IBM Stands Out as a Buy on Next Market Drop (NYSE:IBM)

David Ramos

International Business Machines Corporation (New York Stock Exchange: IBM) highlights successful strategic change and resilience in the third quarter of 2023. This quarter saw significant revenue growth, largely due to the company’s focus on software and consulting services. This article builds on our previous discussion.We then examine IBM’s financial condition. Third quarter performance report. This article focuses on technical analysis of IBM stock to identify potential investment opportunities. IBM in particular has crossed a critical resistance level and is trending upward, potentially reaching a record high.

financial performance

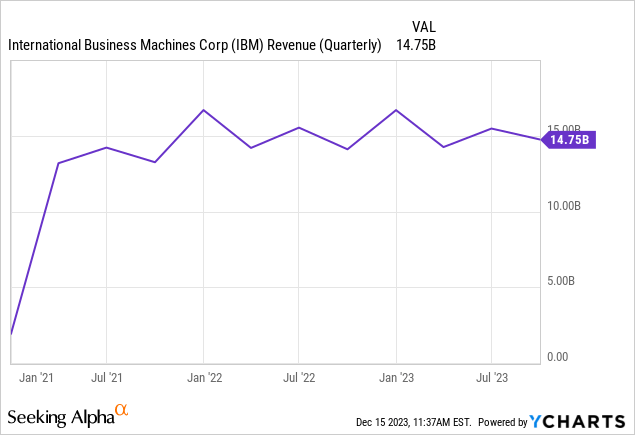

IBM reported strong financial performance in the third quarter of 2023, reflecting the company’s successful transition to emerging technologies and a hybrid cloud approach. As you can see in the chart below, IBM’s revenue increased 4.6% to $14.75 billion. This growth is primarily due to significant advancements in the software and consulting segment driven by increased adoption of IBM’s WatsonX AI and hybrid cloud solutions. that much The 8% increase in software revenue and 6% increase in consulting revenue reflect strong customer interest in IBM’s sophisticated technology solutions. However, infrastructure revenues fell 2%, suggesting either a shift in focus in the sector or a difficult market.

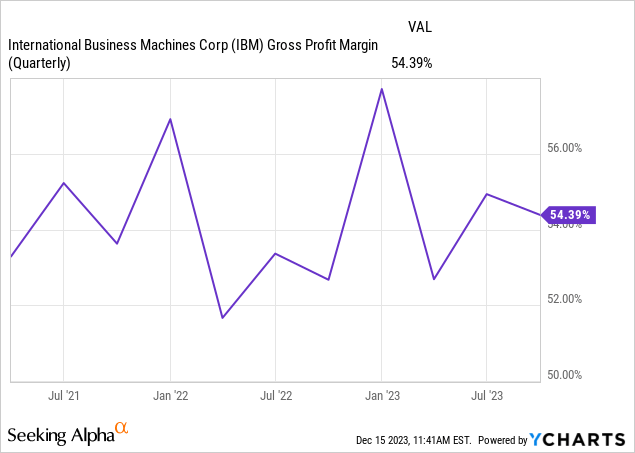

The company’s gross profit margin improved to 54.39%, indicating improved cost management. Pre-tax profit margins also jumped significantly, demonstrating IBM’s improved profitability and operating efficiency. These improvements reflect the company’s effective management strategy and focus on high-margin businesses.

The significant cash generation also highlights IBM’s strong financial position, with net cash from operating activities of $9.5 billion and free cash flow of $5.1 billion. This cash flow capability has allowed IBM to focus on AI and hybrid cloud and increase investments in R&D and strategic acquisitions while maintaining shareholder returns through dividends. This balance of investments and shareholder returns demonstrates IBM’s commitment to future growth and current stability.

Within the software segment, hybrid platforms and solutions and the growth of Red Hat indicate strong demand for IBM’s cloud solutions. Significant increase in automation, data, and AI segments also highlights the market growth for these technologies. Mixed results in the infrastructure sector, with zSystems performing well but declining in distributed infrastructure and infrastructure support, suggest changing customer requirements and technology trends.

As of the end of the third quarter, IBM’s balance sheet reflected a strong financial position with $11 billion in cash and marketable securities. However, IBM’s increase in total debt, including financial debt, to $55.2 billion indicates strategic leverage that needs to be monitored. Managing this debt carefully is critical to IBM’s long-term financial health. IBM also expects revenue to grow 3% to 5% in 2023 and free cash flow to reach approximately $10.5 billion, representing growth of more than $1 billion from 2022.

Overall, IBM’s third quarter 2023 financial results show that the company is adept at navigating the evolving technology landscape. Growth in software and consulting combined with strong cash generation reflects IBM’s strategic focus on AI and cloud technologies to ensure long-term sustainability and profitability. While infrastructure sector challenges and rising debt highlight areas for vigilance, IBM’s active management and positive outlook for 2023 indicate a strong trajectory toward continued success and innovation in the technology industry.

Explore price dynamics in resistance zones

summary

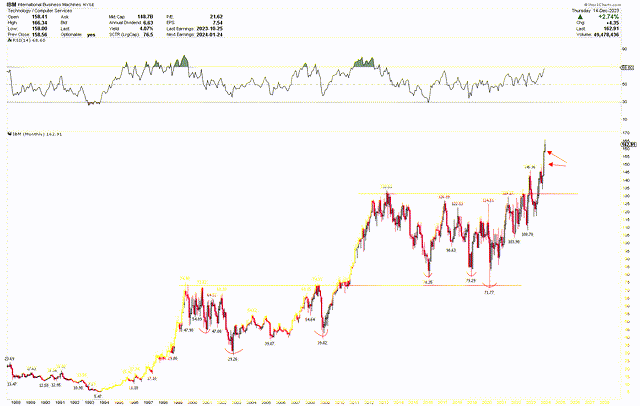

In the previous article, we looked at the long-term outlook by analyzing annual and quarterly charts. The annual chart highlights two significant buying opportunities for long-term investors in IBM’s history. The first was in 2002 and the second appeared in 2020. This opportunity coincided with a key support level and triggered a significant price rally. Buy signals for 2020 remain active and prices continue to rise, highlighted by the strong annual candle formation. This bullish outlook gains further credence from the quarterly chart, which shows the development of a rounding bottom pattern at key buy points. The latest round bottom, marked at the 2020 low around $80, stands out as an important support level for long-term investing.

A follow-up article elaborated on this optimistic view, highlighting a strong buying opportunity for IBM. The article highlighted that a breach of the $148 threshold could initiate a major upward move in the stock market.

next move

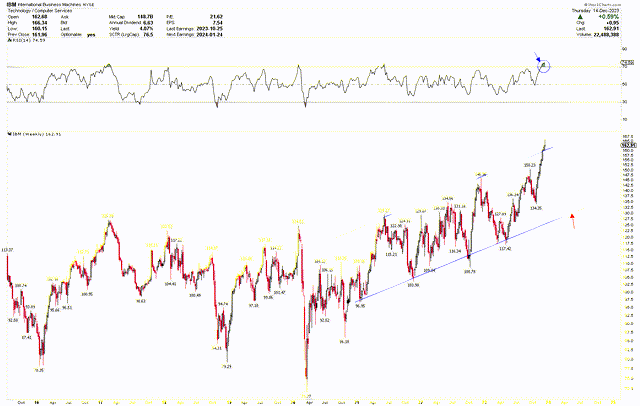

IBM’s stock price has experienced a notable rebound from low levels and has bounced strongly, surpassing the expected price of $148. The monthly chart below has two important red lines that indicate important long-term support levels. This chart shows an overall upward trend over a long period of time. In addition, the positive trend is expected to continue as it has continued to show a noticeable increase since the low point in 2020. The strength of this rally signals IBM’s strategic moves in the market and a vote of confidence from investors in the company’s future growth potential.

IBM monthly chart (Stockchart.com)

IBM’s stock hit a 2020 low due to the broader economic impact of the COVID-19 pandemic. However, starting in 2021, the company has seen a strong upward trend, driven by several key factors. IBM has strategically pivoted into high-growth areas such as cloud computing, artificial intelligence, and quantum computing to more closely align with industry trends and customer needs.

This pivot has been strengthened through significant investments in research and development and notable acquisitions, strengthening our portfolio and competitive advantage. IBM’s commitment to hybrid cloud with Red Hat has significantly expanded its market reach and capabilities. This strategic move has been well-received by investors, reflecting a consistent upward trajectory in the stock price through 2021, 2022, and 2023. Additionally, IBM has focused on innovation and adaptation while providing a strong financial foundation through stable revenue streams from existing enterprise customers. We have gained newfound confidence from our stakeholders in the evolving technology landscape.

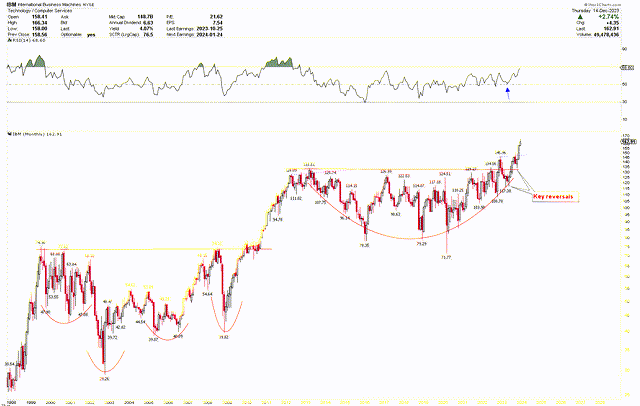

The updated monthly chart from the previous article shows a rounding bottom pattern with a price breakout above the $148 mark. This upward breakout occurs after the formation of important bullish reversal candles in May and October 2023. Additionally, the pivotal reversal in May 2023, supported by the RSI stabilizing at intermediate levels, indicates a bullish trend in the price trajectory.

IBM monthly chart (Stockchart.com)

KEY ACTIONS FOR INVESTORS

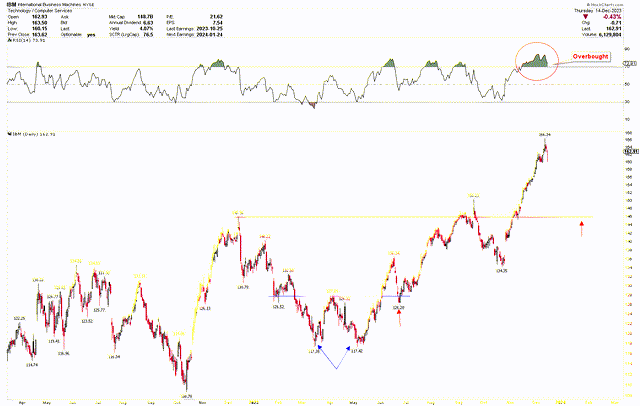

From the above discussion, it is clear that IBM stock remains on a bullish trajectory. However, the current trend appears to be reaching a point of exhaustion at the critical resistance level. This resistance is clearly visible within the blue channel on the weekly chart where RSI has entered overbought territory. As a result, the stock price may stabilize before attempting another upward move.

IBM Weekly Chart (Stockchart.com)

This overbought condition can also be seen on the daily chart below, highlighting a double bottom pattern with lows of $117.38 and $117.42. This pattern suggests a strong level of support and potential upside for the stock. However, caution is needed as the RSI is currently in an extremely overbought zone, indicating a potential price decline.

IBM daily chart (Stockchart.com)

This price correction is considered a strong buying opportunity for long-term investors, given that the stock’s long-term trend remains bullish.

market risk

Despite overall growth, the decline in infrastructure revenues highlights the potential for market changes or challenges in this sector. This signals a vulnerability in IBM’s portfolio and suggests that the company’s continued growth may depend heavily on the success of its software and consulting segments. Moreover, while IBM’s focus on high-margin businesses has improved its profits, it also poses the risk of over-reliance on certain segments, which could be detrimental if those segments face an unexpected economic downturn.

From a technical perspective, a downward price correction is expected as the near-term trend is approaching an overbought condition. The extent of this adjustment will be important in determining future price direction. A drop below $120 would invalidate the current bullish sentiment and suggest further declines are possible.

conclusion

IBM’s performance in the third quarter of 2023 represents a remarkable example of successful business transformation in an ever-evolving technology environment. The company’s strategic shift to software and consulting services and focus on artificial intelligence and hybrid cloud technologies have resulted in significant financial growth, as evidenced by increased revenue and improved profit margins. This transformation demonstrates IBM’s adaptability and forward-thinking approach in a highly competitive market.

Technical analysis of IBM stock further strengthens our confidence in IBM’s future prospects. The company’s stock has shown a strong upward trajectory since its 2020 lows, breaking important resistance levels and maintaining a bullish trend. Breaking the $148 threshold is an important point and suggests the possibility of continued growth. However, overbought conditions on the weekly and daily charts indicate that the stock may experience a near-term price correction towards $140-$150. This price correction is seen as a potential buying opportunity for investors given the overall bullish trend in the stock.