How to profit from a bullish gap down reversal | MEM edge

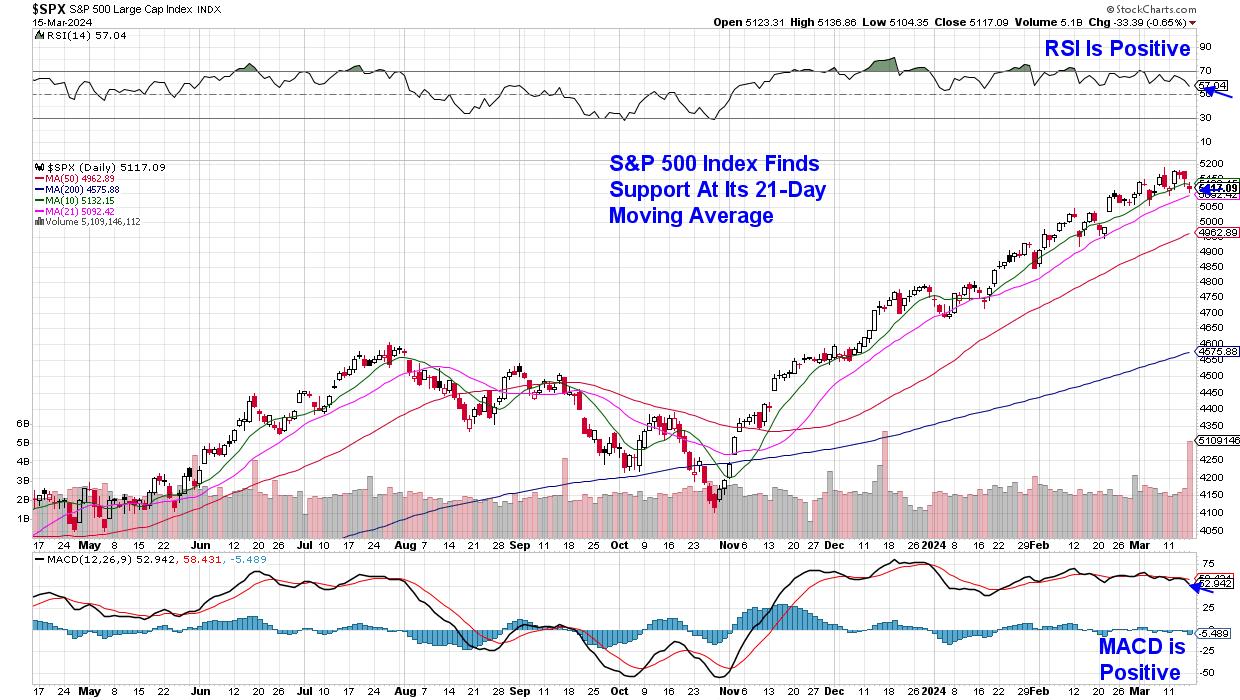

The S&P 500 ended the week on a slight decline, with the index closing below its key 10-day simple moving average but above its 21-day simple moving average. The short-term upward trend of this index remains intact as both RSI and MACD are in positive territory. Last week’s orderly price action is consistent with the four other nominal declines we’ve seen so far this year, but there was plenty of turbulent price action beneath the surface as investors reacted sharply to several high-profile companies following the announcements. Earnings Report.

S&P 500 Index Daily Chart

S&P 500 Index Daily Chart

Many of you who follow my research will know that I am very bullish on post-earnings price differentials. This is because it often follows a period of consolidation to absorb large gains, leading to further rises. A representative example is Shake Shack (SHAK), which experienced a price gap after reporting strong earnings in mid-February, causing the stock to break out of its base and enter an upward trend. SHAK was part of my MEM recommended holding list right before launch and remains on my buy list as it is trending upward.

Today we’ll focus on stocks that gapped down after earnings but continue to gap down. These stocks usually have more work to do before entering a new upward trend. However, short-term investors can take advantage of reversals by using appropriate intraday charts to guide their entry.

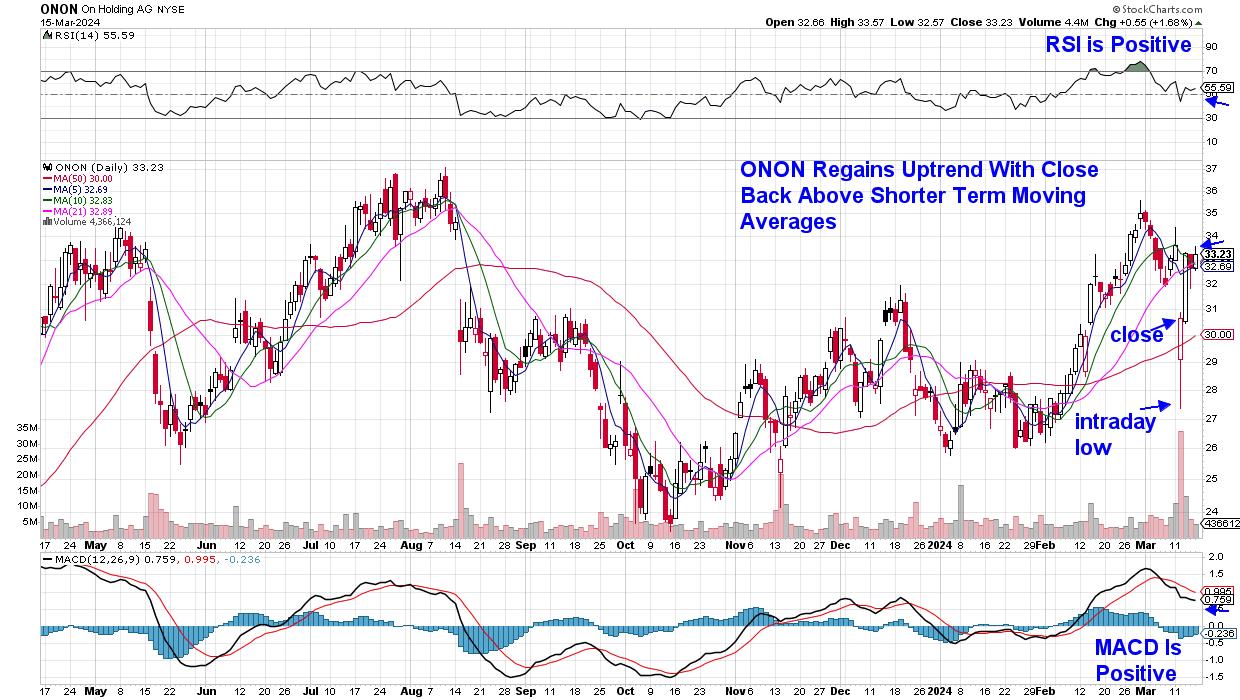

Let’s look at Swiss shoe company ONHOLDING (ONON). Shares fell 18% on Tuesday after reporting lower-than-expected earnings. As you can see in the daily chart below, investors came into the bear market and ended the day down 8%. The stock continues to trend higher and ONON is currently on an upward trend.

On Holding (ONON) daily chart

On Holding (ONON) daily chart

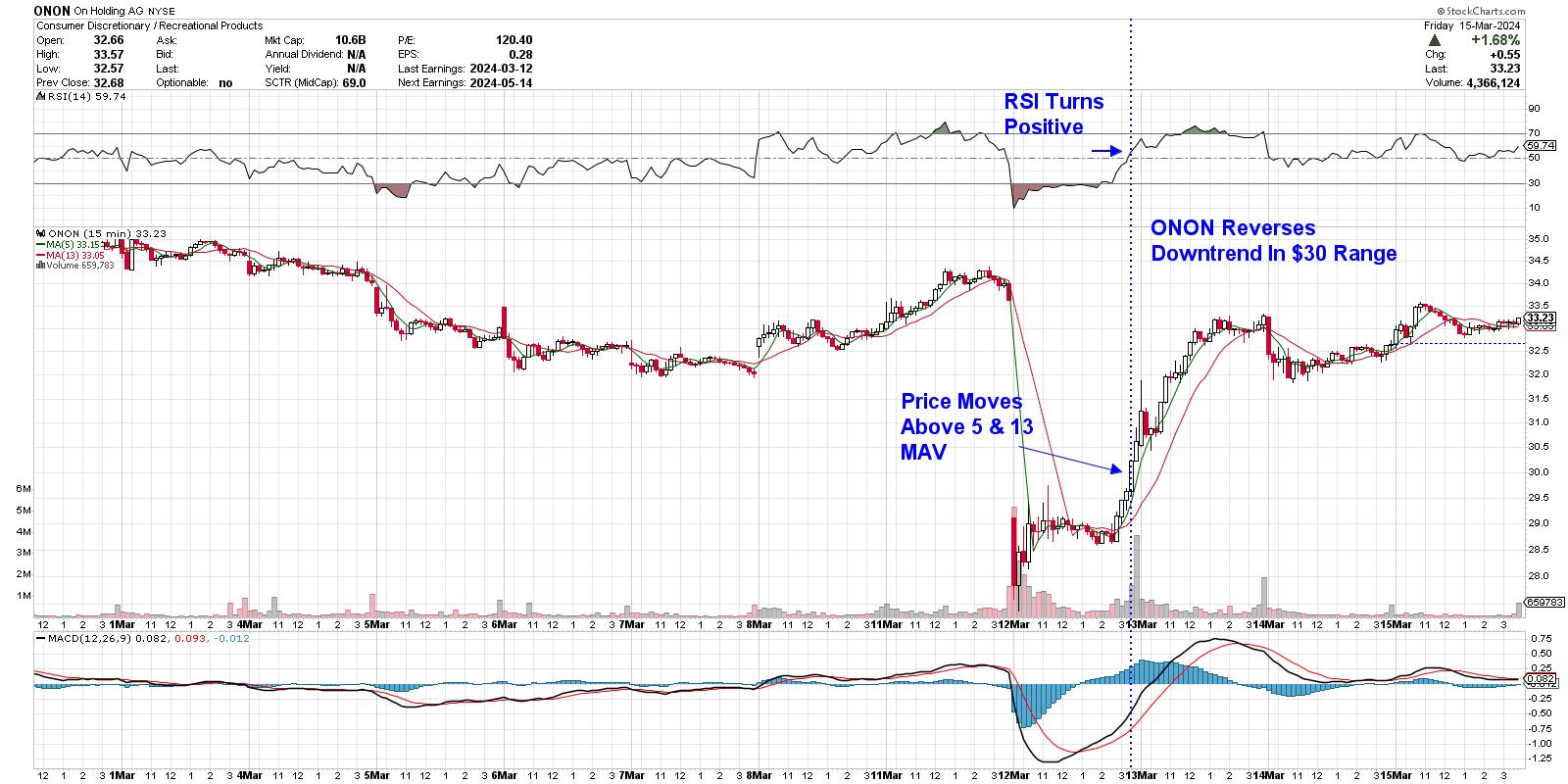

As investors begin to buy stocks on the downside, short-term investors will want to watch the 15-minute/intraday charts carefully. Using the same indicator as the daily chart, the first positive signal would be a close above the 5 and 13 simple moving averages. From here, we can watch to see if the upward trend is confirmed as RSI moves above 50 and into positive territory. For ONON this occurred in the $30 range. Both signals must remain the same for the trade to hold, in which case you would have made a 10% profit.

Onholding (ONON) intraday/15-minute chart

Onholding (ONON) intraday/15-minute chart

As mentioned earlier, the broader market is trending upward and, while constructive, the technology sector is close to turning negative after several heavyweight sectors came under selling pressure last week. Those who want insight into what is happening in the leadership areas of the market can try the MEM Edge report twice a week for 4 weeks for a small fee using this link here. You will also receive information regarding rotations occurring elsewhere in the market and alerts on reversals in the current market uptrend.

warmly,

Mary Ellen McGonagle

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more