Honeywell’s Winning Strategy: Why You Can Gain More Than 14% Annually (NASDAQ:HON)

Kevin Dietsch

introduction

Honeywell International (NASDAQ:HON) This is a stock I’m starting to focus more on this year as it strives for an impressive turnaround.

The company had no problems. It didn’t grow as fast as it used to. Changes in industry dynamics have necessitated a complete overhaul of business models.

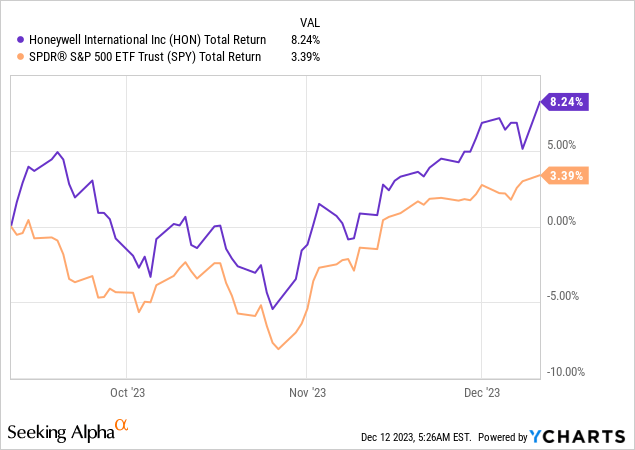

My most recent article on stocks was written on October 16th. Betting on Megatrends: How Honeywell Makes Money. Since then, the stock has returned 9%, outperforming the S&P 500 by about 300 basis points.

Now that the company is making great progress, it’s time for an update.

Since I wrote the article on October 16, the company has announced its third quarter 2023 results, updated investors and analysts on its earnings turnaround, attended the annual Baird Global Industrial Conference, and participated in the multibillion-dollar acquisition of Carrier’s (CARR) .) Security Department.

Well, there’s a lot to discuss, so let’s get started!

Positioning for higher growth

In previous articles, I have highlighted that I am focusing on specific megatrends that companies can address using their existing business models and actually leverage through business improvement.

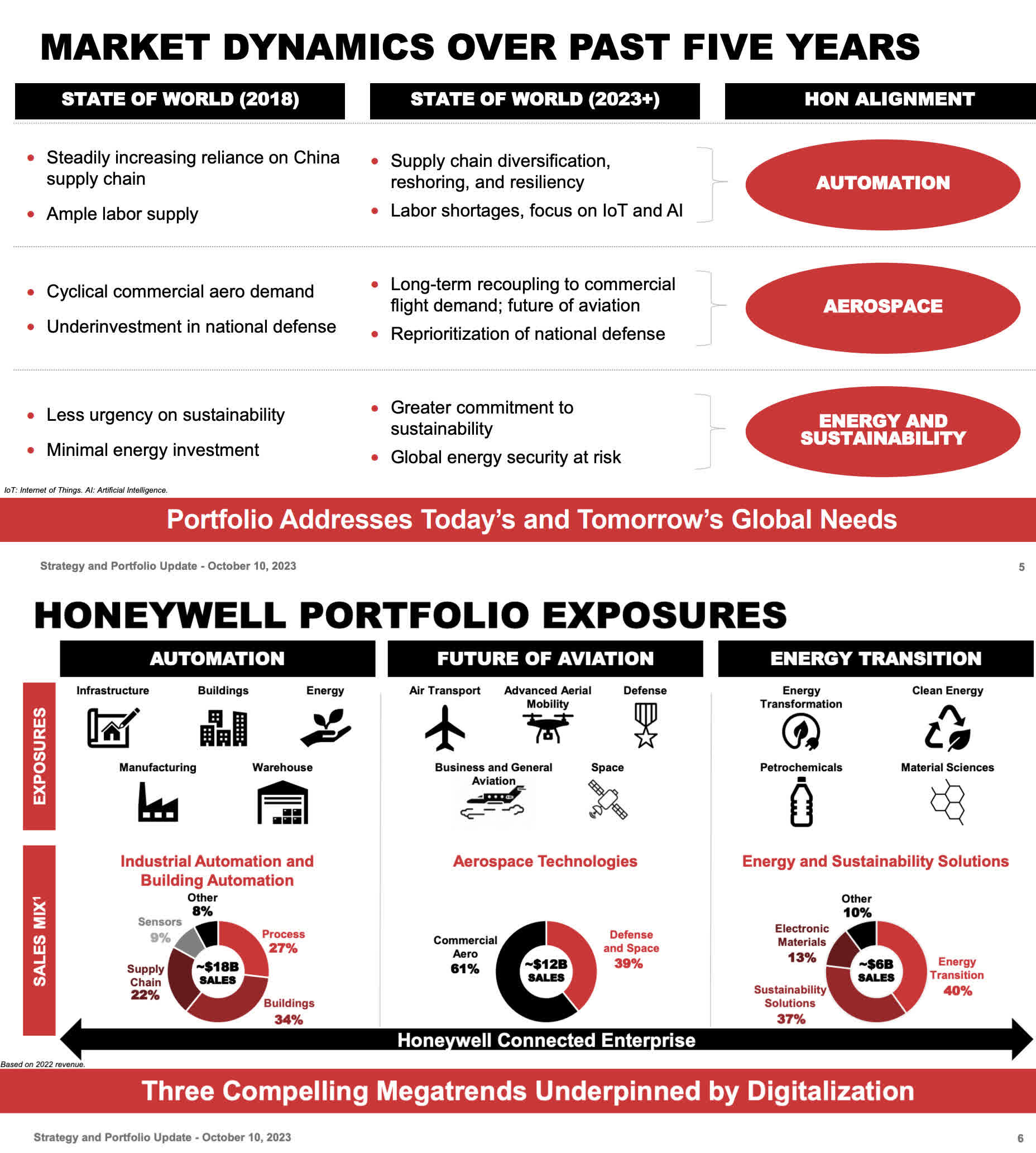

Honeywell International is embracing strategic change to capitalize on three powerful megatrends: automation, the future of aviation, and the energy transition. This reorganization enables HON’s continued growth in line with global market dynamics and long-term trends.

The three megatrends the company is focused on are automation, the future of aerospace, and the energy transition.

Honeywell International Co., Ltd.

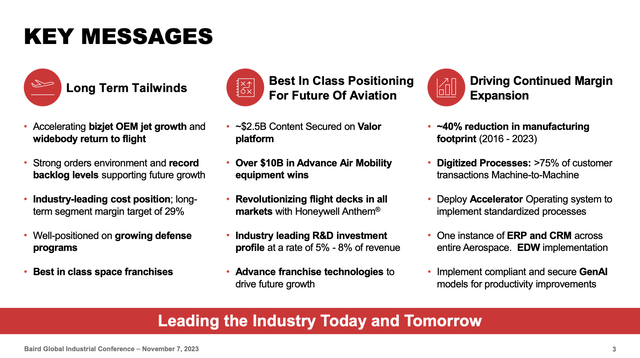

At the Baird Global Industrial Conference, the company detailed its plans.

For example, about 10% of the company’s portfolio does not fit any of the identified megatrends and is unlikely to see major changes like Garrett or Resideo.

In other words, the ongoing portfolio review is not about a radical transformation, but rather about selling off companies that do not meaningfully contribute to shareholder returns.

According to the company, this approach is rooted in its commitment to quality and ensures that companies secure their position in the portfolio by meeting specific indicators and health criteria.

my Industrial Automation (“IA”) In our field, we believe Honeywell is poised for innovation and growth.

The company is strategically leveraging its existing critical assets to define a new vision for IA. In particular, the focus is on identifying synergies in terms of technology and supply chain between companies such as SPS and HPS.

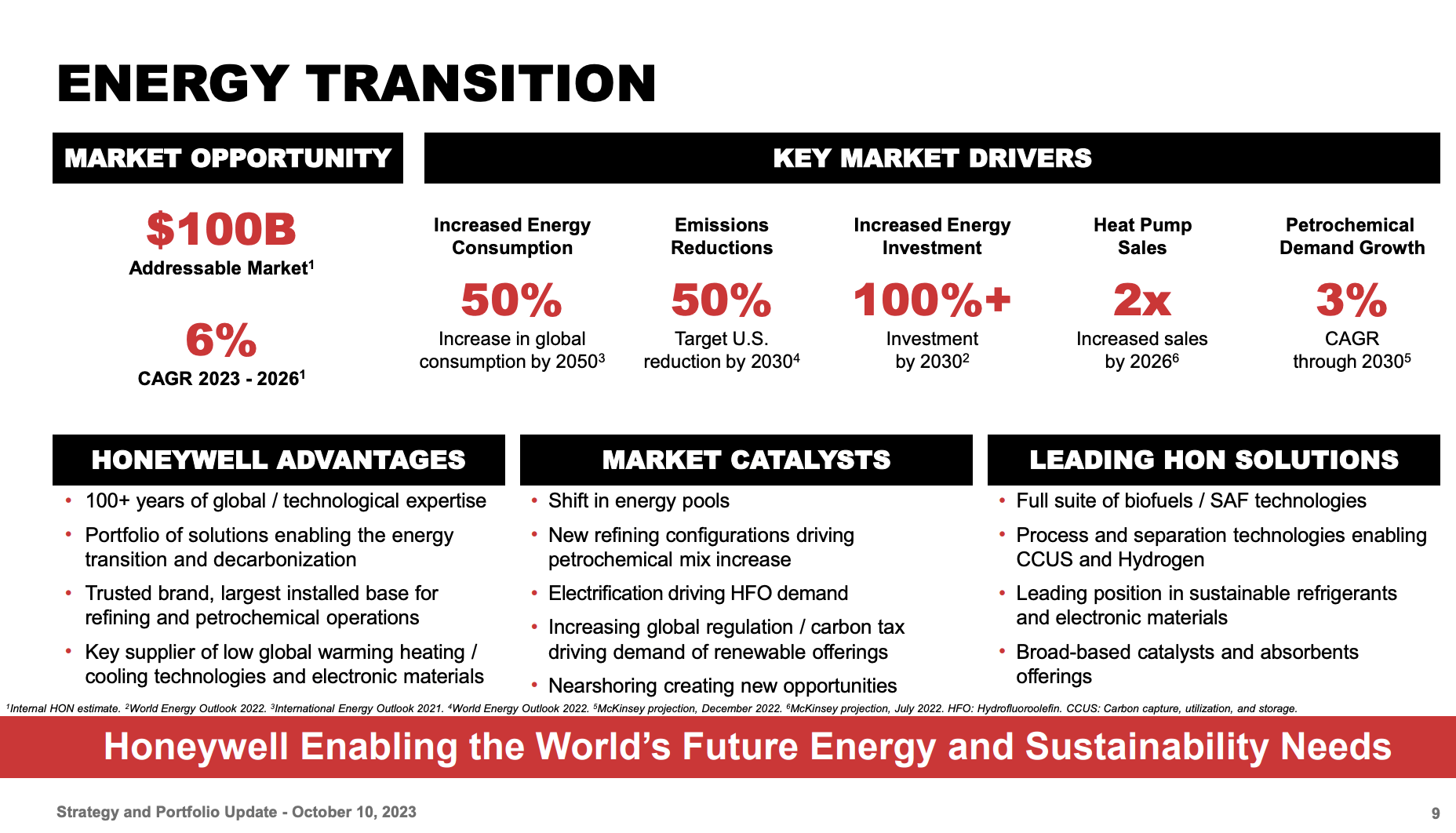

at energy transition In line with the megatrend, Honeywell wants to become more aggressive.

According to the company, it’s not just about adapting to the energy transition. You are actively shaping it.

Honeywell International Co., Ltd.

In particular, the Energy Sustainability Solutions (“ESS”) business through UOP is positioning itself as a key player in this transition. The company recognizes the coexistence of new and new energy, and UOP is expected to grow by approximately 10% in 2023.

At the conference, the company pointed to the expansion of new energy vectors such as biofuels and sustainable aviation fuels, indicating a positive trajectory.

Honeywell aims to achieve $1 billion in revenue from sustainable technology solutions within UOP by 2026.

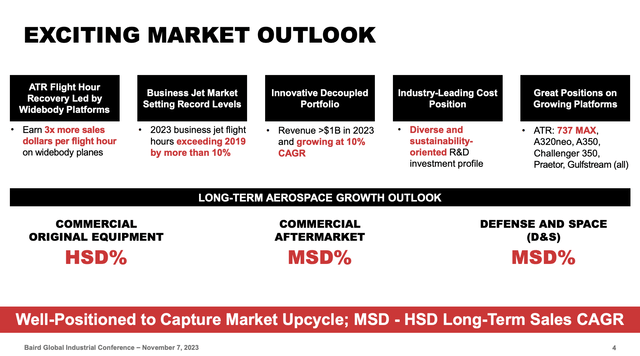

The same optimism can be found in: Aerospace sectorHoneywell remains optimistic as it enjoys strong OE demand and impressive growth in the defense and space sectors.

Honeywell International Co., Ltd.

The company sees urban air mobility as a future growth vector, where it has already achieved significant results.

Investments in programs such as the Bell Valor program and Advanced Air Mobility open significant opportunities for Honeywell. The company has signed billions of dollars in lifetime value contracts, reflecting its strong presence in emerging markets.

The photo below shows part of the Advanced Air Mobility program, a project to grow air mobility on a small scale. This may be the closest thing we have to a flying car.

Honeywell International Co., Ltd.

Over the long term, the company expects mid-single-digit growth in commercial aftermarket sales and defense and space sales. The commercial OE segment is expected to see high single-digit annual growth rates.

Honeywell International Co., Ltd.

When it comes to the defense industry, Honeywell is poised for growth in the defense industry with a book-to-billing ratio exceeding 1.0 and double-digit growth in 2023. This means that new orders are growing faster than the company can produce finished goods. .

According to the company, geopolitical developments and an opening supply base are contributing to demand, creating significant opportunities for Honeywell’s defense-related products and services.

In the third quarter, Honeywell’s defense segment performed strongly, achieving organic growth of 18%.

This growth marks a significant inflection point, with orders increasing by more than 30% for the second consecutive quarter.

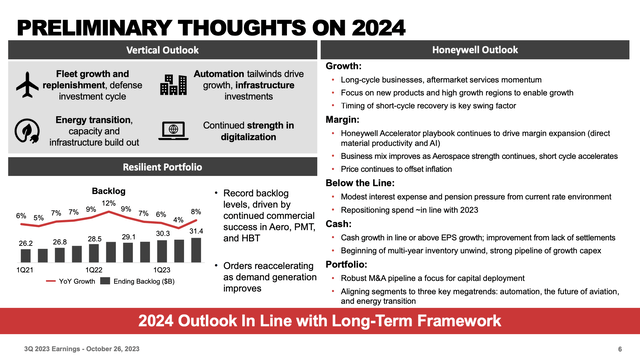

Based on all these developments, the company is not only optimistic about the long term, but also expects strong revenue growth for the remainder of 2023 and 2024.

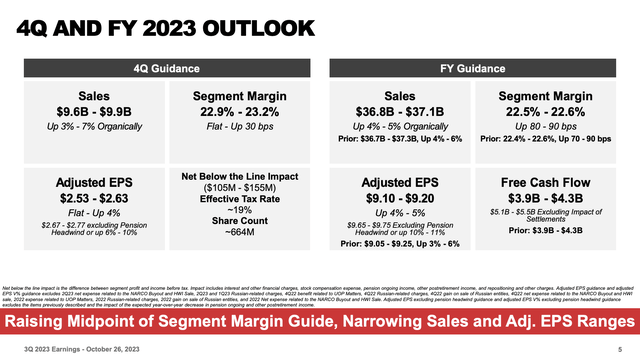

Fourth quarter revenue is expected to be between $9.6 billion and $9.9 billion, representing organic growth of 3% to 7%.

Full-year revenue guidance was adjusted to a range of $36.8 billion to $37.1 billion, representing organic growth of 4% to 5%. Segment margin expectations also increased to a range of 22.5% to 22.6%.

Honeywell International Co., Ltd.

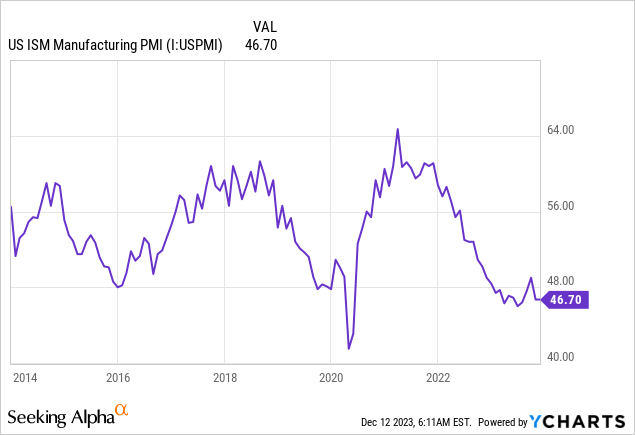

These figures are impressive considering the growing pressure on industrial companies due to slowing economic growth. This is evident in the prolonged decline in the ISM Manufacturing Index, which indicates a decline in demand for almost the entire year of 2023.

While acknowledging the volatility of the macro environment, the company expressed confidence in its favorable end-market exposure in its 3Q23 earnings call, particularly in the aerospace and energy sectors.

Organic growth in 2024 is expected to be led by long-term cycle businesses based on new product innovation and digitalization efforts.

The company also expects continued improvements to its supply chain to provide a strong foundation for growth in 2024.

Honeywell International Co., Ltd.

Moving on to the next part of this article.

Honeywell’s M&A

In a special analyst call earlier this month, the company noted that it is strategically focused on bolt-on acquisitions with the goal of creating synergies that complement its existing business lines and enhance its overall growth and competitiveness.

For these additional acquisitions, Honeywell has set an enterprise value range of between $1 billion and $7 billion, indicating a preference for deals that are impactful but not transformative.

Honeywell has explicitly stated that it is not actively pursuing innovative M&A.

On December 8, the company officially pulled the trigger. Or at least that’s when the deal was announced to acquire Carrier’s security business for $4.95 billion in cash. The article also discussed this deal from Carrier’s perspective.

bloomberg

According to Honeywell, it is paying 13x 2023E EBITDA multiple for the business, which is expected to be in line with the megatrend of automation underpinned by digitalization.

This acquisition, which includes both hardware and software solutions, further supports Honeywell’s recently announced plan to align its portfolio with three powerful megatrends: automation, the future of aviation, and the energy transition, with strong digitalization capabilities and solutions. The Global Access Solutions business will strengthen Honeywell Building Technologies’ business model of leading high-value products essential to buildings.

While the company believes this deal will accelerate innovation (and I agree), UBS argues that the company is paying “highest multiples for the peak of non-residential construction activity.”

I agree with this and believe that the winner of this deal is Carrier. Selling this business at 13x EBITDA at this stage of the business cycle was a smart decision.

Honeywell stands to profit handsomely from this deal, but may have overpaid a bit due to the timing.

The transaction is expected to close by the end of the third quarter of 2024.

Bloomberg reports that the company is likely to use cash (instead of debt), as it had $7.8 billion in cash (and cash equivalents) as of September 30.

$1.15 billion of debt matures in 2024, followed by $1.25 billion in 2025.

The net leverage ratio is close to 1.0 times EBITDA and the credit rating is A.

evaluation

Honeywell is taking the right steps, and analysts are incorporating them into their models. This makes the valuation attractive.

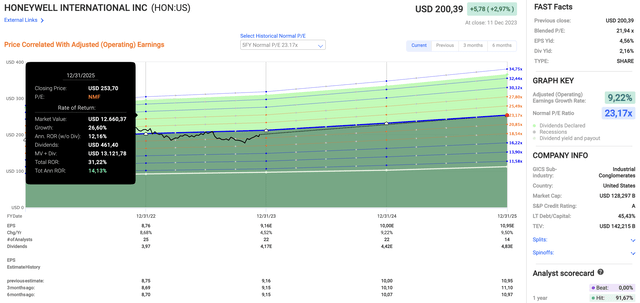

Using the data in the chart below:

- HON is trading with a blended P/E ratio of 21.9.

- The standardized valuation multiple for the past five years is 23.2 times. Although this is higher than the 20-year average enterprise value of 17.7 times, we believe it better reflects the company’s growth potential.

- EPS is expected to increase by 4.5% this year. This figure is expected to increase to 9.2% next year and 9.5% in 2025.

- If the company’s value gradually increases to 23.2 times, reflecting the expected growth rate, it can generate an annual return of 14% until at least 2025.

- Since 2002, HON stock has returned 12.2% per year. This includes the dividend, which currently yields 2.1%.

FAST graph

As I always say, a 14% annual return is not guaranteed. This is especially true if a recession occurs in 2024 or 2025.

However, analysts are buying the company’s transition to faster growth, which makes its current valuation attractive.

If you don’t already have that much exposure to aerospace (>25%), you might be an incremental buyer of HON stock. Not only are HON stock’s growth expectations very impressive, but they are also supported by an established business that is developing successfully.

takeout

Honeywell’s strategic focus on key megatrends, including automation, aerospace, and the energy transition, positions the company for strong long-term growth.

Recent moves, such as the acquisition of Carrier’s security division, are consistent with its commitment to digitalization and strengthening its portfolio.

Despite concerns about economic weakness, the company’s optimistic outlook, strong defense performance, and disciplined approach to acquisitions contribute to an attractive investment case.

With a strong balance sheet and attractive valuation, Honeywell appears well-positioned for continued success, making it a notable stock in an evolving industry landscape.