Hong Kong may allow staking for spot Ethereum ETFs starting this year: Animoca co-founder

Animoca Brands Chairman Yat Siu said Hong Kong asset managers were working to include staking in their spot ether exchange-traded fund, hoping the staking rewards feature would be approved this year.

Hong Kong is “currently in discussions,” Siu told The Block in an interview.  ETH

ETH

-1.22%

He stated that the possibility of ‘staking’ being approved in Asia rather than the United States is ‘almost a foregone conclusion.’

“As for how fast, there is an optimistic side to hoping it will happen within the year,” Siu said. “I would say that unless there is a big movement in annual staking, the election results will be another determining factor in how quickly that could happen in the United States.”

HashKey, which co-manages two spot Bitcoin and Ether ETFs in Hong Kong with Bosera, is formalizing its proposal to introduce Ether staking. “We have put together a plan to reap the rewards without increasing the risks,” said Livio Weng, CEO of HashKey Exchange, adding that details were under discussion and could not be disclosed.

“We hope to conduct some exploration into this area (Ether staking) in a compliant and controlled manner without increasing risk,” Weng said.

Blockchain infrastructure provider Blockdaemon is also in discussions with Hong Kong ETF issuers and custodians to explore the possibility of offering staking services for ETFs, according to Glenn Woo, Blockdaemon’s head of APAC sales.

“Based on discussions with participants, issuers, VATPS (and) custodians this week and last week, we all have a positive outlook in terms of obtaining approval for Ethereum staking,” Woo said.

Woo added that industry players are aiming to approve the staking feature within the year. “Because this is the biggest missing piece and there seems to be a consensus that this is the missing piece.”

“We are very hopeful that this will become a reality soon,” said Woo, explaining that Blockdaemon already offers staking services for some European exchange-traded products.

Hong Kong’s Securities and Futures Commission did not immediately respond to The Block’s request for comment.

How competitive is Hong Kong?

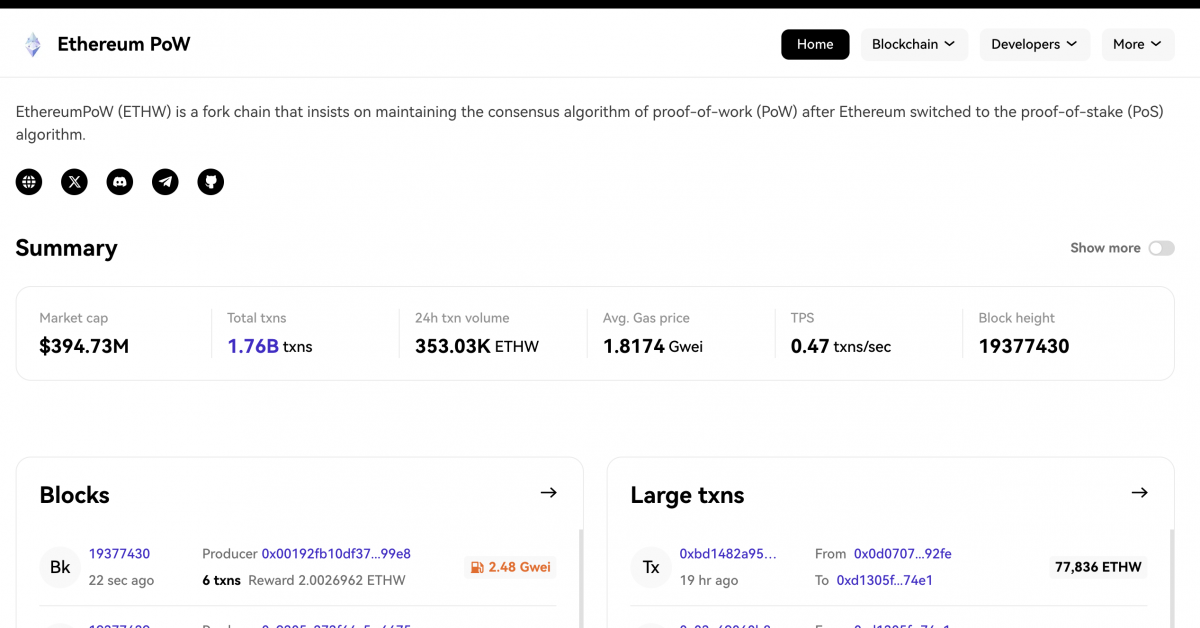

Despite the initial hype surrounding Hong Kong’s spot cryptocurrency ETFs, their performance has been relatively disappointing compared to their US counterparts.

The three Hong Kong spot Bitcoin ETFs are said to have recorded a total daily trading volume of $6.08 million on Thursday, following $2.24 million on Wednesday and $1.96 million on Tuesday. The Block’s Dashboard. In comparison, the 11 spot Bitcoin ETFs in the U.S. Total trading volume: $1.42 billion on Thursday, following Wednesday’s $2.09 billion.

“We agree with the premise that Hong Kong should be able to grow bigger due to the fact that it can attract buyers from both the East and the West,” said Animoca’s Siu. “But you have to be competitive. “Prices should be at least the same, if not lower, than American products.”

As the U.S. Securities and Exchange Commission (SEC) has made clear, the potential for staking rewards could give Hong Kong spot Ether ETFs a competitive advantage over their U.S. counterparts. not allowed Such functionality is possible, at least for the time being.

“If you can stake, you have an advantage, so this can be a competitive advantage,” Siu said. “I think of this as baby steps, first steps. Now the industry needs to push other areas to open it up. I believe staking could be Hong Kong’s biggest differentiator.”

Blockdaemon’s Woo has similar views to Siu on investor interest. “The lack of staking features is preventing many potential Ethereum ETF buyers from participating,” Woo said. “The potential opportunity cost of 3 to 4 percent is quite large.”

Representative Woo explained that the Hong Kong government is also aware of the gap. “There is a push from the Hong Kong government and regulators to get things done faster,” he continued. “I would say that education and (the potential of ETF issuers) staking strategies need to be well communicated to regulators.”

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.