If we do the research, you can get alpha!

Get exclusive reports and key insights on airdrops, NFTs, and more! Subscribe to Alpha Reports now and enjoy the game!

Go to Alpha Report

Bitcoin, the world’s most popular cryptocurrency, has been receiving a lot of attention due to its extreme price volatility, which presents both significant risks and potential rewards for investors. However, two things are certain in the cryptocurrency world. Halving is bullish, cryptocurrency winter occurs after halving.

To better understand these terms, in the Bitcoin ecosystem, a “halving” is a pre-programmed occurrence that halves the rate at which new Bitcoins are created or mined. This event has historically been viewed as bullish for long-term holders, with gains of 3,230% within a year after each halving, according to Coingecko.huh). However, immediately following these surges, the Bitcoin price typically experiences a significant downward correction, plunging into a period commonly referred to as cryptocurrency winter, with prices falling by more than 80% on average.ouch).

The Bitcoin network undergoes a halving event approximately every four years, a mechanism that controls the rate of inflation and maintains scarcity over time. The most recent halving occurred on May 11, 2020, reducing block rewards for Bitcoin miners from 12.5 BTC to 6.25 BTC. At the next halving, mining rewards will drop to 3.123 BTC.

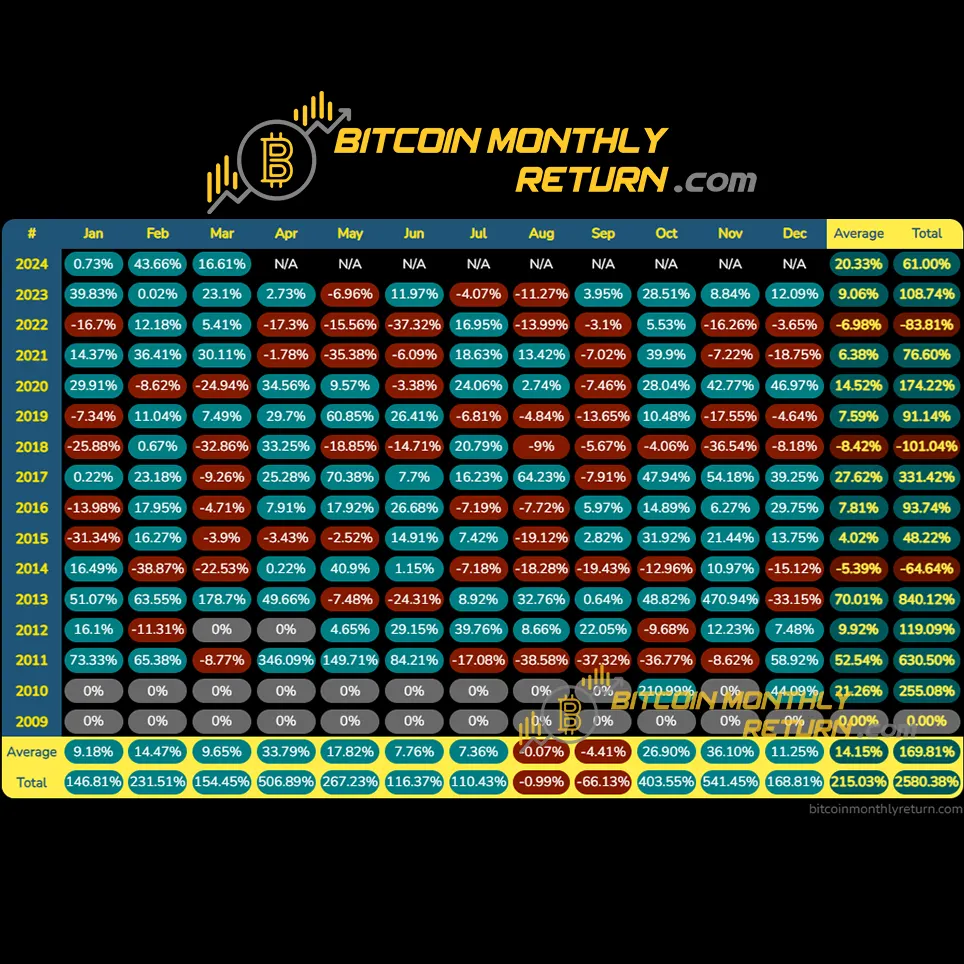

Typically, the halving hype tends to last for about a year, followed by a major correction in the following year. The first halving occurred on November 28, 2012, and by November 2013, Bitcoin had experienced a significant decline, plummeting from $1,130 to $170 in the same year. This is a whopping 85% drop. The second halving in July 2016 followed a similar trajectory. Bitcoin reached $20,000 in November 2017 before plummeting to $3,191 the following month, a decline of 84%. Most recently, the third halving in May 2020 pushed the price of Bitcoin to an all-time high of $68,789 in November 2021, but then plummeted to $15,600 in June 2022, a 77% correction.

Why is Bitcoin plummeting after halving?

Some events, such as the launch of Bitcoin futures contracts, China’s crackdown on the cryptocurrency industry, and even Tesla’s tweet about dumping Bitcoin, have affected Bitcoin’s price performance at a fundamental level. However, unlike these one-time events, Bitcoin halvings occur regularly.

One potential reason for a post-halving crash is profit-taking by investors who have held positions for long periods of time, often motivated by the “January effect.”

Investors believe that stock prices tend to rise early in the year due to increased buying activity following the December price drop. This is often due to tax loss harvesting, where investors sell losing stocks in December to offset capital gains tax obligations and then repurchase them in January, driving up demand and prices.

Investors may consider rebalancing their portfolios by selling risky assets such as Bitcoin in December and reinvesting in stocks in January, when stock markets are traditionally strong.

Another important factor is the ‘mine surrender’ phenomenon.

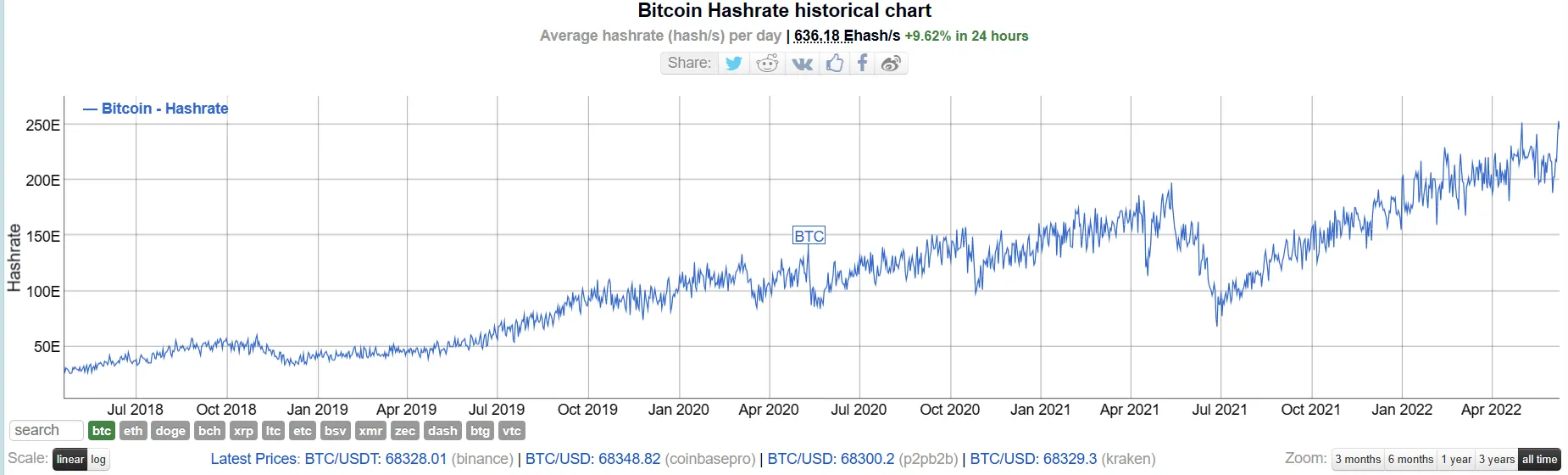

During profitable seasons, miners accumulate Bitcoin and increase the hash rate of the network. However, as the network becomes more powerful, there comes a point when miners need to upgrade or purchase more equipment and sell their holdings to remain competitive or more profitable. While not necessarily aligned with price performance, this selling pressure, combined with other bearish market sentiments, can cause a snowball effect that can lead to a mining capitulation and subsequent price crash. When this happens, miners sell their reserves and equipment to maintain operations, not to remain competitive.

Bitcoin hashrate has fallen over the past two halvings, according to data from Bitinfocharts.

Despite these periodic corrections, Bitcoin has consistently demonstrated its resilience and ability to recover from significant downturns.

How do Bitcoin traders cope?

MicroStrategy founder and chairman Michael Saylor, perhaps the most prominent Bitcoin investor on all of Wall Street, said in an interview with Emily Chang on Bloomberg’s Studio 1.0 in 2022, “If you want to invest in Bitcoin, the short time horizon is 4 years, ( “The median period is 10 years. The appropriate period is forever.” Saylor argues that Bitcoin is a good investment for those who want to survive at least one halving before the next.

“No one has held Bitcoin for four years and lost money,” he said.

Likewise, Bitcoin’s extremely bullish period followed by its massive crash and subsequent bullish period suggests that this is not a speculative bubble. Rather, it is a highly volatile asset class that is becoming increasingly mainstream. That said, these major corrections are relatively healthy for Bitcoin because they balance the mood among investors and avoid a bubble-like scenario that would completely collapse the price.

Now, the end of the year following each halving is known to historically mark the start of cryptocurrency winter, but on a shorter timescale, September is a particularly bearish month for Bitcoin.

This poor performance in September coincides with a similar slump in the stock market. The S&P 500 has experienced an average decline of 0.7% in September over the past 25 years, long before Bitcoin existed. The ‘September effect’ is caused by investors exiting market positions after returning from summer holidays to prevent profit or tax losses ahead of the end of the year.

So, for what it’s worth, investors may want to avoid buying BTC in September or around Christmas the same year the halving occurs.

With the fourth Bitcoin halving approaching and the price recently regaining $71,000, investors and enthusiasts are eagerly anticipating the potential impact. History suggests that a post-halving correction may occur next year, but today’s situation is different from events that affected Bitcoin as an asset in the past. Regulations have become clearer, Wall Street has poured billions of dollars into Bitcoin ETFs, countries have invested in the coin, and the network has become more powerful than ever.

Wall Street traders tend to say that time in the market is better than timing the market. But for the Bitcoin community, HODL is a way of life. It’s up to you to decide when to buy, but whatever you decide, do it quickly. There are only two weeks left until the half-life.

Edited by Stacey Elliott.