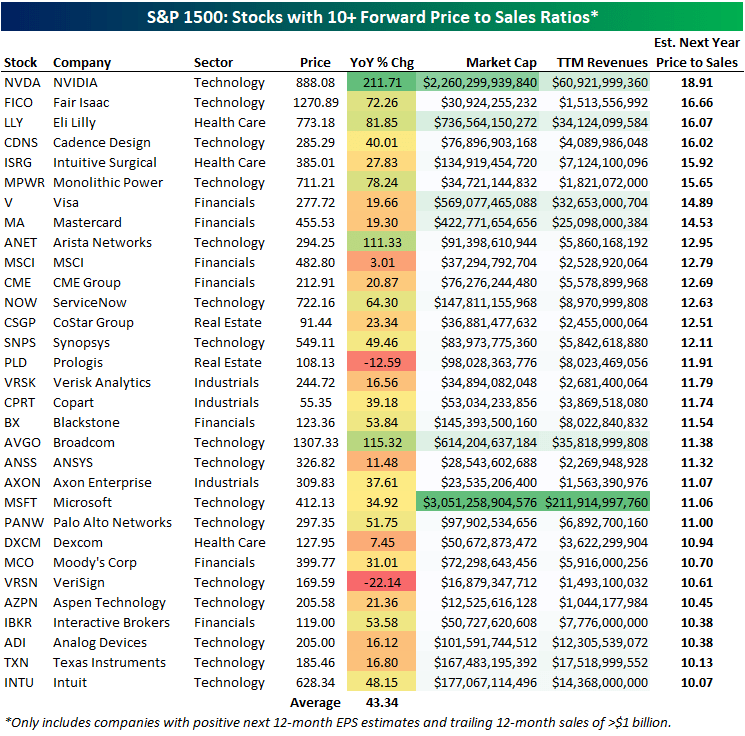

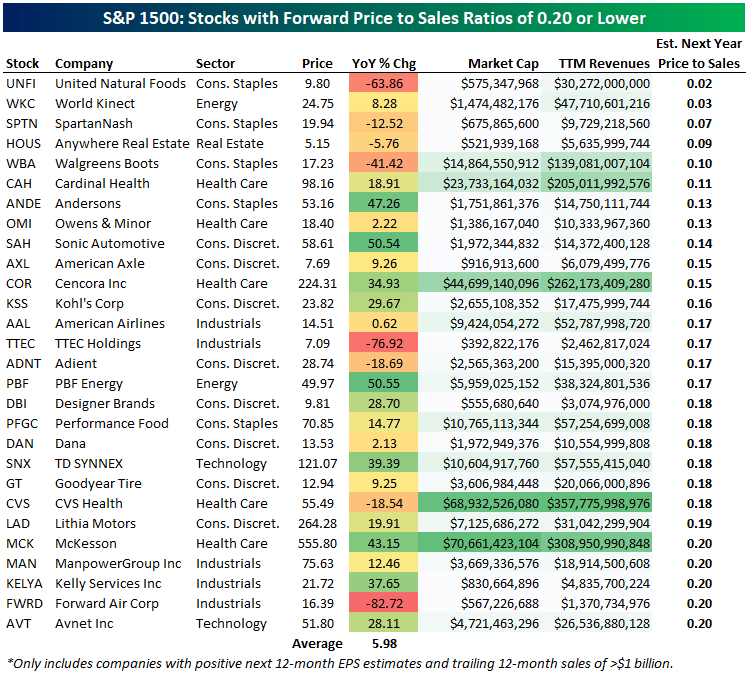

Highest and lowest price-to-sales ratio

patpitchaya/iStock (Courtesy of Getty Images)

The S&P 1500, which includes the large-cap S&P 500, mid-cap 400, and small-cap 600, has fewer than 1,175 stocks. Positive EPS estimates for next year and 12 months lagging Over $1 billion in revenue. We wanted to determine which stocks in this group currently have the highest and lowest forward price-to-sales ratios. For those of you unfamiliar with the price-to-sales ratio, it is simply a stock’s current market capitalization divided by its annual sales (in this case, the consensus estimate of sales for the next 12 months). Among the more than 1,150 stocks that fit our initial criteria, the average stock’s current price-to-sales (P/S) ratio is 2.59, but the median is much lower at 1.73. In particular, 31 stocks currently have forward P/S ratios greater than 10. The limit is 10 times greater than expected annual revenue. That’s a very high P/S ratio, and the company will get better results. If you’re hoping to maintain those types of multiples, you’re going to grow significantly. Collectively, these 31 stocks have gained an average of 43.34% over the past year! Here’s the list for those interested:Nvidia (nvidia) currently has the highest futures price-to-sales ratio at 18.9. The stock is up 211.7% over the past year. Five other stocks had P/S ratios above 15: Fair Isaac (FICO), Eli Lilly(lee), Cadence Design (CDNS), intuitive surgery (ISRG) and monolithic power (MPWR). Credit card company Visa (V) and Mastercard (mom) both have P/S ratios of 14x, and other notable large companies with P/S ratios of more than 10x include Microsoft (MSFT), Broadcom(AVGO) and Texas Instruments (TXN). Obviously, many of the tech stocks on this list have seen massive gains starting in late 2022 due to the current AI boom, and investors are still expecting big things in the coming years to justify these kinds of multiples. They actually have a lot to live up to.

On the other hand, there are stocks with the lowest price-to-sales ratios. Currently, there are 338 stocks with a forward P/S ratio of less than 1. This means that the market capitalization of the stock is lower than the annual sales estimate. When sales are greater than market capitalization, a company’s margins are typically very low and generally declining. Many of the names below with P/S ratios below 0.20 come from slow and steady groups, such as wholesale food distributors, large retailers, or large health insurance providers. Meanwhile, 31 stocks with P/S ratios above 10 rose. % Compared to last year, the group of stocks below only gained an average of 6% year over year. Many of these names will continue to decline going forward, but we are confident that some of them will turn their margin situation around, especially once an easing inflation environment emerges. Now dig deeper and find them!

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.