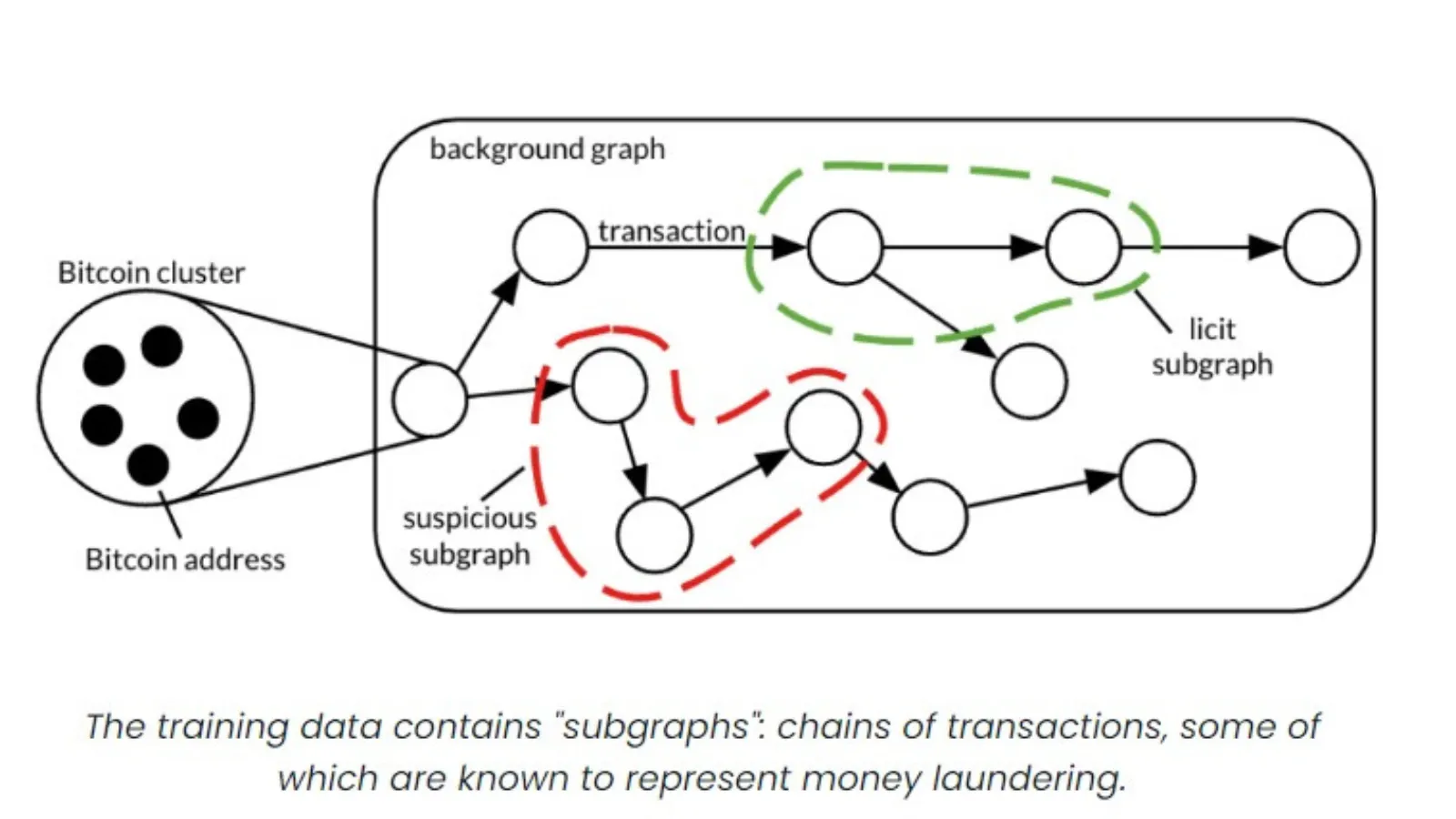

Bitcoin is known for its use of a decentralized public ledger, which is a key aspect of the technology that made the study possible, Elliptic said. Elliptic and MIT-IBM used AI to separate legitimate and illegal transactions into groups and track links between the latter to uncover potential money laundering.

“Blockchain provides fertile ground for machine learning techniques, thanks to the availability of both transaction data and information about the types of entities being traded, collected by us and others,” Elliptic wrote. “This contrasts with traditional finance, where transaction data is typically siled, making these technologies difficult to apply.”

No testing has been attempted with so-called ‘privacy coins’.

“Counterparty information is provided for every transaction (in Bitcoin),” said Tom Robinson, co-founder and chief scientist at Elliptic. decryption, adding that this technology can also be applied to other open blockchains such as Solana and Ethereum. “This is not the case with privacy coins like Monero.”

New Elliptic research released today explores how: #AI Blockchain can be utilized to detect money laundering and other financial crimes. The study applied the new technique to a dataset containing more than 200 million transactions that is currently publicly available. https://t.co/k3GdjWJ08P

— Elliptic (@elliptic) May 1, 2024

“Instead of identifying transactions performed by rogue actors, machine learning models are trained to identify ‘subgraphs,’ which are chains of transactions that indicate that Bitcoin is being laundered,” Elliptic explained. “With this approach, we can focus on the ‘multi-hop’ laundering process more generally rather than on the in-chain actions of specific wrongdoers.”

According to Elliptic, the report released today continues the work the company began at the MIT-IBM Watson AI Lab in 2019. Elliptic initially tested its theory by working with an unnamed cryptocurrency exchange.

“Of the 52 ‘money laundering’ subgraphs predicted by the model that ended up with deposits to this exchange, the exchange confirmed that 14 were received by users already flagged as linked to money laundering,” the report said. “On average, “Less than 1 in 10,000 of these accounts are flagged as such, indicating that the model is working very well.”

Government regulators, especially in the United States, have been using money laundering laws as one of many cudgels with which to attack the cryptocurrency industry. On Tuesday, a U.S. federal judge in Seattle sentenced Binance founder Changpeng “CZ” Zhao to four months in federal prison for money laundering violations.

Last month, the founders of Bitcoin mixer Samourai Wallet were arrested on money laundering charges by the U.S. Department of Justice.

In the indictment, FBI Assistant Director James Smith said “threat actors” use technologies like Samourai Wallet to evade detection by law enforcement and create an environment conducive to criminal activity.

“Defendants knew that while offering Samourai as a ‘privacy’ service, it was also a haven for criminals to engage in large-scale money laundering and sanctions evasion,” the Justice Department said in the indictment. “Indeed, as defendants intended and well knew, a significant portion of the funds handled by Samurai were the proceeds of crime passed through Samurai for the purpose of concealment.”

Edited by Ryan Ozawa.