How the Fed’s interest rate moves could affect various sectors of the stock market in 2024

Wall Street seems to agree that U.S. stocks will hit new all-time highs in 2024. But the most important question for investors may still be the direction and speed of interest rate movements.

Interest-rate sensitive stock groups with weaker fundamentals, such as financials, utilities and staples, “could perform better at least early in the year” if they expect interest rates to “fall quickly and permanently,” Nicholas Colas said. ., co-founder of DataTrek Research.

But “if rate increases are expected to be larger,” powerful groups such as technology and technology-related sectors “must do better,” Colas said in a note to clients on Monday.

The S&P 500’s Utilities, Consumer Staples and Energy sectors have been the worst-performing parts of the large-cap benchmark index so far in 2023, according to FactSet data.

The S&P 500’s Utilities sector XX:SP500.55 is down more than 10% year-to-date, significantly underperforming the broader index’s 23.6% gain in SPX.

The S&P 500’s best-performing Information Technology sector XX:SP500.45 is up 56.5% over the same period. However, the Consumer Staples XX:SP500.30 and Energy XX:SP500.10 sectors are down 2.6% and 4.1%, respectively, so far this year, according to FactSet data.

Utilities and consumer staples are generally considered defensive investment sectors, or “bond proxies.” This is because it can help investors minimize stock market losses during an economic downturn. Companies in these sectors typically provide electricity, water, gas, or sell products and services that consumers buy on a regular basis regardless of economic conditions.

But utility and consumer staples stocks have been under a lot of pressure this year. The persistent rise in U.S. Treasury yields in October made defensive stocks less attractive than government bonds or money market funds offering 5%. Especially as the economy remains strong and expectations of a recession grow.

Colas expects the “weaker group” to see a stronger tailwind if interest rates continue to fall.

see: Markets are declaring Powell’s victory over inflation, and some economists are worried.

Last week, the yield on the 10-year Treasury note BX:TMUBMUSD10Y posted its biggest weekly decline in a year after the Federal Reserve signaled a switch to rate cuts in 2024, helping the S&P 500 record its longest weekly winning streak since 2017. This has been done.

The S&P 500’s Utilities and Consumer Staples sectors rose 0.9% and 1.6%, respectively, last week, while the Information Technology sector fell 2.5% and the Communications Services sector fell 0.1%, according to FactSet data.

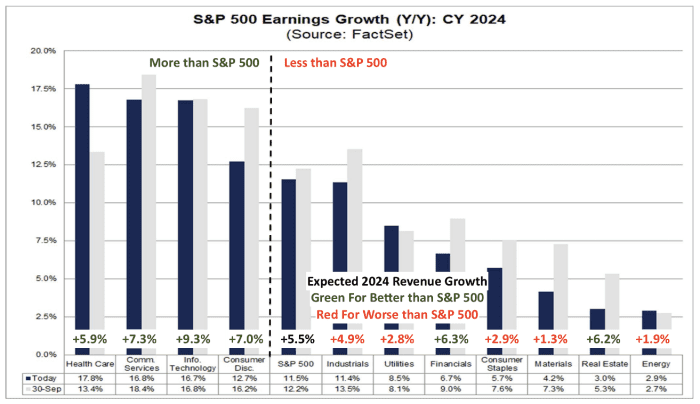

Earnings growth expectations for each S&P 500 sector in 2024 are shown below. Sectors to the left of the black dotted line are expected to show better earnings results than the S&P 500 as a whole, while sectors to the right are expected to show weaker earnings growth.

Source: FACTSET, DATATREK study

Wall Street expects S&P 500 earnings per share (EPS) to rise 11.5% to $244 next year and revenue to rise 5.5%, according to FactSet data.

However, there is wide dispersion across S&P 500 sectors. The range ranges from 2% revenue and 3% revenue growth for the Energy sector to 9% revenue and 17% revenue growth for the Information Technology sector, according to data compiled by DataTrek Research.

“So playing fundamentally weaker sectors means a lot more good news in terms of interest rates,” Colas said, adding that it was still riskier than sticking to “tried and true groups” like technology.

Moreover, sectors like Utilities, Financials, and Consumer Staples aren’t expected to see 10% revenue growth next year, while groups dominated by Big Tech, like Healthcare and Communication Services, Technology, and Consumer Discretionary, are expected to post much better than average earnings. is expected to show. Colas forecast revenue growth in 2024, citing FactSet data.

U.S. stocks closed higher on Monday, with the Dow Jones Industrial Average DJIA hitting a record high last week. The S&P 500 rose 0.5% and the Dow industrials closed slightly higher. Nasdaq Composite COMP rose 0.6%, according to FactSet data.