Here’s how to trade Nvidia stock heading into GTC 2024 (NASDAQ:NVDA).

Justin Sullivan

NVIDIA Corporation (NASDAQ:NVDA) has maintained a relentless surge since the launch of OpenAI’s ChatGPT sparked mainstream interest in generative AI. Since then, the stock has increased fivefold, driven by hot demand for Nvidia’s AI chips. It is the backbone of the ongoing technological revolution. Not only is Nvidia’s tremendous revenue growth over the past year commendable, but its phenomenal pace of concurrent margin expansion is also impressive. This combination continues to highlight the value that comes from Nvidia’s visionary management team’s ability to execute and their commitment to innovation.

But the stock’s biggest intraday decline since May 2023 late last week boosted trading volume on concerns about whether Nvidia’s current high valuation and growth expectations are sustainable. Of course, demand for AI chips will eventually normalize as the associated computing capacity and infrastructure builds. It progresses in stages of scale. However, the industry is unlikely to be able to moderate demand in the near term, as the majority of computing demand is in the early stages of transitioning from learning to inference. In other words, if humanity is indeed embarking on AI innovations that will revolutionize technology, such as the emergence of IoT, existing computing infrastructure will likely handle only the tip of the iceberg of demand.

As such, this highlights the further expansion of the AI accelerator and GPU markets in which Nvidia is succeeding. And the continued resilience of Nvidia’s core demand environment is corroborated by increased levels of ongoing and imminent investment in early-stage technologies. OpenAI’s Sam Altman, for example, has been pushing ambitious plans to create a $7 trillion venture firm to develop artificial intelligence (AI) that will surpass humans. These investment plans similarly mirror SoftBank’s Masayoshi Son’s consideration of a $100 billion AI chip venture. With near-term prioritization of capital expenditures to build AI infrastructure across hyperscalers and enterprise server providers, there is a much higher demand for GPUs than what is currently (or will soon be) available in the market.

And the market’s unwavering confidence in Nvidia’s expanding lead in the fierce AI race is evident in the stock’s rapid recovery this week. Our analysis shows that Nvidia is currently trading exactly where it should be. Historical observations suggest that Nvidia will experience some new volatility through next week as its annual GTC keynote gets underway. However, momentum is expected to recover gradually after GTC, and is expected to become more pronounced by the end of the first quarter of 2025 and shortly after the earnings release.

NVIDIA is right where it needs to be

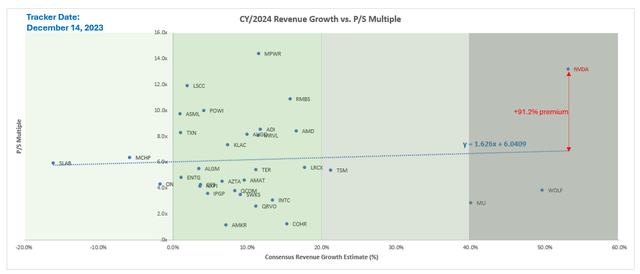

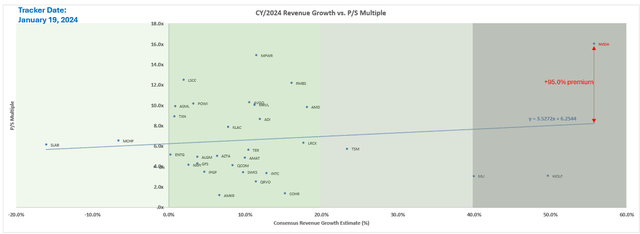

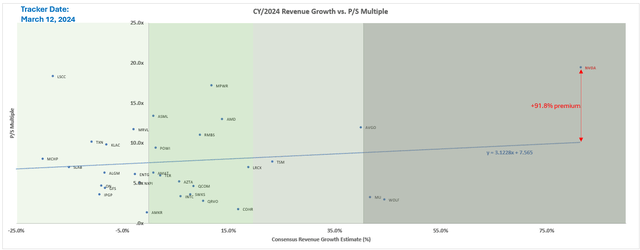

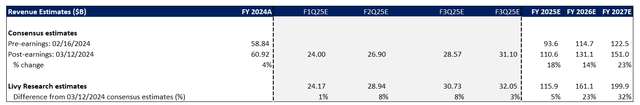

Nvidia is trading where it should be right now after normalizing the market’s favorable pricing on its F4Q24 performance and solid F1Q25 guidance. We’ve been tracking Nvidia’s valuation multiples compared to its broad semiconductor peer group over the past quarters. And Nvidia has consistently shown a ~90% premium to its peer group trend line relative to consensus growth estimates.

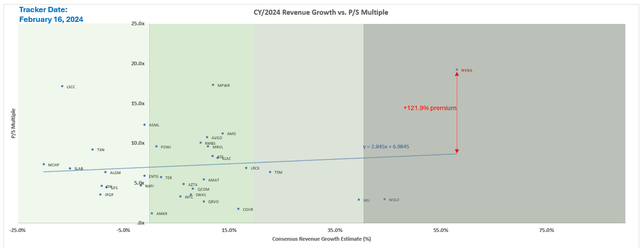

Data from Seeking Alpha; Tracked by author Data from Seeking Alpha; Tracked by author Data from Seeking Alpha; Tracked by author Data from Seeking Alpha; Tracked by author

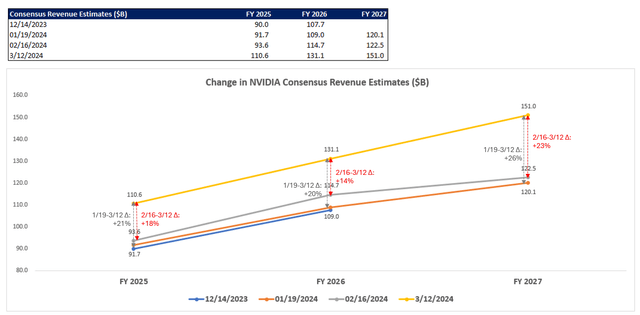

An exception was observed in February, shortly after Nvidia completed its fiscal fourth quarter. Our February tracker showed Nvidia’s premium to its peer group trendline rising sharply to 122%, nearly 30 percentage points off its consistent previous average premium of ~93%. We believe this jump is to illustrate the market’s lead in anticipation of a strong F4Q24 report and F1Q25 guidance. And this has come to fruition, with consensus growth estimates for Nvidia through FY 2027 increasing by an average of 19% following F4Q24 earnings compared to previously observed estimates for the same period.

Data from Seeking Alpha; Tracked by author

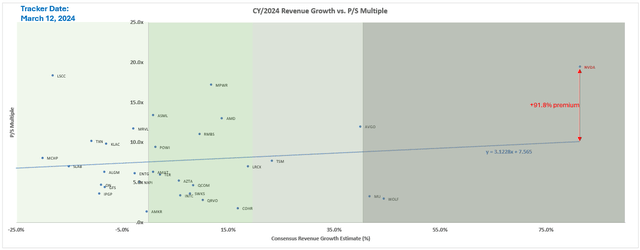

And after Nvidia’s plunge on Friday (March 8) led to a similar decline in the broader Philadelphia Semiconductor Index (SOX), Nvidia has now normalized to its previous trend, trading at a 92% premium to its peer group’s trendline. In our opinion, this is where Nvidia should trade right now.

Data from Seeking Alpha; Tracked by author

Specifically, we believe that the stock is likely in a rinse-and-repeat cycle as observed in the months leading up to its F4Q24 earnings release, given the lack of material changes in the underlying AI momentum and GPU demand environment. Specifically, our argument is that given that AI momentum remains flat in the near term, Nvidia is expected to see a significant increase in its multiple premium to its peers after the close of F1Q25, similar to what was observed in February. This is further complemented by Nvidia-related growth tailwinds this quarter, including improving H100 supply, H200 shipments beginning, and accelerating inference demand from hyperscalers and enterprise spend segments.

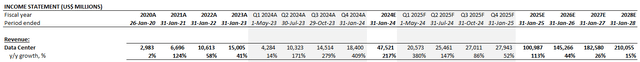

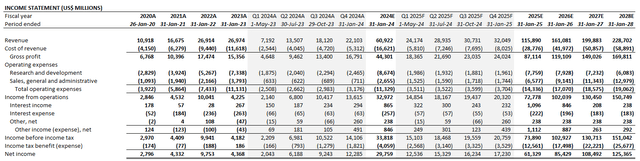

Nvidia’s baseline forecast, updated to take into account actual F4Q24 performance and F1Q25 guidance, projects revenue growth of 90% to $115.9 billion in FY 2025. This will be primarily driven by consistent sequential expansion of data center sales.

author

As previously mentioned, Nvidia shows company-specific tailwinds that support continued growth performance in the near term. This includes favorable H200 pricing through improved GPU supply and increased shipments to meet backlogged demand. Nvidia’s major customers across the cloud computing and enterprise segments reflected resilient capital spending and R&D priorities for AI development for the foreseeable future during recent earnings seasons. This will inadvertently strengthen demand for AI chips and supporting infrastructure, including full-stack Nvidia software, for accelerated computing data centers.

The expected acceleration of inference workloads as recently developed AI solutions hit the market is also expected to complement Nvidia’s data center sales. Inference refers to the process of generating output from a deployed AI solution, such as a response to a ChatGPT query. Current industry forecasts predict that inference activities will soon overtake training workloads as the primary source of computing power demand, with “the number of cycles and spend on training doubling by mid-2025.” Nvidia recently stated that only 40% of its current data center revenue is attributable to AI inference. And this number is likely to expand beyond 2025 as CPU-based data centers transition to accelerated computing to improve efficiency and TCO for handling increasingly complex inference workloads. This will inadvertently strengthen demand for Nvidia’s full range of data center solutions geared toward the AI revolution, encompassing GPUs, accelerators, networking solutions that enable scalability, and full-stack software.

Although we expect a sharp slowdown in core data center growth toward fiscal 2025 and fiscal 2028 before segment demand normalizes, this is unlikely to prevent further valuation appreciation in the short to medium term. Specifically, our forecast projects annual data center revenue growth to be cut in half by fiscal year 2028. This is consistent with previously observed cloud momentum. This has increased sharply throughout the pandemic and into fiscal 2022, and has also been accompanied by a surge in the valuation of Nvidia stock. The expected momentum in higher-margin data center sales will strengthen the sustainability of Nvidia’s gross margins in the mid-70% range as directed by management. This therefore provides incremental durability to the value premium over peers over the coming year.

author

Pricing Considerations

Current revenue growth estimates for fiscal 2025 through fiscal 2027 outperform consensus expectations at similar levels to what was observed following the F4Q24 earnings release. So, this confirms that there is likely to be another upward deviation in Nvidia’s valuation multiple premium to its broader semiconductor peer group, which we expect to see leading into its next earnings, which will be another surprising rally.

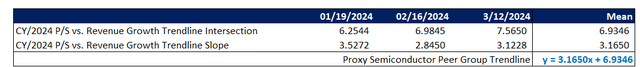

author

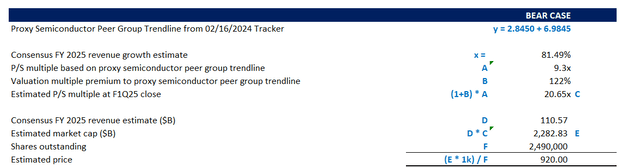

The big question is where the multiple trend lines for the broader semiconductor peer group will be. In other words, what is the basis for Nvidia’s expected valuation premium leading into F1Q25 earnings? It is true that there is uncertainty in forecasting these bases, given the combination of company-specific and broader external influences, such as macroeconomic conditions and market risk appetite. To normalize for these unpredictable factors, we use the average sector trendline slope and intersection observed over the past three months as a proxy for the baseline from which Nvidia’s pre-earnings valuation multiple premium will begin.

author

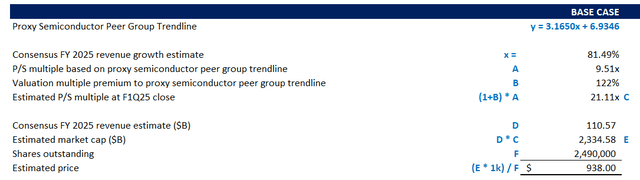

Considering the consensus growth estimate of 81.5% for Nvidia’s fiscal 2025 earnings, the stock should trade at around 9.5x from its proxy trend line. And applying the 122% pre-revenue multiple premium to the proxy trendline results results in a P/S multiple of 21.1x for Nvidia to close F1Q25. Applying a 21.1x multiple to Nvidia’s current consensus FY 2025 revenue estimate of $110.6 billion, the stock should trade at around $938 per share.

author

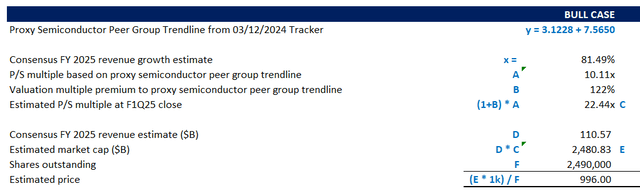

This represents a slight upside from the stock’s current levels, despite expectations of another increase in Nvidia’s future estimates following its F1Q25 earnings release. However, if we apply a 122% multiple premium to the current multiple trend line of the semiconductor peer group, the resulting P/S ratio of 22.4x would yield an estimated price closer to $1,000 per unit. There remains potential for further upside of this magnitude as Nvidia approaches its next earnings release. In particular, the higher baseline at current levels may remain sustainable as it already reflects recent declines in the broader peer group to normalize prior bullish market pricing errors for a stronger-than-expected fourth-quarter earnings season.

author

Alternatively, a flatter peer group trend line, such as observed in mid-February, may indicate a fair case of industry weakness in the near term. Based on the preceding analysis, we believe that AI momentum should remain intact and resilient in the near term. Long-term easing should therefore not deviate significantly from the lows observed in recent months. Applying a 122% multiple premium to this baseline would result in a P/S ratio of approximately 9.3x and an expected price of approximately $920.

author

Taken together, we believe that Nvidia’s decline below the $900 level until its next earnings release would represent a buying opportunity for further upside potential in the near term. We see the upcoming GTC keynote event as a potential opportunity. Annual keynotes are usually accompanied by stock volatility. Nvidia saw an immediate but brief decline after its stock price averaged 5% over the four-day event. This could be an opportunity for upside potential leading up to the next earnings release.

conclusion

Despite Nvidia Corporation’s high premium at current levels, we remain bullish on the stock considering its trends relative to its broader peer group. There is also resilient AI momentum in the near term, with demand for processor support remaining a function of supply availability. Therefore, this bodes well for Nvidia’s market leadership and provides further fuel for a potential surge towards $1,000 in the coming months.