Horizon Technology Finance: When Returns Don’t Justify the Risk (NASDAQ:HRZN)

designer491

Horizon Technology Finance (NASDAQ:HRZN) is a relatively small BDC that focuses on lending activities to VC-profiled companies.

In accordance with HRZN’s investment policy, the following criteria are applied when considering new investments.

- Transaction size up to $50 million

- Transaction term based on 3-5 year period with meaningful interest only.

- Priority interest over equity and unsecured debt.

What immediately comes to mind when looking at the investment criteria mentioned above is that HRZN does not appear to follow a conservative investment underwriting process.

For example, it does not focus on predictable cash generation, non-cyclical industries, or other aspects related to prudent fundamental conditions.

However, this is not much of a surprise as HRZN’s primary target segment is mostly early-stage growth companies backed by VC players.

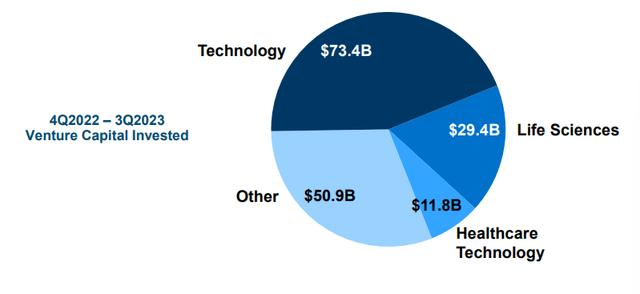

HRZN Investor Briefing Session

The current HRZN portfolio split illustrates this situation very well. That said, the largest share of HRZN AuM is in sectors that are speculative in nature, such as life sciences, technology, medtech, etc. The speculative nature is further enhanced by the fact that the underlying companies are still in the early stages of development and often require cash injections. Or a loan to close the gap in cash generation until a new breakthrough is achieved.

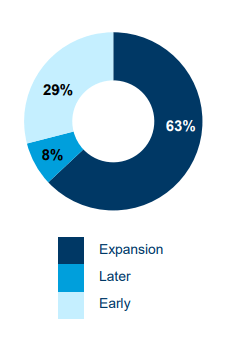

HRZN Investor Briefing Session

As of Q3 2023, only 8% of companies that had raised funds from HRZN were classified as a ‘later stage’ profile, which typically shows some pattern of cash flow neutrality.

Nearly a third of the portfolio is still at a stage where significant funding is needed, and it is unclear whether the company will be able to realize a successful go-to-market strategy. That said, about one-third of HRZN’s portfolio is speculative by definition.

The remaining 63% of exposure consists of businesses that require capital to accommodate growth. It is important to note here that in most cases, growth is needed to achieve economies of scale benefits so that the fixed cost base is offset by sufficient levels of revenue to ensure positive underlying cash flow. What this means is that these companies implement a small margin of error. This means that a slight deviation from the projected growth plan may require additional equity injections or more expensive debt financing to sustain the business until cash flow (or margin) targets are achieved. Attainment.

In terms of external leverage, which is an important part of any BDC’s business, HRZN has a relatively debt-saturated balance sheet. As of Q2 2023, HRZN’s leverage profile has reached 1.2x, which could be categorized more on the aggressive side of a typical BDC player.

Due to its increased risk exposure, HRZN has one of the highest debt portfolio yields in the industry (according to CEO Rob Pomeroy on the most recent earnings call).

The 17.1% debt portfolio return again generated one of the highest debt portfolio returns in the BDC industry, continuing to validate our investment structure with floating rates in a rising interest rate environment.

proposition

In my opinion, the additional risks associated with the nature of the business that HRZN funds make this not an attractive BDC to consider. The risk-to-reward ratio is off, so the return potential doesn’t seem to justify the risk.

Let me explain.

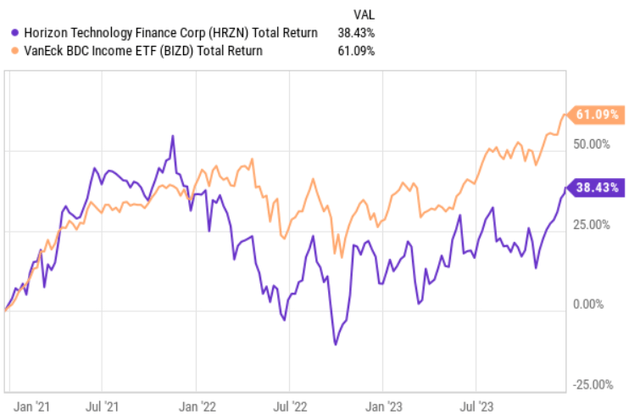

Y chart

First, despite market conditions being very favorable to BDCs, HRZN lagged significantly behind the overall BDC space. So even during periods of strong industry-level tailwinds, when more “risk-taking” BDCs should have outperformed their more conservative counterparts, HRZN underperformed.

Looking at HRZN’s current dividend yield, we can also see that it would be rather difficult for the fund to deliver a return of around 17% to investors. HRZN’s current yield is just 10%, which is below the industry average (~11.5%).

The main reason for this is the low quality of the investment portfolio. As detailed above, the noticeable bias goes towards companies that are somewhat speculative and, for the most part, burning cash.

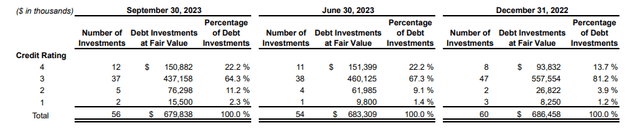

Third Quarter 2023 Financial Results

The table above is a perfect example of this.

HRZN’s portfolio quality has been steadily deteriorating since late 2022. For example, only 5.1% of HRZN’s investments were classified as financially distressed with a high likelihood of capital impairment as of the end of 2022 and currently in the third quarter of 2023. , that figure increased to 13.5%.

This is important not only in terms of rate of change, but also in the context of the overall portfolio.

Even the company’s president, Jerry Michaud, acknowledged the structural difficulties of HRZN’s investment during its third quarter earnings call.

VC activity levels remain significantly stressed as VC investments in new portfolio companies made in 2021 and the first half of 2022 are significantly overvalued in the current economic market. As a result, the ability of VC-backed companies to raise new capital can be challenging. With a virtually closed IPO market and a muted M&A market, it is becoming increasingly difficult for VC-backed technology and life sciences companies to raise the capital they need to fund operations and growth.

conclusion

Overall, HRZN is exposed to several adverse risk factors beyond the already somewhat high risk factors for a typical, standard BDC.

For HRZN, there is a huge concentration of VC profiled companies, many of which are not in a position to generate cash flow in a sustainable way and therefore rely on private external funding. This strategy is effective in an era of low interest rates and an environment where M&A and IPO markets are active. Now that overall financing conditions have tightened, the prospects for many early-stage, cash-burning companies have weakened significantly, making their financial outlook more speculative.

Given HRZN’s relatively unattractive returns (especially in the context of its underlying risk levels) and the very unfavorable trends in portfolio quality, I would avoid investing in HRZN.