I-Mab: Trading for Below Net Cash (NASDAQ:IMAB) with Multiple Upside Options

MF3D

iMap (NASDAQ:IMAB) Biopharma is a clinical-stage biotechnology company focused on immunotherapy and oncology. The company recently announced that it had agreed to sell its assets and business operations in China (the Hangzhou Company) to become a U.S.-based company. Biotechnology company. Following the sale, I-Mab will have a healthy balance sheet with over $400 million in cash, its pipeline will consist of three potentially best-in-class clinical-stage oncology assets, and the potential to receive up to $80 million in cash consideration from I-Mab. There is this. The Chinese business will be sold and the company will have priority negotiating rights outside of China for the three drugs developed in the Chinese business. Trading at about one-third of its net cash value, I-Mab is significantly undervalued due to several call options in the next two to three years.

What’s wrong with I-Mab?

iMap market capitalization peaks in 2021 It was 7 billion dollars. Since then it has lost a whopping 98% of its market value. Clearly something is seriously wrong with the company. To assess the current situation, it is important to understand the series of events that led to iMap’s rise and fall.

iMap is a company that was once loved by all Chinese biotechnology companies due to its differentiated business model and management. Founder Dr Zang was a renowned scientist who was in charge of GSK’s China R&D center before founding I-Mab. Therefore, while almost all Chinese biotech companies under Dr. Zang’s leadership have raised capital to develop their own medicines, I-Mab is an exception, focusing on FIC or BIC biologics targeting the global immuno-oncology market. . One of the hottest targets in immuno-oncology in 2020 was CD47, and I-Mab had one of the most promising CD47 assets globally. Gilead (GILD) spent $4.9 billion to acquire Forty Seven, whose main asset is magrolimab, an anti-CD47 antibody. I-Mab received a major boost in September 2020 when it announced that it had outlicensed commercial rights for its CD47 drug lemzopallimab to AbbVie (ABBV) in a $2 billion deal. prepayment.

iMap raised $418 million through a consortium of institutional investors immediately after acquiring AbbVie.

“It is led by Hillhouse with significant participation from GIC, and also includes other leading Asian and US biotech investment funds such as Avidity Partners, OrbiMed, Octagon Capital Advisors, Invus and Lake Bleu Capital.”

Unfortunately, in January 2022, Gilead announced that “the U.S. Food and Drug Administration (FDA) has suspended studies evaluating the combination of magrolimab and azacitidine due to an apparent imbalance in unexpected serious adverse events reported by investigators.” A decision was made to place a partial clinical hold (SUSAR) between study arms.” This announcement marked the beginning of the demise of the global CD47 asset class. Afterwards, the global CD47 race turned into a disaster as bad news emerged one after another.

In August 2022, AbbVie ended its collaboration with I-Mab for lemzopallimab. Because iMap’s most important asset was lemzopallimab, investors sold iMap’s stock. At the same time, iMap underwent a management reorganization and the threat of delisting. Its market capitalization evaporated by 98%, from $7 billion to $180 million.

Bears deleted I-Mab completely. However, recent events suggest that I-Mab may be at a turning point, which we discuss in more detail below.

China sale

On February 7, 2024, iMap announced the sale of its Chinese assets. According to a press release,

“This agreement to sell our business in China marks an important milestone in I-Mab’s greater focus on markets outside of the U.S. and China,” said Raj Kannan, I-Mab’s Director and CEO. said. “Importantly, we believe this transaction allows us to reduce significant operating expenses and reallocate capital to key current priorities and new potential opportunities to further strengthen our portfolio while maintaining our strong balance sheet.”

Importantly, through the sale, the Company transfers I-Mab’s interest in the divested China operations, thereby extinguishing existing repurchase obligations of approximately $183 million held by the Company’s wholly-owned subsidiaries to certain participating shareholders. That it will help you do that. Following the sale, iMap’s repurchase obligations to non-participating shareholders are expected to range from $30 million to $35 million.

The sale will also provide I-Mab with cash consideration of up to $80 million.

“It is subject to Hangzhou Company Group’s achievement of certain future regulatory and sales-based milestone events. “I-Map will also have priority negotiation rights in regions other than the Greater China region regarding the three new drug candidates being studied in the future,” he said.

The most promising asset owned by the China operation (Hangzhou Group of Companies) is Eftansomatropin Alfa, a differentiated long-acting human growth hormone scheduled for BLA application in China in 2024.

Currently, China’s human growth hormone market is dominated by GeneScience Pharmaceutical (GenSci), a subsidiary of listed company Changchun High-Tech Industries. According to Bypharm, “In 2020, Gene Science’s market share in China reached 76.13%, followed by Anhui Anke Biotechnology (12.48%) and Shanghai United Cell Biotechnology (8.81%). Other Chinese companies (such as Zhongshan Sinobioway Hygene Biomedicine) and two foreign companies (Novo Nordisk and LG Chem) together accounted for about 3% market share.”

GenSci’s 2022 human growth hormone revenue was 10.2 billion yuan, or about $1.4 billion. Once Eftansomatropin Alfa is approved in China, Hangzhou Company group will partner with Hubei Jumpcan Pharmaceutical to sell it throughout China. Hubei Jumpcan Pharmaceutical is a leading pediatric service provider in China with an excellent track record and extensive network. By partnering with Hubei Jumpcan Pharmaceutical, Hangzhou Company group can leverage Jumpcan’s network of pediatric centers to sell Eftansomatropin Alfa. I-Mab will also benefit from a conditional payment with the Hangzhou Company group if Eftansomatropin Alfa is successful.

In summary, the sale of the China business will significantly improve I-Mab’s balance sheet and provide I-Mab with an upside call option if the sold China business is significantly successful in the future.

american pipeline

Following the China sale, iMap’s core assets will consist of three global immuno-oncology programs.

iMap Investor Briefing Session

Of the three immuno-oncology assets, Givastomig and TJ-L14B are both still in phase 1, so it is too early to evaluate them.

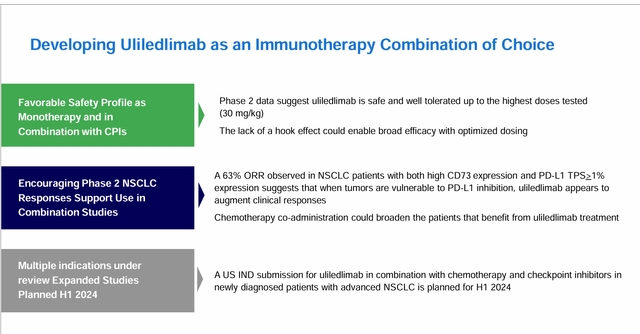

Uliredrimab is a phase II CD73Ab, the rate-limiting enzyme of the adenosine immunosuppressive pathway. During the company’s second quarter 2023 earnings call, management discussed ulledlimab and provided an update on the progress of the ulledlimab clinical trial.

John Hayslip, CMO of iMap, explained the differentiation of uliredrimab as follows:

“uliledlimab is differentiated by being designed to avoid hook effect biology, a potential problem with other competing drugs in development. Simply put, the hook effect can prevent other drugs from fully inhibiting enzyme function. Due to its unique functionality, ulledlimab is designed to provide up to 100% inhibition.”

iMap Investor Briefing Session

Additionally, uliledlimab has shown encouraging phase 2 NSCLC clinical trial data, including:The 63% ORR observed in NSCLC patients with both high CD73 expression and PD-L1 TPS > 1% expression suggests that ulidlimab appears to increase clinical response when tumors are susceptible to PD-L1 inhibition. “. As well as, “It is possible to expand the number of patients benefiting from uliredrimab treatment through concurrent chemotherapy.”. iMap plans to submit an IND for uliredrimab in combination with chemotherapy and a checkpoint inhibitor (toripalimab) in patients with newly diagnosed advanced non-small cell lung cancer in the first half of 2024.

In addition to NSCLC, iMap will continue to ““We expect to enroll patients with previously treated ovarian cancer on the combination of uliledlimab and toripalimab and report preliminary results for this phase 2 cohort of patients in 2024.”. iMap executives hope that the combination of CD73 and chemotherapy could benefit a broader group of patients, regardless of their CD73 expression prior to treatment.

strong balance sheet

As of June 30, 2023, the most recent reporting period, iMap had cash and cash equivalents of $406 million and short-term borrowings of $4.1 million. The company’s net cash position is nearly $400 million. This is down from a high of $734 million in 2020 due to I-Mab’s heavy spending on pipeline assets.

Management estimated its cash burn rate during the first half of 2022 earnings call.

“Our actual cash burn in the first half of the year was approximately $85 million, and we expect to reduce our cash burn in the second half of the year by implementing the costs and expense plans we just discussed. Annual cash burn rate is expected to be between $150 million and $160 million in 2022.

Next year, in 2023, we will continue to execute our priority strategy and cost plan, including facility consolidation, project prioritization and headcount. Going forward, we need to further reduce our operating cash burn to approximately $100 million.”

However, with the sale of the Chinese business, it is almost certain that the cash burn rate will decline in the future. Management did not provide guidance on its cash burn rate following the sale. Because I-Mab’s assets were essentially half Chinese and half U.S. prior to the sale, and most of I-Mab’s operating workforce was in China, its cash burn rate is expected to decrease from the current $160 million to $50 million to $80 million. It is expected. from now on.

danger

The biggest risk associated with iMap’s business is the failure of its remaining pipeline assets in the U.S., particularly uliredrimab. iMab is a clinical-stage biotechnology company and has not yet received FDA approval. Although uliledlimab has shown encouraging phase 2 data, many questions remain in future clinical trials.

Another risk associated with i-Map operation is the frequent change of management. Over the past two years, iMap has changed its CEO and CFO several times. Clearly unstable management is not what investors want to see.

Lastly, there is still uncertainty regarding the sale of iMap’s Chinese business. Non-participating investors may sue I-Mab for the transfer of shares from I-Mab to I-Mab’s Hong Kong subsidiary. iMap considered litigation when signing the contract, but the actual size of the claim in legal proceedings may exceed the company’s expectations.

conclusion

iMap transformed from a China-based biotechnology company to a U.S.-based biotechnology company after selling its China business. I-Mab currently trades with about a third of net cash on its balance sheet, about $400 million. At current valuations, I-Mab is a rare net play with plenty of upside options. Therefore, we present our investment opinion on I-Map as ‘Buy’.