Hot CPI report could be a big problem for the market

Pavel Murabev

Another popular CPI print from March buried interest rate cut talk. The March CPI and Core CPI reports showed 0.4% m/m compared to estimates of 0.3%. Meanwhile, the headline CPI was 3.5% year-on-year, higher than the 3.4% expected, with key items including: At 3.8% y/y, it’s hotter than the estimate of 3.7%.

Beneath the surface, it is clear that the disinflationary process we saw in the second half of 2023 is over. Core CPI rose 4.5% three-monthly and 3.9% six-monthly. Both of these values are up compared to last month, but bottomed out a few months ago.

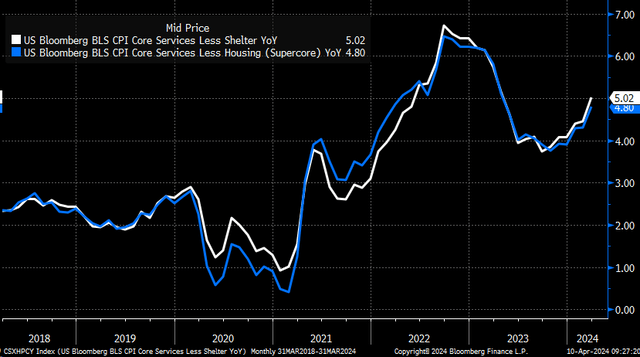

bloomberg

Meanwhile, CPI Supercore and Unsheltered Core Services also rose sharply during the month, both up 0.7% m/m, up from 0.5% in February. This increased Supercore’s year-over-year change from 4.3% to 4.8%. Fewer shelters increased from 4.5% to 5%.

bloomberg

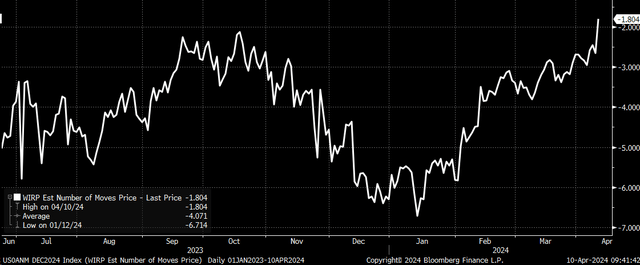

Fewer cuts, higher interest rates, stronger dollar.

The trend isn’t great, and the possibility of a rate cut is fading, with federal funds futures pricing in less than two rate cuts in 2024 and the federal funds rate sitting at 4.89%. At this point, it seems ridiculous to see markets in January pricing in nearly seven rate cuts from the Fed in 2024.

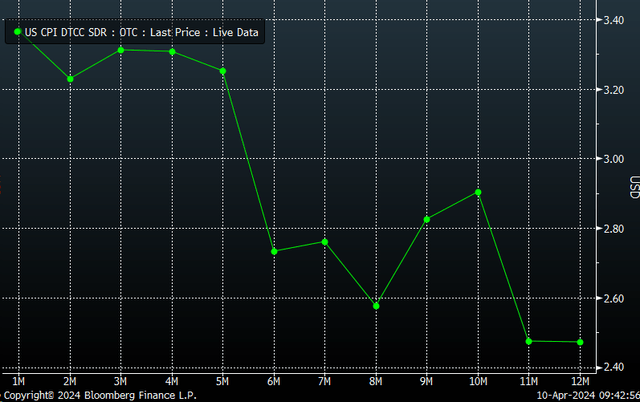

bloomberg

This is not a real problem; expectations for CPI in April, May, June and July are likely to be higher. Those expectations were already high, with CPI expected to be around 3.2% through July. These expectations are likely to rise as most data now points to an acceleration in inflation over the past few months.

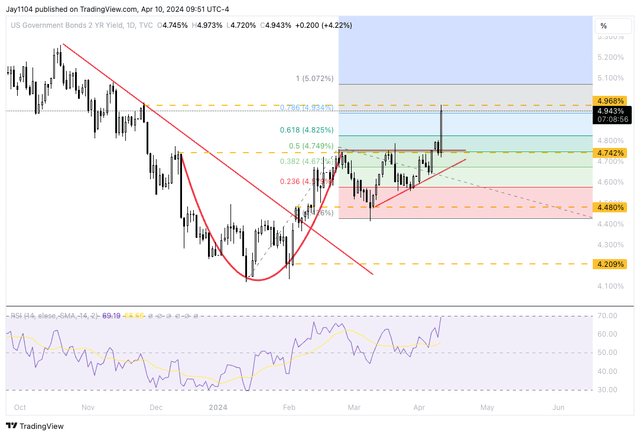

bloomberg

Accordingly, the two-year interest rate soared, rising by about 20bps to 4.95% and then approaching the 5% level again. If interest rate cuts continue to be priced in, they are likely to exceed 5% over a two-year period. A two-year technical pattern that looks like a cup-and-handle pattern suggests interest rates could go higher, and this is what we are seeing today.

TradingView

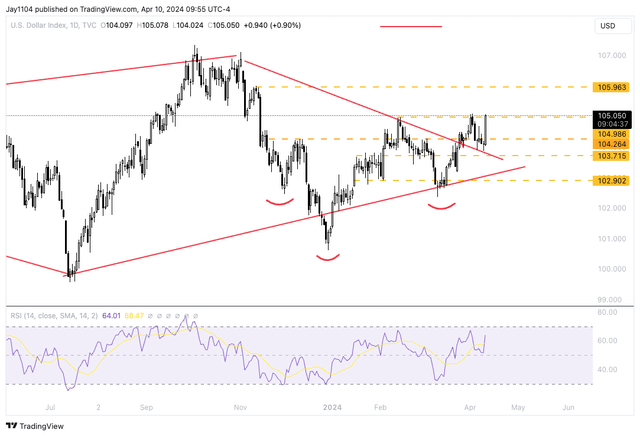

This also caused the dollar index to surge, rising back to 105 and approaching the critical resistance level of 105, which has been tested twice before. However, this time, momentum and the possibility of the dollar index rising beyond the 105 level to the 106 level appear to be prevailing.

TradingView

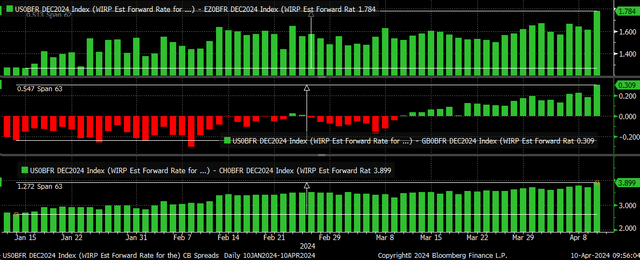

The dollar is likely to continue to strengthen as the spread between the monetary policies of global central banks widens in its favor. As the market adjusts to the number of rate cuts by the Federal Reserve compared to the ECB, BOE and SNB and these spreads widen, it will be beneficial for the dollar.

bloomberg

You need to strengthen your financial situation

Ultimately, given the unfavorable trends, what needs to happen now is for markets to adjust to the number of rate cuts the Fed is likely to deliver, as well as tighten financial conditions. The easing of financial conditions that began in December ultimately brought us back to an era of hot inflation, and the current financial conditions must correct that error.

bloomberg

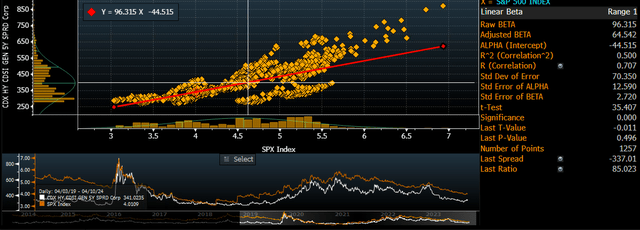

This means credit spreads should now start to widen, which would be problematic for stocks since most of the gains in the S&P 500 over the past few months have come from easing financial conditions. P/E multiples expand. However, now that credit spreads are starting to widen, multiple contracts are likely to occur.

If the CDX High Yield Index returns to its pre-FOMC meeting level of 400 in December, the S&P 500’s current earnings yield could rise to about 4.6% from its current 4%. This equates to a decline in the P/E ratio of approximately 13%, from approximately 25 to 21.8. That would push the S&P 500 back into the 4,450-4,500 range, which may be a conservative view.

bloomberg

In many ways, it was not the Fed that created this acceleration in inflation. It is the market that created it. If monetary policy works through financial conditions, then financial conditions become too loose, essentially loosening the Fed’s policy. The Federal Reserve failed to solve the problem by signaling at the December FOMC meeting that interest rates would be cut while at the same time not opposing easing financial conditions. But now that it’s clear that fears of accelerating inflation have now become a reality while oil prices are trading at the low end of a two-year range, something has to give.