ICL: Valuation expected to improve despite geopolitical and technological risks

Elena Vyonysheva-Abramova

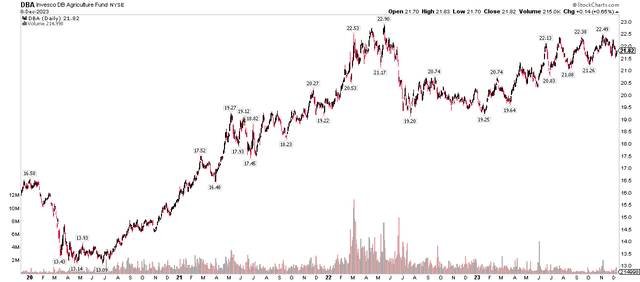

It’s been a tough few years at the produce complex. Russia’s invasion of Ukraine nearly two years ago triggered a bull run across soft markets. While this has helped many companies in the materials sector, it has seen a steep decline. Falling commodity prices in the second half of 2022 later weighed on many agricultural stocks. Today, Invesco DB Agricultural Fund ETF (DBAs) has recovered to within 5% of its second-quarter 2022 high, but not all stocks tied to those soft commodities have performed well.

I am upgrading ICL Group stock (New York Stock Exchange: ICL) Switches from Hold to Buy depending on valuation. Although the stock price is more attractive these days and has some support on the charts, risks still remain. I would also like to see more clarity about the future of this international company, even amidst high geopolitical risks.

DBA Agriculture Commodities ETFs: Rising Towards 2022 Highs

stockcharts.com

ICL ranks second, according to Bank of America Global Research. It ranks 6th in the global potash industry, accounting for approximately 7% of production and is mainly sold to the agricultural sector. Also no. 2nd place in bromine industry. It accounts for about 30% of global production and sells brominated flame retardants, clear brine and other industrial applications. ICL also has a significant phosphates business (fertilizers, food ingredients, industrial applications) and a specialty fertilizers segment.

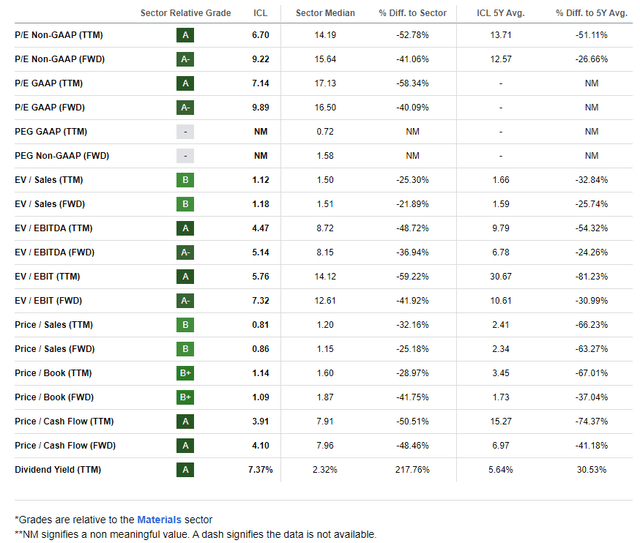

The Israel-headquartered materials sector, $6.5 billion market capitalization fertilizer and pesticide industry company is trading with a low 12-month non-GAAP price-to-earnings ratio of 9.2% and a high trailing 12-month dividend yield of 7.4%. Ahead of earnings scheduled for mid-February, the stock is trading with an implied volatility rate of 28%.

ICL last month reported Decent quarter. Non-GAAP EPS for the third quarter was $0.11, beating the consensus estimate of $0.09, and revenue was $1.9 billion, down 25% from year-ago levels. The company reaffirmed its guidance for 2023 adjusted EBITDA, and its stock price rebounded in the weeks following the report. Elsewhere in the industry, peers Nutrien and mosaic were recently doubled by analysts at Barclays based on strength in the potash market. Raised the grade We scaled ICL from Equal Weight to Overweight, noting that it is also the riskiest stock in the group amid geopolitical tensions in Israel.

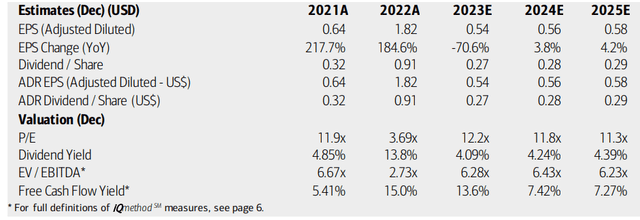

In ~ evaluation, BofA analysts see a sharp decline in profits this year after the agricultural bull market in 2022. Earnings per share are expected to grow at a mid-single-digit rate in both 2024 and 2025. Current consensus estimates are for operating EPS of $0.51 next year, with that expected to increase to $0.64 in 2025, according to Seeking Alpha. Annual revenue is expected to be in the $7 billion to $8 billion range, with little disruption to continued top-line growth. dividendsMeanwhile, volatility is expected, but somewhat higher. The company has a long-standing policy of paying out 50% of adjusted net profits each quarter, so don’t expect a consistent payout ratio.

Although solid free cash flow is expected for the coming quarters (over $400 million in operating cash flow and $217 million in free cash flow in the just-ended third quarter), management said They don’t believe share buybacks are the right use of cash given the current focus on growth. I hope that change and more shareholder engagement becomes a priority.

ICL Group: Earnings, Valuation, Free Cash Flow, Dividend Yield Forecast

BofA Global Research

Assuming a normalized EPS figure of $0.55 and applying ICL’s five-year historical non-GAAP forward earnings multiple of 12.6, the stock would have a fair value closer to $6.90, but since that transition includes a severe bull market in early 2022, we would apply a factor of 10. do. An additional margin of safety of % is prudent. That would bring the default price target closer to $6.20, making the stock about 20% undervalued today.

ICL: Attractive Valuation Index

pursue alpha

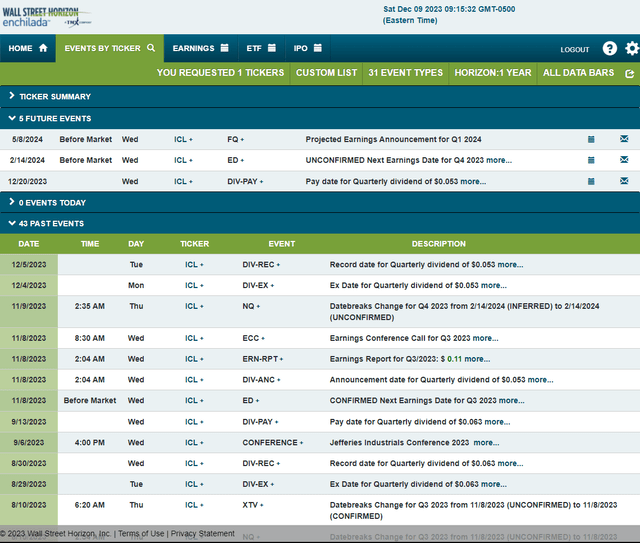

Looking ahead, BMO’s unconfirmed fourth quarter 2023 earnings date is Wednesday, February 14th, according to corporate events data provided by Wall Street Horizon. Other volatility catalysts do not appear on the calendar.

Corporate Event Risk Calendar

wall street horizon

technical take

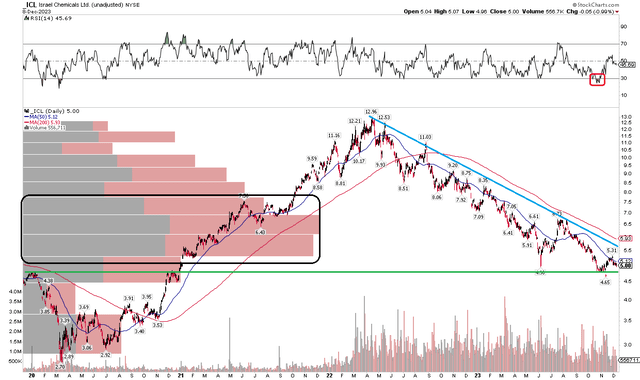

ICL stock remains in a steep bear market. In the chart below, the stock hit a high near $13 in April 2022. We find possible support at ICL’s early 2020 peak, just before the start of the pandemic, down about 60% from that peak. The $4.50-$5 zone has attracted the attention of several buyers recently, but technical risks clearly exist.

First, the long-term 200-day moving average has a negative slope, indicating that the downtrend is leading. Next, a series of lower highs and lower lows has been the mantra for the past few quarters. Additionally, the RSI momentum oscillator at the top of the graph hit a new low as the stock fell to its November low of $4.65. Lastly, the bulls may face difficulties in their rally attempts due to the heavy trading volume between $5 and $8.

So, there are big concerns here, but given that the stock is fundamentally undervalued, a stop below $4.50 (below the 2023 low) could work. This $4.50 technical point consolidates all information presented and is used for risk management purposes.

ICL: Bearish downtrend, major support below $5

stockcharts.com

conclusion

I am upgrading ICL from Hold to Buy at Valuation, but am still concerned about many technical risks.