Holding: Eco Denial (NYSE:ONON) for another premium fashion stock.

people image

Holding AG (NYSE: Onon) On the surface, they had a decent fourth quarter, but prices fell significantly as Q1 guidance slowed even though FY guidance appeared to be on track. during The slowdown in the first quarter is nothing compared to other high-end premium/luxury brands in the fashion space. The baseline has become more mature., disappointments have been common lately, and you can see that that number includes On. Other brands are clearly citing a slowdown in general consumption, and their portfolio of well-positioned luxury brands are also predicting a slowdown. this is what we are worry about on A few years ago, the economy had not yet proven resilient despite rising interest rates. I think ON will continue to grow solidly in the future. There is much more room for growth before the macroeconomy reaches a mature area where it can have a more decisive impact. Moreover, On has several favorable margin drivers, so in addition to its solid performance on top-line, it should also continue to see margin gains.

However, while On has some idiosyncratic elements that are important for its growth, we believe it requires some caution. Differences in compound growth trajectories could have serious implications for valuations, which are heavily dependent on future financings, which likely favored lower first-quarter growth guidance than investors had expected. On is benefiting beyond the operational inflection point for its headline earnings margin, but we’re not sure about its value.

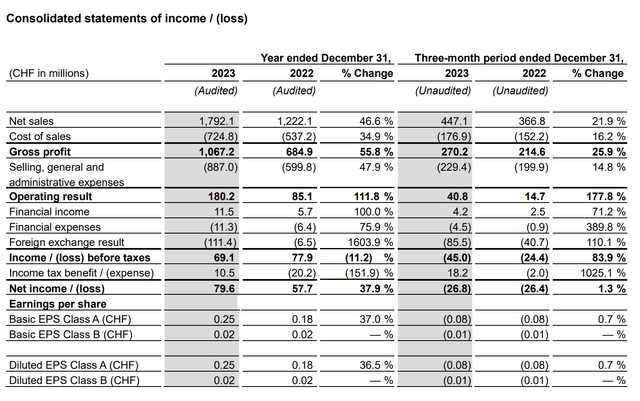

Reviewing 4th quarter performance

am (4th quarter)

Starting with the IS headline, the numbers look very solid. FY saw stellar growth in the fourth quarter, showing a slight slowdown for relatively tough configurations and showing the important fact that while pricing will remain solid, competitors will engage in significantly more promotional pricing. On didn’t do that. They continue to take the approach of selling below supply and chasing sellouts, and despite list prices, strong fourth quarter numbers and a competitive and promotional holiday season make this a solid performance for us.

There were other headwinds in the EMEA wholesale market. There were quite a few closures impacting the EMEA results, but there were also wholesale figures generally focused on Central Europe. They’ve already seen organic decline in those stores ahead of the planned closures next quarter, but it’s still having a significant impact. Nonetheless, EMEA region growth was 26% YoY in Q4 on a CC basis. The impact of these closures will also have a significant impact on first quarter guidance, which likely resulted in negative price action on the earnings release. Wholesale still grew overall, but there were signs that things seemed to be slowing down in North America as well, making it harder for competitors to win even in other regions where there was no closure pressure. Wholesale grew 19% constant currency (CC) and 10.7% reported in the fourth quarter.

DTC, despite its difficult mix, achieved average growth with higher overall numbers, growing 38.2% in the fourth quarter. Based on CC, the growth rate was 49%. This increased significantly in both the FY and Q4 results in a mixed manner, contributing to gross profit growth ahead of revenue growth, signaling meaningful GM gains.

DTC includes not only e-commerce, but also a new retail strategy called On Stores, which has started opening a significant number of stores in major cities in APAC, EMEA and the US, with around 20 vague plans per year. This will be a new focus, along with a wholesale strategy beyond e-commerce. The focus on retail strategy in addition to the already active e-commerce business means that profitability will continue to improve thanks to the continued growth of DTC in the channel mix.

There are also clothing strategies that are managed in much the same way as shoes. Clothing is still a very small part of the mix, at 18 million Swiss francs compared to 425 million Swiss francs in the fourth quarter, but it is a growing sector. We need to make retail services and experiences more powerful. New product launches are also progressing well, and the average age of On consumers is lowering due to successful new product launches, both in securing wallet share of current customers and new customers. 24%~29%.

There is still a lot of room for growth in APAC as it is also a huge market for more premium footwear. In fact, its smaller size and greater scope for growth resulted in a growth of 57.7%, which is still a far cry from the more worrisome Chinese macro frontier.

Guidelines and Concerns

The guidance must have been a sticking point for investors with the earnings release, and likely was in response to the deceleration in first-quarter results expectations after going through a quarter where the holiday season and decisions could be a bit noisy in charting growth trends. Maintain premium pricing. In fact, seeing some confusion before management issued guidance is a sign that management also suspected that guidance might turn off investors.

For FY, they started off thinking that next year could be a 30% growth year, ahead of their 26% CAGR estimate through 2026. However, CC sales growth is expected to be 26% in the first quarter. The CC slowdown was 31% in the fourth quarter, a clear deceleration from the trend set last fiscal year and the first quarter of last year when the skies were more open. Of course, that means sales growth should pick up in the quarter after wholesale closures are digested. They expect the lockdown to put meaningful pressure on EMEA figures.

Now, if we look at EMEA, we can see the impact of the closures, and it’s particularly high in the first quarter. So we see an overall impact of approximately 9% on our Q1 EMEA numbers and approximately a 13% impact on wholesale. So this will actually be about 5% of the wholesale figure after the closures are announced this quarter.

David Allemann, Chairman and Co-Founder of On, Q4 Earnings Report.

It’s not the biggest segment, but that kind of pressure has significantly reduced the growth that we’ve seen in execution rates to date. Additionally, the fact that it is not the largest segment means that door closure does not fully explain the deceleration. The supply chain shortages that accounted for some of last year’s growth pressures no longer exist. Of course, the trend is simply a sequential slowdown, as 2023 was a more open year with growth reaching 78% in the first quarter.

In general, I think the market is reacting to the fact that some of the top premium fashion companies have been hit by disappointing earnings guidance for next year, pending macro considerations. Although there is nothing we have seen in the sports apparel sector, the suspicion could be raised that there may be signs of a slowdown as a result of macro factors. These other companies have a similar geographic split as On and are focused on the US and EMEA, but are actually more focused on EMEA than On, where the US economy is quite healthy in terms of consumer sentiment and trends. But other disappointing returns also came from much more mature companies.

conclusion

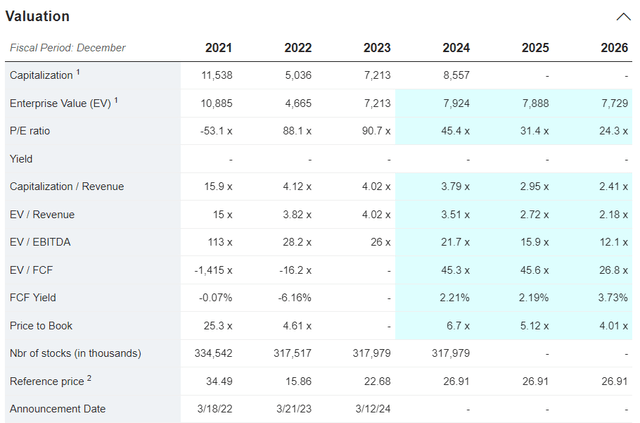

The bottom line is that growth expectations for On Holding AG are quite high. They believe they will grow at a CAGR of 25% through 2026, but are already starting to face some sequential challenges that are not fully explained by strategic closures. We’re also not very confident about the US economy, and would like to know what happens there after the 2024 maturity wall starts to impact company earnings.

prediction (marketscreener.com)

Even assuming guided growth, future valuations are high. Only in 2026 will the P/E approach the average for the premium athletic footwear industry.

They are also planning infrastructure improvements that should bring margins to the medium-term target of 18% EBITDA margin, higher than analyst forecasts, according to data from marketscreener.

As most of you know, constraints at our Atlanta warehouse in the third quarter of 2022 and the resulting shift in volume into the fourth quarter of 2022 made for a very difficult comparative quarter, especially for our Americas business.

…That’s why we invest in warehouse automation. So we’re basically going to lay the groundwork for 2024 to see significant improvements in 2024, even though they’re not there yet.

Martin Hoffmann Co-CEO Reports Fourth Quarter Earnings.

Rising DTC margins are nice, but they still need to spend a lot on marketing, and ultimately revenue growth is what matters most to these valuations and high expectations. We like the product, it’s ubiquitous, it’s clearly gaining traction, and it should still take market share, but we think we’re banking on the fact that the company isn’t taking macro considerations enough. It’s still sold out right now. Investments to provide more supply to customers could worsen the situation if excess demand ends too quickly. An upcoming good growth quarter may not necessarily be a good enough growth quarter for the current On Holding AG stock valuation.