HODLers on the network now exceed 5 million.

Litecoin has reached another milestone as the total number of HODLers on the network now exceeds 5 million, according to on-chain data.

The number of long-term Litecoin holders has been increasing recently.

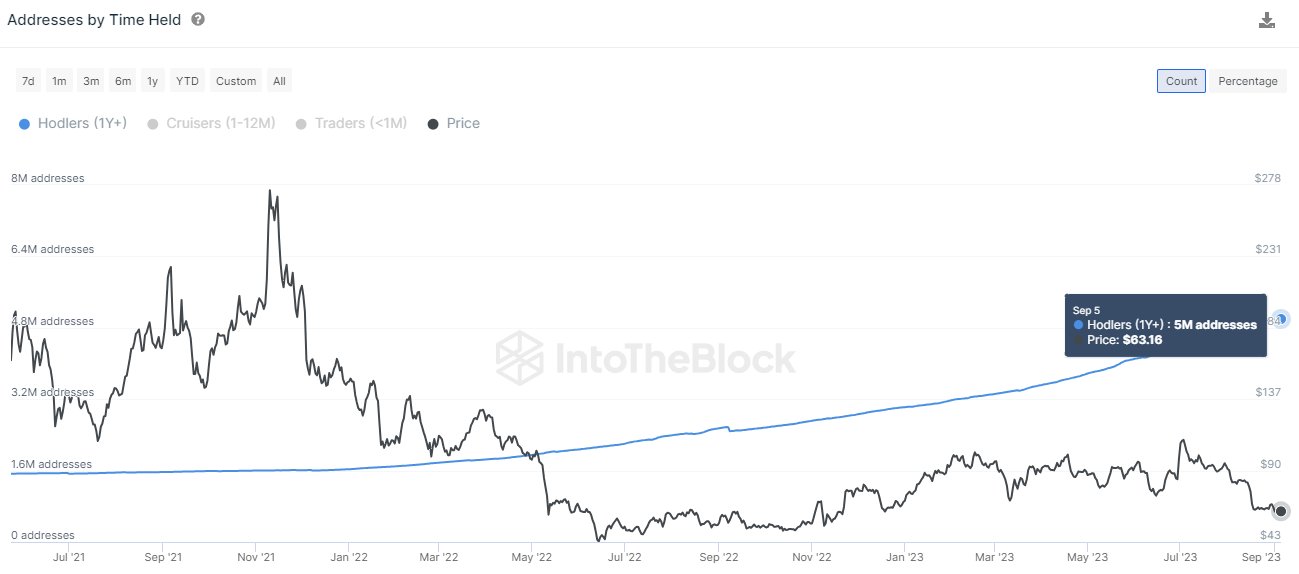

According to data from market intelligence platforms: Into the Block, LTC set a new record for the number of long-term holders this week. The company defines “long-term holders” (LTHs), or HODLers, as investors who have held their coins for at least a year. This criterion for LTH is different from the criteria used by other analytics platforms and is typically around 5-6 months.

The chart below shows how the number of addresses owned by LTH HODLers has changed over the past few years.

The value of the metric seems to have been going up in recent days | Source: IntoTheBlock on X

As shown in the graph above, the number of Litecoin HODLers increased significantly during this period. In particular, indicators have shown an exponential increase since the beginning of last year.

Following this rapid increase, the number of addresses carrying coins from at least a year ago has now surpassed 5 million, a new cryptocurrency record.

Interestingly, while the number of LTHs increased during this period, the price of the cryptocurrency mostly suffered. This shows growing confidence among some holders that despite the low price action, the asset will be a profitable investment in the long term.

This is naturally a positive development for cryptocurrencies. More LTH means more supply locked inside the wallets of these determined hands, which in turn means less potential for sales to occur on the market.

LTC prices continue to struggle recently.

Litecoin’s price has only moved sideways since its mid-August plunge. At the time of writing, the cryptocurrency is trading at around $63.

Looks like the coin hasn't been moving much recently | Source: LTCUSD on TradingView

This slide since July shows that the number of Litecoin HODLers is increasing, which is a constructive sign for the asset, but may not mean much in the short term.

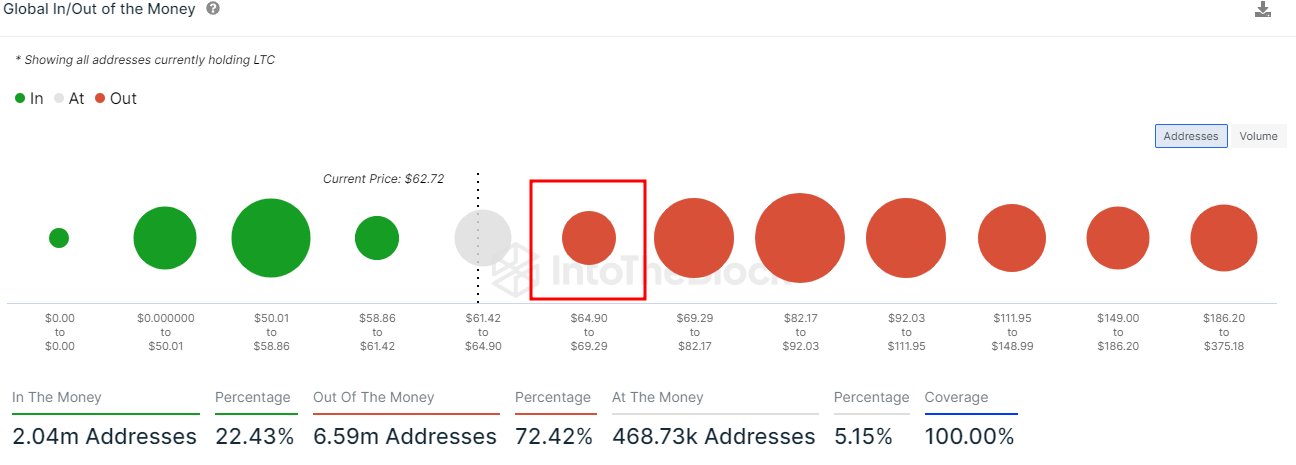

Where LTC price could go next will depend on a number of factors, one of which could be on-chain resistance and support levels. IntoTheBlock shared investor focus across various LTC cost-based price ranges.

Looks like the next range isn't that thick | Source: IntoTheBlock on X

Here, “cost basis” refers to the price at which the investor purchased the coin. For example, in the data above, the dots ranging from $64.9 to $69.29 represent the percentage of Litecoin investors who purchased at prices within this range.

In general, if investor concentration is high and the price surges to cost-based levels, the asset is likely to experience some resistance. This is because investors who had previously suffered losses may enter the green on a surge, which could lead them to sell and exit the market.

The range ahead of the current range does not appear to be very concentrated for holders, which could mean that Litecoin may not find much resistance even if a surge towards the $69 mark occurs. However, the following few price ranges have a notable percentage of holders, making further surges difficult.

Featured image by Kanchanara on Unsplash.com, chart by TradingView.com, IntoTheBlock.com