I-80 Gold: Down But Not Going Away After 2023-24 Dilution Disaster (TSX:IAU:CA)

Klaus Wedfeld

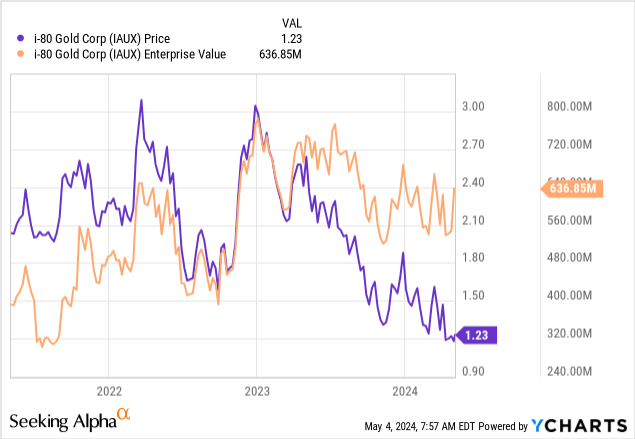

I suggested ~ i-80 gold co., Ltd. (New York Stock Exchange:IAUX) I bought it here in December 2022 for $2.70 per share as a buy idea. My optimistic forecast was based on a series of positive exploratory exercise results. Very strong momentum nature of Nevada gold assets and stock trading. Well, despite a significant rise in gold/silver bullion over 2023-24, the current stock price of $1.23 represents a -55% loss on your investment.

Management has not been able to put enough ounces into production to offset excessive capital spending rates, and drilling new resources costs money. Ultimately, additional ownership shares were issued to find capital to offset operating losses (versus the worse option of borrowing money at high interest rates).

The good news is that overall fundamental values for gold/silver resources are rising along with precious metals. price. Management is seeking a joint venture partner to fund mine construction, and sufficient capital currently exists for continued drilling and asset development in 2024.

Actually, I’m liking chart trading patterns more and more these days. The focus appears to be on a better balance of stock supply versus demand, as higher gold/silver prices are likely to result in higher IAUX in the future. Based on my long-term bullish outlook for precious metals and improving technical trading activity in i-80, I repurchased shares for the first time in months. Let me explain why.

negative dilution effect

What’s wrong? The main answer is that new shares have been issued to keep exploration and development activities moving in the right direction. In its second issuance effort in 2024, the Company completed the offering of an additional 69 million shares of common stock (including an additional 34 million shares of warrants to limit upside for existing shareholders) to fund ongoing operations. There are now more than 384 million shares in existence, compared to 240 million shares “outstanding” in December 2022, which would reduce the pro-rata ownership of gold per unit by 60% over 15 months (this includes exercisable shares). Warrant effects that may occur are not included). If you want to get additional shares at a higher quote). A total of up to 110 million additional shares could be issued through the exercise of options, warrants and convertible notes at fully diluted amounts, potentially adding more than $300 million in net cash to the balance sheet.

Yes, the gold and silver resources in the ground still exist, and the company’s total enterprise value (equity + debt – cash) has barely changed, but we are now dividing ownership among a larger pool of investors. This is how small miners stay in business. This is a situation where significant revenue is not part of the equation and is essentially diluted or killed. In the case of IAUX, the company’s valuation has actually increased slightly over the past three years. That’s because the market believes the company’s gold reserves and resources are worth more in a rising precious metals environment.

YCharts – i-80 Gold, stock price and corporate value, 3 years

As highlighted in the IAUX experience, stock dilution is the biggest enemy of junior miners (i-80 produces a small number of gold ounces) and investors in exploration bets. To maintain the current share price level or profit from the quote, either new metal resources must be discovered to offset the increasing share count, or the price of gold/silver must rise enough to attract new investors to buy at the increasing fundamental value. A story about reserves/resources (if and when they were mined).

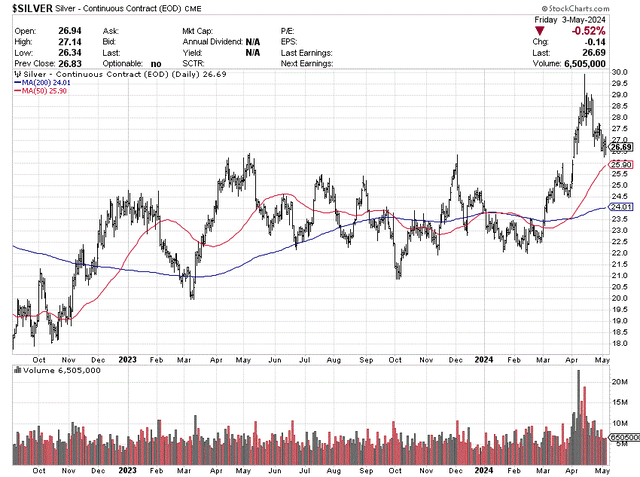

Gold/Silver Assets Didn’t Go Anywhere

Despite the stock market crash, our core bullish investment argument for having safer Nevada gold and silver resource assets in the ground has not changed. I have a target for over US$3000 ounces of gold. In a few years, silver is likely to trade for between $50 and $100 USD. area. I believe foreign central bank purchases of gold, especially Chinese gold, will increase from early 2024, something I discussed in an article last September. Additionally, silver is poised to rise faster than gold starting in 2020 due to supply shortages, with demand for solar panel manufacturing expected to surge in the coming years.

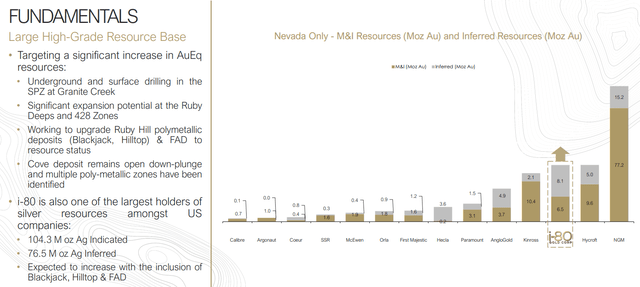

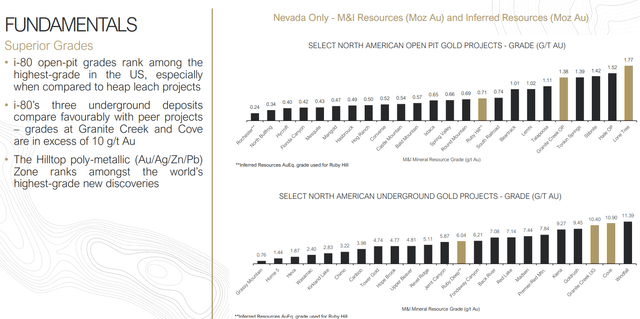

The quality and scale of IAUX assets are also worth serious consideration. The only real question is how to ramp up production quickly and at what cost to the business and shareholders.

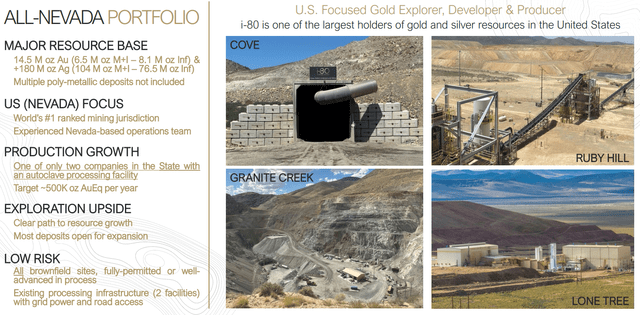

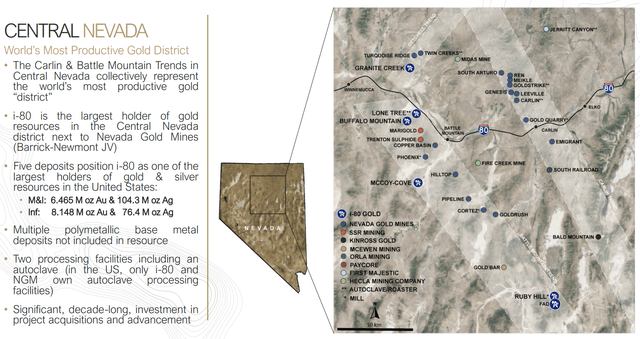

Below we have pulled together slides from the company’s May 2024 investor presentation to illustrate its investment proposition for its mining assets and resource base. There is no doubt that there is tremendous potential for investors, especially with a dramatic rise in gold and silver looming. It features high-grade ores, a variety of locations/types where resources can be located nearby, and relatively low mining costs after the initial capital outlay to build each mine.

i-80 Gold – May 2024 Investor Presentation i-80 Gold – May 2024 Investor Presentation i-80 Gold – May 2024 Investor Presentation i-80 Gold – May 2024 Investor Presentation i-80 Gold – May 2024 Investor Presentation

Improved technical momentum

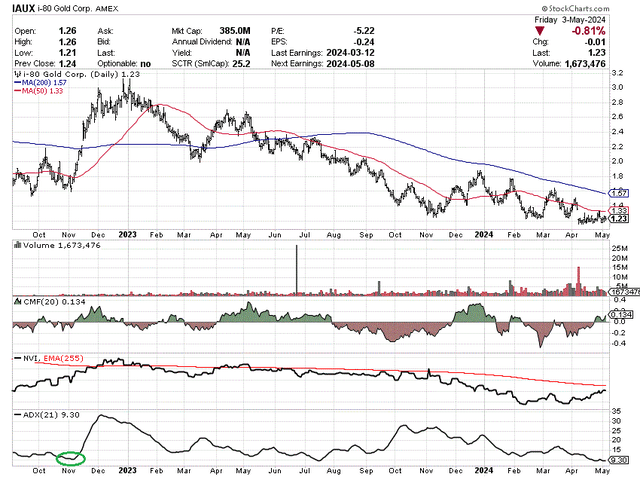

Why should you buy stocks now? I believe the best trading setup for IAUX is currently in place after the November 2022 bottom and rapid price rise. Below is a daily trading chart of price and volume changes since September 2022.

20-day rising combination Chaykin Money Flow Climbing from late April Negative Volume Index Figures since February, lowest in 21 days Average Directional Index A score below 10 in May has not existed since early November 2022 (green circle). My analysis of technical trading setups is that after prices fell on the latest stock offering news in early April, buying interest began to outweigh selling volume.

A breakout of the four-week tight basic pattern could prove that the price is turning positive. All that is needed to confirm the bullish story is for the price to move back above the 50-day moving average, which is currently around $1.33. At that point, short-term traders and trend followers can intervene with buy orders to push the price into an upward trend. My first upside target area would be the 200-day moving average, which is currently around $1.57.

StockCharts.com – i-80 Gold, daily price and volume changes, since September 2022, author reference points

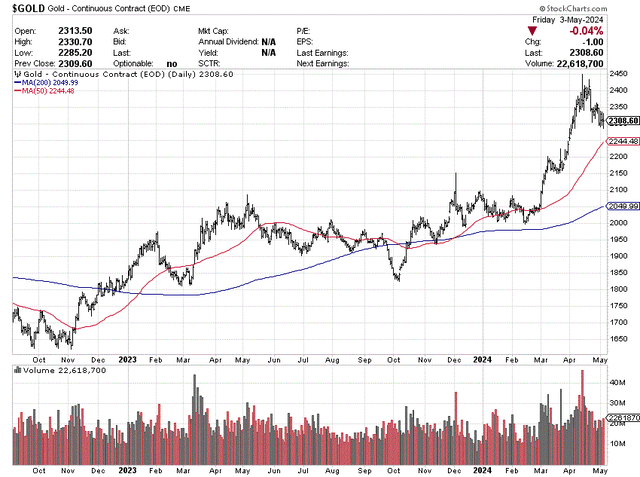

Considering that gold and silver prices have risen significantly over the 20 months I’ve been describing, the i-80 price drop has been a complete disappointment. On the other side of the argument, the fact that further gains in gold/silver are (in my opinion) likely does not detract from the prospects for investing in these securities. And with IAUX’s improving buying momentum, the foundation appears well-supported for significant share price upside for the remainder of 2024.

StockCharts.com – Gold futures nearby, daily price and volume changes since September 2022 StockCharts.com – Silver futures nearby, daily price and volume changes since September 2022

final thoughts

I have traded i-80 stocks several times since December 2022. Fortunately, personal trading/investment losses were limited. One reason is to keep position sizes low in my portfolio. Another risk-reducing factor was the willingness to take losses and re-evaluate ownership logic. Undoubtedly, regular dilution through new stock offerings has been a huge headwind.

The long-term rationale for looking at the stock has remained unchanged over the past 17 months. The nominal intrinsic value of US$33 billion in gold and US$5 billion in silver, measured, expressed and extrapolated from current spot prices (US$2300 for gold and US$27 for silver), is nothing to scoff at. The company operates in Nevada, the #1 jurisdiction worldwide for investor safety. There is also potential for new upside for future resource discoveries.

What this means is that a stock market capitalization of around $480 million and an enterprise value of close to $600 million still provide huge upside for gold and silver prices.

The risk of further dilution remains part of the i-80 story as management seeks a joint venture partner (or more than one for various assets). For example, if management decides to allocate a portion of future production to streamers or major gold miners, e.g. newmont (no) or Barrick Gold (if GOLD is operating right next to real estate), much more upside potential could be forgone to shareholders. However, depending on the transaction structure and IAUX’s future funding requirements to achieve full production of 200,000+ gold ounces per year from its own assets, the JV transaction could have a significant positive impact on the stock price. Certainly, a path to increasing operating profitability and eliminating future dilution needs would be a huge benefit at this stage of the organization’s development.

Realistically, regarding the impact of stock dilution, I would lower my original December 2022 upside price target from $10-$12 to a range of $5-$6 over the next few years. To make this prediction come true, we are using a 15-20 year mine life assessment, 4x sales to safe jurisdiction, for 180,000 worth of gold ounces produced annually in the IAUX account, which sells for $3,000. By 2026-27, at low cash costs, I am assuming an additional 25% dilution to deliver 60,000 ounces under the joint venture agreement. Annual mine production is given to new partners in return for construction capital. Annual gold production of 240,000 ounces is a more conservative forecast than the ambitious 500,000 ounces. That’s the goal outlined in the company’s 2022 hub-and-spoke concept.

If gold/silver prices are strong, the $5-$6 upside could roughly equate to doubling your investment over 3-5 years if you purchased the position after the first story. However, you can achieve much better performance and compound interest by purchasing a share today below $1.30 and riding IAUX to $5 or $6.

Another possible conclusion to the i-80 investment story could be a takeover bid by a larger mining company. I would not rule out another major miner adding a favorable position to IAUX’s high-grade resources to its portfolio. These bids could range from $2 to $3 for 2024, hoping to secure enough votes from disgruntled shareholders to buy around $3 for 2022-23.

Unfortunately for miners who are unable to generate profits and cash flow from their mining operations, the dilution clock is ticking against you as an investor. That’s why, no matter how optimistic you are about your future business fortunes, only invest a small portion of your assets in any given name (as we also suggested in our December 2022 effort).

I understand that previous and existing shareholders have been quite disappointed with IAUX’s share price performance. Investing in the gold/silver mining sector can be quite difficult. To do this well, you have to shake off mistakes (like an NFL quarterback after throwing an interception). Past performance is not always the best indicator of how to approach profit/loss. A large drop in one year is often triggered by a disproportionately large increase in price the following year due to business deals, surprising discoveries, or rising gold and silver prices.

Considering the significant decline in investor sentiment regarding i-80’s stock price outlook for April-May 2024 (a direct result of the poor performance of gold/silver bullion and its peer miners over the past year), frankly it is safer. It may be the opposite moment. To build status. I evaluate stocks BuyAgain, assume we limit the amount of capital invested in the idea.

Thanks for reading. Please consider this article as the first step in your due diligence process. We recommend that you consult with a registered and experienced investment advisor before making any transaction.