High Fees vs. "high fees": How I Learned to Stop Worrying and Love Mempool

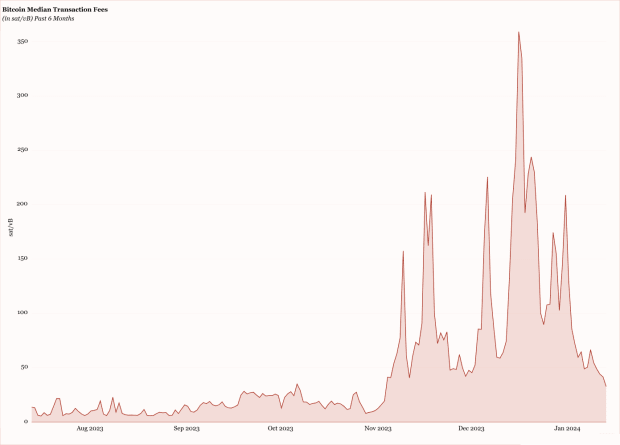

Bitcoin’s recent surge in on-chain fees has reignited a familiar debate within our community, and brought to the surface various perspectives on the meaning and root causes of this trend. Some within the community see these high fees as a strategic solution to Bitcoin’s security budget issues. In contrast, others see this as a potentially strong barrier to global adoption of Bitcoin. This issue is particularly relevant for newcomers to Western markets and Global South communities, where relatively high transaction costs can be particularly burdensome.

The noticeable increase in fees denominated in BTC is mainly due to the growing popularity of ordinal inscriptions, BRC-20 tokens and similar devices on the Bitcoin network. Ordinal inscriptions, which insert data into the witness portion of a transaction, are becoming increasingly popular for creating digital collectibles and unique assets on the Bitcoin blockchain. Although this practice is somewhat new, it requires additional block space, which increases overall demand and consequently transaction fees.

Moreover, the emergence and growing popularity of BRC-20 tokens, which are similar to Ethereum’s ERC-20 but are the standard for the Bitcoin network, have further exacerbated network congestion. Often created for speculation and distribution of memecoins, these tokens require complex and large-scale transactions. The collective effect of these transactions is to intensify network load and further amplify the fee spike problem on the BTC side.

Fundamental changes in network utilization

It is important to recognize that these technologies, and others to come, represent a paradigm shift in leveraging the Bitcoin network. The rise in transaction fees, as measured in BTC, reflects these evolving use cases and highlights the need for continued advancements in network scalability and efficiency. Others have discussed some answers to these issues, and I won’t comment on specific answers other than the two below.

Block size war re-litigation

It is important to be aware, albeit cautiously, of the topic of block size. The idea of restarting the block size war, often suggested by some non-Bitcoin factions, is not only counterproductive, but ignores the nuanced understanding needed to address the current fee environment. There is no need to increase block size for the security and efficiency of the network. In particular, you don’t have to deal with temporary burdens caused by certain uses, such as JPEG or BRC-20.

Mining sector perspective

In the mining sector, the surge in interest in Bitcoin has led to new approaches to running mining pools, as seen with Ocean and Braidpool. These entities allow miners to create their own transaction templates and actively manage network congestion, while Ocean specifically filters out what it deems spam transactions. This evolution of mining strategy represents a balance between the profit motive and the responsibility of maintaining an efficient network.

Understanding the dual nature of ‘high fees’

High fees in real terms and BTC terms

When analyzing the high fee nature of Bitcoin, it is important to distinguish between actual fees (USD) and BTC-based fees. The actual fee increase reflects Bitcoin’s maturity and increasing importance in the global economy and demonstrates Bitcoin’s success. Conversely, high fees on the BTC side highlight temporary bottlenecks in the network, highlighting the need for technological and community-driven innovation to enhance the network’s efficiency and scalability.

Common themes of high fees

- Self-Regulating Economy: Bitcoin’s fee market is the epitome of a self-regulating economy. Users who value fast and guaranteed transactions are willing to pay more to enhance the security and development of the network. This self-regulation is pivotal to Bitcoin’s resilience, adapting organically to market dynamics.

- Efficient use of block space: High fees encourage wise use of block space, fostering innovative applications on the Bitcoin network. The development of two-tier solutions such as Lightning, Fedimint, and Liquid are particularly noteworthy as they promise faster transactions at lower costs, albeit with certain trade-offs.

Congratulations on actually having high Layer-1 fees.

As Bitcoin continues its journey towards global currency status, the inevitability of indeed high Layer-1 fees is a milestone to be celebrated rather than a cause for alarm. The era of high costs for transactions of even 1 sat/vB marks a critical chapter in Bitcoin’s success and global influence. Resisting this trend is not only futile, it goes against Bitcoin’s spirit of growth and stability.

- Reflecting Bitcoin’s Value and Demand: There is no doubt that there is a correlation between high real-world transaction fees and increased Bitcoin’s value and demand. As Bitcoin solidifies as a viable investment and trading asset, the willingness to pay higher fees reflects its perceived usefulness and value. This is an optimistic sign about Bitcoin’s sustainability and long-term success.

- From block rewards to transaction fees: The shift from miner revenue to transaction fees based on block rewards is an essential evolution of the Bitcoin economic model. As the Bitcoin supply limit approaches, high transaction fees in real terms have become critical to rewarding miners and ensuring the security and longevity of the network.

- Indicator of Asset Maturity: High transaction fees in real terms indicate the maturity of Bitcoin as an asset class. Similar to traditional financial systems, the transaction fees present on the Bitcoin network highlight its evolution from a niche technological experiment to a globally recognized financial asset.

- Reflecting its deflationary nature: Unlike fiat currencies, Bitcoin’s deflationary design means its value is expected to increase over time. In fact, high fees demonstrate these deflationary characteristics. As the value of Bitcoin increases, the cost of Bitcoin transactions naturally increases. This phenomenon is expected and indicative of a successful deflation model.

Problems caused by high fees in BTC terms and conditions

While talk of high Layer-1 fees on the practical side highlights Bitcoin’s burgeoning role and value, on the BTC side high fees present unique challenges that require careful consideration. This distinction is essential for understanding both the current state and future scalability of the network.

- Barriers to widespread adoption: On the BTC side, exorbitant fees are a serious obstacle, especially for those in developing countries or engaging in small transactions. Bitcoin’s universal appeal as a global currency is intrinsically linked to accessibility and affordability. The persistence of high BTC denomination fees risks undermining Bitcoin’s promise as a tool of financial inclusion and empowerment.

- Network Congestion and User Experience: On the BTC side, rising fees are often a sign of network congestion, leading to longer transaction times and poor user experience. For Bitcoin to grow into a viable everyday transaction medium, it must deliver consistent reliability and efficiency. Currently, high fees on the BTC side represent a bottleneck in transaction processing, which can deter both potential and existing users.

- Centralization Issues: Any high fees tend to encourage centralization, but in BTC terms this has a significant impact, potentially shifting transaction processing to larger institutions that can afford those fees. These changes challenge Bitcoin’s decentralized spirit, with potential implications for security, integrity, and overall trustworthiness.

‘Security budget problem’ and the ‘mining death spiral’ myth

A common misconception in Bitcoin discussions is the fear of a ‘security budget problem’ or a ‘mining death spiral’. These concerns often stem from misunderstandings about halving and block subsidy reductions, leading to concerns about inadequate miner incentives.

But such fears fail to account for an important element of purchasing power. Consider this: if Bitcoin reaches $550,000 in value, even a constant block fee of about 25 million sats will exceed the purchasing power of the current 6.25 BTC block subsidy, which is currently $40,000/BTC. What matters most is not the amount of Bitcoin paid out, but the purchasing power it represents. As long as this continues to increase, miner remuneration is sustainable and safe.

On the Bitcoin side, the focus should be on ensuring that the purchasing power derived from transaction fees continues to grow, rather than on raising fees or considering alternatives such as tail emissions. This is the cornerstone of Bitcoin’s economic model, emphasizing the importance of a single currency system.

Layer 2 technology and fee dynamics

The emergence and integration of Layer-2 technologies represents a significant development in the Bitcoin ecosystem. These technologies can reduce fees on the BTC side, but are essential to the scalability and future viability of the network. An efficient Layer 2 solution can compress transactions more effectively than is currently possible at Layer 1.

On the BTC side, high fees signal the need for broader, more innovative layer 2 solutions to ensure the network’s scalability and efficiency. It is clear that in its current state, the Bitcoin blockchain cannot handle a significant portion of the world’s daily transaction volume and should not be its goal. The real solution is a combination of enhanced Layer 2 innovations, rule renegotiation, modifications to consensus mechanisms, etc.

conclusion

Summarizing the discourse around Bitcoin’s transaction fees, it becomes clear that the dual view of high fees (one in real terms and one in BTC) is emblematic of a currency in the throes of evolution and maturity. *As long as purchasing power continues to grow, there is no need to raise fees or do anything like tail emissions in Bitcoin terms.* This is the whole point of depreciation or single currency.

In practical terms, high fees should not be seen as a deterrent, but as a feature of Bitcoin’s increasing value and mainstream adoption. Although challenging, this trend is evidence of Bitcoin’s growing acceptance as an important financial asset on the global stage. This highlights Bitcoin’s journey from a new digital experiment to a powerful, decentralized financial system.

Conversely, on the BTC side, the challenges posed by high fees highlight a critical juncture in Bitcoin’s development. They highlight the need for innovative solutions to strengthen network efficiency and scalability, ensure Bitcoin remains accessible and viable for a diverse global user base, and secure an escape route from the ever-encroaching fiat currency. As the Bitcoin community navigates these complexities, it must focus on evolving technologies and strategies that maintain its core principles of decentralization, security, and inclusivity.

As it navigates the future, the Bitcoin ecosystem must balance growing value with a pragmatic approach to technological and economic challenges. Advances in Layer 2 technologies, along with community-driven initiatives, will play a pivotal role in addressing these challenges. As Bitcoin continues to evolve, it is not only a testament to the ingenuity of its design, but also a sign of the potential of a decentralized digital currency to revolutionize the financial landscape.

The author would like to thank @theemikehobart, @cryptoquick, @GrassfedBitcoin, and @barackomaba for their thoughts and comments during the writing of this article.

This is a guest post by Colin Crossman. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.