Icahn Enterprises: Don’t Chase 24% Returns (NASDAQ:IEP)

Someone who enjoys positive cash flow like Carl Icahn. Bamboo Productions

Icahn Enterprises (NASDAQ:IEP) is a legend in the world of high-yield stocks. Boasting a whopping 24% yield, this product will have yield hunters drooling. Although stocks With a simple holding rating from Seeking Alpha Author and Seeking Alpha Quant, he is a star on Wall Street and a consensus star. ‘Buy’ rating There is no sell rating either!

On the surface, it’s somewhat difficult to figure out what an optimistic IEP is thinking. The company appears to score poorly on quality/profitability metrics, boasting dire numbers such as:

-

-4.5% net profit margin.

-

Free cash flow margin of -3.4%.

-

Return on equity (“ROE”) of -11.9%.

-

Return on Invested Capital (“ROIC”) is -2.2%.

-

It has had negative returns in eight of the last ten years.

-

Negative Free Cash Flow (“FCF”) Last 6 of the last 10 years.

-

Dividend payments are decreasing.

This appears to be an open and shut case for avoiding or even shorting a stock. However, there are several aspects that may make an IEP attractive. For example, the portfolio is primarily comprised of “value” sectors such as energy, real estate, senior living, and automotive services. These sectors are generally cheaper than the tech giants, which have been seeing strong gains in the market recently. It’s natural to be interested in portfolios like IEPs.

IEP company (Icahn Enterprises)

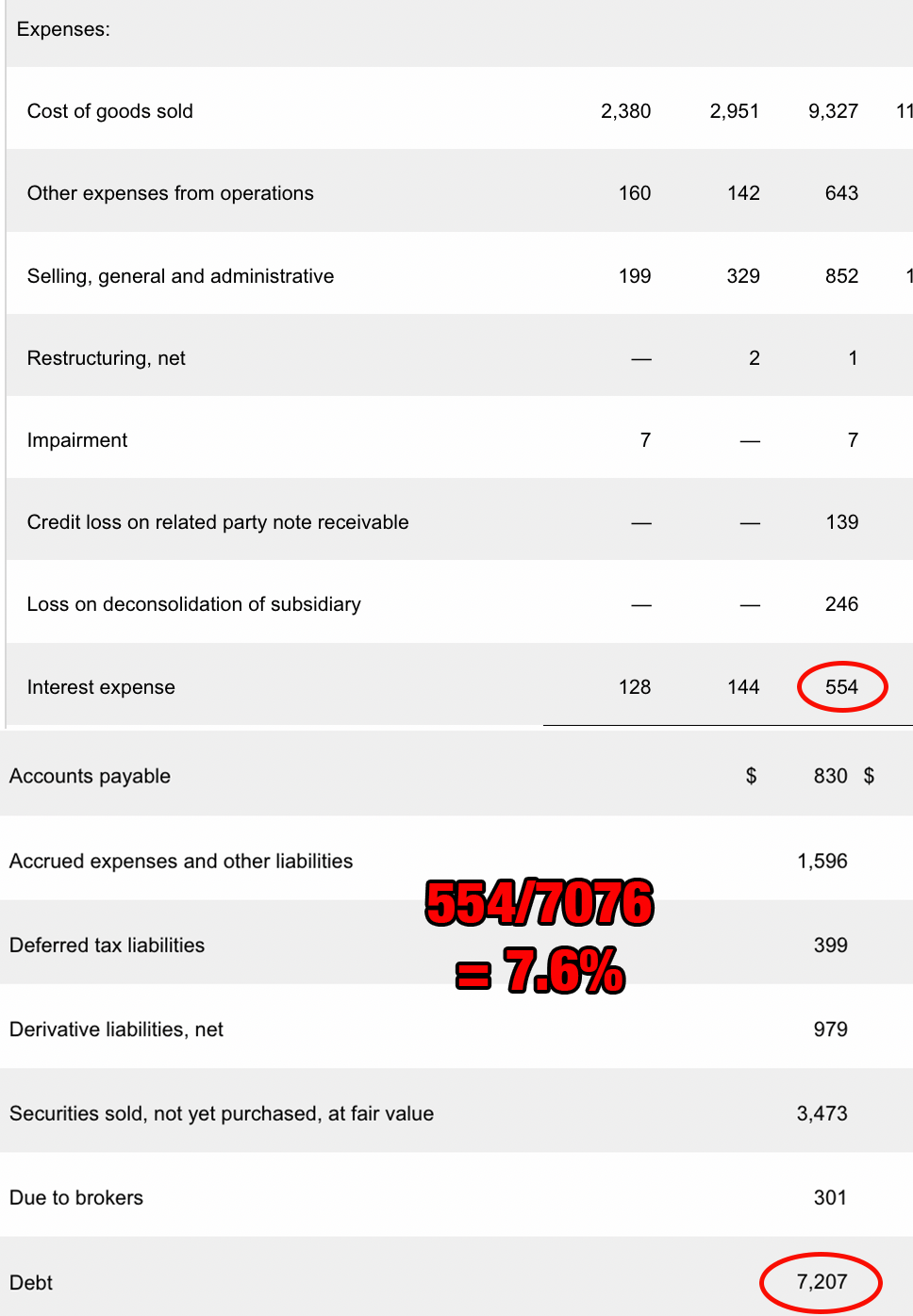

The problem is that this portfolio is owned by a company that has serious financial problems at the corporate level. The company typically loses money and has a Ba3 (“junk”) rating. Moody’s (MCO) appears to be paying a yield of around 7.6% on its debt, as you can see in the image below. Simply put, the company is under severe financial pressure.

High Debt Costs in IEPs (Icahn Enterprises)

Now you can see why some investors are bullish on Icahn Enterprises. With a 24% yield, the company’s stock doesn’t even need to go anywhere to offer attractive returns. If a stock returns 24% and the price moves 0%, your money will double in 4 years + 1 quarter. (Assuming quarterly dividend payments) On the other hand, if the stock price falls to $0.01, you will break even after 4 years + 1 quarter. The latter point is academic. Because it is very unlikely that the stock price will drop to almost zero while maintaining the dividend. I hypothesized this simply to illustrate that sufficiently high returns can provide high returns regardless of stock performance.

But a look at IEP’s dividend history shows that buying stocks just for yield hasn’t worked out very well for long-term shareholders. Ten years ago, IEP was trading at $101.49. It is currently trading at $16.53. From June 2014 to today, we paid out $67 in dividends. So the total return on IEP stock bought 10 years ago and sold today would be -17.7%.

It’s entirely possible that today’s investors will have similar experiences. IEP’s dividends have been declining over time, earnings and free cash flow have been consistently negative, and the company has been issuing stock to pay dividends. The possibility of additional dividend cuts in the future cannot be ruled out. For this reason, IEP is basically a stock to avoid, but we consider it a hold because it is not suitable for selling due to the risk factors that will be covered in the next paragraph.

High levels of debt resulting from enormous costs

In the introduction, I repeatedly mentioned IEP’s high returns and said that IEP’s portfolio has several attractive characteristics. Given that I have mentioned two positive characteristics of an IEP, it should explain why there is a risk that poor performance will continue in the future because of the efforts the company is making.

The biggest reason why IEP’s poor performance may continue is because of its financial situation. There are several red flags in the company’s balance sheet. Although IEP’s debt is less than equity and its current ratio is above 1, its metrics combining both the balance sheet and income statement are less attractive. for example:

-

The cash position has been declining for 10 years.

-

The book value per share during the same period was 82%.

-

EBIT interest coverage is only 24%.

-

As mentioned earlier, $554 million in interest versus $7.2 billion in debt implies an interest expense of 7.6%.

-

Sales are decreasing while total receivables are increasing. (representing a large amount of non-cash revenue)

This is a very dangerous list of red flags. Investors should also consider any equity offerings currently underway. Icahn Enterprises has issued approximately 281 million new shares over the past 10 years. This is relevant to balance sheet quality for the following reasons:

-

This contributes to the decline in book value per share.

-

This offsets one of the few positive balance sheet characteristics that IEP has: the company’s reduced debt levels.

One final note: Although IEP’s debt levels have declined dramatically over the past five years, interest costs have actually increased since 2018. The company’s cost of debt is therefore higher than average and is clearly trending higher over time.

evaluation

Icahn Enterprises’ financial condition appears to be poor. Most have poor balance sheets and interest coverage metrics and are not consistently profitable. Dividends per share are also decreasing. You would expect such stocks to trade at rock-bottom valuations. Surprisingly, this is not the case with IEPs. It gets an A+ on Seeking Alpha Quant’s reviews page. Probably because its price/cash flow ratio is an incredibly low 2.3. However, some of the other multiples do not represent cheapness.

-

The 107 EV/EBIT ratio is very high.

-

The expected P/E ratio of 30.87 is roughly similar to the Nasdaq 100 index, which is comprised mostly of profitable, growing companies.

-

Both price/book ratios look cheap on the surface, but keep in mind that book value is trending downward.

Simply put, in a scenario where historical trends change, Icahn Enterprises is not cheap. (e.g. decrease in revenue and book value) keep going.

Risks of Short Selling

Everything I’ve written about IEP so far has been very bearish, but there are some serious risks to shorting here. In fact, one can be potentially fatal.

Dividends.

When shorting stocks using the traditional method “Borrow, sell, repay, repay” This method requires you to pay stock dividends to your stock lender. For IEP, if the dividend isn’t cut, the cost would be about 24.5% of the stock price! As I wrote above, I think there is a risk that IEP’s dividend will be cut. However, there is no guarantee that will happen in the near future. A one-year period with a dividend payout of 24.5% and interest expense of 5% could result in a short seller having to cover his position at a loss. Therefore, the IEP is not a good candidate for shortening.

conclusion

Overall, Icahn Enterprises is a stock best avoided. There are so many financial issues that investors can’t reasonably expect good results if they take a long position, but dividends can cause problems for those who take a short position. Considering these two possibilities side by side, a neutral or slightly bearish view of IEPs appears to be correct.

One of Icahn Enterprises’ ‘short’ plays that seems smart on the surface is using puts rather than borrowing stocks for trading. Put options allow you to make money by betting against a stock, but they don’t have to pay dividends directly like traditional short selling. However, higher dividends tend to increase the premium for put options, and in fact IEP puts generally look more expensive than call options. So I also cannot support the put strategy. I want to avoid an IEP. There are easier ways to make money in the markets.