Identifying Economic Moats Using a Quantitative Lens: S&P 500 Economic Moat Index

Hongruwawa

Rupert Watts

The term economic moat, popularized by Warren Buffett, refers to a company’s sustainable competitive advantage that allows it to maintain market share and generate high profits over the long term. In this analogy, businesses are compared to businesses in the Middle Ages. Surrounded by a deep and wide moat, it protected the castle from attacks.

Likewise, an economic moat protects a business from competitors and other external threats by making it difficult for competitors to replicate or challenge its position in the market. There are several potential sources of economic moats, including network effects, economies of scale, strong brand awareness, and high switching costs.

We believe that sustainable economic moats can be identified using available financial statement indicators. Moreover, a purely quantitative approach helps overcome the limitations of subjective selection processes. Earlier this year, S&P DJI that much S&P 500® Economic Moat Index, seeks to identify companies with a sustainable competitive advantage. In this blog, we will introduce this index by reviewing its methodology and historical performance.

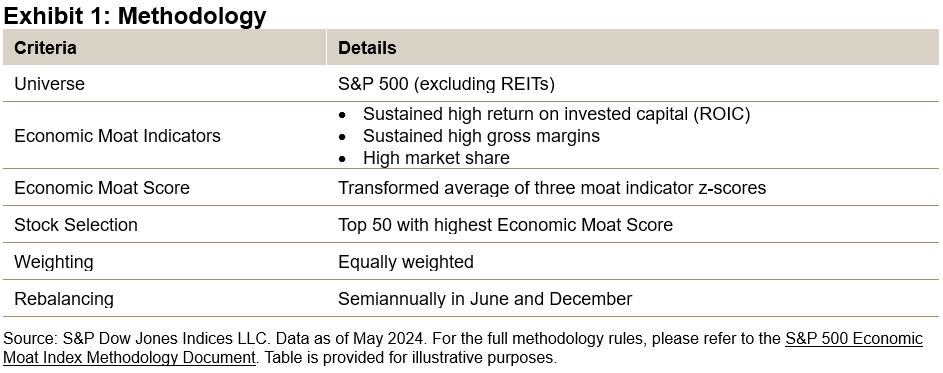

Methodology Overview

No single quantitative measure is the only indicator of an economic moat. Instead, you should use multiple metrics, carefully considering how they complement each other. Our research identifies three key metrics by which companies should be evaluated: high ROIC, high gross margin, and high market share. We’ll look at each of these metrics in more detail in the next blog.

consistency This is another key aspect to consider when identifying your economic moat. Many companies can generate high profits in the short term, but their ability to do so on a sustained basis indicates a wide moat. Therefore, metrics must be analyzed over multiple time periods.

The final selection is based on the average of three economic moat metrics, known as the Economic Moat Score. After selecting the top 50 companies, they are equally weighted to prevent concentration risk and put each company on equal footing.

performance review

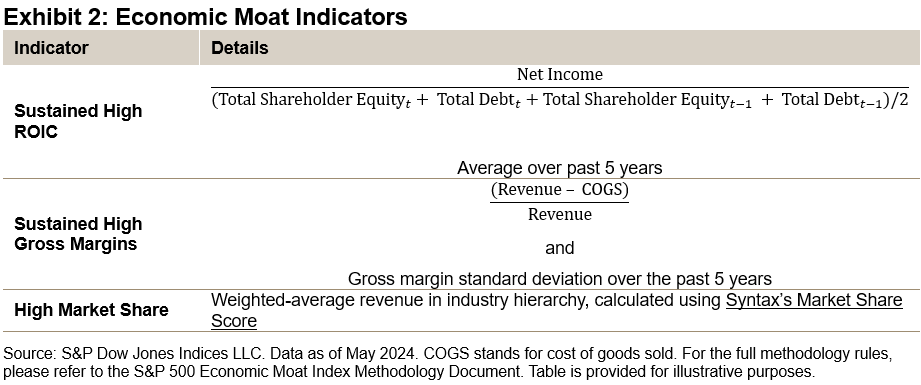

Backtest data shows that companies with the widest economic moats have performed significantly since June 30, 2013 (see Figure 3). Over the entire period, the S&P 500 Economic Moat Index outperformed the S&P 500 by an average of 2.63% per year.

Moreover, the index has shown defensive characteristics, with reduced volatility and capturing downside trends. This is expected because companies with wider economic moats tend to be of higher quality and better able to withstand market stress and uncertainty.

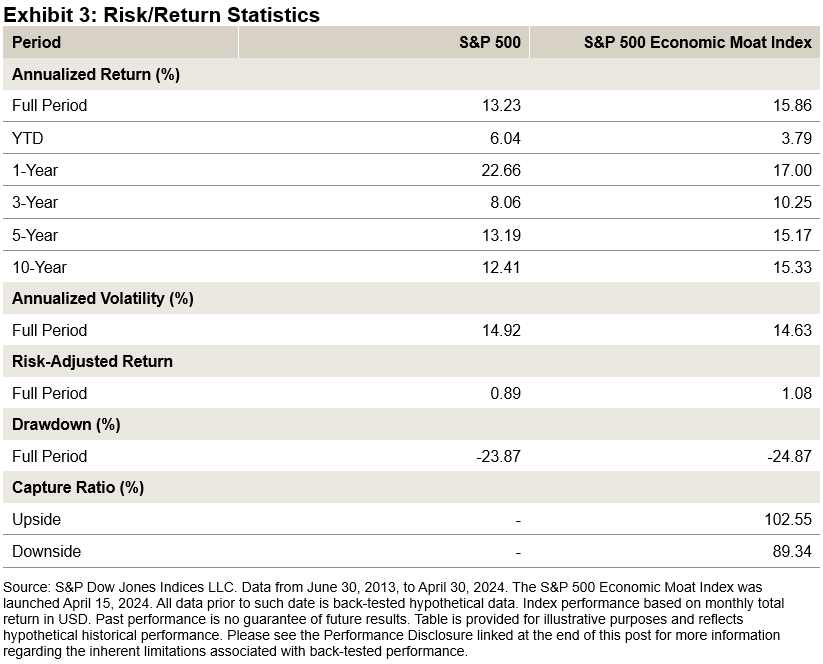

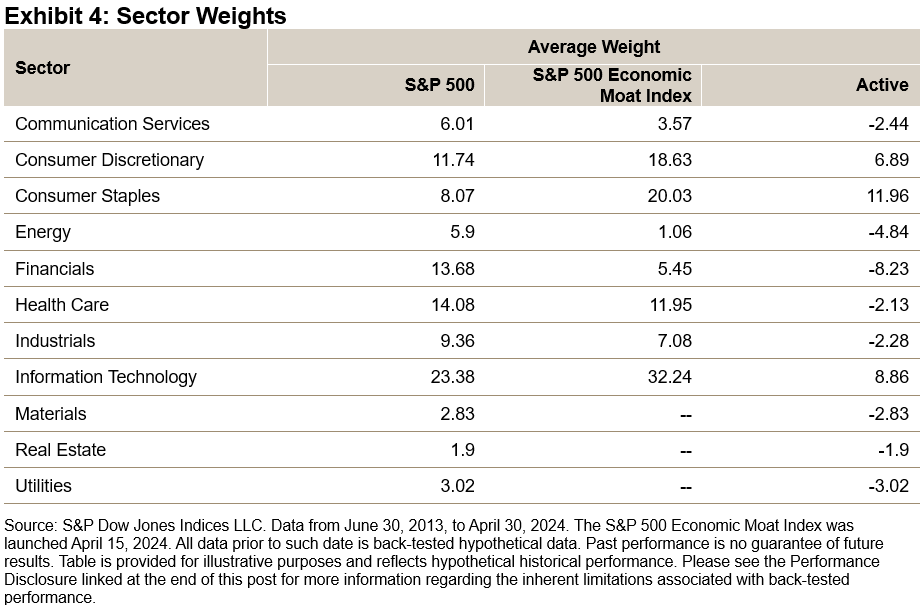

Historical sector weights

Let us now look at the average sector weights in Table 4. Historically, the S&P 500 Economic Moat Index has had the highest sector weightings in the Consumer Discretionary, Consumer Staples, and Information Technology sectors. The most notable underweight stocks were the energy and financial sectors.

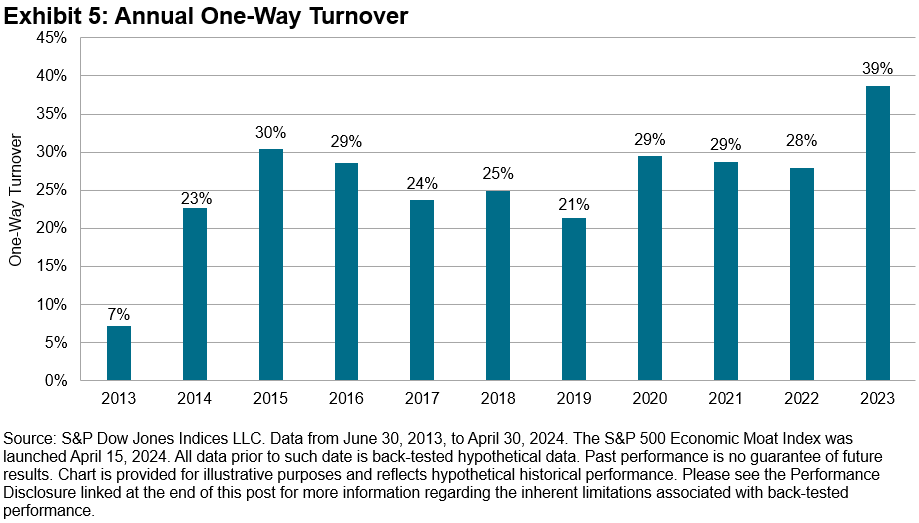

historical turnover

Now let’s examine another attractive feature of this index: its low turnover rate. Over the entire backtest period, the index recorded an average one-way turnover of 27.01%, which is lower compared to other factor-based indices.

conclusion

S&P Dow Jones Indices is pleased to continue index innovation with the launch of this new index to the Factor family. For those who want to track high-quality companies with strong performance and defensive characteristics over the long term, the S&P 500 Economic Moat Index can be an attractive option.

expose: Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material was reproduced with the prior written consent of S&P DJI. For more information about S&P DJI, visit: S&P Dow Jones Indices. For full terms of use and disclosures, please visit: www.spdji.com/terms-of-use.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.